Speaker | CPA & Attorney |

Speaker | CPA & Attorney |

9-Time Best-Selling Author,

James Lange,

is Available to Speak to Your Association!

Workshop topics include:

- New Tax Laws Create Unintended Benefits for Savvy IRA and Retirement Plan Owners Who Act Quickly.

- The $214,000 Mistake: How to Double Your Social Security & Maximize Your IRAs.

- Who Says You Can’t Control from the Grave? Using Trusts to Protect your Family.

- Roth IRA Conversions: Pay Taxes Once and Never Again.

- Cut Taxes on your IRA Withdrawals: More Money for You and for Your Heirs.

- The Best Estate Plan for Traditional Married Couples.

- Solving the Investor’s Biggest Dilemma: How to Stop the Next Downturn from Decimating Your Portfolio.

NEW Signature Talk:

How to Stop Pending Changes In Tax Laws From Taking Up to 1/3rd of Your IRAs and Retirement Plans

The SECURE Act, which was signed into law on December 20th, 2019 allows the IRS to

confiscate roughly 1/3 of your retirement plan within 10 years of your death, potentially costing your family $1 million dollars or more. In this timely message, Jim presents 6 strategies that will help protect your family.

Protect Your Retirement Plan

Now that the SECURE Act has effectively killed the Stretch IRA, bold action is required to safeguard your family.

Without bold measure,s Congress is poised to ravage your IRA. Although there is no “one size fits all” solution for unique individuals with their own fact pattern, Jim will demonstrate the ins and outs of the following strategies:

When and how much to convert to Roth IRAs, the best estate plan after the new law, getting Social Security right, and a variety of gifting strategies and techniques.

If you’d like to learn more about my New Signature Talk and why retirement plan owners need this information, watch this short video and take a look at my SECURE Act-specific Speaker Brochure.

Link to Video: https://paytaxeslater.com/WhyJamesLange

Link to Speaking Brochure: https://paytaxeslater.com/JamesLangeSpeaker

Contact us to Learn More!

Prepare yourself for the best in retirement and estate planning information available! Jim Lange, CPA/Attorney, and nationally recognized IRA expert is charged and ready to deliver the most cutting-edge strategies to your organization.

Jim’s presentations can be customized to specifically cover topics and issues that are the most crucial to your members. He not only unleashes the best, substantive retirement and estate planning advice but he also reveals how to use these proven strategies to dramatically improve the attendee’s financial security. Inviting Jim Lange to present to your group will electrify your audience and provide real value all at no cost to you or your members.

Jim speaks to thousands of IRA and retirement plan owners, financial advisors, accountants, and attorneys annually on proven tax-saving strategies–all 100% legal–that keep your wealth in your hands … and out of Uncle Sam’s.

For more information or to book Jim to speak with your association, please call Erika Hubbard or Jim Lange at 412-521-2732 or email Erika@PayTaxesLater.com or Jim@PayTaxesLater.com today!

The talk is free.

But the advice could mean the difference between your members living comfortably in retirement versus just scraping by.

If you are interested in learning more about Jim Lange’s turnkey workshop systems, contact us at 412.521.2732, 1.800.387.1129, or admin@paytaxeslater.com.

About Your Speaker, James Lange

Jim is the President and Founder of three inter-related companies: a registered investment advisory firm with $750 million under management, a law firm that has drafted 2,871 wills, and a CPA firm that prepares 821 tax returns. Jim is a 9-time best-selling author, has been quoted 36 times in The Wall Street Journal and over 30 times in the Pittsburgh Post-Gazette, and has accumulated over 35 years as a CPA/attorney, and wealth advisor.

Jim speaks to thousands of IRA and retirement plan owners, financial advisors, accountants, and attorneys annually on proven tax-saving strategies-all 100% legal- that keep your wealth in your hands…and out of Uncle Sam’s.

In addition, he has written feature articles for Kiplinger’s, Trusts & Estates, Forbes, The Tax Adviser, Financial Planning and many other trade journals. He is the author of three editions of the best-seller, Retire Secure! The book is distinguished with a foreword by Larry King of CNN and an introduction by Ed Slott, CPA. It enjoys glowing reviews from the industry’s best: Charles Schwab, Roger Ibbotson, Jane Bryant Quinn, and 40 other financial professionals. Charles Schwab calls Retire Secure! “a road map for tax-efficient retirement and estate planning.” Jim is also the author of the best-sellers, The Roth Revolution: Pay Taxes Once and Never Again, The $214,000 Mistake: How To Double Your Social Security & Maximize Your IRAs, Retirement Plan Owner’s Guide to Beating the New Death Tax, and The Ultimate Retirement and Estate Plan for Your Million-Dollar IRA. In addition, Jim is a regular columnist for Forbes.com.

Jim lives in Squirrel Hill with his wife, Cindy, and their daughter, Erica. He enjoys hiking, biking, chess, and playing bridge.

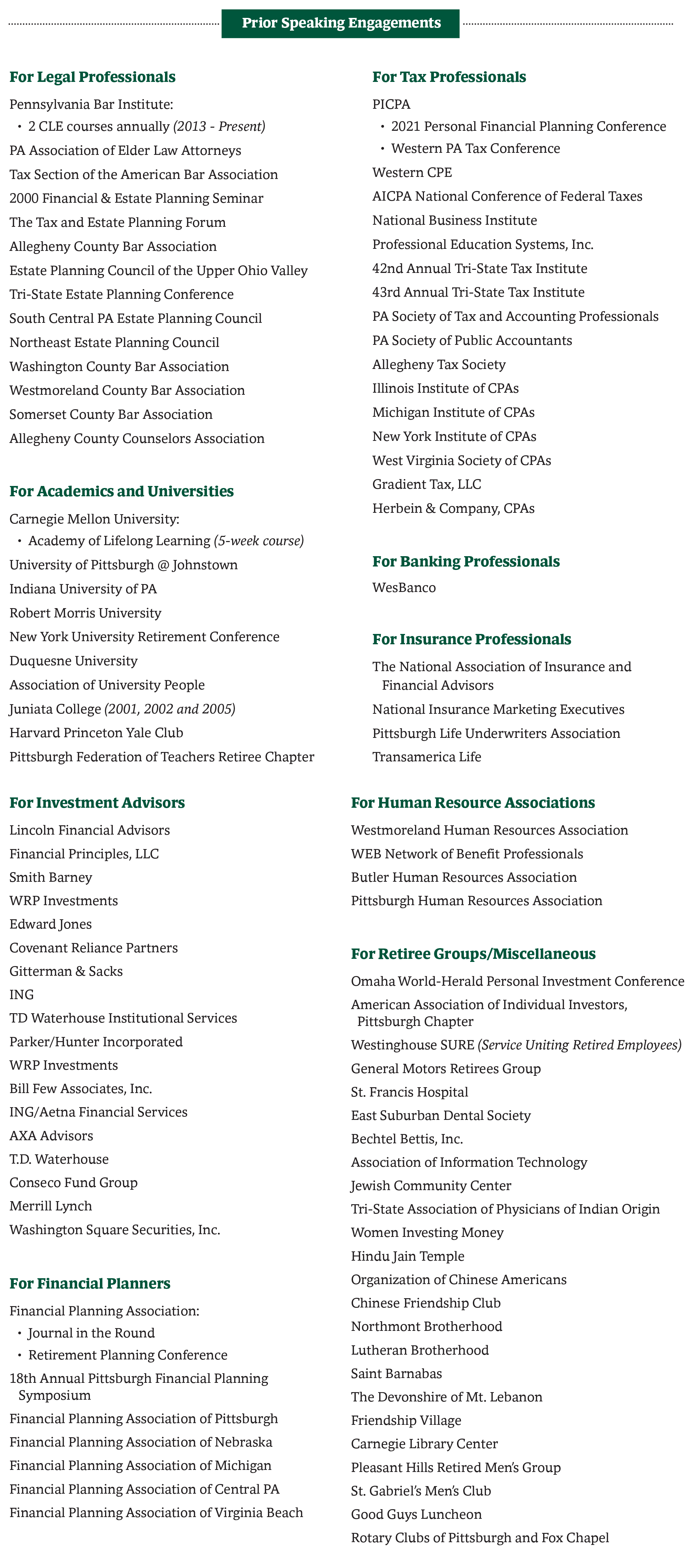

Click here for a PDF of Jim’s prior speaking engagements.

Pennsylvania Bar Institute Evaluations

“Please let Jim know that I have been attending Pennsylvania Bar Institute for 5+ years and I think he gave the best CLE I’ve ever had there.”

“Excellent job! Loving this seminar! Glad my CLE courses included yours.”

“Thank you for a brilliant presentation!”

“Lange is easy to listen to and commands the audience’s attention all day!”

“Jim had great substance and knew the subject deeply—Fantastic seminar!”

Testimonials and Endorsements for Keynote Speaker,

James Lange, CPA/Attorney

“On behalf of the Westinghouse SURE organization, I would like to thank you and your staff for taking the time to prepare and provide an excellent presentation to the group on September 11, 2019. There was an excellent turnout, about 80 members, for the meeting. The members were engaged during your presentation and the ensuing “Questions & Answers” session. The topics you offered were significant for all members. Several attendees approached me after the meeting and expressed they were impressed with you, the material you presented and your knowledge of the subjects. Thank you for allowing SURE to forward the slides of the session to our members. Thanks!!!!!”

Bob McFetridge, Westinghouse SURE Financial Roundtable Coordinator

“Jim Lange’s seminar was excellent. He simplified complex issues and provided clear and concise answers to technical questions. I received many positive comments about his presentations.”

William O’Donnell, Senior Vice President, Parker/Hunter

“The Tri-State Tax Institute each year invites notable speakers in regard to current tax issues. Mr. Lange was requested to return for a second year by virtue of his high ratings on participants’ survey sheets. The audience of lawyers, CPAs, CFPs and insurance agents highlighted not only his timely topics, but his excellent manner of presentation. I would highly recommend Mr. Lange for his professionalism and knowledge.”

Chris Freeman, Director, Tri-State Tax Institute

“The presentation was one of the most outstanding we have ever had. Questions from the audience were answered completely. The audience agreed that the presentation was particularly useful. We plan on inviting Mr. Lange back.”

Parvin Lippincott, SURE Coordinator, Westinghouse

“Your presentation on the “greedy givers” and the benefits of using retirement assets to fund charitable giving remainder trusts will be very helpful to our development team as they work with their planned giving prospects. We appreciate your professionalism and expertise.”

Larry Karnoff, JD, CFRE, Director of Planned Giving

University of Pittsburgh

“Over the years I’ve attended dozens of financial “seminars” with advance claims to astonishing benefits. I have never been so impressed. The workshop delivered the goods. Thank you for opening my eyes.”

Unsolicited testimonial from a public workshop participant

For more information or to book Jim to speak with your association, please call Erika Hubbard or Jim Lange at 412-521-2732 or email Erika@PayTaxesLater.com or Jim@PayTaxesLater.com today!

For more information on customizing topics or to request that Jim speak at your next gathering, please contact Erika Hubbard or Jim Lange at 412-521-2732 today! You can also email Erika@PayTaxesLater.com or Jim@PayTaxesLater.com.

Videos of Jim’s Previous Workshops

|