Special Report Sequence for People with Disabled Beneficiaries

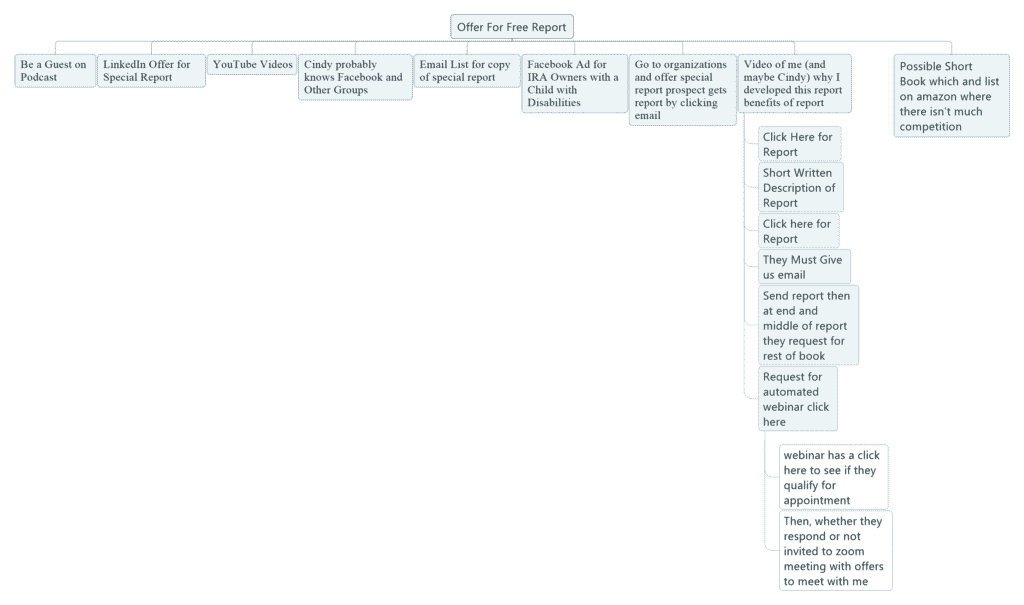

This is a sequence Dave Dee proposed during our meeting last week. It centers around using the planning for disabled beneficiaries chapter in Jim’s forthcoming book, adding an introduction using Jim and his family’s own story (his wife, Cindy, wrote an initial draft of their story for this portion which is now being edited and expanded by Jim and one of our editors), and packaging it as either a short book or Special Report/White Paper.

To attract interested parties (people with non-spousal beneficiaries who do or could qualify for the exemption that would allow them to stretch the distribution of an Inherited IRA or retirement plan out over the course of their own lifetime) we will reach out directly to groups and organizations that include or focus on disabled people, do targeted advertising online, and hopefully also utilize the lists and contacts of the disability attorney with whom we partner on this.

Getting your beneficiary legally qualified as ‘disabled’ is critical if you want to utilize the strategies that our Special Report advocates, and getting this designation from Social Security is also a complicated and difficult process that requires an experienced SS Disability attorney. Our law firm does not do that kind of work, so it makes a lot of sense for us to partner with an attorney/firm that does. (Having access to that attorney’s audience/list would also be a benefit of a partnership.) This might be an attorney with whom Dave has worked on many projects/co-ventures, or it might be someone she refers us to. She was on vacation in Spain for some time after our meeting with Dave but we believe she’s back now and that Dave has reached out to make the introduction and hope to hear from her soon.

The direct outreach to groups and organizations will focus on a compiled list of those that provide community, support or services to people with cognitive or physical disabilities, people who are chronically ill, or people diagnosed with mental illness (groups like NAMI, Autism Speaks, the National Down Syndrome Society, etc.), as well as on any informal groups for family members of special needs people of which we are aware (ex: Facebook groups for parents of chronically ill children, etc.).

The information in the Special Report could help ensure a disabled person’s financial security for life, so if the decision makers at these organizations understand that, many of them would love to offer it to their members. So the plan for this outreach to groups and organizations is to send a letter (which is being drafted by Bob Bly who, apart from being a top-notch copywriter, is also the parent of a child with special needs, and his understanding of the unique struggles this group faces should make it all the more effective) enclosing a copy of the Special Report (or short book) and offering them the opportunity to share it, and the valuable information in it, with their members. The letter will include the URL of a website where, after providing their name and email address, visitors will receive the Special Report in PDF format via email. After visitors enter their information the Thank You page of that website will be a video of Jim telling some portion of his personal story, telling people that this special report comes from a forthcoming book Retire Secure For Professors, and offering a special gift: provide us with your mailing address and we will mail you a free hard cover copy of the book once it is published (this will allow us to capture the prospect’s direct mail address and add them to our direct mail newsletter list).

The email delivering the Special Report will also have a CTA: it will offer access to a pre-recorded workshop on retirement and estate planning for people with a special needs beneficiary. So the next step in the sequence is this pre-recorded workshop, anywhere from 90 minutes to 2 hours in length, (hosted on the EverWebinar platform) featuring Jim and, if possible, the disability law expert with whom we will partner on this project. The CTA of this pre-recorded workshop: a consultation with Jim.

We also plan to engage our own “tribe” (our direct mail newsletter subscribers, email newsletter subscribers, people in Jim’s professional networks, the “tribe” of the disability attorney we partner with, as well as our own friends and family members) to ask them to share the URL for the Special Report with their friends and family members who have special needs/disabled/chronically ill children, grandchildren, nieces or nephews, etc.

The final and most innovative step of this sequence will be an informal Zoom Meeting with a number of prospects who express interest. This ‘inviting prospects to an informal discussion via zoom meeting’ is a new kind of closing mechanism that Dave Dee has been using on his webinars. But the basic idea is that after a certain number of people (that number is TBD) have attended the pre-recorded webinar, we will send all of them an invitation to an informal discussion of special needs planning topics (Dave called it a “parent get-together”) that will happen over Zoom. Cindy Lange will participate in these sessions. And this is the portion of the sequence where we offer consultations with Jim to interested and qualified prospects. The “pitch” for our services won’t be a formal “pitch” or “close” like the ones Jim does in our webinars, it will be a Q&A format back and forth between Jim and the host (Erika) modeled after what Dave and one of his business partners do in their own versions of these meetings.

Once this whole sequence has been developed, the cycle described above can be repeated over and over. This is a developing project, and we will have more of the details fleshed out in the coming weeks.

Vital Information for IRA Owners Who Have a Beneficiary With a Disability

If you have a beneficiary with a disability, there is likely no better use of your time than to read this chapter and implement at least some of the recommendations.

To illustrate the life changing difference between effective and ineffective planning for your child with a disability , I am sharing my family’s personal story and the steps my wife, Cindy, and I took to best protect our daughter who has a disability and is currently receiving Social security disability income.

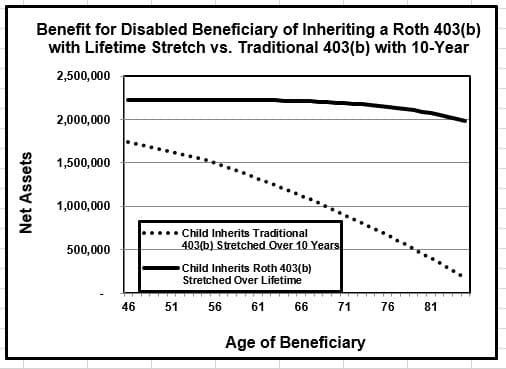

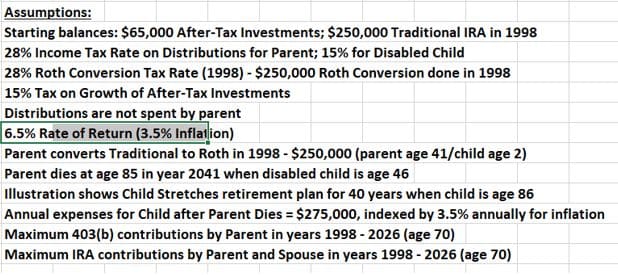

Let’s start at the end of the story. As a consequence of being pro-active on two critical fronts our daughter will be $1,890,544 better off measured in today’s dollars than she would have been had we not taken these steps.

Please don’t assume the only benefit of the Roth conversions and contributions were for estate planning only. Cindy and I will be $491,829 better off over our lifetime even forgetting the benefit to our daughter. The reasonable assumptions used to make to make both these calculations are in the appendix.

The only differences in the chart below between Erica having $1,890,544 instead of being broke are:

- We did a series of Roth IRA conversions, and Roth IRA and 401(k) contributions as opposed to no Roth conversions and making traditional contributions to our IRAs and retirement plans.

- We took the necessary steps in order for Erica to qualify as an eligible designated beneficiary (EGB) which under the new laws including the SECURE Act and SECURE 2.0. As a consequence of our actions in conjunction with the new laws, Erica will be able to “stretch” the inherited Roth IRA over her lifetime instead of having to withdraw it over 10 years which she would have had to do had we not executer the appropriate estate plan, including getting her qualified to receive Social security disability income.

Here is the chart that demonstrates how much better off Erica is starting at our deaths and continuing to her death as a result of our Roth strategies as well as qualifying her as a EGB.

The bottom line is that at age 86 everything else being equal in a true apples to apples comparison, Erica will still have a comfortable $1,890,544 instead of running out of money. Preferably, Erica will be able to able to enjoy many benefits during her life that she would not have otherwise had the chance to do things for her comfort and her health that she would have been denied because of lack of money.

Add these to the assumptions:

We do not include any government benefits the child has received already or will receive in the future.

In year 2042, when the child is age 46, the child is responsible for their own expenses.

Since this is 20 years from now, we used $275,000 in annual expenses for the disabled child which equates to $138,200 in today’s dollars or $11,500/month.

Inheritance taxes, estate taxes, and any state income tax on a Roth conversion have not been included in the analysis as Pennsylvania does not tax retirement distributions

ALL THE ABOVE ASSUMPITONS SHOULD GO IN THE APPENDIX

THE FOLLOWING SECTION NEEDS TO PULL AT THE HEARTSTRINGS, THE FOLLOWIG TEXT DOESN’T. I AM GOING TO WAIT UNTIL WE HAVE SOMETHING THAT WORKS FOR THE REPORT AND THEN LIKLEY USE THAT OR CANNIBALIZE FROM IT.

Our daughter Erica is a very sweet and very smart 27 year old who has a disability. Our concerns for her long term security and safety kept us up at night. We could not rest easy until we were convinced we had planned appropriately and substantively for Erica. I suspect that as the parent of a child with a disability, you have these same fears. We love our amazing kid as do all parents, but we are also trying to be very realistic about long-term concerns once we have passed on.

I hope our planning strategies offer some ideas that you can act on to dramatically improve the long-term financial security of your disabled beneficiary.

A Brief Summary of Erica’s Health History for Context (you can skip this part)

CINDY NELSON EDITED THIS STORY MORE THAN I WANT BUT IN THE INTEREST OF MOVING ON, I AM LETTING IT GO AT THIS POINT

I would like to preface this narrative by saying that Erica is comfortable with sharing her story/our story, especially since I have important information that will help provide financial security for other children with disabilities.

Erica has had major problems since eighth grades, but we were managing. But later, one day Erica was acing her SATs and two days later she got so sick that she had to quit school. We consulted with gastroenterologists, neurologists, pain docs, cardiologists, psychiatrists, psychologists, acupuncturists, energy healers, chiropractors, a Lyme disease specialist, and on and on. We travelled to specialists in New York, Cleveland, Minneapolis, Salt Lake City, California, and more. Spoiler alert, none of doctors and therapists had anything to significantly help Erica.

Finally when she was 17, we connected with a doctor who gave us what we think is an accurate diagnosis. Erica has dysautonomia, which means her autonomic nervous system doesn’t function properly. The autonomic nervous system controls involuntary body functions like your heartbeat, breathing and digestion. That explains why she has so many different problems. Unfortunately, there hasn’t much that the doctors have been able to do to improve her situation. It has been a heart-breaking journey for our family. We attempt to control her symptoms—there are better days and worse days—but she has no real prospect of holding down a job.

After a grueling legal marathon, we won our Social Security Disability Insurance (SSDI) case. That was a significant step in protecting her financial security.

Back to the Substance, Roth IRA Conversions and Appropriate Estate Planning

One of the critical exceptions to the SECURE Act covered in Chapter XX is if the beneficiary is considered disabled or chronically ill and the estate documents are prepared optimally combined with optimal estate administration, beneficiaries with a disability can treat an inherited IRA or Roth IRA like any beneficiary could in 2019 before the effective date of the SECURE Act.

The reason Erica winning her SSDI case is so critical to her long-term financial security, is that will very likely qualify her to enjoy massive deferral of the distribution of our inherited IRAs and Roth IRAs. This deferral along, even without the Roth conversions would mean $xxxxxxxx to her.

The Roth conversions would be worth XX. The synergy of the Roth conversions and the inherited “stretch status” is where we got the $1,8 total savings in todays dollars with reasonable assumptions.

WE NEED TO FILL IN THE HOLE BETWEEN NEW REGS SAYING THAT WILL ACCEPT S DETERMINATION TO DETERMINE FOR TAX PURPOSES.

Assuming she maintains her disability status, which is very likely, she will qualify as an eligible designated beneficiary (EDB). A necessary designation under the SECURE Act to allow her to stretch or extend the distribution of her inherited IRAs and inherited Roth IRAs over her lifetime.

Our Journey To Ensure Erica’s Security—Roth IRA conversions and contributions

The first pro-active thing we got right was optimizing our Roth IRA conversions and Roth contributions. The second was getting the estate planning right in response to the SECURE Act and SECURE Act 2.0.

Back to the chart at the risk of repetition, but it is so critical to demonstrate the benefits of things we did that you can likely do also. The chart that follows begins at my and my wife’s projected death in 2041 (at age 85), when our daughter, Erica, will be 46. The consequences of our pro-active planning is represented by the solid black line. The dotted line represents the outcome she would have been facing had we not planned well. In this example, we do not include any government benefits Erica has received already nor any that she will receive in the future.

PLEASE NOTE SOME CHANGES SHOULD BE MADE TO THE CHART, like the TITLE. ALSO, THAT ASSUMPTIONS SHOULD BE CLEAR THAT ONE SET IS FOR THE ACTIONS AND ONE IS FOR DOING NOTHING.

ReTITLE CHART

Benefit for Erica of Us Optimizing Roth Strategies and Estate Planning Strategies vs. Ineffective planning

Of course we are fortunate to have substantial retirement savings. I suspect most readers will have a smaller retirement plan to work with, and furthermore we adopted Roth conversion strategies as early as 1998 when they first became an option. (My “aha” moment regarding Roth IRA conversions actually occurred in 1997 before Roth IRA conversions were even part of the law. ) So most readers and their children will not benefit as much as my daughter, but by you getting the strategies that we got right could easily make a difference of hundreds of thousands of dollars or maybe over a million dollars. .

MAYBE HERE INCLUDE A FEW THINGS THAT THE EXTRA MONEY WOULD PAY FOR AND PAINT A BETTER PICTURE OF

While the analysis doesn’t include every variable of our financial life, the result is clear and the math used to make the projection can be reproduced as it was by different number crunching CPAs in our office. In full disclosure, it does omit some details that I didn’t think were important or relevant. The most critical information to convey is the potential benefits for your child that accrue from getting the two things right—Optimal Roth planning s and estate planning.

For every dollar your child is better off in this analysis, that is exactly how much worse off Uncle Sam is. So basically, these strategies involve a massive wealth transfer from Uncle Sam to your beneficiary with a disability. To be fair, since I did include an investment rate of return on the IRAs and Roth IRAs, I assume the government would have earned the same amount to arrive at the total tax savings.

The Critical Role Roth IRAs and Roth Conversions Play in Our Story

Our Roth story actually began in 1997 when the Roth IRA conversion was just in the proposal stage. I knew this would be huge for clients with IRAs and retirement plans. I wrote the first peer reviewed article on Roth IRA conversions that was published in the Tax Advisor in May, 2018 and won article of the year. Please see chapter XX for a more detailed coverage of my actual Roth IRA conversion story.

Here is the short version. Ion February 16, 1998, right at the beginning of tax season, my office suffered a devastating fire.

At the time, my wife and I had combined IRAs f $249,000. I wanted to convert all of it to a Roth IRA. My wife Cindy, who has a master’s degree in electrical engineering from Carnegie Mellon and strong critical thinking skills, strongly resisted because she didn’t want to pay the taxes on the conversion.

Then, we “ran the numbers” (my firm’s specialty) using the same methodology that we used for the peer reviewed article and to some extent we still use today. After seeing convincing proof that our family would be much better off by hundreds of thousands of dollars in the long run, we went ahead with the conversion. .

Over the years we have contributed to Roth IRAs, backdoor Roth IRAs, and since 2006, the assumptions for the calculation assumed I contributed everything to a Roth. In reality, some years when my income was high, I used a regular 401(k) contribution, but for the sake of the analysis I am presenting, I am keeping it simple and assuming we only contributed to Roths and not traditional retirement plans.

In the chart [you can see the impact of making a series of Roth conversions, contributing the maximum to your Roth 401(k)/403(b) account, making “back-door” Roth conversions (while they are still permitted), and having your disabled child qualify for as as EDB so the qould qualify for the inherited “stretch IRA” or “stretch Roth IRA”.

We cannot stress more strongly the importance of getting your estate planning done right and having your child qualify to be treated as a EDB while you are still alive. In addition, we can’t overly stress the benefits of getting Roth IRA strategies right.

The Benefits of Getting The Roth Right to You

What does the graph tell us and what does this mean for you and your child with a disability? First of all, it means you will be able to spend more money in your lifetime and still provide for your child with a disability. The benefits of the Roth conversion and contributions to you, at least consistent with my fact pattern, will be roughly $491,829 in today’s dollars.

Whyat does this mean? You will be able to afford more money for caregivers for your child while you are alive, and that might provide you with more flexibility. For us, it has meant that we can afford certain services that allow Erica to live outside our home with her boyfriend and have services brought to where she lives so she doesn’t have to live with us so both she and us can be somewhat independent, though Cindy still spends a lot of her day taking care of Erica’s needs from a distance. In addition to a lot more money that we can afford for her care now, we are taking advantage of other services that enhance the quality of our life that you potentially could be doing too. We have an assistant in Pittsburgh and a “home concierge” in Tucson where we spend the winter. We would have been much more reluctant to buy a winter home if we weren’t able provide Erica with the extra $1,890,544 because of the strategies we implemented. We have a cleaning service in Pittsburgh and Tucson, lawn and yard service, snow removal a private chef, etcI p oint these things and other things out that will all be paid for because we got the Roth IRA and Roth IRA conversions strategies right. Maybe you will even be able to enjoy some of these benefits or afford a second home, or at least be able to rent another place in the south in the winter for a couple of months every year, all because you did the Roth conversions and invested in Roth 401(k)s instead of the traditional 401(k).

Benefits to Your Child

For your child, after you are gone, instead of running out of money, your child will have the same benefits you took advantage of as well as being able to afford private nurses, a concierge medicine doctor, healthy organic meals specifically designed for her condition delivered to her door, out of network specialists, alternative treatments and medicines and modalities that aren’t covered by insurance or Medicaid, good housing, personal transportation services, using psychologists and psychiatrists, that may not accept insurance, etc. If your child lives or will eventually live in some type of group home, it can be the one with the best reputation where your child will be happiest.

The benefit that is hardest to quantify is the relief you will experience from acting on the steps we advocate. Imagine letting go of the fear that your child will run out of money after you and your spouse are gone. These steps are a gamechanger! To be fair, my wife still worries, but not nearly as much as she did.

My example may not be typical or average because I am an attorney/CPA and have been studying and preaching the benefits of Roth conversions, Roth contributions, and being able to achieve a lifetime stretch of your IRA for years. Admittedly, the savings for Erica are larger than for most readers children with a disability if for no other reason is that my wife and I have a seven figure retirement plan, now in a Roth IRA or Roth 401(k). But if you have less money, getting planning right could be even that much more important for you and your family.

If you have a beneficiary with a disability, your biggest worry in your lifetime is likely the same as my and my wife’s biggest worry—the care for your child while you are alive and after you are gone. Parents of a child with a disability understand all the anguish and fear we have for our child and the way we constantly think and worry about our child’s problems.

This chapter does not cover the nonfinancial aspects of providing for a child or grandchild with a disability, but will cover key financial concepts.

If you know parents who have IRAs or other retirement plans and who have a child or grandchildren with a disability, please let them know about this book or better yet buy it for them and tell them to read this chapter. You could also tell them to go to www.paytaxeslater.com/disabilityreport to get a free report similar to this chapter. You could be doing them and their child an enormous service by recommending this chapter to them.

I am giving all my royalties on the book to charity. I THINK WE SHOULD SWITCH FROM WATER CHARITY TO AN ORGANIZATION WHO SERVES PEOPLE WITH A DISAIBLTY.

Also, be grateful to the person or people who drafted the SECURE Act who made it possible for beneficiaries with disabilities to take distributions over a lifetime from Inherited IRAs and retirement plans.

This is Difficulty to Coordinate all the Moving Pieces in Line to Get the Best Result

Tto make sure that all the pieces are correctly aligned, I think it is prudent to attempt to understand the important principles and make sure and that you work with CPAs or advisors that really get Roth IRA conversions and the benefits for the “stretch IRA”. Your will likely need a specialist attorney to get your child qualified to be a EDB. You will also need an estate attorney who knows how to draft and plan for a child with a disability to qualify as an EDB and get all the terms of the trust to not only enable the beneficiary to get all the tax benefits, but also protect proceeds from any kind of government assistance the beneficiary may or may not receive in the future.

In addition, you have to make sure the executor or person handling the estate either understands these concepts or at least plans to utilize advisors and attorneys who understand these concepts.

In short, qualified beneficiaries with disabilities will meet the standards to use the old “stretch IRA rules,” which, as I showed in Chapter 12, are life changing. (In this book, I do not address all the complexities of getting your beneficiary qualified as disabled with the Social Security Administration.)

Extreme caution is warranted. First, the inherited IRA or inherited retirement plan proceeds will most likely need to be placed in a trust for the beneficiary with a disability. Most of the time this is a testamentary trust that isn’t funded until your and/or your spouse’s death. The trust should be drafted in such a way to protect the government benefits you beneficiary might be eligible to receive or is already receiving.

In addition, the trust must meet four specific conditions in order to be treated as a designated beneficiary that will allow the favorable tax treatment. Getting this right is a very big deal if you have a beneficiary with a chronic illness or disability. It can literally be the difference between financial security versus being broke for that beneficiary. Remember, you can have perfectly drafted documents, but you need appropriate execuation after you are gone. This is especially important if you employ a special needs trust (SNT) as part of your estate planning.

Remember, in this and practically all cases when we are talking about an IRA or retirement plan asset, the key document is not the will or revocable trust, but the beneficiary designation of the retirement plan. One drafting technique is for the beneficiary designation of the IRA to refer to a testamentary trust inside your will or revocable trust. But, if that isn’t done right, even if your will and the trust instrument have all the correct language, if the beneficiary designations for your IRA or other retirement plan assets are not correct, all that careful planning could go down the toilet and your child ends up broke. .

While the SECURE Act does provide an exception to the ten-year rule (the rule that says inherited retirement money must be distributed within 10 years of the death of the plan owner), the law’s definitions of who qualifies as an Eligible Designated Beneficiary (EDB) who can then take advantage of the lifetime stretch for distributions is quite narrow, so if you didn’t already have a distaste for Congress, you will now! In addition, though I don’t have the statistics to back this statement up, there are a lot of people that you and I might consider disabled who do not qualify as an Eligible Designated Beneficiary. Even if they do qualify the administrative process puts a huge burden on the family to prove the need for SSI, SSDI, or Medicare. The problem of caring for individuals with a disability is already a massive problem and will get much worse with a likely increase of patients suffering with long COVID.

I know that sounds self-serving because our firm has expertise in some of the key areas (except we don’t have expertise in qualifying beneficiaries to win their SSI or SSDI cases nor can we draft documents for non-Pennsylvania residents). That said, we can refer clients to firms that do both the work to qualify a child to be an EGB and the drafting of wills, trusts and beneficiary forms and then work together with those firms for the benefit of our mutual client.

How Do Beneficiaries Qualify as Disabled or Chronically Ill?

The contrast between the treatment of inherited IRAs under the SECURE Act and the old law is bad enough for a beneficiary without a disability. Because their disabilities often preclude them from entering into or remaining in the workforce, many beneficiaries with disabilities severe enough to qualify for the SECURE Act exemption are far more dependent upon inherited monies to finance their basic living expenses than the average recipient of an Inherited IRA might be. It is bad enough to live with a disability, but to suffer that and be broke is tragic. And it is particularly devastating to know that there will be potentially millions of Americans with disabilities that will live in poverty whose long-term financial security could have been insured if their parents/grandparents/loved ones had only known about and used the appropriate retirement and estate planning tools. We just mentioned two areas to get right, Roth and estate planning. There are more.

DISTINGUISH BETWEEN LIVING WITH BASIC NEEDS AND THE LIST OF GOODIES I INCLUDED IN A PRIOR EMAIL.

In our own case, our daughter was first turned down for benefits and and she did not qualify for Medicare. With the help of an attorney and my wife’s exhaustive review of our daughter’s file and the miserable job the first attorney did on the case, she compiled sufficient accurate details that the attorney we hired did eventually win the case on appeal.

Social Security Disability Income (SWSCI) DON’T UNDERSTAND THIS ACRONUM vs. Social Security Income

A quick note about Social Security assistance for your special needs child. Social Security Income is means-tested, but Social Security Disability Income (SSDI) is not means-tested. Once one of the parents of the special needs child is receiving Social Security retirement (or disability) benefits, the special needs child can claim SSDI based upon the parents’ work history. The means test then goes away, and it does not matter that the special needs child does not have any work history. In order to qualify, the adult child’s disability must have begun before age 22. Our daughter qualified under SSDI so she can have unlimited assets in her name or unlimited income in her name and/or in a trust for her benefit.

Frankly, I think the definition that the IRS uses to determine who is disabled is far too limited and attorneys who work in this area will tell you benefits are often denied for deserving beneficiaries. Parents of a child with a disability have enough challenges in their lives that they should not have to worry about meeting the IRS’s and the administrative judge’s strict overly strict view of who qualifies as being disabled. Let’s take a look at the new definitions used to qualify as an EDB.

Disabled Beneficiary: A disabled beneficiary is defined in Code Section 72(m)(7): “For purposes of this section, an individual shall be considered to be disabled if he is unable to engage in any substantial gainful activity by reason of any medically determinable physical or mental impairment which can be expected to result in death or to be of long-continued and indefinite duration. An individual shall not be considered to be disabled unless he furnishes proof of the existence thereof in such form and manner as the Secretary may require.”

This definition is quite limited. The intended beneficiary must have substantial health challenges which result in a limited capacity for earning a living. However, if the beneficiary can engage in “any substantial gainful activity,” even if very limited, that person will not qualify as an EDB and will not be eligible for the exception to the 10-year rule. Partial disability doesn’t count, nor does a disability that prevents the heir from working in a previous line of occupation, but does not preclude some type of gainful employment. We know of a parent whose son had low-functioning Down Syndrome who was denied benefits because with substantial support he could work bagging groceries.

The other issue IRA owners should worry about is that the beneficiary with a disability may not be inclined or able to prove their disability. That is a frequent problem when it comes to proving disability for other benefits like Social Security Disability Income (SSDI). If you have a beneficiary with a disability and you would like that person to enjoy the benefits of deferring your IRA over their lifetime, it would be prudent to establish proof of their disability while you are still alive and the sooner the better.

In our case, our daughter, while bright, could never have put together thee exhaustive work her Mother put in that I believe was the difference between winning and losing our case. My wife had to do that and it took an enormous effort. In the feedback we received from the judge, some of the most important information we presented were the personal stories from family and friends that described the real-life impact of her disability and questionnaires completed by her medical providers. This information provided the real-life evidence of her disability and ended up being most persuasive in helping win our case. It is important to mention that this sort of information gathering should continue, particularly from regular doctor visits, during the course of the disabled child’s life so that disability can be confirmed during the periodic reviews by Social Security.

Here is the big current news. Under Proposed Regulations from the IRS released in February 2022, beneficiaries who have already been qualified as disabled by the Social Security Administration will also qualify as disabled for the purposes of the SECURE Act. So, if your child is already qualified to collect SSI or SSDI, you won’t have to prove disability again, (other than periodic updates) provided those Proposed Regulations actually become effective and provided you maintain the status of having a disability.

This proposed regulation was a very big deal for us and if you are reading this chapter and your beneficiary has already qualified as disabled for Social Security, it should be a big deal for you too. Though we won our SSDI case, we were not assured that our daughter would qualify as an EDB that would allow her to stretch the inherited IRA and Roth IRA that we will leave her.

Chronically Ill Beneficiary A chronically ill heir is defined in Code Section 7702B(c)(2) with certain modifications. This Code Section provides: “(A) In General – The term “chronically ill individual” means any individual who has been certified by a licensed health care practitioner as— (i) being unable to perform (without substantial assistance from another individual) at least 2 activities of daily living for a period of at least 90 days due to a loss of functional capacity, (ii) having a level of disability similar (as determined under regulations prescribed by the Secretary in consultation with the Secretary of Health and Human Services) to the level of disability described in clause (i), or (iii) requiring substantial supervision to protect such individual from threats to health and safety due to severe cognitive impairment. Such term shall not include any individual otherwise meeting the requirements of the preceding sentence unless within the preceding 12-month period a licensed health care practitioner has certified that such individual meets such requirements. (B) Activities of daily living for purposes of subparagraph (A), each of the following is an activity of daily living: (i)Eating. (ii) Toileting. (iii) Transferring. (iv) Bathing. (v) Dressing. (vi) Continence.”

I would offer the same caution that I mentioned in the previous section on beneficiaries with disabilities. I think it is prudent for you to establish proof of your beneficiary’s chronic illness while you are still alive.

As Martin Shenkman wrote in Forbes:

(https://www.forbes.com/sites/martinshenkman/2020/12/29/secure-act):

The above definition suffers from the same overly restrictive terms as the definition of “disabled” above. Many intended heirs are living with challenges that may limit or even prevent gainful employment, but they are not so severely incapacitated as to meet the requirements of chronically ill according to the above definition. Yet, these same people who need the protections of a trust, and who may desperately need the economic benefits from the plan assets to be bequeathed, will be forced to have the plan balance distributed in 10-years and lose the continued tax deferred growth, etc.

Any IRA owner planning on an heir meeting the requirements of being “disabled” or “chronically ill” to qualify as an EDB under the SECURE Act should carefully evaluate the stringent requirements involved.

What has to happen under the new law for a beneficiary with a disability or chronic illness to qualify for the exception to the ten-year acceleration of income taxes? First, you must have appropriate estate planning and more specifically, you must have the correct language for assigning the beneficiary of your IRA and retirement plan. You also must have the beneficiary certified as disabled or chronically ill.

Critical Extra Step that Likely Needs to Take Place

There is pending legislation that requires documentation supporting the disabled or chronically ill diagnosis of the beneficiary be submitted to the [trust?] custodian by a certain date. Under the current proposal, the documentation supporting the diagnosis of a disability or chronic illness must be provided to the custodian of the account, no later than October 31 of the calendar year following the calendar year of the IRA owner’s or employee’s death. This means if your disabled child is the beneficiary of your IRA and you die on July 1, 2022, the IRA custodian must be provided with documentation supporting the disability of your disabled beneficiary no later than October 31, 2023.

If this legislation passes and becomes law and you have the ability to do so, we recommend you provide the documentation of your disabled or chronically ill beneficiary to the custodian while you are still alive. If the custodian is able to notate your account file or minimally if you have a plan in place to obtain and produce this information after you pass away, you are making certain the important deadline is not missed.

The documentation and the timing of providing the documentation is very important and if not done properly, the lifetime stretch could be eliminated and your disabled beneficiary would be limited to the 10-year rule. This means all of the painstaking efforts you took to provide for your disabled or chronically ill child, could go up in smoke if the documentation is presented too late.

Two Trust Strategies and a Tax-Free Savings Strategy for Supporting Special Needs Heirs

I think that when it comes down to it, if you are “IRA heavy” and don’t have substantial after-tax dollars and you want to provide for a beneficiary with a disability, you can use different trust strategies or a tax-free savings account or more likely a combination of strategies. Both of the trust strategies described in this Chapter involve the use of special needs trusts.

Designation as Disabled or Chronically Ill Plus Special Needs Trust as IRA Beneficiary

The first strategy is to do everything you can to make sure your child receives the necessary designation as disabled or chronically ill. Then work with an attorney to draft a special needs trust (SNT) with your child as beneficiary of the trust and make sure that trust is the beneficiary of your IRA. Since SNT will be funded by someone other than the disabled beneficiary, it will typically be referred to as a third-party special needs trust or a supplemental needs trust (there is also a first-party special needs trust funded with assets already owned by the disabled beneficiary or often from an outright inheritance). As I stated above, drafting this trust requires the expertise of an attorney who is experienced in these matters. If not drafted correctly, the trust will not stand up under the scrutiny of the IRS and the public benefits agencies. Two bad things can happen if the trust isn’t drafted appropriately.

- The trust will be considered an asset available to the child which could result in government benefits being terminated and potentially require that the government be reimbursed for past benefits the child received.

- The ability to stretch IRA distributions will be lost, and massive taxes will be triggered at the very high trust income tax rates.

When planning for this trust, it may also be prudent to consider making a Roth IRA conversion and leaving at least a portion of your IRA as a Roth IRA.

Cool Idea for IRA Owners in a High Tax Bracket

There is an entire discussion of the benefits of a one person 401(k) plan over an IRA discussed in Chapter 7, That would be a good background for this idea that some readers will absolutely love.

There is also a fascinating idea of planning for your beneficiary to make a Roth conversion of an inherited 401(k) after you die. This will not work with an inherited IRA but will only work with non-IRA retirement plans provided it is allowed under the plan. This strategy works really well if you are in a high-income tax bracket but your beneficiary will be in a low income tax bracket and your beneficiary will not need to qualify for any government assistance program that has an income and/or asset eligibility limit. That is, if it makes sense for the disabled beneficiary to receive means-based government benefits, , reducing some of the strategic tax benefit (described in more detail later in this Chapter).

The SECURE Act does allow accumulation trusts for chronically ill or disabled beneficiaries who also qualify for lifetime payout of IRA assets. With accumulation trusts, the trustee has discretion over how much of the annual IRA distribution will be paid directly to the beneficiary or used for the benefit of the beneficiary. The portion paid to the beneficiary will be taxed at the beneficiary’s (usually lower) tax rate, and the trust pays tax on the portion retained at higher trust income tax rates.

Converting Your Inherited Retirement Plan to an Inherited Roth IRA After You Die

We had a client with a high RMD and a high tax bracket. He ran a small consulting practice as part of his post “retirement” activities. We rolled his IRA into a new one person 401(k) which has practically the same rules as an IRA. But, when he dies, his (who is not receiving public benefits) will be able to make an Inherited Roth 401(k) conversion or even a series of Inherited Roth 401(k) conversions at their low tax rates. This plan could result in the savings of tens, maybe hundreds of thousands of dollars or even more for the beneficiary.

The big distinction between keeping the money in the IRA vs. a Solo 401(k) is your beneficiary cannot do a Roth conversions on an inherited IRA account, but assuming the plan allows it, your beneficiary could do Roth conversions on an inherited 401(k) account.

This will likely work better for a beneficiary receiving SSDI and doesn’t have an income cap. If not, the decision to do a Roth conversion needs to be decided and planned for in the year of the conversion as needs-based assistance could be jeopardized. Why we like the idea of moving the assets into a Solo 401(k) vs. an IRA is to have the flexibility to do a low-cost Roth conversion or a series of low-cost Roth conversions over a period of time, but only if it makes sense. The advantage of having this option is you can have the Roth account continue to grow tax-free , and your child will be able to take the stretched minimum required distributions, providing you with the peace of mind that they will be cared for long after you and your spouse are gone.

The beauty of the Roth conversion either while you are alive or even after you are gone (only possible with an inherited 401(k) or 403(b) account and not an IRA) is your beneficiary can get all the benefits of ‘tax-free’ and ‘stretched’ minimum required distributions of the inherited Roth IRA for their entire life just like under the pre-2020 rules before the effective date of the SECURE Act.

One caveat to mention, a downside to having the Roth conversions done post-death is the inherent income tax liability on the conversion cannot be deducted on your federal estate tax return or possibly your state inheritance tax return (for example, Pennsylvania).

Another possible downside to this plan is it is foreseeable they will change the rules on converting Inherited 401(k)s so we still see doing the conversions yourself as the primary Roth strategy, not just your beneficiary doing the conversion after death.

This is one of the reasons why it is so important to do proper planning and run the numbers ahead of time to see what makes the most sense for your particular situation.

While the above strategy could be extremely useful for a limited number of readers, it is usually secondary to making roth ira conversions while you are alive. and your beneficiary will get a tax-free stretch for their entire lifetime.

Another downside to this strategy that learned from a column by Jeffrey Levine is that you can’t do a Qualified charitable deduction with a one person 401(k) plan.

Special Needs Trust Funded with Life Insurance

Another strategy is buy life insurance and make a special needs trust (SNT) the beneficiary of the life insurance policy. Please see Chapter 26 on life insurance. An advantage of this approach is that it may work well in the event your beneficiary will need special assistance but does not qualify as an EDB for the purpose of stretching the inherited IRA. Also, the life insurance strategy is almost always just one part of the masterplan and at least for us has never been the centerpiece of the plan.

My wife and I have life insurance as one important part of our estate plan. The benefits of the life insurance are not included in our projection of saving $1,890,544 in taxes for Erica. One of the benefits of having the life insurance is it gives us “permission” to spend more money as our daughter is provided for. Before we had the insurance and had the Roth conversions and estate planning in place, my wife was more frugal because she wanted to leave more than enough money for our daughter. She is still far more frugal than I am, but less frugal than she was. Running the numbers also helped her feel more comfortable with spending more money.

Why a Special Needs Trust?

There is a very good chance that it would be most prudent to leave the money to the beneficiary in a SNT rather than leaving them the money directly. There are conflicting definitions in the literature about what a SNT is, so for the purposes of this chapter, I am talking about a very specific type of trust.

If the beneficiary has a disability or a chronic illness, whether they meet the IRS’s restrictive definition or not, there is a reasonable chance that either now or at some point in the future, the beneficiary will qualify for some type of government aid that does place limits on the beneficiary’s income and/or assets. It might be Supplemental Security Income (SSI), Social Security Disability Income (SSDI), Medicaid, or another essential federal or state public benefits program.

The goal of the SNT is to make sure that the trust is not considered an available asset as defined by public benefit agencies. The attorney drafting the trust must be mindful of both income and principal when drafting the trust because too much of either, without the appropriate provisions, could result in loss of benefits or potentially the requirement to return benefits.

Over the years, competent attorneys who work in this area have found language that works for these purposes. It is critical that if the underlying asset of the trust is an IRA or a Roth IRA, then the trust must meet four specific conditions in order to qualify for the “stretch” treatment. We have reviewed hundreds of these types of trusts that other attorneys have prepared and by Matt Schwartz’s (our senior estate attorney) estimate, 90% or more trusts where the IRA or retirement plan is the underlying asset have significant flaws that if discovered could disqualify the beneficiary from being able to stretch the inherited IRA or Roth IRA.

Ideally, the person drafting the trust to be named as the beneficiary of an IRA or retirement plan knows the rules to protect the beneficiary’s government benefit and preserve the “stretch” of the inherited IRA and the trusts they draft will not disqualify the beneficiary from receiving the “stretch” treatment. This provision is particularly important if the IRA and/or retirement plan is the primary asset in the estate.

Avoid Entrusting Siblings With Resources Intended for a Child With a Disability

In my practice, I have seen IRA owners try to get around all these complications by naming a sibling as the beneficiary of the IRA or other funds with the tacit assumption that the sibling will use the money for their sibling with a disability and not themselves. This might work, but it could also be disastrous.

What if the named beneficiary falls victim to a lawsuit, bankruptcy, or a divorce and loses the money that was intended for their sibling with a disability? This work-around is not on our list of recommended strategies, even though it might work. The other problem with this approach is that only the beneficiary with the disability or chronic illness can stretch the inherited IRA so this “oral trust” approach is a particularly bad idea under the SECURE Act when the underlying asset is an IRA.

Beware of High Trust Income Tax Rates for Accumulation Trusts

Finally, even if the trust is drafted perfectly, having a lot of IRA or retirement plan money in this type of trust means that a good chunk of retirement plan money may go towards paying taxes at very steep rates, even with the smaller payouts of a stretch IRA. While this strategy is better than directing it to a beneficiary with a ten- year payout, retirement income retained in an accumulation trust will be subject to the steep tax rates for trusts. Under current tax law, any income that stays in the trust will have a very high tax rate on the smaller payouts since retained income in the trust above $13,450 a year gets taxed at the 37% rate, and there are current proposals in Congress to tax all retained income in trusts at 37%.

Tax-Free Savings Under the ABLE

Once a SNT is established or planned for a disabled beneficiary, it is important to coordinate all anticipated future assets that the beneficiary might receive so that the terms of the SNT will control them all. That being said, there is also an easy (and cost effective) way for a beneficiary with a disability to save some funds (outside of a SNT) while still protecting eligibility for government benefits and providing a tax benefit.

An ABLE account (or a 529A account) is a tax-advantaged way to save for individuals with disabilities, created pursuant to federal legislation known as the Achieving a Better Life Experience Act of 2014 (ABLE Act).

The primary purpose of the ABLE Act is to provide an alternative tax-free savings option similar to a traditional college savings 529 plan for parents of children with disabilities, though in this case the disabled person is the account owner. As of 2022, there is an annual contribution limit of $16,000 (higher if the disabled person is working) for the account and contributions can be made from any person using after-tax dollars. The contribution limit is per beneficiary. This is different from contributions to a 529 plan where multiple family members can make annual contributions per year for the same beneficiary, though even with a regular 529 plan there are still limits

There is only one ABLE account per disabled beneficiary. This means if there are multiple family members wanting to contribute to a disabled family member’s ABLE account, the combined contributions cannot exceed the annual contribution limit. Contributions to an individual’s ABLE account may be made by an individual, trust, estate, partnership, association, company or corporation. The contributions are not tax deductible on the Federal level, but some states may provide a state income tax deduction.

In general, eligibility for an ABLE account is automatic if an individual is already receiving benefits under SSI or SSDI or has otherwise meet the disability criteria under Social Security. In all cases, the onset of the disability must be prior to turning 26 years of age, though the ABLE account can be opened at any age even if after age 26.

ABLE account funds (whether cash or investments) grow income tax-free and are not subject to income tax when distributed so long as the funds are used for qualified disability expenses. Most normal expenses would qualify so you probably don’t have to worry that the distributions will be taxable. Qualified disability-related expenses include education, housing, transportation, employment training and support, assistive technology, personal support services, health, prevention and wellness, financial management and administrative services, legal fees, funeral and burial expenses, and basic living expenses. If you’re reading it covers basically everything, you are right! The ABLE account does not impact the beneficiary’s means-tested benefits, such as SSI and Medicaid, as long as the ABLE account balance is less than $100,000 (can be higher if not concerned about means-tested benefits). A key difference with the special needs trusts described earlier is that upon the death of the ABLE account beneficiary, the remaining funds must be used to reimburse the state for Medicaid payments made on behalf of the beneficiary.

If a disabled beneficiary qualifies for government benefits, coordinating a SNT with an ABLE account provides advantages to the disabled person. Generally in this case, a SNT should not be used to pay for basic costs of living that would typically fall under government assistance (food and groceries, rent or mortgage, utilities, and basic medical care) or at least not be used without consulting first with an estate attorney, financial advisor or other trusted professional who is familiar with planning for a disabled beneficiary. Using the funds for a non-supplemental purpose could reduce the government benefit. ABLE accounts do not have this penalty and a trustee could contribute funds from the SNT to the ABLE account and those qualified disability expenses could be paid from the ABLE account without any negative impact to the disabled beneficiary’s government benefits.

If you think about it, an ABLE account or even a college savings 529 plan is a lot like a Roth IRA. You contribute after-tax dollars. The fund grows tax-free assuming the eventual distribution is for a qualifying purpose. Even better, the accounts may not be taxed in your estate. Most states have their own college savings 529 plan and ABLE plans. You don’t need to pay an advisor for the investments because you can use whatever the state has set up. Pennsylvania for example has a variety of asset allocation options and all the options have low fees. IS THE PA ABLE ACCOUNT GIVE VANGUARD AS AN OPTION? IT IS FOR THE REGULAR 529 PLAN.

The Tax Cut and Jobs Act allows tax-free rollovers up to the current gift tax exclusion amount (currently $16,000) from a 529 plan account to the ABLE account through the end of 2025. The $16,000 rollover limit replaces the $16,000 contribution limit. This means, you cannot contribute $16,000 to an ABLE account in a given year and initiate a $16,000 rollover from a 529 plan in the same year. Funds distributed from the 529 plan to be contributed to the ABLE account must be completed within 60 days. If the contribution limits are exceeded, there is a 10% penalty tax plus even worse, it could impact adversely the ABLE beneficiary’s eligibility for certain public benefits.

To put it in plain English, if you or a family member, have several children with multiple 529 plans, and one of your children becomes disabled before age 26 and does not attend college, you could transfer any leftover monies from a 529 plan into the disabled child’s ABLE account. That being said, you should discuss the matter with your advisor to make sure you receive the best advice for your particular situation. There are some additional benefits that a 529 plan has over an ABLE account and it may make more sense to retain funds in the 529 plan – higher contribution limits, higher total funding limit, additional ownership options, no state agency recapture, and a waiver of the IRS 10% penalty if used for care and support of a disabled beneficiary (though still liable for income tax on earnings). When transferring a 529 Plan to a disabled family member’s ABLE account, the IRS rules consider a family member as a son, daughter, stepson or stepdaughter, brother, sister, stepbrother or stepsister, father or mother, son-in-law, daughter-in-law, father-in-law, mother-in-law, brother-in-law, sister-in-law, spouse, first cousin, or adopted child.

It is important to look at your specific state’s rules about ABLE accounts. In some states, like Pennsylvania for example, the entire ABLE account (both savings and growth) is exempt from Pennsylvania inheritance tax. Also, in most cases, the ABLE account is protected from creditors. Since this is a complex area, we strongly recommend you consult with an advisor who has experience with disabled beneficiaries and special needs trusts before making any decisions.

The SECURE Act Isn’t ALL Bad for Disabled Beneficiaries: Introducing the Applicable Multi-Beneficiary Trust

Please note in our legal practice, we don’t utilize the multi-beneficiary trust because our attorneys doesn’t like it. That said, plenty of excellent estate attorneys do utilize it so we include it for completeness.

The SECURE Act does include a few provisions that make estate planning easier for chronically ill or disabled beneficiaries. One is a provision that establishes Applicable Multi-Beneficiary Trusts, which are trusts with at least one beneficiary who qualifies as chronically ill or disabled. This provision allows IRA owners to designate a single master-trust as beneficiary of an IRA. Upon the death of the IRA owner, the master-trust will be split among all the beneficiaries, and the new trust for the chronically ill or disabled child will be allowed to stretch their IRA distributions over their lifetime. The separated trusts for any other non-disabled beneficiaries will still be subject to the ten-year rule. Under the old law, separate trusts and separate IRA beneficiary designations would have been required to take advantage of the longer payout period for disabled beneficiaries.

In addition, if all beneficiaries of an Applicable Multi-Beneficiary Trust qualify as disabled or chronically ill, this trust may be structured as an accumulation trust while still qualifying for lifetime payout treatment. This is in contrast to the rules for spouse or minor child beneficiaries who require a conduit trust to qualify as an exception to the 10-year rule.

While it seems simpler to draft a single trust as beneficiary of an IRA and splitting that trust at death into separate trusts for multiple beneficiaries, as stated above the estate attorneys in our office don’t recommend this strategy at this time. The use of the Applicable Multi-Beneficiary Trust is still relatively new and, as we go to press, there are pending IRS proposed regulations that could modify the implementation and use of this sort of trust. Along with the usual cautions that the trust must be drafted correctly and that the IRA beneficiary designations must be correct, the IRA owner no longer has control over making sure that the lawyers and financial advisors do everything right at his or her death. The advisors may not do the paperwork properly or may not know how to effectively implement the Applicable Multi-Beneficiary Trust. There are just too many things that can go wrong. When things go wrong with inherited IRAs and retirement plans, it can be extremely costly.

Please see

an article by Jeffrey Levine who discusses accumulation trusts, conduit trusts and multi-designated beneficiary trusts.

Flexibility In Planning with the Toggle Trust

It goes without saying how important it is to plan for the future needs of a disabled or chronically ill family member, particularly when that person is already receiving or qualifies for means-based government benefits. That being said, you might be in a situation where your young child is diagnosed with a mild disability and it is unclear whether the disability will prevent the child from working in the future or if the child would simply need some modest accommodations or assistance in order to work. Or a young person could have mental or emotional health concerns that may or may not get worse later on in life and perhaps the person will need someone else to oversee an inheritance. These circumstances create an uncertain future. It is possible to include a trigger or toggle within your will or trust that allows the disabled person’s inheritance to be directed to a SNT based on the circumstances known at the time of distribution (generally the date of your passing). This sort of planning is available for other scenarios where trust protections may also be necessary and is not only for disability planning. These are important considerations to discuss with your estate attorney and other trusted advisors.

Key Ideas

- The planning I did for my daughter with a disability will provide her with close to an additional $2M during her lifetime measured in today’s dollars. That is likely a bigger savings that most reader’s child would receive, but the strategies to protect your children can still save most beneficiaries with a disability hundreds of thousands of dollars.

- Under the SECURE Act, children with disabilities or chronic illnesses who are deemed Eligible Designated Beneficiaries can continue to stretch Inherited IRA distributions over the course of their lives. However, the definitions are extremely narrow and may not cover your beneficiary who you considered disabled or chronically ill.

- Roth IRA conversion planning, both while you are alive and after you are gone can make an enormous difference in the quality of life for your beneficiary.

- Making the effort to get your beneficiary designated as disabled or chronically ill for the purpose of Social Security while you are still alive can not only provide an immediate income, but assuming they maintain their disabled or chronically ill status allow them to stretch inherited IRA distributions over their lifetimes.

- Be aware of the documentation requirements and timing required by the custodian of your IRA or employer plan to support your disabled or chronically ill beneficiary. If possible, provide the required documentation to the custodian as soon as you have it so nothing is compromised later after your death.

- SNTs allow your child to inherit IRA funds without jeopardizing their eligibility for government aid. However, they must contain the four conditions to ensure they function as intended and to preserve the “stretch” of an inherited IRA. A majority of the trusts we have reviewed fail to meet the four conditions meaning the stretch IRA is in jeopardy because of poor drafting.

- Naming a sibling of your disabled child as the beneficiary of your IRA with the understanding that the sibling will help to support their disabled brother or sister can backfire. This should only be done as a last resort.

- Using an ABLE account to save and invest money for a disabled person in a tax-advantaged way and without affecting eligibility for government benefits, and if applicable, discuss with your advisor the option to transfer 529 plan funds to a disabled family member

- Applicable Multi-Beneficiary Trusts can simplify estate planning by allowing a single trust to be beneficiary of an IRA. On the death of the plan owner, this single trust is split among beneficiaries, and the disabled or chronically ill beneficiary’s portion can receive IRA distributions over that beneficiary’s lifetime instead of ten years. That said, our estate attorneys don’t regularly utilize it because they think it increases the chances of an extremely costly mistake.

- The SECURE Act allows accumulation trusts for chronically ill or disabled beneficiaries that also qualify for lifetime payout of IRA assets.