Welcome to PayTaxesLater.com!

We are excited to present a series of exclusive webinar replays designed to help you optimize your retirement and tax strategies.

Led by Jim Lange, CPA/Attorney and best-selling author, these presentations offer valuable insights to help you minimize taxes and maximize your retirement income.

Webinar 1:

Click here to watch the replay.

What You’ll Learn:

- Proactive Multi-Year Tax Planning: How to develop the ideal long-term Roth IRA conversion plan.

- Prepare for potential tax rate volatility.

- Asset Diversification for Tax Optimization: How to move a portion of your taxable investments (IRAs and other retirement plans) into tax-free environments of not only your Roth accounts, but 529 plans and your children's Roth IRAs and Roth 401(s). Note: This shift could potentially be more valuable to your children than making Roth IRA conversions directly in your own accounts.

Foundational & Advanced Roth Conversion Techniques including:

- Optimal Timing for Roth Conversions: The peer-reviewed math behind the best timing strategies.

- The Back-Door Roth IRA: How to contribute to a Roth IRA even if you exceed income limits.

- Benefiting from SECURE Act 2.0: How individuals born between 1951 and 1959 can profit from recent legislative changes.

- Tax-Free Transitions: How to convert after-tax dollars in retirement plans to a Roth IRA at no cost, potentially saving hundreds of thousands in taxes down the road.

- Inherited Retirement Plan Strategies: How to convert an inherited retirement plan to a Roth at your beneficiary’s tax rate after you die—a little-known strategy with big tax savings for those who qualify.

Webinar 2: Post-Election Optimal Estate Planning for Married IRA Owners

Click here to watch the replay.

What You’ll Learn:

- Lifetime Gifting Strategies: How increasing lifetime gifts to your heirs now can reduce future tax burdens and provide financial assistance when it's most impactful for your loved ones. This approach isn't just about tax savings; it's also about enriching your family's lives today.

- Who Gets What? Strategy: A rarely discussed method that evaluates the tax consequences of leaving differing types of assets to children in different tax brackets. We will cover a similar strategy for charitable giving. By optimizing your strategies, you could save hundreds of thousands of dollars in taxes.

- State-Level Tax Considerations: Techniques to protect your wealth from potential increases in state-level income taxes, as well as inheritance and estate taxes. State taxes can significantly impact the assets your heirs receive, so proactive planning is essential.

Social Security: Maximizing Your Lifetime Benefits including:

- Risk and Reward Delaying Benefits: Are the risks of benefits cuts and dying young sufficient to take Social Security before 70 for the primary wage earner? And if you take Social Security before 70, can you stop it? Or should you delay taking your Social Security benefits to significantly increase your lifetime payouts, potentially by hundreds of thousands of dollars?

- Integrating Social Security into Your Retirement Plan: Strategies to incorporate Social Security strategy impact other areas of your planning. Learn how synergistically timing your Social Security benefits and Roth conversions can enhance your financial security.

Webinar 3: 7 Costly Retirement Mistakes & How to Avoid Them

Click here to watch the replay.

Here's a sneak peek at two of the critical mistakes we will explore:

1. Allowing Lifelong Habits and a Depression Era Mentality to Blindside Effective Planning.

Accumulating money for retirement is a great objective. But, continuing to accumulate more and more money until you die is not necessarily advisable, and has at least three unfortunate consequences:

- Retirement with fewer rewarding and enjoyable experiences, including missed family vacations.

- Missed opportunity to provide heirs with financial assistance when they really need it.

- Potentially huge tax burden for your children that could have been largely avoided with good planning.

Making this retirement planning mistake can undo many years of diligent saving and hard work. We will discuss how to balance saving with spending and explore ways to use your wealth effectively during your lifetime and passing it on after you are gone.

2. The Missing Link: The Discrepancy Between the Terms of Your Will & Your IRA Beneficiary Designations.

Did you know that with IRA and other retirement accounts, the beneficiary designation—which you quickly filled out, without much thought, when you opened the account--supersedes the instructions in your will or trust?

We will show you the actions to take to correct this mistake—so that the assets in your IRA and retirement accounts go to the beneficiaries you intend. Join us for this informative and engaging workshop to discover the most common estate planning mistakes and how to protect yourself against each.

Important Note: Investment advisory services offered by Lange Financial Group, LLC. Investing involves risks, including the potential for loss of principal. There is no guarantee that any investment plan or strategy will be successful. Visit our website https://paytaxeslater.com for more information on our investment advisory services. Please see https://paytaxeslater.com/privacy for additional disclosures.

Interested in our services? Click here to learn more!

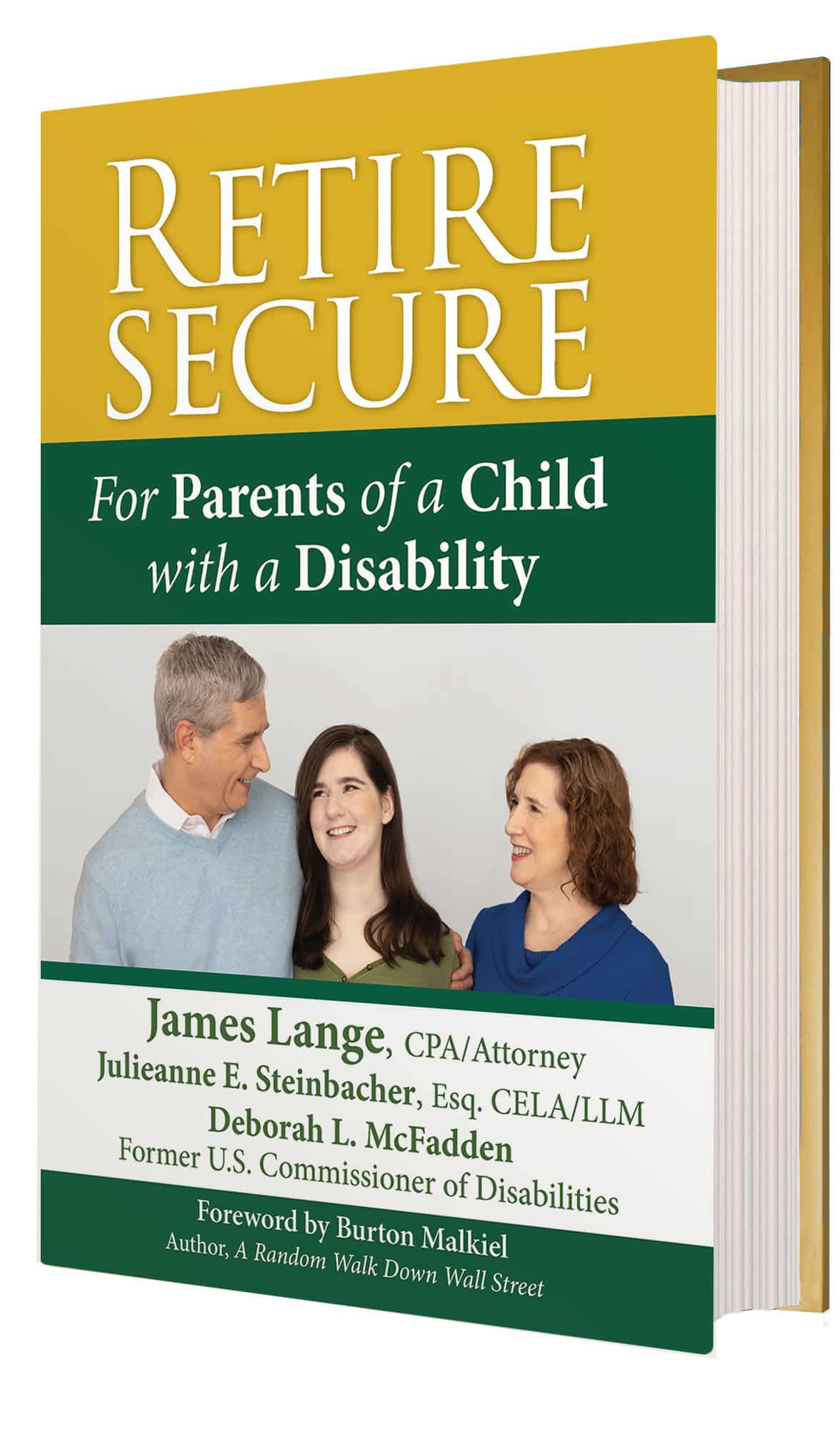

“Combining warmth and compassion with functional hard-headed advice, the dream team of Jim Lange, Deborah McFadden, and Julieanne E. Steinbacher have provided families of children with disabilities with the guidance they need to achieve financial security.”

―Burton G. Malkiel

Professor Emeritus of Economics, Princeton University and Author, A Random Walk Down Wall Street (Over 2 Million Copies Sold)

My co-authors and I believe you have discovered the best and most comprehensive financial resource available for parents of a child with a disability.

Our book explains, analyzes, and demonstrates how most parents can use very specific strategies to secure their financial life and the long-term financial life of their child.

Get your copy today by clicking here!