Table of Contents

- Ethical Wills – A Way to Pass Along Wisdom & Values to Your Family

- 2018 Estate and Trusts: Tax Planning Considerations

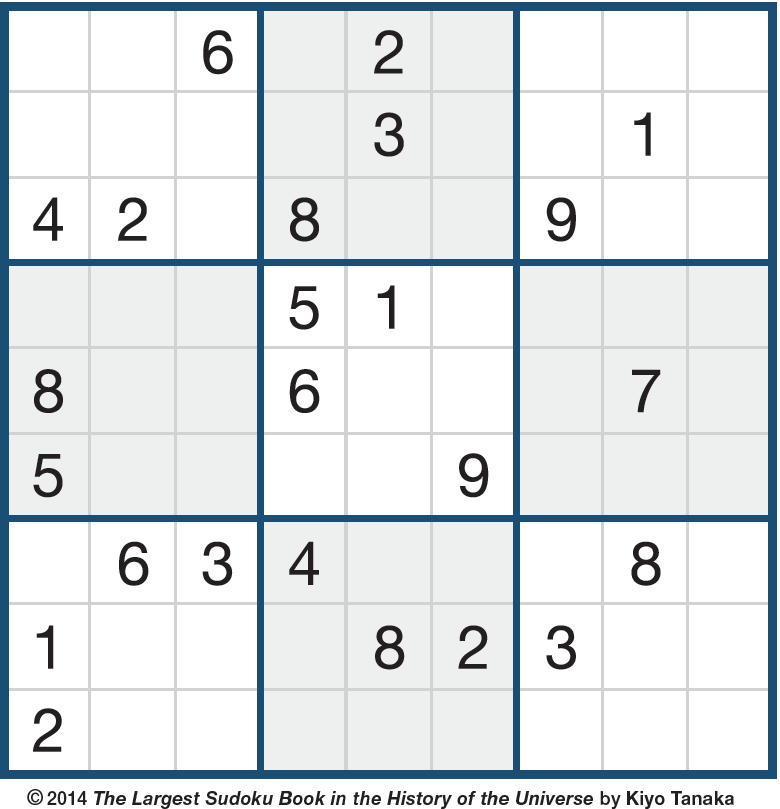

- Sudoku

- Recipe: Cauliflower “Rice”

Ethical Wills – A Way to Pass Along Wisdom & Values to Your Family

by James Lange, CPA/Attorney

As estate attorneys, we focus on helping our clients pass along material wealth to their loved ones both while our clients are alive and after death. I like to think we go much deeper than most planners or estate attorneys, but frankly, even when we do, we tend to focus on smart tax strategies and optimized plans for distributing money and material wealth. We are less involved in helping clients communicate personal and family values.

Many of us assume, simply as a function of being parents of grown children, that we have done everything we could to pass on our wisdom and values to our children. We frequently assume they know what we think and what we want for them. I think many of us might benefit from thinking about how we can expressly pass on some of our values and wisdom to our loved ones.

This is not a new topic for me, and some of you may have remembered the speaker I brought in, Susan Turnbull. We also did a radio show. Susan is the leading expert on ethical wills, and I think she offers some lessons that are worthwhile for all of us.

First, the ethical will is not a legal document, and it has really nothing to do with the passing of material wealth from one person to another either during lifetime or at death. This is from Susan: “An ethical will is a personal letter, or it can certainly also be a recording or some kind of a multimedia creation, from you to your heirs with the idea that this letter or recording would live beyond you and be part of the record of your life. It really takes a look at what sort of information and what kinds of themes and reflections, what values, some of the lessons that you’ve learned that you would like to pass on as part of your legacy.”

I think we all cherish the memories of our loved ones that have passed. Some of us are fortunate enough to have old letters or even old cassette tapes-to remind us of their voices and ways of expressing their thoughts. I have several documents written by two people who probably never heard of the term “ethical will”. My great grandmother, Annie Jacobs Davis, who married Barnett Davis, my great grandfather, wrote an autobiography that chronicled the events of her life, but also shared her values. She was known as The Mother of Montefiore Hospital because she was one of the founding members of a committee that helped Montefiore Hospital become a reality in 1908. Her passion for caring for the underserved found continued expression in the next generation when one of her children, Isaac Davis, my grandfather, an ophthalmologist, did not hesitate to treat patients who could not afford treatment. Clearly, her values were communicated to her son. But, her autobiography passed her values on to multiple succeeding generations. My mother, Bernetta Davis Lange, sent me some personal letters that I will always cherish and which I look forward to sharing with my daughter, so she can learn from her grandmother too. I believe my values have been shaped by the good examples of my ancestors.

Ethical wills are certainly not new. Rabbi Jack Riemer writes “The first ethical wills are found in the Bible. Jacob gathers his children around his bedside and tries to tell them the way in which they should live after he is gone. And Moses makes a farewell address, chastising, prophesying, and instructing his people before he dies. David prepares Solomon before he goes to his eternal rest.” More recently, Randy Pausch, a young terminally ill CMU professor, created an international sensation with his last lecture found at https://www.cmu.edu/randyslecture/.

Though what you write will not likely achieve that degree of notoriety, it could add a different type of legacy for your family.

If you wanted a quick free resource of how to go about writing an ethical will, you could listen to my radio show or read the transcript of the show with Susan found at https://paytaxeslater.com/radio-show/169-ethical-wills-susan-turnbull.

There are other resources on how to write an ethical will recommended in the show. I know my life is enriched because some of my family members, including one I never met, took the time to create a communication that could be cherished for generations.

If you are interested in more financial information (we have written 5 best-selling financial books, many peer reviewed articles, have 208 hours of our radio archives, etc.), we encourage you to visit our website, www.paytaxeslater.com. It has a wealth of valuable free material of special interest to IRA and retirement plan owners, or please call (412) 521-2732 for a free copy of James Lange’s 420-page hardcover book, Retire Secure! or to see if you qualify for a free second opinion consultation.

The foregoing content from Lange Financial Group, LLC is for informational purposes only, subject to change, and should not be construed as investment or tax advice. Those seeking personalized guidance should seek a qualified professional.

2018 Estates and Trusts: Tax Planning Considerations

by Matt Schwartz, Esq.

Estate planning has changed radically since I started practicing over 20 years ago and 16 years with Jim. When I started practice in 1997, the federal estate tax exemption was $600,000, and it was lost if the first spouse did not utilize it. Before I started working with Jim, the name of the game was saving estate taxes (cutting the death tax). When I started working with Jim, his concern was mainly not the estate tax but saving income taxes. I quickly became an estate attorney that concentrated in cutting income taxes.

In 2018, the federal estate tax exemption is $11,180,000 per person and with the ability to transfer it to the surviving spouse, the effective federal estate tax exemption per couple is $22,360,000. So for our average client, avoiding federal estate tax is easy because their estate is less than the federal estate tax exemption. Now, saving income taxes is the primary tax goal for our clients with significant IRAs and retirement plans. But, there are additional concerns besides income tax reduction.

What is the value of developing a well thought-out estate plan when the federal estate tax exemption is so high? Here are some planning ideas under the new tax law.

1. Preservation of the Stretch IRA

The new law preserved the full stretch IRA. Beneficiary designations particularly when inheritances are being left in trust are more important than ever. More than 90% of the wills I review prepared by other attorneys botch this and it can cost your family hundreds of thousands, maybe millions of dollars. It is crucial that the trusts created in your documents have the right language for the Trustee to be able to stretch the inherited IRA over the beneficiary’s lifetime or in other words, pay taxes later.

2. Roth IRA Conversions

With lower marginal income tax rates, now is a better time than ever to consider Roth IRA conversions particularly when you consider that these rates are only guaranteed under the current law for eight years.

3. Flexible Estate Planning Documents

It is more important than ever to maintain flexibility in your estate plan, and we think there is no better plan than our office’s Cascading Beneficiary Plan. I have prepared nearly 1,000 of these plans. Sadly, many of our clients have died but the resulting flexibility with these plans in place has enabled many families to save hundreds of thousands, some millions of dollars, overtime.

4. Termination of Irrevocable Life Insurance Trusts

With the higher estate tax exemption, many clients no longer need to give up control of their life insurance with an irrevocable life insurance trust and can instead terminate the trust so the policy is owned by them. We generally recommend this strategy when including the life insurance in the client’s estate will not cause a federal estate tax problem. This is particularly important if you have an irrevocable life insurance trust and one of the beneficiaries either has a spending problem, a drug problem, a spousal problem, or has some different need than was anticipated when drafting the irrevocable trust.

5. Preserve Charitable Tax Deductions by Making Donations from Your IRA

If you are over 70-and-a-half, consider making charitable donations from your IRA particularly if you are not able to itemize deductions under the new tax law.

6. Think Before You Make a Gift

Your instinct might be to start making large gifts because of the large exemption. However, please remember that highly appreciated assets receive a full step up in cost basis (wiping out the life-time capital gain) after the owner’s death. So, please be careful by transferring these assets to your kids. Instead, only transfer these types of assets if they can sell the securities at low income tax rates.

7. Plan Around the Kiddie Tax

The kiddie tax is now more punitive because it is taxed at the higher marginal income tax rates for trusts and estates rather than the parents’ marginal rates. Consider holding off on gifts to children until they are filing their own tax returns to avoid the application of the kiddie tax.

8. Loss of Excess Deductions on Termination for Estates and Trusts

The loss of the ability for beneficiaries to be able to deduct excess income tax deductions on a termination of an estate or trust lead to planning opportunities to recognize income to soak up what would have otherwise been wasted losses.

Best wishes for a prosperous and successful 2018

Cauliflower “Rice”

Makes: 2 Cups

Prep Time: 5 minutes

Cook Time: 10 minutes

- 1 head cauliflower

- 2 tablespoons extra-virgin olive oil

- 2 small yellow onion, finely chopped

- Pinch of sea salt

- Juice of 1/2 lime

- Pinch of cumin

- 1 tablespoon chopped fresh cilantro

Cut the cauliflower in half. Place a box greater over a large bowl and grate each cauliflower half over the big holes of the grater – holding the cauliflower by its stems as you grate it into “rice”.

Heat the olive oil in a medium nonstick pan over medium-high heat until shimmering. Add the onion and cook until softened, 2 to 3 minutes.

Add the cauliflower “rice” to the pan and stir to combine. Cook, stirring frequently, until cauliflower is slightly crispy on the outside but tender on the inside, 5 to 8 minutes. To enhance flavor, add the lime juice, cumin and cilantro. Serve.