Table of Contents

Over two million copies of A Random Walk Down Wall Street were in print before the Anniversary Edition went on sale on January 3, 2023.

A Random Walk Down Wall Street is on virtually every list of the best financial books ever written. At 90 years old, Burt is as sharp as ever. He maintains that time has vindicated many of his opinions that were considered financial heresy at the time of his first edition. As an indication of how sharp and witty he can be, he joked that he and Jack Bogel (May 8, 1929 – January 16, 2019), who Jim interviewed twice for his radio show, were the only two original shareholders of an old fund dubbed Bogel’s Folly but now known as the Vanguard S&P 500.

Jim and Burt have developed a professional and personal relationship that has fostered the confidence to conduct these three video interviews examining Burt’s time-tested insights and his most recent assessments of the market. Furthermore, Burt has been extremely generous with testimonials for Jim’s books, offering strong endorsements of Jim’s recommendations spanning books from the second edition of Retire Secure! (Wiley & Sons 2009):

“Keeping your investment expenses low and following Jim Lange’s tax savings strategies are the surest routes to a comfortable retirement.”

Through The Roth Revolution (2011):

“Jim Lange has done it again. In Retire Secure!, Jim showed how minimizing taxes and investment expenses can lead to a comfortable retirement. In The Roth Revolution, he clearly explains the remarkable advantages of Roth IRAs and their role in estate planning. Everyone considering conversions of traditional IRAs to Roths should read this book.”

And The IRA and Retirement Plan Owner’s Guide to Beating the New Death Tax (2020):

“Minimization of costs and taxes are the key elements of every financial plan. On the tax front, there is no one better than Jim Lange to provide timely and useful bedrock tax solutions.”

Culminating, to date, with the eloquent and glowing foreword for Jim’s most recent book, Retire Secure for Professors.

Jim is convinced that the new and time-tested information in the 50th Anniversary Edition is so important that he is taking the lead on spearheading an intensive social media campaign. Though he is still razor sharp, Burt isn’t a social media expert and trusts Jim to get the word out.

Jim and his team will be distributing the video footage (both complete versions and snippets) of his interviews with Burt through YouTube and other social media distribution channels. Working in concert with Burt’s publishers, W.W. Norton & Company, Jim wants to be sure the 50th Anniversary Edition of A Random Walk Down Wall Street (fully revised and updated) is read by as many investors as possible!

But that isn’t the only good news for readers of this newsletter. Jim is making his interviews with Burt available to his clients and readers ahead of the general public. He also has a special promotion for readers who want to buy Burt’s book as well as an offer to receive a copy of Jim’s soon-to-be-released book, Retire Secure for Professors. The combined information could be transformative for everyone on the path to a comfortable and secure retirement—especially those who want to save more, spend more, and leave more!

Please go to https://PayTaxesLater.com/BurtonInterview to watch the first of the three interviews with Burton G. Malkiel.

Please visit https://PayTaxesLater.com/RandomWalk to take advantage of the special offer.

*Please note all of Jim’s assets under management (AUM) clients will receive a free hardcover copy of Retire Secure for Professors when it is available.

Tax-Savvy Million-Dollar IRA Owners Celebrate Passage of SECURE Act 2.0

New Year, New Laws, Learn About the New Opportunities for Million-Dollar IRA Owners

Tuesday, January 31, 2023

Register to Attend 1, 2, or all 3 FREE Webinars at:

https://PayTaxesLater.com/webinars

Finally, some good news coming from Congress, but only for those who learn how to take advantage of the ground-breaking legislation.

Do yourself and your family a huge favor and attend these workshops.

Secure Act 2.0 provides new tools and opportunities for IRA owners to implement optimized strategies to get the most out of what they’ve got. Don’t be complacent. Be proactive. Education and action are the keys to increasing and preserving your retirement wealth!

Our team is committed to helping IRA owners save more, spend more, and leave more. Our new and classic strategies—including some advanced techniques that are not well-known or used—are much more powerful with the new legislation. Equally exciting, strategies that we thought would be eliminated are still permitted which means more tax-free contributions for many viewers.

We also wanted you to hear from not only Jim but some of the top people on our team. We will be expanding our webinar panel of experts to include Matt Schwartz, our veteran quantitative estate attorney, and three of our number-crunching CPAs, Steve Kohman, Shirl Trefelner, and Jen Hall. This critical-thinking team will analyze the offerings and opportunities in SECURE Act 2.0.

Join us to discover both proven and new methods for getting the most from your IRAs and retirement plans.

You must register for each session individually.

Click here to register

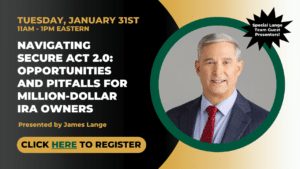

Session 1 Navigating SECURE Act 2.0: Opportunities and Pitfalls for Million-Dollar IRA Owners

11 am – 1 pm Eastern

Presenters Include:

- Jim Lange, CPA/Attorney, and author of eight best-selling investment books.

- Steve Kohman, CPA, CSEP, CSRP, will share some of his cutting-edge Roth IRA conversion techniques.

- Matt Schwartz, Estate Attorney, will share proactive legal techniques he routinely uses to implement estate planning essentials.

- Jen Hall, CPA, CMA, CFP, CRPC, will share how she is already saving clients a ton of money with these new laws.

What We Will Cover:

- How many can profit from delayed RMD beginning dates?

- Expanding opportunities to move from the taxable to the tax-free investing environment—potentially more valuable than Roth IRA conversions for some investors.

- New opportunities to transition after-tax dollars of retirement plans, to a Roth IRA at no cost —potentially saving hundreds of thousands of dollars in taxes down the road.

- How to benefit from back-door and MEGA back-door Roth IRA conversions that we thought would be eliminated.

- Capitalizing on Roth IRA conversions through 2025 while favorable income tax rates remain and before 2026 when the “Sunset Provisions” of The Tax Cut and Jobs Act of 2017 take effect and tax rates go up substantially.

- How to plan for the conversion of an Inherited retirement plan to a Roth at your beneficiary’s tax rate, not your own.

- Using Qualified Longevity Annuity Contracts (QLACs) to alleviate concerns about running out of funds in later life and to reduce income to allow for additional Roth IRA conversions in your mid-70s and early 80s.

- Rollover possibilities of 529 Plans to Roth IRAs make 529 Plans more attractive than ever.

Click here to register

Session 2 The Best Estate Plan for Married Couples with a Large IRA

1:30 pm – 3:30 pm Eastern

Presenters Include:

- Jim Lange, CPA/Attorney, and author of eight best-selling investment books.

- Matt Schwartz, Estate Attorney, will share proactive legal techniques he routinely uses to implement estate planning essentials.

- Shirl Trefelner, CPA, CSRP, will share her knowledge on the benefit of the increased 7520 rates in addition to Charitable Remainder Unitrusts (CRUTs).

Getting your retirement plan correct is critical, but if you don’t get your estate planning right, your family could lose hundreds of thousands in taxes. That can be prevented.

Between the SECURE Act and pending tax hikes, unless you take aggressive action, you and your loved ones will likely take a massive income tax hit on the monies in your IRAs and retirement plans. This workshop will concentrate on what you can do to protect your estate from Uncle Sam.

We will review what we consider the best estate plan for most married IRA owners but will also cover some advanced trust planning.

Getting trusts right, particularly when the underlying asset is an IRA or retirement plan is crucial. In our reviews of trusts of this type, more than half the trusts we examine are not done right. This common estate planning mistake can be devastating for families with a large IRA and who prefer leaving money to one or more beneficiaries in a trust rather than leaving it to them outright. This could be a minor’s trust, a spendthrift trust, an asset protection trust, or the “I don’t want my no-good son-in-law to inherit one red cent trust.” This webinar shines a light on this common sloppy and costly estate planning error and how you can get it right.

We Will Also Dive Into:

- The details of the best estate plan for married retirement plan owners know as Lange’s Cascading Beneficiary Plan.

- Should your heirs inherit your IRA and other retirement assets directly, or would naming a trust be wiser?

- Charitable trusts as beneficiaries of your IRAs and retirement assets.

- We will combine our newest thinking with some of our classic strategies for protecting your children or grandchildren from themselves, but also creditors, possibly including their spouses.

Click here to register

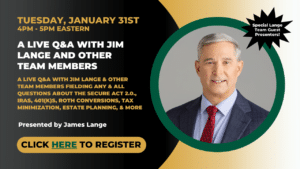

Session 3 A Live Q&A with Jim Lange and Other Team Members

Fielding Any and All Questions about the SECURE Act 2.0., IRAs, 401(k)s, Roth Conversions, Tax Minimization, Estate Planning, and More

4 pm – 5 pm Eastern

We will answer attendees’ questions submitted in advance of these webinars as well as those submitted during the webinar.

Take advantage of this remarkable opportunity to have your financial questions answered.

You must register for each session individually.

Register to Attend 1, 2, or all 3 FREE Webinars at:

https://PayTaxesLater.com/webinars

Investment advisory services are provided through Lange Financial Group, LLC. Past performance is no guarantee of future results. All investing involves risk, including the potential for loss of principal. There is no guarantee that any strategy will be successful. Indexes are not available for direct investment.

SECURE Act 2.0 Summary for IRA and Retirement Plan Owners and Webinar on January 31, 2023

by Jen Hall, CPA, CMA, CFP, CRPC (with a few edits by Jim Lange, CPA/Attorney)

Finally, some good news. As we go to press, SECURE Act 2.0 has passed. The 90 provisions included in the bill provide incentives for both employees and employers. The bi-partisan goal of the bill was to increase retirement savings through employer-sponsored plans and IRAs. Please join our January 31st webinar that will feature many of the beneficial changes in SECURE Act 2.0.

There are notable changes included in SECURE Act 2.0 which encompasses 4,100 pages. Below is a snapshot of the ‘key’ highlights that may impact your future retirement. Note: We have not included all of the provisions of the bill—rather, we only included those provisions that we feel will have the most impact on our clients and readers who tend to be age 55 and older and have substantial IRA and/or retirement plans. These changes combined with taking the appropriate action will have a major beneficial impact on both you and your family.

It is also important to note that many of the provisions outlined below will require the employer to make plan amendments and/or modify their procedures to accommodate these changes. In other words, the new law doesn’t automatically change the rules of a retirement plan. In order to take advantage of some of the benefits included in SECURE Act 2.0, your employer (or you, if you are self-employed) will likely have to have the plan changed. Therefore, it may be a while before some of these changes are implemented. The effective dates of the provisions vary between the passage of the SECURE Act 2.0 to the year 2028.

Please see the provisions below we thought were most important to our readers.

Required Minimum Distributions (RMDs)

Increased Age for RMDs – Currently, the age for RMDs is 72 (previously, the RMD age was 70 ½ before the SECURE Act was passed). Now, the ages for RMDs have changed again:

- If you were born before 1950, RMDs started at age 70½

- If you were born in 1950, RMDs start at age 72

- If you were born between 1951 and 1959, RMDs start at age 73

- If you were born in 1960 or later, RMDs start at age 75

Note: There is a discrepancy within the bill that needs to be corrected. For those individuals born in 1959, the bill inadvertently reads they have two ages to take their RMDs: age 74 and 75. We included the table above in the years as experts perceive the intention of the bill. Stay tuned for a technical amendment in the future. For some, you will now have an extra (3) years for additional planning considerations, including accelerating more Roth conversions and/or smoothing out Roth conversions over a period of time to lower IRMAA charges, net investment income taxes, and possibly, capital gains tax brackets.

Surviving Spouse – In 2024, a surviving spouse inheriting a retirement account can elect to be treated as the deceased account holder for RMD purposes. This means if a younger spouse predeceases, the surviving spouse can hold off taking RMDs. Once RMDs are required to begin, they would be based on the younger deceased spouse’s age and thus, would be smaller than the older surviving spouse’s age. There is an interesting planning opportunity that could result from this provision. If the surviving spouse dies before their RMDs start, the surviving spouse’s beneficiaries may be treated as though they were the original beneficiaries. This means any beneficiaries falling under the Eligible Designated Beneficiary (EDB) category may qualify for the lifetime stretch vs. the 10-year payout. As in current law, if the surviving spouse is younger than their deceased spouse, they already are able to delay RMDs based upon their life expectancy. Plus, their RMDs will be smaller because they will be based on the younger decedent’s age.

RMDs on Roth 401(k)s Eliminated – While you do not have to take RMDs on a Roth IRA, before SECURE Act 2.0, you had to take an RMD on a Roth employer plan. With SECURE Act 2.0, you no longer have to take an RMD beginning in years 2024. Prior to SECURE Act 2.0, employees would roll their Roth 401(k) into a Roth IRA to avoid the RMD rules. With the passage of SECURE Act 2.0, they no longer have to employ this strategy. This creates several advantages. If you like the investments in your Roth 403(b) or perhaps in TIAA that pays a good interest rate, you no longer have to roll that Roth 403(b) to a Roth IRA to avoid the RMD. Also, if you have a one-person Roth 401(k), you don’t have to take RMDs from that plan. A small side benefit is by keeping your money in the Roth 401(k)/403(b) plan at work, you are provided with greater asset protection, as the employer-sponsored plans are subject to ERISA rules and provide the best asset protection.

Increased Roth Contribution Opportunities

Roth SIMPLE and SEP IRAs – Roth contributions to SIMPLE and SEP IRAs are now permitted beginning in the year 2023.

Employer Matching Contributions – Optional Roth Treatment vs. Pre-Tax Treatment – Effective in 2023, employers can now allow the employer match to go into a Roth account for 401(k)/403(b)/457(b) plans. The employee will be taxed on the contribution and the match will be immediately vested. This is an optional provision, and the employer plan must be amended to allow these types of contributions. Almost all younger workers should take advantage of this provision and many mid and late-career employees should also. Again, the plan at work must be changed before you can do this. We are changing our 401(k) at Lange so employees can take advantage of this new option. Most of us at Lange love the Roth and love this change.

Catch-Up Contributions for High-Income Earners – For employees earning $145,000 or more, their catch-up contributions will no longer be allowed to be tax-deferred. Instead, they will have to be in the form of Roth contributions beginning in 2024. This means these contributions will not be in the form of pre-tax dollars and will be subject to income taxes. This may hurt a few people who have big incomes late in their careers, but for most of us, it isn’t a bad thing. Note: This does not affect catch-up contributions to IRAs (including SIMPLE IRAs). Though it doesn’t seem fair, If the employer does not have a ‘Roth’ feature in their employer-sponsored plan, then no employees will be permitted to make catch-up contributions.

Transfers from 529 Plans to Roth IRAs – Effective in 2024, a tax and penalty-free rollover from a 529 Plan to Roth IRAs will be permitted under certain circumstances. Beneficiaries of 529 Plans will be permitted to roll over up to $35,000 over the course of their lifetime from their 529 Plan account in their name to their Roth IRA. The rollovers are subject to Roth IRA annual contributions limits, and the 529 Plan account must have been established for more than 15 years. The rollover contribution from the 529 Plan to the Roth IRA replaces the Roth IRA contribution, and it is not an addition to the Roth IRA contribution. This increases the attractiveness of 529 Plans in general because if you overfund a 529 Plan (most likely for a grandchild), the money can keep accumulating and eventually transfer to the grandchild’s Roth IRA. This provision provides a great reason to make college savings a priority without worrying about a child or a grandchild not going to college, receiving substantial scholarships negating the need for a 529 Plan, etc.

Increase in Catch-Up Limits

The employee retirement plan contribution limit is increased for those aged 50 or older. For 2023, the catch-up contribution limit amount is limited to $7,500 and is indexed for inflation

Note: This is for employer-sponsored plans (not IRAs).

SECURE Act 2.0 provides a second layer increase in the employee retirement plan contribution amount for those aged 60, 61, 62, or 63 effective in tax year 2025. The ‘second’ catch-up limitation is $10,000 for 401(k)/403(b) plans and $5,000 for SIMPLE plans. These limits are also subject to inflation adjustments. This provision will dovetail with the provision above for employees earning more than $145,000 wherein the catch-up contribution will need to be in the form of a Roth contribution providing greater opportunity to contribute to their Roth 401(k)/403(b) account.

For participants of IRAs age 50 and older, the catch-up limit is $1,000. Under current law, the catch-up limit is not subject to increases for inflation. The current bill makes the IRA catch-up amount adjusted annually for inflation adjustments for years 2024 and thereafter.

Modification of Age Requirement for Qualified ABLE Plans

Previously, the disabled person had to be disabled before age 26 to have an ABLE account established; now, the disability must have begun before age 46 to qualify for an ABLE account effective in the year 2026. ABLE Plans are like 529 Plans for someone with a disability. We are big fans of the ABLE plans and are in process of maximizing Erica Lange’s (Jim’s daughter) ABLE Plan.

Disabled Beneficiaries and Special Needs Trusts

Charity as Remainder Beneficiary – Effective in 2023, a Special Needs Trust can now name a charity as the remainder beneficiary of the Special Needs Trust. (This may cause a disagreement because some families will want any remaining money to go to charity and others will want to keep it in the family.

The Backdoor and Mega Backdoor Roth Conversions Survived!

We were surprised the legislation did not include any provisions to eliminate backdoor Roth conversions and mega backdoor Roth conversions, nor did it place more restrictive limits on Roth contributions. Earlier in the year, we were led to believe these Roth conversion/contribution strategies would be restricted.

Mandatory Automatic Enrollment

Effective in 2025, new 401(k) and 403(b) plans must automatically enroll eligible employees. Automatic deferrals start between 3% and 10% of compensation, increasing by 1% per year, to a maximum of at least 10% (no more than 15% of compensation). Note: This provision does not apply to current 401(k) and 401(b) plans.

Emergency Savings

Employers can add an emergency savings account that is a designated Roth account eligible to accept participant contributions beginning in 2024. Contributions are limited to $2,500/year and the first four (4) withdrawals per year would be tax and penalty-free. Contributions may be eligible for an employer match as defined by the plan rules. The purpose of the emergency savings fund is to encourage employees to save for short-term and unexpected expenses.

Qualified Charitable Distributions (QCDs)

The previous limit for QCDs was $100,000, but now with SECURE Act 2.0, they are indexed for inflation. In addition, you can make a one-time charitable distribution of $50,000 to a Charitable Remainder Trust (CRAT/CRUT) or a charitable gift annuity beginning in 2023 if you are age 70½ or older. This is an expansion of the type of charity that can receive a QCD.

Qualifying Longevity Annuity Contracts (QLACs)

Effective for contracts purchased or exchanged in 2023 or later, up to $200,000 can be placed into a QLAC. Previously, only 25% of the qualified plan up to $145,000 could be placed into a QLAC. Also, there is a 90-day ‘free look’ period that may be offered. We like QLACs for the right fit client. Ideally, the client would be single with no children and have a long life expectancy.

Employer Matching of Student Loan Repayments

Effective in 2024, employers have the option to match student loan repayments as if the student loan repayments were employee deferrals. This applies to 401(k)s, 403(b)s, SIMPLE, and 457(b)s. This would be a great benefit for young workers and the tax savings would sweeten the match.

Improving Coverage for Part-Time Workers

Prior to SECURE Act 2.0, part-time workers needed to have at least 1,000 hours of service in a 12-month period or 500 service hours in a three (3) consecutive year period to participate in the employer’s qualified retirement plan. SECURE 2.0 reduces the three (3) year period to two (2) years for plan years beginning in 2025.

Conclusion

Again, we did not attempt to make this a complete description of the 4,100-page law. There are a host of favorable changes for specialty groups that are not covered in this article. With all the new tools and opportunities at your disposal, we encourage you to attend our webinar on January 31, 2023, which will include how to take advantage of this new favorable law.