Roth IRAs, Roth 401(k)s, and Roth 403(b)s, offer outstanding retirement and estate planning opportunities to most readers who qualify. Further, the chance to benefit from a Roth account does not end when employment ends, as Roth IRA conversions are favorable for many retirees. A significant change to the tax law that became effective in 2010 has the potential to significantly enhance the benefits of your retirement savings. The change which is now effective is that there is no income cap for Roth IRA eligibility for 2010 and beyond. This means regardless of income, all IRA owners are eligible for a Roth IRA conversion. Previously, only those with incomes under $100,000 could do a conversion.

If you are unsure about using a Roth plan, read on and discover how a Roth retirement plan can help provide you and your family with long-term financial security. In most cases, you will be better off and in many cases, you could start the foundation for a tax-free dynasty.

Roth IRA Contributions – Rules and Recommendations

In most cases, we recommend that you make a $5,500 Roth IRA contribution for yourself and (if applicable) a $5,500 contribution for your spouse for 2013. If either you or your spouse is over age 50, these amounts are increased to $6,500.

According to Roth IRA rules, to qualify for the maximum contribution, married taxpayers filing a joint return must have combined Adjusted Gross Income (AGI) of less than $178,000 (for 2013) and your earned income must be at least as much as the amount you want to contribute to the Roth IRA. For singles, you must have an AGI of less than $112,000 to make the maximum contribution and an earned income of an amount at least equal to the contribution amount. However, if you make above $127,000 (or $188,000 for married couples), a Roth IRA contribution is not available to you. Individuals and couples whose modified adjusted income falls between these amounts could be eligible for partial Roth contributions.

If you are wealthy and have qualifying children or grandchildren (i.e., the children or grandchildren are earning at least $5,500), please consider giving any eligible child or grandchild a gift of $5,500—with the stipulation that he or she should put the money into a Roth IRA for themselves.

Why is a Roth IRA Better than a Regular IRA?

Roth IRAs, with a few exceptions, grow income-tax free and owners are not required to begin taking minimum distributions at age 70½. Your Roth IRA can continue to grow tax-free for as long as you, or possibly your children or grandchildren, own it. Regular IRAs grow tax-deferred, and both the original investment and the growth will be taxed when the money is withdrawn. This tax-free growth leads to a larger return on your investment.

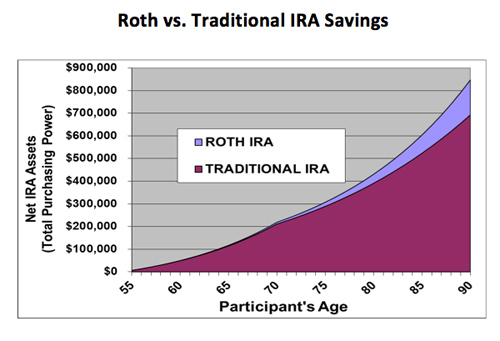

Take for example Mr. Traditional, a 55-year-old who saves the maximum $6,500 in a Traditional IRA until age 70 and his counterpart, Mr. Roth, a 55-year-old who saves the maximum $6,500 in a Roth IRA until age 70. Assuming a 7% rate of return on investment, a 25% ordinary tax rate and a 3% PA tax rate as well as 3% inflation for each; the chart below will show that at age 90, even if Mr. Traditional re-invests his required minimum distributions in an after-tax fund, Mr. Roth ends up over $100,000 ahead.

The disadvantage of the Roth IRA is that you do not receive a tax deduction when you make a contribution. In effect, Congress is taxing the seed (your contribution), but you reap the harvest (your withdrawals) tax free. In contrast, with a traditional IRA, you are not taxed on the seed, but your harvest is taxed.

The exception to our preference for the Roth over the regular IRA would be when you can anticipate that your income tax bracket will be lower later. However, even with a lower tax bracket in retirement, the Roth IRA can still be a better choice unless a short investment period is anticipated.

Roth IRA Conversion

Now that the $100,000 income limit is gone, you should give serious consideration to converting at least a portion of your current regular IRA to a Roth IRA. For most clients, we generally recommend a partial conversion or series of partial conversions. Making the conversion does require paying taxes on the converted amount to the extent it produces taxable income and larger conversions can result in taxes at higher rates. But, taking that tax payment into account, a strategic amount of conversion provides a dramatic increase in long-term benefits to your family.

How much better off are you? In the simple example graphed below using consistent tax rates, if you convert $100,000 today, then in 20 years, you are $51,227 ahead (using reasonable assumptions too lengthy to list).

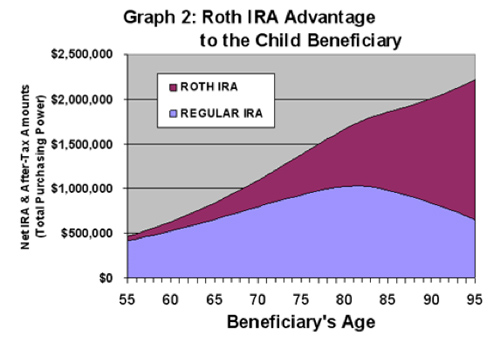

But, then please consider this scenario: what if you die 20 years after you make the conversion and you opt to leave the Roth IRA to your 55-year-old child?

How much better off is your child? $1,537,493. To be fair, that is in future dollars. The present value of the benefit to your child or children in today’s dollars is $260,963 adjusted for 3% inflation.

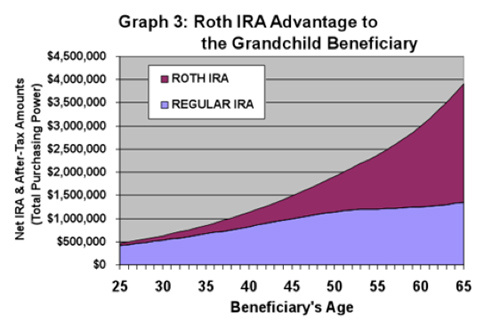

But, what if you instead decide to leave the Roth IRA to your 25-year-old grandchild?

How much better off is your grandchild? $2,555,058. Again, to be fair, that is in future dollars. The present value of the benefit to your grandchild or grandchildren in today’s dollars is $433,678 adjusted for 3% inflation. This is a greater advantage than for the children because the younger grandchildren have lower required minimum distributions and thus more tax-free growth than do the children.

What if the Tax Rates Go Up?

You will be ecstatic that you made the conversion. If you convert when taxes are lower and cut taxable income when taxes are higher, the benefits of the conversion will be much better than the graphs indicate.

What if We Abolish the Income Tax?

Oops, your hot air balloon will be deflated. You would have paid income tax for nothing.

Estate Planning for Roth and Regular IRAs

While conducting your estate planning, please keep in mind that it is not your will or living trust that establishes who will inherit your IRAs, Roth IRAs and retirement plans. Those determinations are controlled by the beneficiary designations that you have chosen for each of these specific plans. Many readers have complicated wills, but they make the mistake of not doing the same depth of planning when specifying their IRA and retirement plan beneficiaries. IRA owners and retirement plan participants should consider whether they need sophisticated IRA and retirement plan beneficiary designations, in addition to sophisticated wills or living trusts. An integrated tax-savvy approach including wills, trusts and retirement plan beneficiary designations will dramatically increase the amount of the funds retained by the family.

Discover the wealth-building power of a Roth IRA!

Every quarter Jim makes available a limited number of FREE CONSULTATIONS for western PA residents only. For a more in-depth discussion on whether you can benefit from a Roth IRA conversion or our other innovative tax, estate and financial planning strategy, e-mail admin@paytaxeslater.com to see about scheduling an appointment.

——

There are few advisors as IRA-knowledgeable as Jim Lange. His book is chock full of creative Roth IRA planning ideas to help every client.

| NATALIE CHOATE, ESQ. Author, Life and Death Planning for Retirement Benefits (6th Edition) |

In The Roth Revolution, Jim clearly explains the remarkable advantages of Roth IRAs and their role in estate planning. Everyone considering conversions of traditional IRAs to Roths should read this book.

| BURTON G. MALKIEL Princeton University, Professor of Economics Author, A Random Walk Down Wall Street |

About The Roth Revolution

In essence, a Roth IRA conversion requires paying taxes on the portion of your IRA or 401(k) that you convert, but then that money can grow income tax-free for the rest of your, your spouse’s, your children’s and grandchildren’s lives. The advantage of a tax-savvy long term Roth IRA conversion is often measured in the millions. The real eye-opener, however, is that Roth IRA conversions are great for older IRA owners, regardless of the benefits to future generations

In essence, a Roth IRA conversion requires paying taxes on the portion of your IRA or 401(k) that you convert, but then that money can grow income tax-free for the rest of your, your spouse’s, your children’s and grandchildren’s lives. The advantage of a tax-savvy long term Roth IRA conversion is often measured in the millions. The real eye-opener, however, is that Roth IRA conversions are great for older IRA owners, regardless of the benefits to future generations

The Roth Revolution addresses the following topics clearly and objectively:

- Whether, how much, and when to convert

- Costs and benefits of a Roth IRA conversion

- Advice for taxpayers in each income tax bracket

- The impact of future tax increases

- Synergy of delaying (or returning) Social Security and Roth IRA conversions

- Combining charitable gifts and Roth IRA conversions

- Tax-free conversions of after-tax dollars in IRAs and retirement plans

- Converting and recharacterizing strategies