Table of Contents

- Introduction

- Medicare Tax

- Capital Gains and Losses

- Zero Percent Tax on Long-Term Capital Gains

- Step-Up-In-Basis Rules

- Taxation of Social Security Income

- Estate and Gift Tax Opportunities

- Itemized Deductions & Exemptions

- Miscellaneous Year-End Tax Reduction Strategies

- Charitable Giving

- Roth IRA Conversions

- Inherited IRAs

- Tax Benefits for Education

- Alternative Minimum Tax

- Conclusion

Ever since I can remember, there has never so much uncertainty of how to plan for our taxes. For long-term planning, IRA and retirement plan owners need to read my new book, The Ultimate Retirement and Estate Plan for Your Million Dollar IRA, Including How to Protect Your Nest Egg form the Pending “Death of the Stretch IRA” Legislation. A preview is the Senate Finance Committee voted 26-0 to kill the stretch IRA. If you are a client, we are in the process of mailing you a copy of that book. If you are not a client, or if you want to read about the miserable changes now, please go to www.paytaxeslater.com and download the book. Please read the addendum too.

So, back to year-end planning outside of what is recommended in the book which is more of a huge shift in our planning, but not specifically related to year-end planning. With year-end planning, the question is where do we go from here?

Donald Trump’s election and GOP control of Congress will provide Republicans with an easier path to getting tax legislation passed. Reducing taxes is one of the centerpieces of Trump’s economic plan. He has proposed lowering and consolidating tax rates for individuals, expanding family related tax breaks, ending estate taxes, and repealing the Affordable Care Act—although he seems to be wavering on his commitment to a total repeal. He also plans to reduce income taxes on businesses. I think his bark is worse than his bite, but we are still living in uncertainty.

We expect to know more about his proposals in the next several months, but with major tax overhaul reform proposed by the incoming administration and no details, we are left in a tax-limbo when it comes to year-end planning for 2016. The following example sheds some insight.

Annual year-end tax planning strategies typically include whether to defer income into the next tax year or accelerate income in the current year. The same can hold true for deductions. Depending on an individual’s tax situation over a projected two-year period, either strategy can be useful. There’s also the time value to paying taxes later. Most high-income taxpayers may look to defer income into 2017 and accelerate deductions in 2016 considering President-Elect Trump’s plan to cap the highest individual tax bracket at 33%. Also, taxpayers who currently expect to be in the 28% – 33% tax bracket may save between 3 – 8% in 2017.

On the other hand, based on President-Elect Trump’s proposed tax brackets, singles with taxable income between $127,500 and $200,500 could see a tax increase by 5%. Another part of his proposal includes increasing the standard deduction somewhere between $15,000 for singles and $30,000 for married couples. Some taxpayers who itemize their deductions in 2016 may be using the higher proposed standard deduction in 2017. It may make good sense to accelerate itemized deductions before the end of 2016 especially if you’re a good candidate to use the new higher proposed standard deduction. This strategy may have a double benefit as current tax rates are higher in 2016 than those being proposed in 2017. As you can imagine, without definitive income-tax rates and capital-gains tax rates for 2017, tax planning becomes a lot of “if-then” scenarios.

The 2016 changes to tax brackets and tax rate increases remain in effect for 2016, albeit with slight inflation-adjusted amounts to the tax-bracket tables. As was the case in 2015, it is very important for higher income taxpayers to focus on ways to reduce their adjusted gross income. Tax rates, tax credits, tax deductions and additional tax increases (surtax) are closely tied to taxpayer’s adjusted gross income. In today’s current tax climate, it is recommended that tax practitioners examine a two-year window rather than just focusing solely on current year adjusted gross income.

One of our main goals is to help clients identify specific opportunities that coordinate tax reduction with their investment portfolios. To achieve this goal, we continually stay current about potential year-end tax strategies and keep abreast of future strategies that our clients might want to consider to help reduce their taxes. We hope you are continually implementing long-term tax reduction strategies. We hope you will use us as a resource. We urge you to begin your final year-end tax planning now!

As a comprehensive financial services firm, Lange Financial Group, LLC is committed to helping our clients improve their long-term financial success. This special report covers many year-end tax strategies for 2016. Of course, since every situation is different, not all strategies outlined will be appropriate for you. Please discuss all potential tax strategies with your tax preparer. Remember, this is not advice for preparing your taxes. Our goal is to identify ways to reduce your taxes!

My entire team at Lange Financial Group, LLC is available to provide you with updated information that can help with all your financial planning needs. If you would like us to send a copy of this important report to any of your friends or associates, please call Alice Davis at 412-521-2732.

It should be noted that our frequently-recommended three best tax shelters that create income-tax free growth are particularly appropriate in today’s tax environment. These three tax shelters are:

- Roth IRA conversions, please see my article, Roth: Four Little Letters Leading to Long-Term Financial Security at https://paytaxeslater.com/reading/roth_ira/.

- Section 529 plans (college plans for grandchildren and children). We would recommend Joe Hurley’s book, Saving for College or his website, www.savingforcollege.com.

- Life insurance.

As always, if you have any questions about your specific situation before our next scheduled meeting, please feel free to call your preparer.

Sincerely,

James Lange

Certified Public Accountant

Attorney at Law

Once again in 2016, many higher income taxpayers had larger tax bills due to the 3.8% Medicare contribution tax on net investment income. The focus must be on reducing your adjusted gross income to help mitigate the additional tax costs. Try and manage your adjusted gross income by keeping it as close to the threshold as possible. Going well below the threshold provides no additional benefit as it relates to computing the 3.8% surtax. With a few strategic moves, we might be able to reduce your adjusted gross income enough to mitigate the impact of these new taxes.

The Medicare contribution tax is imposed only on “net investment income” and only to the extent that total Modified Adjusted Gross Income (MAGI) exceeds $200,000 for single individuals and $250,000 for taxpayers filing joint returns. The amount subject to the tax is the lesser of:

- Net investment income; or

- The excess of MAGI over the applicable threshold amount listed above.

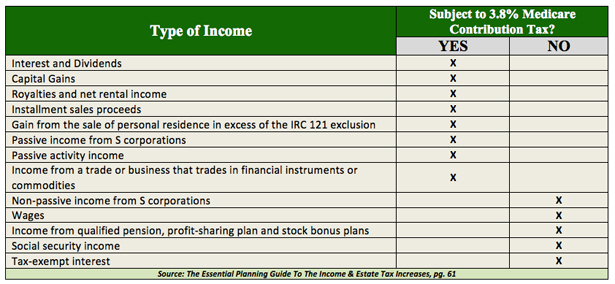

In addition to the complexity of calculating “net investment income” subject to the tax, another difficulty will be determining what constitutes net investment income that is subject to the tax. The chart below summarizes what qualifies as investment income under the new law.

Let’s examine ways to reduce your adjusted gross income before the end of 2016.

Many taxpayers, especially wage earners, have less control over their adjusted gross income when compared to self-employed taxpayers or even those in retirement. The following year-end moves can be ideal if any of these situations apply. If you have earned income from self-employment or an employee, one of the best ways to manage adjusted gross income is through retirement plan contributions. There are many alternatives to choose from that enable individuals to make retirement plan contributions. Now is an ideal time to make sure you maximize your retirement plan contributions for 2016, and start thinking about your strategy for 2017. Examine your year-to-date elective deferral contributions on your most recent pay stub. While your intentions may have been to maximize current year contributions to your 401(k) or 403(b), you may find out that you have not hit the maximum amounts as anticipated. There is still time to have your employer increase your contributions from your remaining paychecks to reach the maximum level of contributions allowable for 2016. Just recently the Internal Revenue Service announced cost-of-living adjustments affecting dollar limitations for pension plans and other retirement-related items for tax year 2017. Highlights include the following:

Higher 401(k)/403(b) Contribution Limits. The elective deferral (contribution) limit for employees who participate in 401(k), 403(b), most 457 plans, and the federal government’s Thrift Savings Plan remains unchanged at $18,000. The catch-up contribution limit for employees age 50 and over who participate in 401(k), 403(b), most 457 plans, and the federal government’s Thrift Savings Plan remains at $6,000. Looking ahead, if you’re currently set up to have the maximum salary deferral in 2016, you’re good to go for 2017 as the limits remain unchanged.

Planning Note. We are big proponents of using Roth 401(k) and Roth 403(b) plans for elective deferral contributions. Considering the current increased tax rate structure and the focus on reducing adjusted gross income, higher income taxpayers should consider switching back to making tax-deductible retirement plan contributions instead of funding their Roth accounts. An ideal strategy may be to split your contributions during the year if you’re in overlapping tax brackets. For example, consider making tax deductible contributions to reduce your income to the bottom level of your upper tax bracket and fund the remaining portion of your current year retirement account with non-deductible Roth contributions in a lower bracket. If you’re interested in this strategy, be sure to discuss with your professional tax preparer.

Make a Tax-Deductible IRA Contribution. For those taxpayers who qualify, you can make a tax-deductible contribution of $5,500 with a catch-up (for taxpayers 50 or older) of an additional $1,000. The contribution can be made until April 15, 2017 and still be a deduction on your 2016 tax return.

Planning Note. Due to the fact that the IRA contribution can be made after the end of the calendar year, calculating the actual tax savings provides a great advantage and shouldn’t be overlooked.

While it Lasts. For those of you who don’t qualify for a regular Roth IRA contribution (because your income is too high) and who have no other traditional IRAs, you can take advantage of a nice loophole in the code. Consider making a traditional IRA contribution and converting it immediately to a Roth IRA. You will run into complications with this strategy if you have other traditional IRAs. Once again, if this strategy fits your situation, make your 2016 contribution as soon as possible and repeat the process with your 2017 IRA contribution in early January 2017. If you are married, you can apply this strategy to your spouse even if they don’t work assuming your earned compensation is sufficient.

Caution: If you are planning to do a rollover from a qualified plan to an IRA account prior to the end of the year, the above strategy will be unsuccessful and the conversion will result in unexpected taxable income. It will not matter if the IRA contribution and the immediate Roth conversions occurred earlier in the year before the rollover date.

For those of you who can afford it, I encourage establishing and funding a Roth IRA for your children or even grandchildren and get a tax-free retirement fund started for their benefit. The longer period of tax-free growth provides a greater benefit. Like any IRA, the owner must have earned income for you to make a contribution.

Tax Loss Harvesting. If your capital gains are larger than your losses, you might want to do some “loss harvesting.” This means selling certain investments that will generate a loss—converting them from unrealized losses to realized losses. You can use an unlimited amount of capital losses to offset capital gains. However, you are limited to only $3,000 of net capital losses that can offset other income, such as interest, dividends and wages. Any remaining unused capital losses can be carried forward into future years indefinitely. Tax loss harvesting will generate even greater savings for higher income taxpayers that are subject to additional 3.8% net investment income tax on net capital gains. (Don’t forget to review your “Trust Investment Accounts” for loss harvesting as the higher tax rates apply at much lower levels of taxable income). Being tax savvy by reviewing your investment portfolio(s) for loss harvesting should be done annually prior to the end of the current tax year.

Please note that if you sell an investment with a loss and then buy it right back, the IRS disallows the deduction. The “wash sale” rule says you must wait at least 30 days before buying back the same security to be able to claim the original loss as a deduction. However, you can buy a similar security to immediately replace the one you sold—perhaps a stock in the same sector. This strategy allows you to maintain your general market position while capitalizing a tax break.

If you are planning to write-off a non-business bad debt, be sure to establish that it is bona fide debt and document unsuccessful efforts to collect. Form over substance matters in these instances.

Defer Income and/or Accelerate Expenses. If you’re a cash business owner, it can be beneficial to defer income into 2017 by delaying end-of-year billing and paying expenses early that might normally be paid in 30-60 days that would extend into 2017. Make use of your business line of credit to provide you with the short-term financing necessary to implement this strategy. Business income is taxed as ordinary income which does not receive preferential tax rates such as capital gain income. As mentioned earlier, a two-year analysis of your tax situation can help you maximize tax bracket savings and also make available tax credits that may otherwise be lost.

Utilize Installment Sales. If appropriate, reporting taxable gains using an installment sale will allow you to the spread the gain over several years rather than recognizing the entire gain in the year of sale. In many instances, this type of gain is also subject to the 3.8% Medicare surtax on “net investment income” thus managing your adjusted gross income can save additional taxes. Keep in mind that Medicare Part B premiums are determined by looking at your tax return from two years prior to the current year. An installment sale may enable you to spread the gain over several years while never crossing the threshold that would trigger increased Medicare premiums in any one year. Alternatively, if you have entered into an installment sale arrangement, you may have an option to elect out of the installment sales tax treatment. This election allows you to recognize the entire gain in the year of sale even though payments you receive will be over multiple tax years. Consider this option if it’s the appropriate tax strategy.

Maximize your HSA Contribution. If you are enrolled in an HSA (health savings account) plan, it is not too late to maximize your 2016 tax deductible contribution to the account. In fact, you have until April 15, 2017 to fund your HSA account and still get a 2016 tax deduction. Similar to an IRA contribution, the exact amount of tax savings can be calculated. It is the only section in the Internal Revenue Code that allows a tax deduction on the way in and tax-free on the way out for qualifying distributions. For those who can afford it, fully funding the HSA account and never using the funds to pay for current medical expenses (using other monies to pay for medical expenses incurred) can allow for a big pot of tax-free money to accumulate over time to be used for future medical costs. These funds can come in handy during retirement when you normally experience more medical expenses while having less annual income.

Consider Like Kind Exchange. No gains are recognized if property held for use in a trade or business or for investment is exchanged solely for property of a like kind to be held either for use in a trade or business or for investment. Any gain realized, but not recognized, adjusts the basis of like-kind property received in the exchange. Caution, make sure you are aware of the rules when doing a like kind exchange.

Funding Self-Employed Retirement Plans. If you are self-employed, you have other retirement savings options. We will review these alternatives with you when you come in for your appointment. One of my favorites for many one person self-employed businesses is the one person 401(k) plan.

Funding Self-Employed Retirement Plans. If you are self-employed, you have other retirement savings options. We will review these alternatives with you when you come in for your appointment. One of my favorites for many one person self-employed businesses is the one person 401(k) plan.

Most self-employed retirement plans allow for contributions to be made as late as October 15th of the following year. This is really cool because it allows you to calculate various levels of savings based on various contribution amounts. The 2016 maximum contribution allowable for these plans can be as high as $59,000 if catch-up contributions are permitted for taxpayers age 50 and older.

Increase Tax-favored Income. Converting taxable interest to tax-exempt interest will serve to reduce adjusted gross income and modified adjusted gross income. For example, moving money from CDs or money market accounts will not create any taxable income. Alternatively, selling corporate bonds may produce a taxable gain and reduce or offset the benefits.

Reduce Business or Rental Real Estate Income. Make full use of depreciation including bonus depreciation and Section 179 expensing allowances for property and equipment placed in service before the end of the year. You have more control in attaining the desired profit or loss level if properly analyzed. The Path Act of 2015 allows for more favorable treatment of certain building improvements in 2016. These type expenditures have historically been subject to much longer depreciation recovery periods.

Looking at your investment portfolio can reveal several different tax-saving opportunities. Review your year-to-date sales of stocks, bonds and other investments. This allows you to determine the net amount of capital gains or losses you have realized to date. Also, review the unsold investments in your portfolio to determine whether these investments have an unrealized gains or losses. (Unrealizedmeans you still own the investment while realized means you’ve sold the investment).

Most taxpayers are able to obtain the tax basis of their investments. In most instances, basis refers to the price that you paid to acquire the investment. Some investments allow you to reinvest your dividends and/or capital gains to purchase additional shares. These additional shares add to the cost basis of the original purchase.

If your capital gains are larger than your losses, you can begin looking for tax-loss selling candidates. This strategy called “loss harvesting” converts the unrealized losses to realized losses. Tax loss harvesting and portfolio rebalancing are a natural fit. If you’re more of a buy and hold mutual fund investor, your capital gains may be in the form of mutual fund distributions. These distributions are typically paid out towards the end of the tax year and sometimes can be quite substantial. Implementing the “loss harvesting” strategy after these additional gains are included provides for more accurate tax planning. The tax code allows you to apply to up to $3,000 of net capital losses to reduce ordinary income items such as interest, dividends and wages. Any remaining unused capital losses can be carried forward into future years indefinitely.

Please note that if you sell an investment with a loss and then buy it right back, the IRS disallows the deduction. The “wash sale” rule says you have to wait at least 30 days before buying back the same security in order to be able to claim the original loss as a deduction. However, you can buy a similar security to immediately replace the one you sold—perhaps a stock in the same sector. This strategy allows you to maintain your general market position while utilizing a tax break.

Zero Percent Tax on Long-Term Capital Gains

If you are in the 10% or 15% tax bracket, the tax rate for long-term capital gains is zero percent! In order to qualify for this tax break, your 2016 taxable income cannot exceed $37,650 for singles and $75,300 for married joint filers.

Please note that the 0% tax rate only applies until your taxable income exceeds the current 15% tax bracket. For example, let us assume that a married couple with wages of $70,000, long-term capital gains of $40,000 and deductions of $14,700 leaving them with $95,300 of taxable income. The first $20,000 of long-term capital gain is tax-free, but once their taxable income passes the $75,300 limit, the remaining long-term capital gain of $20,000 is taxed at 15%.

If you are eligible for the 0% capital gains tax rate, here is a cool maneuver. It might be appropriate to sell some appreciated stocks to take advantage of the zero percent capital gains rates. Sell just enough so your gain pushes your income to the top of the 15% tax bracket, then buy new shares in the same company. The newly purchased shares will have a higher cost basis than the shares you sold. If you should eventually sell these shares, it will be with a new higher tax basis. This allows you to take advantage of the 0% tax rate now. Please also note that you do not have to wait 30 days before you can buy the stock back when there is a taxable gain. This technique is referred to as “gains-harvesting.” The 30 days period only applies to securities sold at a loss.

If you are eligible for the 0% capital gains tax rate, here is a cool maneuver. It might be appropriate to sell some appreciated stocks to take advantage of the zero percent capital gains rates. Sell just enough so your gain pushes your income to the top of the 15% tax bracket, then buy new shares in the same company. The newly purchased shares will have a higher cost basis than the shares you sold. If you should eventually sell these shares, it will be with a new higher tax basis. This allows you to take advantage of the 0% tax rate now. Please also note that you do not have to wait 30 days before you can buy the stock back when there is a taxable gain. This technique is referred to as “gains-harvesting.” The 30 days period only applies to securities sold at a loss.

If you’re ineligible for the 0% capital gains tax rate, but you have adult children in the 0% bracket, consider gifting appreciated stock to them. Your adult children will pay a lot less in capital gains tax than if you sold the stock yourself and gifted the cash to them. This is especially true if you are subject to both the Medicare surtax on net investment income, and you’re in the 39.6% tax bracket. In this scenario, you are paying 23.8% on your long-term capital gains.

If you’re ineligible for the 0% capital gains tax rate, but you have adult children in the 0% bracket, consider gifting appreciated stock to them. Your adult children will pay a lot less in capital gains tax than if you sold the stock yourself and gifted the cash to them. This is especially true if you are subject to both the Medicare surtax on net investment income and you’re in the 39.6% tax bracket. In this scenario, you are paying 23.8% on your long-term capital gains.

But be careful—you can’t “go back in time” if you subsequently discover you would have fared better had you identified different shares before you made a particular sale. If you don’t specify which shares you are selling at the time of the sale, the tax law treats the shares you acquired first as the first ones sold. In other words, it uses a FIFO (First-In, First-Out) method. This may not produce the optimal result that you had wished for.

Hidden Gem. When a parent’s income is too high to claim education tax credits, (the American Opportunity and Lifetime Learning), and the parent is also subject to Alternative Minimum Tax, shifting the income to the kid’s return can generate tax savings. In this tax-planning strategy, the parent is eligible to claim the child as a dependent but chooses not to on the parent’s tax return. Although the parent is giving up the child as a dependent on their tax return, the child “can’t” claim a personal exemption for themselves on their own tax return. By waiving the dependency deduction, the parent also gives up the right to claim the college tax credit on their return. Keep in mind the parent wouldn’t be eligible to take the tax credit on their tax return so no loss there.

The kid is now able to claim the education credit on their own tax return up to $2,500 depending on which education credit they’re eligible for. This is even true if the parent pays for the college tuition and qualified expenses. Ideally you would shift enough long-term capital gain income from the parent to the child to be offset by the $2,500 education tax credit. Caution: You always should make sure that adding income to your kid’s tax return will not affect eligibility for any kind of student aid. Usually in this scenario, the family unit has too much income and too many assets to be eligible for any income based financial aid.

Even shifting income from a parent to a minor child can help save taxes. This can work well with high income taxpayer parents who are already subject to the 3.8% surtax on investment income. Even though the shifted income may be subject to the “kiddie tax” rules (effectively taxing the income at the parent’s income tax rate on the child’s tax return), it wouldn’t be included in the parent’s net investment income calculation. Hence, it wouldn’t be subject to the additional 3.8% surtax on investment income.

Another very important but often overlooked item is a step-up-in-basis, which occurs when a taxpayer inherits certain assets. The new cost basis is the fair market value as of the date of death, which is often much greater than the original basis that the decedent had in this investment. However, the step-up-in-basis rule does not apply to certain investments, such as IRAs and other tax-deferred accounts.

Remember that if someone gifts you an appreciated asset while they are alive, then the recipient’s basis is the same as the basis of the giver.

Taxation of Social Security Income

Social Security income may be taxable, depending on the amount of other income a taxpayer receives. If a taxpayer only receives Social Security income, the benefits are generally not taxable, and it is possible that the taxpayer may not even need to file a federal income tax return.

If a taxpayer receives other income in addition to Social Security income, and one-half of the Social Security income plus the other income exceeds a base amount, then up to 85% of the Social Security income may be taxable. The base amount is $25,000 for a single filer and $32,000 for married taxpayers filing a joint return.

A complicated formula is necessary to determine the amount of Social Security income that is subject to income tax. IRS publication 915 contains a worksheet that is helpful in making this determination.

Social Security income is included in the calculation of MAGI for purposes of calculating the Medicare contribution tax, as discussed earlier. Therefore, taxpayers having significant net-investment income will have a reason to delay receiving Social Security benefits.

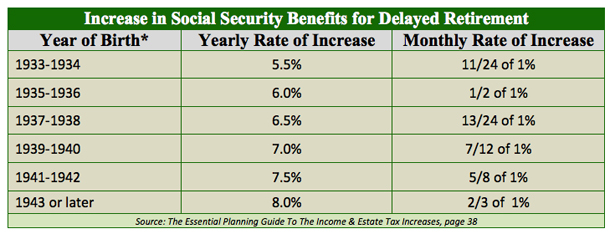

Assuming a reasonable or long life expectancy, it is generally beneficial for an individual who is eligible to receive Social Security on or after age 62 to delay payments until full retirement age. Assuming a full retirement age of 66, an individual who elects to receive Social Security benefits at age 62 will see benefits reduced by 25%. However, if the same individual delays receiving Social Security benefits until after full retirement age, a delayed retirement credit may be available. The chart below shows the percentage increases when an individual delays receipt of retirement benefits.

An interesting wrinkle in long-term planning related to the taxation of Social Security is the synergy of developing a good long-term Social Security maximization plan and a good long-term Roth IRA conversion plan. We often enjoy tremendous benefits using the following combination strategy under the right circumstances.

One effective strategy is holding off on Social Security and making Roth IRA conversions in the years after you retire and you don’t have wages, but before age 70 when you will have Required Minimum Distributions (RMD) and full Social Security. Make those Roth IRA conversions while your marginal income tax bracket is at an all-time low. Please note a Roth IRA conversion increases income which could increase Social Security taxes.

On November 2, 2015, President Obama signed the Bipartisan Budget Act (BBA) of 2015 into law. This law eliminated two of the most effective methods available for maximizing Social Security benefits: Apply and Suspend and filing a Restricted Application for benefits. For an excellent and concise explanation of these new rules please see my The Little Black Book of Social Security Secrets at https://www.paytaxeslater.com/ss. We do “run the numbers” and provide personalized solutions for both Social Security maximization and Roth IRA conversions for our assets under management clients.

Estate and Gift Tax Opportunities

The game of estate planning for most clients has changed from trying to reduce gift or estate tax to trying to reduce income taxes. For 2016, each taxpayer can pass $5,340,000 (minus past taxable gifts that he/she has made) to children or other beneficiaries without having to pay gift or estate taxes. (This exemption increases to $5,490,000 in 2017). If you are married, you will be able to pass $10,900,000 without any federal gift or estate taxes. There is a 35% estate tax on gifts or estates of deceased persons exceeding the limits. This is the exemption amount for federal estate tax, not for PA inheritance tax, which is a flat 4.5% to lineal heirs (children and grandchildren).

The game of estate planning for most clients has changed from trying to reduce gift or estate tax to trying to reduce income taxes. For 2016, each taxpayer can pass $5,340,000 (minus past taxable gifts that he/she has made) to children or other beneficiaries without having to pay gift or estate taxes. (This exemption increases to $5,490,000 in 2017). If you are married, you will be able to pass $10,900,000 without any federal gift or estate taxes. There is a 35% estate tax on gifts or estates of deceased persons exceeding the limits. This is the exemption amount for federal estate tax, not for PA inheritance tax, which is a flat 4.5% to lineal heirs (children and grandchildren).

Many people believe that with the estate tax exemption set at over $5,000,000 per person, they don’t need to worry about shrewd, tax-wise ways to give wealth. However, these people might want to rethink their strategy. Congress can change the law (and has changed the law in the past), and your wealth could grow faster than expected, thereby subjecting you to estate tax—although that will be less likely with Republican control of the government. Nevertheless, before you gift something away, you need to consider the income tax effects of making a particular gift. Giving away the wrong asset can cost your family some unnecessary taxes. However, if you have an estate that is worth less than $3,000,000, I would recommend focusing on long-term planning to reduce income taxes, not estate taxes. Planning appropriately for your IRA, Roth IRA, Roth IRA conversions and your retirement plan should be your biggest concern.

You and your spouse can each give $14,000 per calendar year ($28,000 for couples) to as many individuals as you’d like without reducing your lifetime gift tax exemptions. Depending on your circumstances, it may be smart to make a gift before the end of this year. Gifts to medical or educational providers are not included in the $14,000 limit. In fact, there is no limit on qualified gifts as long as the check is made directly to a school or medical facility.

If you are going to make a gift, it is important to determine which asset is the best one to gift. It is usually best to gift high-basis assets or cash, especially if the taxpayer is in poor health. In most cases, it is best not to give low-basis assets because the basis of gifted assets is the same for the recipient as it is for the donor, and the gifted assets will not usually receive a step-up-in-basis when a taxpayer passes.

Before making sizable gifts to children or other family members, keep in mind that these gifts may actually backfire in some cases. For example, a gift might make a student ineligible for college financial aid, or the earnings from the gift might trigger tax on a senior’s Social Security benefits.

Congress has created a number of tax breaks over the last few years to help pay for education. One of the most popular types of savings plans is the 529 plan. Withdrawals (including earnings) used for qualified education expenses (tuition, books and computers) are income-tax free.

The amount you can contribute to a Section 529 plan on behalf of a beneficiary qualifies for the annual gift-tax exclusion. However, the tax law allows you to give the equivalent of five years’ worth of contributions up front with no gift-tax consequences. The gift is treated as if it were spread out over the 5-year period. For instance, you and your spouse might together contribute the maximum of $140,000 (5 x $28,000) on behalf of a grandchild this year without paying any gift tax.

Itemized Deductions & Exemptions

Taxpayers are entitled to take either a standard deduction or itemize their deductions on IRS Form 1040, Schedule A. Itemized deductions include, but are not limited to, mortgage interest, certain types of taxes, charitable contributions and medical expenses. Unfortunately, itemized deductions are subject to several limitations. For example, in 2016, medical expenses are now deductible only to the extent that they exceed 10% of AGI in any given year. However, if you or your spouse is over age 65, the deduction limit will stay at 7.5% until December 31, 2016. The Affordable Care Act resets the phase-out for medical expenses beginning January 1, 2017 at 10% of adjusted gross income for all taxpayers for computing the total unreimbursed allowable medical care expenses. Eligible senior taxpayers should pay for medical expenses prior to December 31, 2016 to take advantage of the lower phase-out percentage of 7.5%.

Consider “bunching” your deductions. Many taxpayers don’t have enough itemized deductions to reduce their taxes more than if they take the standard deduction. If you find you often miss the threshold by only a small amount per year, it may be best to “bunch” your deductions every other year, taking a standard deduction in the alternate years. The standard deduction for 2016 is $6,300 for singles and married persons filing separate returns, $9,300 for head of household and $12,600 for married couples filing jointly.

Confirm that you are taking all available dependent exemptions. It might be best to support your parents to make them dependents. Providing more than one-half of the support of a parent qualifies for the $4,050 per-dependent exemption and the ability to deduct medical, dental and educational expenses incurred for parent(s).

These medical expenses can include nursing home expenses. Deductible expenses associated with nursing home care are transportation primarily for and essential to medical care, meals and lodging that are necessary, and prescription medications. Also deductible are long-term care services, which include diagnostic, preventative, therapeutic, and other personal care services when such services are required by a chronically-ill individual.

Miscellaneous Year-End Tax Reduction Strategies

Most taxpayers cannot control the timing of received income, but many of us can determine when to pay or not pay deductible expenses. Prepare tax projections for 2016 and possibly 2017 to determine which tax bracket you are in and where you can get the most bang for your buck. The projections may also help minimize AMT and reduce the Medicare surtaxes. Let’s say for example, your deductions and exemptions are greater than your income, and you will have a negative taxable income, with a tax liability of zero. This is often the case with seniors who receive tax-free Social Security income. In this case, it would be a good strategy to increase your income from negative taxable income to zero taxable income, because the tax on zero taxable income is still zero! One of the best ways to do this is to do a partial Roth IRA conversion up to the amount that brings your negative taxable income up to zero. Depending on your tax bracket, you may wish to convert even more, especially if you expect to be in a higher income tax bracket in the future. If a Roth conversion is not appropriate or desirable, then taking additional retirement account distributions in one year while lowering the amount in the following year may save tax dollars. This strategy is similar to bunching itemized deductions but using income instead of expenses.

If you are itemizing your deductions in 2016, you may want to consider accelerating some of these deductions before the end of this year:

Make your January 2016 mortgage payment on your residence before the end of this year, which enables you to deduct the interest portion in 2016 unless you’re going to be in a higher tax bracket in 2017.

Make your January 2016 mortgage payment on your residence before the end of this year, which enables you to deduct the interest portion in 2016 unless you’re going to be in a higher tax bracket in 2017.- Maximize your payments of state or sales taxes. Taxpayers who itemize deductions can choose between writing off their state income taxes or their state sales tax in 2016. In most cases, income taxes will provide the bigger tax break. However, if you buy a big ticket item such as a car or boat by December 31, 2016, you may be better off deducting sales tax instead.

- Prepay the state income taxes in 2016 that are due in January 2017 as part of your estimated tax payments or the estimated amount of state income tax due on April 15, 2017. See AMT reference. It is very essential to consider analyzing prepaying state income taxes prior to December 31, 2016 in certain situations. For example, let’s say that you have a non-recurring income generating transaction occur this year. This additional income pushes you into a higher tax bracket. Paying the anticipated increased state income taxes prior to December 31, 2016 will provide the greatest tax savings. Of course, you’ll need to make sure you’re not subject to AMT in 2016 or the benefit of prepaying will be lost.

Please note that some of these deductions do not count toward computing Alternative Minimum Tax (AMT). If you are subject to the AMT, it is often best to delay these payments. With the highest marginal rate now being 39.6%, many taxpayers will not be subject to AMT as their regular tax will be greater than AMT. Paying some of the aforementioned deductions in a year where AMT does not exist provides the greatest benefit.

Paying taxes is bad enough. Paying a penalty is even worse. If you face an estimated tax shortfall for 2016, have the extra tax withheld on an IRA distribution. Withheld taxes are treated as if you paid them evenly to the IRS throughout the year. This can make up for any previous underpayments, which could save you penalties.

If you turned age 70 ½ during 2016, you still have until April 1, 2017 to take out your first RMD. This is a one-time opportunity in case you forgot. Remember—if you do not take out your RMD by this date, you will be faced with a 50% penalty on the amount that you should have taken out, but didn’t. Before holding off until April 1, 2017 to take your first RMD, review the tax implications especially if you’re likely to be subject to the Medicare surtax on net investment income. (NOTE: If your first RMD is due by April 1, 2017, you will be responsible for taking out two RMDs in 2017. This will often put you in a higher tax bracket in 2017. Therefore, if you need to take out your first RMD by April 1, 2017, you may want to take your first RMD out on or before 12/31/2016).

Harvesting Ordinary Income. Harvesting ordinary income is another part of an overall successful year-end plan. Many older taxpayers incur extraordinary high medical expenses. Without proper planning, thousands of dollars of medical expenses can be incurred with no tax benefit. Harvesting ordinary income should at least equal itemized deductions plus exemptions; and the targeted tax liability at least equals tax credits available. Furthermore, harvesting ordinary income may be considered in order to “fill up” your marginal tax bracket.

Making Trust Distributions. Net investment income tax also applies to trusts and estates. In light of compressed tax brackets for trusts compared to individual tax brackets, making permitted discretionary distributions to beneficiaries can reduce overall taxes. By making the proper election, trusts can distribute current year income up to 65 days into the following year and still have the income taxed to the beneficiary in the current tax year.

Dependent Care Credit. Taxpayers can claim a non-refundable tax credit against income tax liability for employment-related expenses up to $6,000 for two or more qualifying individuals. These expenses are paid with after-tax dollars and not through an employer provided plan typically offered in a cafeteria plan. Many taxpayers and tax preparers assume the expenses need to be pro-rated between the two qualifying individuals. This is false. If you pay $5,900 for one child and $100 for the other, the full $6,000 is taken into account. If the taxpayer has only one child, $3,000 is taken into account when computing the credit. For example, you pay $5,900 of child care for your youngest child. If you paid no more child care, you would get a $600 tax credit ($3,000 x 20% assumed rate that applies). If your 12-year-old child, who normally doesn’t require child care, was sick one day, and you paid $100 for the care of that child, you now would be eligible for a second $600 tax credit. For a $100 investment, the parent gets an additional $600 (nice deal).

Pennsylvania 529 Plan Contribution Deduction. Don’t miss out on the state tax deduction for contributions to a Section 529 College Saving Program. A taxpayer can reduce their PA taxable income up to $14,000 per plan beneficiary (kids, grandkids, nieces, nephews, etc.). Married couples can deduct up to $28,000 per beneficiary per year, provided each spouse has taxable income of at least $14,000. If your child is currently in college and you are writing checks to the college for tuition or qualified expenses, you should open the 529 plan immediately. You can deposit the college expense money into the account and immediately write the check to the college. You have just generated an immediate 3.07% rate of return on the deposit. Now that’s a winner.

Deferring Losses. Another idea would be to defer business losses into next year if the loss deduction is more valuable in 2017 than 2016. If you’re an S Corporation shareholder with current year business losses, you may want to choose to not increase the basis in your S Corporation stock for 2016. Without sufficient stock basis, the losses would not be deductible in 2016 thus suspended to tax year 2017. Electing whether to fully expense eligible business assets purchased in 2016 under code Section 179 or depreciating the asset(s) over several years should be evaluated for the greatest tax benefit. Once again, with proposed lower business tax rates in 2017 you will need to evaluate your tax situation carefully.

Non-Business Energy Property Tax Credit. The Path Act of 2015 extends the 10% credit of nonbusiness energy property up to $500 through 2016. There is a possibility of this credit expiring at the end of 2016. If you are planning on purchasing any of these improvements in the near future, such as energy efficient windows, doors, heating and air conditioning units, it may be wise to make the purchase before the end of 2016. Keep in mind, the timing of your next purchase is not relevant for claiming the energy credit if you have already used up the maximum lifetime exclusion of $500.

Under the current tax system, a focus on controlling adjusted gross income can provide tax savings. The Path Act of 2015 made permanent the popular Qualified Charitable Distribution (QCD) rules for making charitable contributions from an IRA. Taxpayers age 70 ½ and older can transfer up to $100,000 directly from their IRA over to a charity, satisfying all or part of the RMD with the IRA-to-charity maneuver. Please read the June 2016 Lange Report for a great summary of how seniors can get more out of their charitable giving.

Under the current tax system, a focus on controlling adjusted gross income can provide tax savings. The Path Act of 2015 made permanent the popular Qualified Charitable Distribution (QCD) rules for making charitable contributions from an IRA. Taxpayers age 70 ½ and older can transfer up to $100,000 directly from their IRA over to a charity, satisfying all or part of the RMD with the IRA-to-charity maneuver. Please read the June 2016 Lange Report for a great summary of how seniors can get more out of their charitable giving.

This is a great time of the year to clean out your basement and garage. However, please remember that you can only write off these non-cash charitable donations to a charitable organization if you itemize your deductions. Please do yourself a favor and follow the substantiation rules to tilt the scale in your direction if the deduction is questioned by the IRS. Determining the value of non-cash donations can sometimes be challenging. You can find estimated values for your donated clothing at http://turbotax.intuit.com/personal-taxes/itsdeductible/. It can never hurt to have pictures of the donated items (cell phones cameras make this much easier). The more detailed the receipt, the better. Please send cash donations to your favorite charity by December 31, 2016, and be sure to hold on to your cancelled check or credit card receipt as proof of your donation. If you contribute $250 or more, you also need an acknowledgement from the charity. Many taxpayers kindly help out various charities making non-cash donations.

Tax tip for coaches: Manytaxpayers have children who participate in youth, intermediate or even high school level sports. If dad or mom volunteer their time as coaches, assistant coaches, timekeepers etc. they can be eligible for an income tax deduction for various out-of-pocket expenses incurred. For example, miles driven on their cars while performing their role as coach are deductible charity miles. Many teams travel out of town to compete. You are entitled to deduct certain travel expenses as a charitable deduction. See the IRS website Newsroom for “Tips for Taxpayers Who Travel for Charity Work” for a list of qualifying deductions.

My favorite substantial charitable gift is leaving a portion of your IRA or retirement plan to a charity of your choice after you and your spouse die.

If you want to give money to a charity and get the deduction this year, but don’t know which charity you want to benefit, you should consider donor directed funds that could be set up by a group like The Pittsburgh Foundation.

As mentioned earlier, if you plan to make a significant gift to charity this year, consider gifting appreciated stocks or other investments that you have owned for more than one year. Doing so boosts the savings on your tax returns. Your charitable contribution deduction is the fair market value of the securities on the date of the gift, not the amount you paid for the asset, and therefore, you never have to pay taxes on the profit!

Do not donate stocks that have lost value. If you do, you can’t claim a loss. In this case, it is best to sell the stock with the loss first and then donate the proceeds, allowing you to take both the charitable contribution deduction and the capital loss.

In general, we like Roth IRA conversions for taxpayers who can make a conversion and stay in the same tax bracket they are currently in and have the funds to pay for the Roth conversion from outside of the IRA. It is best to run the numbers to determine the most appropriate time and amount for your situation. We like to develop a long-term Roth IRA conversion plan that usually involves multiple years of partial conversions. Good for those individuals who converted during the recent big dip from the middle of August to the end of September.

In general, we like Roth IRA conversions for taxpayers who can make a conversion and stay in the same tax bracket they are currently in and have the funds to pay for the Roth conversion from outside of the IRA. It is best to run the numbers to determine the most appropriate time and amount for your situation. We like to develop a long-term Roth IRA conversion plan that usually involves multiple years of partial conversions. Good for those individuals who converted during the recent big dip from the middle of August to the end of September.

An interesting rule regarding a Roth IRA conversion is that the taxpayer has an ability to “re-characterize” a Roth IRA back to a Traditional IRA. This makes sense if the value of the Roth IRA has decreased since the conversion has taken place. Why pay taxes on a larger amount of money if the value has gone down? You have until October 15, 2017 to change your mind if you converted in 2016. Unfortunately, a re-characterization is an all or nothing affair—you cannot choose the specific investments within the Roth that may have gone down in value.

In order to get around this problem, you might want to establish two Roth IRA accounts. If one decreases in value, you can then re-characterize that particular Roth IRA back to a Traditional IRA and still keep the appreciated Roth IRA. This method gives you the maximum flexibility and benefits. Taken to the extreme, you could do this with 10 Roth accounts. All these different rules and regulations regarding IRAs can be confusing, and we would be more than happy to review them with you at our meeting.

You can also time a Roth conversion with a large charitable donation. The charitable contribution can offset that income and possibly protect you from being pushed into a higher tax bracket.

A conversion to a Roth IRA today does not have an income limitation cap. You should keep in mind that a conversion to a Roth IRA may place you into a higher tax bracket. In addition, converted IRAs distributed prior to five years or age 59 ½, whichever occurs first, may also be subject to a 10% excise federal income tax penalty. If you are interested in this option, please contact us.

Be careful if you inherit a retirement account. In many cases, a decedent’s largest asset is his or her retirement account. When a beneficiary receives this distribution, it is often a very large sum of money, and there is no step-up-in-basis on retirement accounts. If you inherit a retirement account, such as an IRA or other qualified plan, the money is usually taxable upon receipt. In addition to this immediate taxation, the extra money could push you up into a higher tax bracket, causing you to pay more taxes than you might have if this taxable income was spread out over a period of time.

The solution to this problem is to establish an Inherited IRA, allowing you to spread out the distributions over your lifetime which should reduce and defer your income taxes significantly. Sounds easy, right? Unfortunately, the tax laws regarding the inheritance of retirement accounts are very complicated and all of the rules need to be followed in order to avoid any unnecessary income taxes.

There is proposed legislation, which, if enacted, will reduce the stretch period to five years for non-spouse beneficiaries and greatly accelerate income taxes on these inherited IRAs. We will closely observe any potential change in the law and develop strategies to maximize your wealth. You can download The Ultimate Retirement and Estate Plan for Your Million-Dollar IRA.

The Path Act of 2015 permanently extended The American Opportunity Tax Credit (formerly Hope Scholarship Credit). The Tax code now requires that the taxpayer possess a valid Form 1098-T to claim the American Opportunity Tax Credit. It allows an annual maximum credit of $2,500 per student for the first 4 years of college. Due to income phase-out thresholds, should you have the ability to manage your adjusted gross income, you can preserve this valuable tax credit. There are situations when not claiming your child as a dependent can make better use of qualifying education expenses.

The Path Act of 2015 permanently extended The American Opportunity Tax Credit (formerly Hope Scholarship Credit). The Tax code now requires that the taxpayer possess a valid Form 1098-T to claim the American Opportunity Tax Credit. It allows an annual maximum credit of $2,500 per student for the first 4 years of college. Due to income phase-out thresholds, should you have the ability to manage your adjusted gross income, you can preserve this valuable tax credit. There are situations when not claiming your child as a dependent can make better use of qualifying education expenses.

The annual contribution limit to Coverdell Education Saving Accounts (ESAs) is $2,000 in 2016 and 2016. Distributions from these accounts can be used to pay qualified elementary and secondary education expenses. The American Tax Relief Act of 2012 makes permanent the 2001 tax law changes as it relates to the Coverdell Education savings accounts.

The Alternative Minimum Tax, better known by its acronym “AMT,” imposes an higher tax on certain taxpayers. Congress enacted the tax in 1969 to prevent wealthy taxpayers from paying little or no tax by utilizing tax loopholes. In past years, Congress stepped in and applied what has become known as the “AMT patch” to increase the exemptions amount. For taxable years beginning after 2012, The American Relief Act of 2012 permanently indexes the exemption amounts for inflation. Those taxpayers trapped by AMT typically lose the benefit of many of their otherwise tax deductible expenses. In many instances, higher income taxpayers don’t enjoy the lower long-term capital gains tax rates due to AMT. It can never hurt to run some figures to see if AMT can be minimized.

The Alternative Minimum Tax, better known by its acronym “AMT,” imposes an higher tax on certain taxpayers. Congress enacted the tax in 1969 to prevent wealthy taxpayers from paying little or no tax by utilizing tax loopholes. In past years, Congress stepped in and applied what has become known as the “AMT patch” to increase the exemptions amount. For taxable years beginning after 2012, The American Relief Act of 2012 permanently indexes the exemption amounts for inflation. Those taxpayers trapped by AMT typically lose the benefit of many of their otherwise tax deductible expenses. In many instances, higher income taxpayers don’t enjoy the lower long-term capital gains tax rates due to AMT. It can never hurt to run some figures to see if AMT can be minimized.

Please note that Pennsylvania does not follow the same rules and computations as the federal income tax rules. Make sure you check with your tax preparer to see what tax rates and rules apply for your particular state.

Identity Theft Affidavit: Consider filing IRS Form 14039 (available on the IRS website) before the 2016 tax filing season arrives. Identity theft has been steadily on the rise. The IRS will provide you a 6-digit PIN number to use when filing your income tax return. The PIN will help the IRS verify a taxpayer’s identity and accept their electronic or paper tax return. The PIN will prevent someone else from filing a tax return with your SSN as the primary or secondary taxpayer (spouse).

IRS Scams: Threatening emails and phone calls purporting to be from the IRS have been proliferating—don’t get caught in a scam. Please read the article in the October 2016 Lange Report for helpful facts.

Final Thoughts: When it comes to tax planning and paying income taxes it’s usually not what you know, but rather what you don’t know that can leave you with un-happy tax results. We are here to help close that knowledge gap. We look forward to seeing you soon.

About Glenn Venturino, CPA: Glenn has been an integral part of the Lange Accounting Group, LLC for over 29 years. As our longest standing Lange team member, Glenn manages the tax department and oversees many of the day-to-day operational functions such as payroll, employee benefits, financial reporting and billing. As a CPA, Glenn has built a substantial accounting practice having working relationships with hundreds of individual clients and various small businesses.

About Jim Lange, CPA/Attorney: James Lange is President of Lange Financial Group, LLC and has 30+ years of experience working with retirees and those about to retire. Jim can be reached at (412) 521-2732.

The views expressed are not necessarily the opinion of Lange Financial Group, LLC and should not be construed, directly or indirectly, as an offer to buy or sell any securities mentioned herein. This article is for informational purposes only. This information is not intended to be a substitute for specific individualized tax, legal or investment planning advice as individual situations will vary. For specific advice about your situation, please consult with a financial professional.

Some Content Provided by MDP, Inc. Copyright MDP, Inc.

Help us grow in 2017!

We would be honored if you were to help us offer our services to other people just like you! It is as easy as:

- Giving us the contact information of your friend, and we will send them a copy of our book and add their name to our mailing list;

- Bringing someone to a workshop; or,

- Inviting someone to come in for a complimentary initial meeting.

If you can help us, please call Alice Davis at (412) 521-2732.