Table of Contents

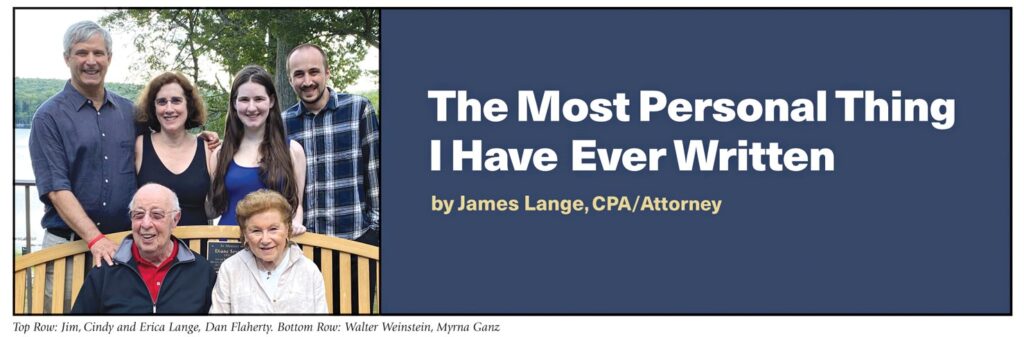

My newest book, the 400+ page Retire Secure for Professors, which would benefit virtually all IRA and retirement plan owners, includes what is unequivocally the most personal chapter I have ever written. It is tentatively titled: The Three Surprising Keys to Protect Your Disabled Child’s Financial Security After You are Gone.

This chapter is personal because it reveals a particularly difficult/challenging aspect of my family’s story. For the last fifteen years, my newsletters and anecdotes in my books have included personal non-business thoughts about health, travel, happiness, family relationships, and other topics that I have felt comfortable and even enthusiastic about sharing with you, my clients, readers, and friends.

I have written about my mom and her passing, my wife, Cindy, and her family, my brothers, cousins, and my closest friends. I have also included certain stories about our daughter, Erica. What I didn’t share was that during her adolescence, Erica developed a disability that will prevent her from ever being able to work or lead a life that we would typically anticipate for a smart and charming young woman.

Part of the reason I didn’t write about her disability was I wanted to wait until she was old enough to make an informed decision as to whether she was comfortable with me sharing her story publicly. Though her disability is clearly a major part of our family’s life and always will be, it doesn’t follow that she would want her life with her disability discussed publicly, especially since I have a 30,000-email subscriber list and a 5,000-person hard copy newsletter list! Now she is 27 years old. She has made an informed choice that allows me to talk about her disability and how we have planned for her financial future. Erica wants this information to be available for parents of children with a disability because if read and acted upon, it could make an enormous difference for other children with a disability.

Erica’s Story

Between the ages of 11 and 17, we were grasping for solutions to Erica’s health problems. We took her to see numerous specialists in many different areas all over the country. I will spare you the details, other than to say it was a major part of our lives. Spoiler alert, none of the doctors and therapists could really help Erica in any substantive way.

Finally, when she was 17, we connected with a doctor who gave us what we now think is an accurate diagnosis. Erica has dysautonomia, which means her autonomic nervous system doesn’t function properly. That explains why she has so many different problems. The autonomic nervous system controls your heart rate, digestion, blood pressure, breathing patterns, and multiple other bodily functions that when working properly, we don’t think about. Unfortunately, even after the diagnosis, doctors have not been able to significantly improve her situation beyond helping her manage some of her symptoms. It has been a heartbreaking journey for our family.

My Emotional Response

Another reason I never wrote about her disability is that frankly, it was so hard seeing her suffer. I really didn’t want to talk about her at work. Before the pandemic I would physically drive to my Squirrel Hill office, away from home, to work. It was something of an escape—a safe haven, so to speak—from watching her in pain and thinking about how sad it is that she has this disability. I knew if I wrote about or communicated her problems that well-meaning caring clients and others would always ask about her during our reviews and in other communications. Then, I would be taken from my safe haven when I wasn’t thinking about Erica and plunged back to thinking about Erica and her problems.

Parents of a child with a disability understand all the anguish and fear we have for our child and the way we constantly think and worry about their care. The worry is only made worse by our fears of what will happen when we are gone. Which is what makes the rest of our story so important.

Erica Has Her Ups and Downs

Of course, we do our best to manage her treatment and suffering, but at this point, it doesn’t look like there will be a cure.

Our family just spent four days together at Cindy’s family’s annual reunion. (I have written about the value of family reunions!) She is, for the first time, living independently in Beverly, MA, just north of Boston. She met a wonderful, genuinely nice, young man, who treats her so well and they are madly in love. She has been with him for over a year. He has done more for her spirits and hence her health than all the therapists and doctors put together.

At least for this vacation, she rose to the occasion. She was in better spirits and health than I have seen her in years. She made it to every family lunch and dinner. She walked a lot and even made it halfway up the climbing wall—twice—which I would have never expected. She interacted beautifully with her cousins and was genuinely a joy to spend time with. She hung out during family activities both in the days and the evenings. In contrast, at previous reunions, she spent most of her time in bed, and we were lucky if she joined us for one meal.

But just because she had a great couple of days and is doing better than when she was living with us, barring a medical miracle, she will never be able to hold down a job or lead a typical life. Cindy still spends a lot of time taking care of things from a distance. Cindy also travels to Beverly periodically to help Erica with myriad practicalities and other issues.

What We Have Done to Alleviate Some of Our Worries

Through extensive research, effort, and applications of both new and old tax law, we uncovered several key strategies to financially protect Erica long after we are gone. Through just two strategies in particular, Erica will be almost $1.8 million dollars better off in today’s dollars from the time Cindy and I die until the time she dies than she would have been if we had not taken these steps.

Our history and our actions provide the backbone for the chapter dedicated to parents of children with disabilities. I write not only about these two steps, but on some of the other most important financial steps that parents of a child with a disability should take to insure their child’s financial security.

My Aha! Moment

Then I realized the information in the chapter was so valuable that I really needed to make it available to the millions of parents of children with disabilities. It warranted greater exposure than in a book aimed at professors’ retirement planning. I have decided to repurpose the chapter into a special report, it might even become a separate book.

Why Me?

Why Me?

The other thing that is so exciting about this project is that I am the right guy to tell this story. A major part of the long-term financial solution stems from a series of Roth IRA conversions and Roth contributions. But an equally important part of the solution is getting the estate planning right after the SECURE Act and SECURE Act 2.0. Under the SECURE Act and the proposed new tax law known as SECURE Act 2.0, if you meet the Social Security’s definition of a disabled beneficiary, the IRS will allow that beneficiary to “stretch” an Inherited IRA and Inherited Roth IRA over your lifetime. For those of you who have followed my recommendations for years before the SECURE Act took effect, you know how much I cherished the power of the “stretch IRA” for all beneficiaries and how much I mourned its loss. The SECURE Act’s ten-year rule is a poor substitute. But returning this power to stretch the inherited IRA or Roth IRA for beneficiaries with approved designations as disabled is welcome news.

But perhaps the main reason I am the right guy to spread the news—even more important than all the technical information I can provide—is that I share a bond with parents of a child with a disability because I am one. I have first-hand experience with the problems we parents face and the strategies I am recommending.

Who Can Benefit?

I expect the vast majority of the parents will not have resources equivalent to mine to ensure such an advantageous outcome for their child—I recognize my privilege. But my strategies can still provide a significant advantage for those with less resources. For example, someone who dies with a $500,000 IRA can, with Roth IRA conversions and appropriate estate planning, help their child be better off by $239,000 in today’s dollars. That might be the difference between your child being OK financially versus running out of money.

Cat and Mouse with the IRS (All Legal)

Retire Secure for Professors also places a great deal of emphasis on effective charitable giving. By effective I refer to more money going to the charity and the family and less to the IRS. Effective planning for disabled children falls into a similar category. To oversimplify, I hope for a massive shift of money from the IRS to the disabled children of IRA and retirement plan owners—people like Erica.

The report and the chapter in our book have other technical information on strategies that are powerful both for parents of a child with a disability or even a child in a lower income tax bracket than their parents’ tax bracket. Did you know that a beneficiary of a 401(k) plan can convert an Inherited 401(k) to an Inherited Roth 401(k) after the 401(k) owner dies? This strategy can be extremely relevant for a child with a disability. Few financial advisors know about this strategy or can help implement it for the child after the death of the parent.

For More Information

Though we aren’t quite done with the chapter, if you are interested in reading the details, please go to https://PayTaxesLater.com/Disability. If you have a friend or colleague who has a child with a disability, please forward this newsletter or link to them.

If you are interested in joining our launch team to promote Retire Secure for Professors and get early access to all of our valuable information from a 400-page PDF of the book (with a detailed Table of Contents so you can find what you are looking for quickly), please go to https://PayTaxesLater.com/ProfessorBook. It is by far my best and most thorough book thus far. Yes, the title is Retire Secure for Professors, but the book will be extremely relevant for all IRA and retirement plan owners.

Please note that there may be a time lag between when you sign up, and when I deliver the report or the PDF of the book.

Chicken with Oven-Roasted Tomatoes

Serves: 4

Prep. Time:15 minutes

Cook Time:30 minutes

- 1 yellow bell pepper, seeded and thinly sliced

- 1 orange bell pepper, seeded and thinly sliced

- 1-pint grape tomatoes halved

- 1 shallot, minced

- 4 garlic cloves, thinly sliced

- 2 tablespoons extra-virgin olive oil

- Sea salt and freshly ground black pepper

- 1 pound boneless, skinless chicken breasts, cut into bite-sized pieces

- 2 tablespoons fresh lemon juice

- ¾ teaspoon smoked paprika

- ¼ cup thinly sliced green olives

- ¼ cup finely chopped fresh parsley

Preheat the oven to 450⁰F.

Toss the bell peppers, tomatoes, shallots, and garlic with the olive oil on a rimmed baking sheet. Season with a pinch each of salt and black pepper. Roast until the peppers are just tender and the tomatoes start to collapse for about 20 minutes.

Meanwhile, in a medium bowl, toss the chicken with 1 tablespoon of lemon juice and the paprika. Season with a pinch each of salt and black pepper. Scatter the chicken on top of the roasted tomato mixture and roast until the chicken is just cooked through, about 10 minutes.

Add the olives, parsley, and remaining 1 tablespoon lemon juice and toss to combine. Season with a pinch each of salt and black pepper and serve.

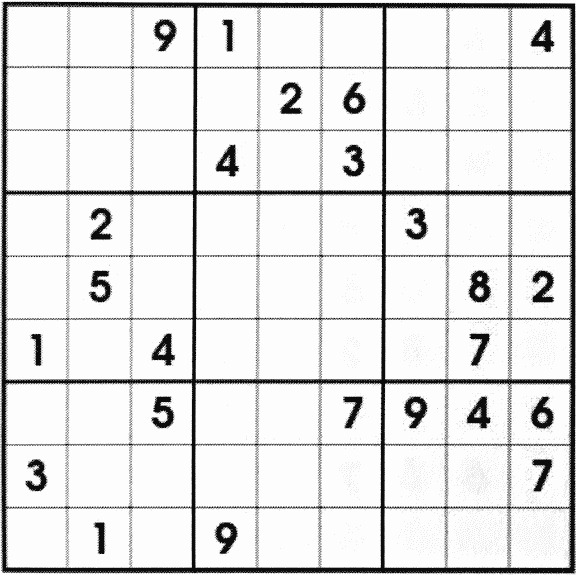

Sodoku

Answer Key

Why Me?

Why Me?