Table of Contents

I recently spoke at Jim Dahle, MD’s White Coat Investor’s Conference in Phoenix, AZ. Jim is the author of The White Coat Investor: A Doctor’s Guide to Personal Finance and Investing which sold 75,000 copies. He hosts an annual event and invited me to speak. There were roughly 500 in person and 500 virtual attendees.

Jim is a doctor who loves helping other doctors with their finances from pre-medical school to the grave. He has a strong following of roughly 75,000 members for his podcasts, books, emails, Facebook group, etc. He really delivers excellent content in his email communications, podcasts, books, and workshops. He put together a lot of excellent speakers in an idyllic setting in Phoenix.

Other than Jim Dahle, I was the only speaker to have both a keynote and a breakout session talk. My first talk covered Roth IRA conversions, the best estate plan for doctors, and some specialty estate planning techniques including Who Gets What? — the charitable technique that encourages IRA and retirement plan owners to leave money to charity from their IRAs as opposed to their after-tax dollars.

Since I genuinely love answering questions and wanted to give the attendees as much value as I could, I answered questions for five straight hours after my talk! With one exception, all the questions were regarding Roth IRA conversions and backdoor Roth IRA conversions.

The doctors, most of them financially sophisticated, knew that going from the taxable environment (IRAs and other traditional retirement plans) to the tax-free environment (like Roth IRAs) was the right long-term strategy. The questions I received demonstrated a better than average understanding of taxes.

Given the level of interest and basic understanding, I revised my second talk to include a lot more material on Roth IRA conversions and backdoor Roth IRA conversions. While revising my second presentation, additional ideas regarding the backdoor Roth IRA conversion came to mind, and I incorporated those ideas into my webinar.

My upcoming May webinars include a two-hour session on Roth IRA conversions and backdoor Roth IRA conversions. If you would like to attend my next Roth IRA workshop, please register to attend at https://PayTaxesLater.com/Webinars. Please see pages 2 and 3 of this newsletter for more details.

A few other observations about the conference…

It was interesting to get a personal insight into how doctors feel about their jobs and careers. For instance, doctors—at least the ones I met and had dinner with—hate being limited to 20-minute appointments when they know many appointments should be longer. And one survey, conducted by Jim Dahle, indicated that even upon reaching their financial goals, most doctors would keep working, but would give up being on call. Being “on-call” was something that practically all the doctors I spoke with disliked.

Furthermore, they are well aware of the mess our health care system is in. In fact, one of the talks was titled How Doctors Can Save the Medical System, not the Government. They predict a massive crisis in health care infrastructure stemming from insufficient resources and a lack of medical professionals to treat the burgeoning demand for care.

They also are voracious readers. I was on a Jim Dahle podcast, and 1,700 doctors ordered my last book, Beating the New Death Tax. Many of the doctors I spoke with not only read that book, but also at least one other book that I wrote. Like the rest of the population, they don’t necessarily love lawyers.

If you would like to learn more about The Whitecoat Investor, please go to https://WhiteCoatInvestor.com.

To learn more about Roth IRA conversions and backdoor Roth IRA conversions, please register to attend my upcoming Roth IRA workshop on Tuesday, May 3rd from 1–3 p.m. (EDT) at https://PayTaxesLater.com/Webinars.

New Briefing Teaches Million-Dollar IRA Owners Safe, Peer Reviewed, and 100% Legal Strategies to Defend Your Wealth from Accelerated Taxation in the Post-SECURE Act Era

Tuesday & Wednesday, May 3 & 4, 2022

Register to Attend 1, 2, 3, or all 4 FREE Webinars at:

https://PayTaxesLater.com/Webinars

Session 1: Tuesday, May 3rd (10 am – Noon Eastern)

How IRA and Retirement Plan Owners Can Protect Their Hard-Earned Retirement Dollars from Accelerated Taxation

- Featuring a Special Briefing: What Million-Dollar IRA Owners Should Know About the Pending SECURE 2.0 Legislation

- Strategic planning recommendations to defend retirement plan owners and their families from massive taxation in the post-SECURE Act era.

- Gifting strategies to maximize family wealth.

- A quantitative analysis of combining multiple long-term financial planning strategies.

- How retirement plan owners should respond to the sunset provisions in the Tax Cuts and Jobs Act of 2017.

- Which assets you should spend first and which assets you should spend last during retirement? Please note the answer has changed since the SECURE Act.

If you have significant assets in your IRAs and other retirement plan accounts, you will learn Jim’s practical strategic solutions to the disastrous consequences of the SECURE Act’s accelerated taxation formula…solutions that hundreds of our clients have already implemented to defend their wealth and their financial legacies.

Retirement plans have specialized distribution rules both while you are alive and after you are gone. Understanding these rules is critical for effective planning.

This session will cover our strategic recommendations for what you should be doing while you’re working and at retirement, though the emphasis will be on those retiring within the next several years or already retired. Please note this session will not cover Roth IRA conversions as there is an entire session on Roth IRA conversions at 1 pm.

Session 2: Tuesday, May 3rd (1 – 3 pm Eastern)

Roth IRA Conversions: Pay Taxes Later Except for the Roth

- Breaking News Update: We’ll look at how SECURE 2.0, if passed, could impact Roth IRA conversion planning and strategy for millions of Americans.

- The peer-reviewed math of Roth IRA conversions.

- Effects of the SECURE Act on your retirement plans and how Roth IRA conversions defend against the SECURE Act.

- Optimal timing for Roth IRA conversions.

- Why it may make sense to pay for a Roth IRA conversion with a home equity loan.

- The one single financial decision that can get you bigger Social Security checks.

- The implications of the back-door Roth and what to do about it in 2022.

The passage of the SECURE Act and inevitable tax rate increases make Roth IRA conversions more important than ever to protect your and your family’s financial security.

Roth IRA conversions are a critical tool to cut taxes. Not only do many economists feel that tax rate increases are inevitable, even if no additional tax legislation is passed, but the sunset provisions of the Tax Cuts and Jobs Act of 2017 will also dramatically increase income taxes in 2026.

The benefits of a series of well-timed Roth IRA conversions can mean tens, or hundreds of thousands, of dollars difference to retirement plan owners and their families. This isn’t a matter of opinion. It is a matter of math based on our article that was published in The Tax Adviser, the peer-reviewed journal of the American Institute of CPAs.

Making a series of Roth IRA conversions over a period of years, perhaps between now and 2026, can be an incredibly advantageous strategy for many retirement plan owners. In addition, Roth IRA conversions can reduce estate and inheritance taxes.

We will examine the synergy between timing when you begin taking Social Security and making Roth conversions.

We will also explore other methods of transferring money from the tax-deferred world (like IRAs) to the tax-free world (like Roth IRAs).

We get a lot of questions on back-door Roth IRA contributions and conversions. Though we fear the elimination of this wonderful tax strategy, there still may be an opportunity to save a significant amount of taxes for you and your family, and we will cover how this works and what action, if any, you should take now.

Session 3: Wednesday, May 4th (10 am – Noon Eastern)

The Best Estate Plan for IRA and Retirement Plan Owners Including Trust Planning

- How do required minimum distributions of inherited IRAs and retirement plans work under the old law versus the enacted SECURE Act?

- How will this change impact your family and your legacy?

- How to ensure financial security for the surviving spouse, and potentially save hundreds of thousands to pass on to your heirs after the SECURE Act.

- The details of the best estate plan for married retirement plan owners known as Lange’s Cascading Beneficiary Plan.

Trusts:

- Should your heirs inherit your IRA and other retirement assets directly, or would naming a trust be wiser?

- Charitable trusts as beneficiary of your IRAs and retirement assets.

- Do you need the ever more popular “I don’t want my no-good son-in-law to inherit one red cent of my money trust?”

We will delve into the nitty-gritty of what happens to your IRA and retirement plan at death under the SECURE Act. We will explore an estate planning system based on a series of disclaimers. Disclaimers allow enormous flexibility for planning for your estate, and we believe should be used routinely, but in practice rarely is.

You will be able to see the benefits of some of our strategies and decide if it is appropriate for you. The tax hit on your IRAs and retirement plans will be unprecedented unless you take aggressive action. This workshop will concentrate on what you could do to preserve your estate, especially around wills, trusts, and beneficiary designations of your IRAs and other retirement plans.

We will combine our newest thinking with some of our classic strategies for protecting your children or grandchildren from themselves, but also creditors, possibly including their spouse.

Please note that most existing trusts have language that could prove devastating to your family and most IRA and retirement plan owners don’t know anything about them.

Session 4: Wednesday, May 4th (1 – 3 pm Eastern)

A Focused Live Q&A with Larry Swedroe of Buckingham Strategic Wealth and James Lange: Inflation, the War and Socially Responsible Investing

People across the country are starting to feel the impact of inflation everywhere from the gas station to the grocery store. Or as one Wall Street Journal article put it in March, “Americans are having an inflation ‘aha’ moment.”

And just as we are starting to feel and worry about these daily cost increases, the human tragedy that is Putin’s war on Ukraine, which continues to wreak incalculable harm and suffering upon the people of Ukraine, has exacerbated inflation, and thrust an already volatile market downward.

It may seem callous to be concerned about personal finances in the light of so much human tragedy, but it is also very understandable. Because this combination of inflation and global instability could have a serious impact on the financial security of millions of Americans.

And for older Americans who are retired or approaching retirement, this “aha moment” has triggered another set of serious, relevant, and pressing financial fears.

Yes, market ups and downs are a fact of life and most of us will have weathered a couple of downturns prior to reaching retirement. But, for a retiree or as someone nearing retirement, a sudden downturn can be financially catastrophic. There is always the risk that by the time the market rebounds (as historically it has done) it may be too late to salvage your life savings.

As a firm that advises many retired and soon to retire clients on finances, retirement, and estate planning, we know that many of people are very concerned about their investments and inflation and want to seek information from the most knowledgeable experts…

Which is why we are so happy to announce this focused Question & Answer workshop with the best person we can think of to provide that analysis: Larry Swedroe, an investing expert who was among the first to publish a book explaining the science of investing in layman’s terms.

Larry has since authored or co-authored more than 16 books on investing and serves as the Chief Research Officer for Buckingham Strategic Wealth. Larry’s next book, Your Essential Guide to Sustainable Investing: How to Live your Values and Achieve your Financial Goals with ESG, SRI, and Impact Investing, will be available on April 5th and you can pre-order it on Amazon today!

During this 2-hour live event, Larry and Jim will answer your pre-submitted and live questions.

Is there something proactive that you should be doing now? What about alternative investments which Larry has been talking about for years?

Want to learn more about the pros and cons of all the investments that claim to be “inflation-proof” your portfolio?

Then, you won’t want to miss this webinar! Register and submit your first question today.

Register to Attend 1, 2, 3, or all 4 FREE Webinars at: https://PayTaxesLater.com/Webinars

Welcome, Jennifer Hall, CPA, CMA, CFP®, CRPC®*

*Certified Public Accountant, Certified Management Accountant, Certified Financial Planner, Chartered Retirement Planning Counselor

Jennifer Hall joined Lange Financial Group, LLC in May 2021. Jen is a consummate “number cruncher.” I say that as a huge compliment!

Jen loves doing the calculations we make for our assets-under-management clients. Our clients truly appreciate her professionalism and sensitivity. That combination of strengths is highly valued in this business. Jen will be the first to acknowledge the excellent mentorship she received from our senior “number runners,” Steve Kohman and Shirl Trefelner.

Jen has and continues to provide both content and editorial help for our most current book, Retire Secure for Professors. For instance, she wrote the chapter on Qualified Longevity Annuity Contracts (QLACs) as well as improving several other chapters. I have no doubt she will make valuable contributions to future books. And I look forward to collaborating with her.

Jen brings over 30 years of experience in various financial roles. She was attracted to Lange Financial Group because she enjoys working with clients and playing “what-if” by numbers. How much to convert, when? Jen believes it is a matter of math and it is her job to “run the numbers” and objectively report her findings while being sensitive to clients’ needs. But she will likely have recommendations that are different than the status quo that she can back up.

Jen and her husband, Tom, live in Pittsburgh’s Franklin Park. They enjoy spending time with family and friends and traveling. Jen especially enjoys reading and studying advanced planning techniques that can be used to further our clients’ objectives. She is more of a nerd than I am.

Jen loves working with people, enjoys providing the personal attention we offer our clients and values the effectiveness of our planning for our clients. Each assets-under-management client’s plan is unique, and Jen’s plans address each client’s personal goals and needs.

In addition to doing great work, everyone at the office likes Jen and we see her as part of the “family” already. It is a pleasure to introduce her to our newsletter subscribers.

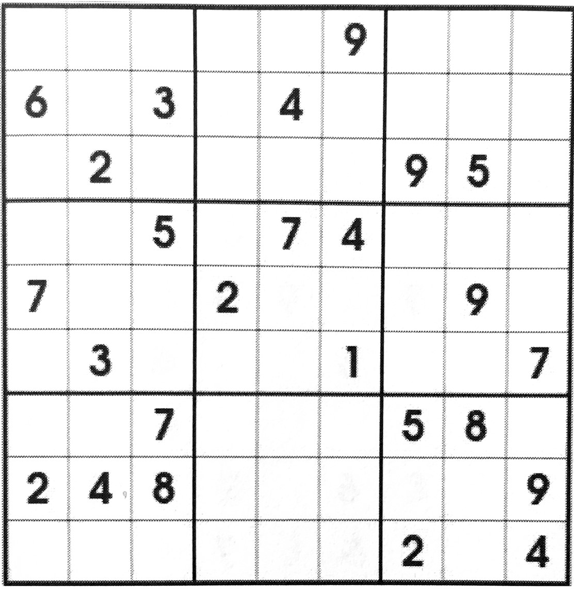

Sudoku