Table of Contents

Spend the Right Money First When You Retire

(Including a New Wrinkle in Our Bedrock Principle)

by James Lange, CPA/Attorney

For more than twenty years, I have advocated “Pay Taxes later, except for the Roth.” This is applied in the accumulation stage when you are accumulating money for retirement, the distribution stage when you are deciding which assets to spend first, and even in the estate planning stage. I always said there were some exceptions to this bedrock foundational principle, but this was a great starting point for general advice.

Since the SECURE Act became effective on January 1, 2020, the exception to this general rule became much bigger for many IRA and retirement plan owners.

What follows comes from our newest book, Retire Secure for Professors, which has great information for all IRA owners. Non-professors could skip the chapters on TIAA and still get a lot of value from the book. Please see the end of this article to learn how you can request a copy of the book for you and/or any friends or colleagues who you think might find it valuable.

Following is an excerpt from Retire Secure for Professors:

The next big question is: In what order should you spend the money you have saved for retirement? Subject to exception, you should spend your after-tax dollars before your retirement plan or IRA dollars.

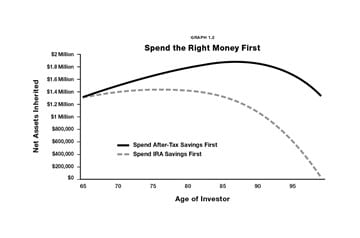

Please look at the graph that follows. Both couples start with the same amount of money in a regular brokerage account—which I refer to as after-tax dollars—and in their retirement plans. The graph below indicates, subject to exceptions, that most readers should spend their after-tax dollars first and then IRA and retirement plan dollars. The solid line shows what happens to the first couple who spend their after-tax dollars first and withdraw only the minimum from the IRA when they are required to (more on RMDs in the next section). They pay-taxes-later. The dashed line shows what happens to the second couple who spend their IRA first. They pay-taxes-now.

Graph 1.2: Spend the Right Money First*

*Detailed assumptions can be found at https://paytaxeslater.com/graph/

The only difference between the dashed line and the solid line in this graph is that the first couple retained more money in the tax-deferred IRA for a longer period. Even starting at age 65, the decision to defer income taxes for as long as possible gives the first couple an extra $625,591 if the couple lives to age 87. If one of them lives longer, paying taxes later will be even more valuable to them.

Subject to exception, I generally prefer you not spend your Roth IRA dollars unless there is a compelling reason. The Roth IRA grows income-tax-free for the rest of your life, your spouse’s life and for 10 years after you and your spouse are gone. In addition, there is no required minimum distribution for you or your spouse with a Roth IRA.

So, in general, the last dollars you want to spend are your Roth IRA dollars. Of course, there may be times when it makes sense to spend your Roth dollars before other retirement plan dollars if it keeps you in a lower tax bracket.

That said, subject to exceptions, you and your spouse will realize a benefit by deferring the income taxes due on your retirement plans for as long as possible and generally hold off on spending your Roth IRA. And with the SECURE Act now part of the law, your children, and grandchildren (subject to some important exceptions, which I will cover in Chapter 5) will have to pay income taxes on the Inherited Traditional IRA within 10 years of your death.

A New Wrinkle in our Bedrock Principle

Since the passage of the SECURE Act, which will be explained in Chapter 5, however, adhering to the pay-taxes-later rule in the distribution stage might not always be the best advice. With income tax rates likely on the rise, for some professors, it might make more sense to plan for a transition from the taxable world (most TIAA accounts, IRAs, retirement assets, etc.) to the tax-free world (Roth IRAs, 529 plans, life insurance, your children’s Roth IRAs, etc.). To get the best result, it is best to analyze each situation on a case-by-case basis.

In short, the SECURE Act dramatically accelerates the taxes on your retirement plan after your death. For your children, losing the lifetime stretch on an inherited retirement account can carry a huge tax burden. I will cover this idea more in Chapter 5.

One reasonable strategy for some professors with significant IRAs and retirement plans who will not likely spend all their money is to make taxable withdrawals from the retirement plan and/or IRA, pay the tax, and then gift the net proceeds. The gift could be invested in something that grows tax-free like a 529 plan, your children’s Roth IRAs, life insurance, etc. That serves the purpose of getting some money out of your estate and allows tax-free growth for your children.

As a result, for many faculty members, an earlier transition from the taxable world to the tax-free world might work better than the standard rule of “pay taxes later.”

And I wanted to close this month’s feature article with a quick reminder. Last month, we announced that the Advance Reader Copy (ARC) of my new book, Retire Secure for Professors: Maximizing and Protecting Your TIAA, IRAS, and Other Retirement Assets, was available and invited you to request copies.

We’ve already received several requests for print and digital copies of the ARC. If you haven’t requested your “hot off the press” copy, please go to: https://PayTaxesLater.com/ProfessorARC.

When you complete the form on the page, you’ll receive a digital copy of the book immediately, and you will be on the list to receive a print copy as soon as they arrive at our offices. Please feel free to share this link!

To ask for additional print copies for you or for your friends, you can also call Edie at 412 521-2732.

Help Us Grow! Seeking Qualified CPAs.

We have a great problem. We have more new good work than we can handle. Our financial master plans and our assets under management business are exploding.

To fulfill the demand for the work and have it done to my satisfaction, we need at least one if not two more experienced CPAs. To do the projections, the CPA must have a strong tax background.

These financial masterplans involve a process that we call “running the numbers.” It is more accurately described as preparing long-term financial projections for our clients. Our process requires the CPA doing the projections to not only have a strong tax and spreadsheet background but also to be able to prepare projections and run different scenarios with the client in the room (or these days over Zoom).

We are also flexible as to the need for the CPA to come to the office.

We do not expect to find candidates who already know how to run the sophisticated financial projections — they will have excellent mentors to help them expand their horizons. We will expect that every candidate has a solid income tax preparation background and excellent communication and interpersonal skills — positive direct client contact is essential to the job. He/she will be self-motivated, independent, flourish in a fast-paced work environment, and interact well with a supportive and energetic team.

From there, we will train that CPA over a 4-to-6-month training period by me, Steve Kohman, Shirl Trefelner, and Matt Schwartz.

We did hire two CPAs in the last year who have completed their training, but their schedules are now full.

Both of our recently hired CPAs, Dominic Bonaccorsi and Jennifer Hall, love the added scope of preparing financial master plans. They both left great positions at promising companies to join us. They find the work they are doing now much more interesting than just preparing tax returns. The new CPA will still have some tax return preparation work, but the real attraction for the job should come from the dramatic expansion of their existing capabilities.

Frankly, since the market pays this type of work more than tax preparation, we can offer a great salary and a portion of the financial masterplan and assets under management revenue.

Perhaps more importantly, we are offering a great career that includes professional advancement, working with a great team, and an ever-increasing salary and bonus.

If you know of a CPA who may be interested, please ask him/her to go to the following website, https://PayTaxesLater.com/LAGCPA/, to learn more about the position requirements, benefits, and our company.

Job Security

We are a small firm looking for a CPA who will mesh with our top-notch team. Both our professional and administrative staff rarely turnover. The names and number of years that some of our staff has been with us on a continuous full-time basis include Glenn Venturino, CPA, 33 yrs.; Steve Kohman, CPA, 25 yrs.; Matt Schwartz, Attorney, 18 yrs.; Sandy Proto, Project Manager, 29 yrs.; Donna Master, Bookkeeper, 23 yrs. and Daryl Ross, Paralegal, 22 yrs.

If you know of any CPA who may be interested in this career, kindly share this website, https://PayTaxesLater.com/LAGCPA/ with them. Thank you.

Almond Chicken Salad

Serves: 4

Prep. Time: 20 minutes

Cook Time: 8 minutes

- 1/3 cup sliced almonds

- 4 (4 ounces) thin-cut chicken cutlets

- ¼ cup plus 2 tablespoons extra-virgin olive oil

- ½ teaspoon sea salt

- grated zest and juice of 2 limes

- 2 small shallots, minced

- 2 teaspoons chili powder

- 1 teaspoon paprika

- 1 head romaine lettuce, roughly torn

- 1 head radicchio, shredded

- ½ head Napa cabbage, shredded

- 2 carrots, peeled and shaved into strips

Toast the almonds in a small skillet over medium heat, stirring frequently, until golden brown, 2 to 4 minutes.

Heat a well-seasoned stovetop grill pan over high heat. Rub the chicken cutlets with 2 tablespoons of the oil and season with ¼ teaspoon of the salt. Working in batches, place the chicken on the grill pan and cook for 2 to 3 minutes per side. Transfer the chicken to a cutting board and let cool. Once cool, slice each chicken cutlet into strips.

In a small bowl, whisk together the remaining ¼ cup olive oil, lime zest and juice, shallots, chili powder, paprika, and remaining ¼ teaspoon salt.

In a large bowl, combine the lettuce, radicchio, cabbage, and carrots and toss with the vinaigrette to coat evenly. Arrange the warm chicken strips over the salad and garnish with toasted almonds. Serve.