One of the most common mistakes financially savvy people make is dying with too much money. They fail to come up with a long term spending and distribution plan. To some extent, we fall back on familiar patterns. If we have enough money to do what we want to do, and we do not feel as if we are depleting our savings, we do not give sufficient thought to gifting and distribution planning. But we should!

Without a thoughtful spending and distribution plan, you may accumulate too much money. And after your death, that money won’t all go to your children. Uncle Sam will take a huge cut— especially after the SECURE Act. Your children, who may be in their sixties (if not older) when you die, will inherit what is left after taxes.

Furthermore, their inheritance later in life will not be as meaningful as smaller gifts received earlier. I suspect you are giving some monetary gifts to your children and even funding 529 plans for your grandchildren. But it is also likely that your spending and gifting efforts are far too conservative. Do not die with the regret that had you spent more and gifted more earlier, that money could have made a huge difference to you, your spouse, and your kids and grandkids as well as your favorite charities.

Face it. Dying with too much money is a lousy plan for someone as bright and thoughtful as you. I am not saying you should spend flagrantly. Hope for the best

and prepare for the worst—including a potential long downturn in the market, an expensive illness, or a long period of incapacitation. But so many investors save much more than they will need, even accounting for these and other contingencies.

A much better plan would be to try to gauge how much you can actually afford to spend and gift—and then start doing it or at least move in the direction of spending and/or gifting more.

Think about this for a minute. Let's say that somebody gave you or you inherited $100,000 tomorrow. Would it have a significant impact on your life? Or would it just add more to your investments? Would you suddenly decide to eat out more often or go on one more vacation? Not likely. But think of receiving a gift of that amount (adjusted for inflation roughly $50,000) 30 years ago. How would that have changed your life?

Well, your children might be in that same situation now.

Parents also frequently underestimate their children’s stress level about money. Adult children don't necessarily want to count on an expectancy (that is the amount that you'll leave them after you die). With an uncertain job market and the expense of raising kids and college tuition, it is very possible that your adult children may be facing significant financial stresses. Wouldn’t it be a good idea to help them now, when they truly need help?

For example, maybe they could buy a house or move to an area that they cannot afford right now that has good public schools. Or alternatively, they could use some money for private schools or parochial schools. Or maybe they could just use some money for some things that you denied yourself when you were their age.

Wouldn’t it be a better plan to use some of that money while you are alive so you and your kids can experience additional enjoyment, stress reduction and a better life all around?

Many parents worry that giving too much money too early may reduce motivation. How early is too early? Is your child an irresponsible 20-year-old or a responsible 50-year-old with an excellent work ethic and a history of thoughtful saving and spending? You can decide and make decisions based on your good judgment. And you can also make recommendations for how your gift is to be used, such as providing money for Roth IRAs and retirement plan contributions. I am confident you can think of ways that will help your kids no matter their circumstances.

And literal gifting is not the only option. I have long recommended sponsoring a family vacation annually, if you can manage to corral the extended family, or whenever it is possible. Or, what about just taking a month or two and heading South in the winter without the kids. Yesterday I was speaking to a thoughtful client who would love to do just that and could clearly afford to do that. It wasn’t even on his radar. Another client could afford to spend an extra $10,000/month. He bragged to me that he was going on an expensive vacation in Europe. I asked him if he was traveling business or first class and of course his answer was no. Well, at least I got them thinking about it.

I am not advocating spending and being generous to the point of putting yourself in financial jeopardy, but with your help, you and your family will have a much better life if you have a good distribution plan.

There are other ways to spend money too. I often hear, “I have everything I want. What else should I spend money on?” Personally, I’m a big believer in spending money on personal healthcare. I like having the services of a concierge MD, and I suspect you would too. Any time I have a problem, I call or email and get a response, and, if needed, an appointment. I also spend money on supplements and other things that are not covered by health insurance.

Without my personal trainer, I would not keep on top of my strength training, which is particularly important as we get older. I also work with a nutritionist who, after getting results of a variety of tests, developed my ideal eating plan. Of course I don’t strictly follow the plan, but I am eating more healthier meals than I ever have—selected with my wellness in mind.

I schedule tests not covered by insurance to get helpful information. For example, one test revealed I had dangerously high mercury levels. I paid good money for a treatment plan that was also not covered by insurance, but significantly reduced my mercury readings. To me that was money well spent.

The bottom line is that you need to look realistically at your finances. Speak with your financial advisor or work out how much you can safely spend. Map out what you might conceivably need for your long-term security, even overestimate what you think you will need. Then think about your kids and the charities you support and come up with a plan to distribute some money in a manner that will have the biggest impact.

So, please consider these observations. Hopefully, this article will at least get you thinking and gifting more. If you do, I believe you and your family will live a happier life.

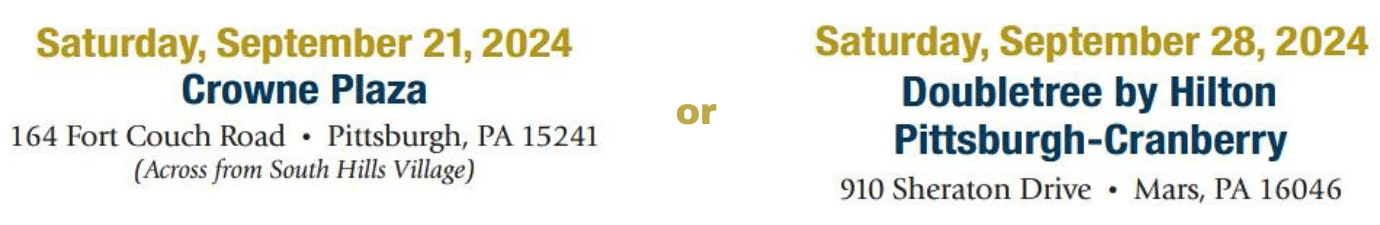

Two easy ways to reserve your seats:

Call 412-521-2732 or register at

PayTaxesLater.com/SeptemberWorkshops

Spouses are encouraged to attend. Free refreshments served.

Session One: 9:30 - 11:30 AM

Roth IRA Conversions:

Pay Taxes Once and Never Again

Little-Known, Highly Effective Strategies and Techniques

This workshop addresses critical fundamentals like pay-taxes-later except for Roth plans. We will cover how to take advantage of the recent SECURE Act 2.0 and introduce new cutting-edge Roth conversion strategies that can help mitigate the massive income tax acceleration your children will face because of the SECURE Act. Both foundational and advanced Roth IRA conversion techniques are included in this session.

- Peer-reviewed math and optimal timing for Roth IRA conversions.

- The back-door Roth IRA.

- How individuals born from 1951–1959 profit from SECURE Act 2.0.

- How to move a portion of your taxable investments (IRAs, and other retirement plans) to the tax-free investing environment (529 plans, your children’s Roth IRAs, and more). This shift could potentially be more valuable to your children than making Roth IRA conversions in your own accounts.

- Capitalizing on Roth conversions through 2025 while favorable income tax rates remain and before the 2017 Tax Cut and Jobs Act’s Sunset Provisions take effect in 2026 when tax rates are scheduled to substantially rise.

- The timing synergy between when you begin taking Social Security and making Roth conversions.

- How to transition after-tax dollars in retirement plans to a Roth IRA at no cost, potentially saving hundreds of thousand dollars in taxes down the road.

- How to convert an inherited retirement plan to a Roth at your beneficiary’s tax rate, not your own, after you die. (This is a little-known strategy with big tax savings for those who qualify.)

Session Two: 12:30 - 2:00 PM

Who Says You Can’t Control from the Grave?

Using Trusts to Protect Your Family and the Best Estate Plan for Most Married Couples

The SECURE Act is no friend to virtually all IRA and retirement plan owners with $1 million or more in retirement plans. Unless you take aggressive action, it is likely that your loved ones will take a massive income tax hit upon inheriting any money from those plans. We will provide strategies to avoid massive taxation and explain how our disclaimer based estate planning system fits into the picture.

Getting trust documents right, particularly when the underlying asset is an IRA or retirement plan is crucial. We will combine our newest thinking with some of our classic strategies for protecting your children or grandchildren from themselves, but also creditors, possibly including their spouse. Plus, this workshop shines a light on common sloppy and costly estate planning errors and how you can avoid them. In this session, you’ll discover:

- How SECURE Act and SECURE Act 2.0 changes could impact your family and your legacy.

- How to ensure financial security for the surviving spouse, and potentially save hundreds of thousands to pass on to your heirs.

- The details of the best (and most flexible) estate plan for married couples known as Lange’s Cascading Beneficiary Plan™.

We’ll also dive into trust planning strategies, including:

- The pros and cons of having your heirs inherit your IRA and other retirement assets directly versus through a trust.

- The growing popularity of the “I don’t want my no-good son-in-law to inherit one red cent of my money” trust.

- A rarely discussed strategy—Who Gets What?—evaluates the tax consequences of leaving differing types of assets to children who are in different tax brackets. We will cover a similar strategy for charitable giving. By optimizing your strategies, you could save hundreds of thousands of dollars in taxes.

Session Three: 2:30 - 4:30 PM

7 Costly Retirement Mistakes and How to Avoid Them

I’ve spent decades guiding thousands of clients through the intricacies of securing their financial futures. Over the years I have identified recurring patterns of costly planning mistakes. We aim to help you avoid these common mistakes and provide you with sound professional advice on how you can avoid them.

Here's a sneak peek at two of the critical mistakes we will explore:

1. Allowing Lifelong Habits and a Depression Era Mentality to Blindside Effective Planning

Accumulating money for retirement is a great objective. Continuing to accumulate more and more money until you die and subjecting your almost retirement age children to massive taxation is not productive or helpful. There are at least several unfortunate consequences to this behavior:

- A retirement with fewer rewarding and enjoyable experiences, including missed family vacations,

- A missed opportunity to have provided heirs with financial assistance when they really needed it, and,

- A potentially huge tax burden for your children that could have been largely avoided with good planning. This mistake will undo many years of diligent saving and hard work. We will discuss how to balance saving with spending and explore ways to use your wealth effectively during your lifetime and pass it on after you are gone.

2. The Missing Link: The Gap Between Your Will and Your Beneficiary Designations

Perhaps you have a comprehensive estate plan with a detailed 30+ page will or trust. Sadly, some of your biggest assets—likely held in your IRA or other retirement accounts—may be distributed in a way that does not align with that carefully articulated plan. To be fair, I blame the estate attorney, not you. Estate attorneys make these and other extremely costly mistakes, and this session will identify a number of them and potential fixes.

Case in point, with respect to IRAs, etc., the beneficiary designation supersedes the instructions in your will or trust. And for many IRA owners, the beneficiary form was completed quickly in two lines—spouse first and the kids equally as contingent beneficiaries—more often than not, a significant mistake. We will show you how to ensure your retirement assets are distributed as intended.

These are just 2 of the 7 costly mistakes we will explore in the workshop. But best yet, we will provide practical solutions to help you avoid them. Join us for this informative and engaging workshop to discover all of the 7 common mistakes and learn how to protect your hard-earned wealth.

6 Valuable Bonus Gifts: Yours FREE When You

Attend Any Workshop Session!

Bonus #1: Register today and receive a free hardcover copy of Jim Lange’s magnum opus, Retire Secure for Professors and TIAA Participants, the best book Jim and his team have ever written. Please note 90% of the content in this book is for all IRA and retirement plans owners.

Bonus #2: A free hardcover copy of Jim’s best-selling book, Retirement Plan Owner’s Guide to Beating the New Death Tax, detailing how to respond to the SECURE Act.

Bonus #3: A free hardcover copy of Jim’s best-seller, The Roth Revolution: Pay Taxes Once and Never Again. Jim shows how to use a series of Roth IRA conversions to grow income from your IRAs tax-free.

Bonus #4: You will receive a laminated copy of our 2023-2024 Tax Planning Card.

Bonus #5: Attendees will receive a free hardcover copy of Jim’s latest book, Retire Secure for Parents of a Child with a Disability.

Bonus #6: Qualified attendees are eligible for a FREE Retire Secure Initial Consultation with Jim Lange and one of his number-crunching CPAs.

Disclaimer: Lange Accounting Group, LLC offers guidance on retirement plan distribution strategies, tax reduction, Roth IRA conversions, saving and spending strategies, optimized Social Security strategies, and gifting plans. Although we bring our knowledge and expertise in estate planning to our recommendations, all recommendations are offered in our capacity as CPAs. We will, however, potentially make recommendations that clients could have a licensed estate attorney implement.

Asset location, asset allocation, and low-cost enhanced index funds are provided by the investment firms with whom Lange Financial Group, LLC is affiliated. This would be offered in our role as an investment advisor representative and not as an attorney.

Lange Financial Group, LLC, is a registered investment advisory firm registered with the Commonwealth of Pennsylvania Department of Banking, Harrisburg, PA. In addition, the firm is registered as a registered investment advisory firm in the states of AZ, FL, NY, OH, and VA. Lange Financial Group, LLC may not provide investment advisory services to any residents of states in which the firm does not maintain an investment advisory registration. Past performance is no guarantee of future results. All investing involves risk, including the potential for loss of principal. There is no guarantee that any strategy will be successful. Indexes are not available for direct investment. If you qualify for a free consultation with Jim and attend a meeting, there are two services he and his firms have the potential to offer you. Lange Accounting Group, LLC could offer a one-time fee-for-service Financial Masterplan. Under the auspices of Lange Financial Group, LLC, you could potentially enter into an assets-under-management arrangement with one of Lange’s joint venture partners.

Please note that if you engage Lange Accounting Group, LLC and/or Lange Financial Group, LLC for either our Financial Masterplan service or our assets-under-management arrangement, there is no attorney/client relationship in this advisory context.

Although Jim will bring his knowledge and expertise in estate planning to this workshop and to the meetings, it will be conducted in his capacity as a financial planning professional and not as an attorney. This is not a solicitation for legal services.