Table of Contents

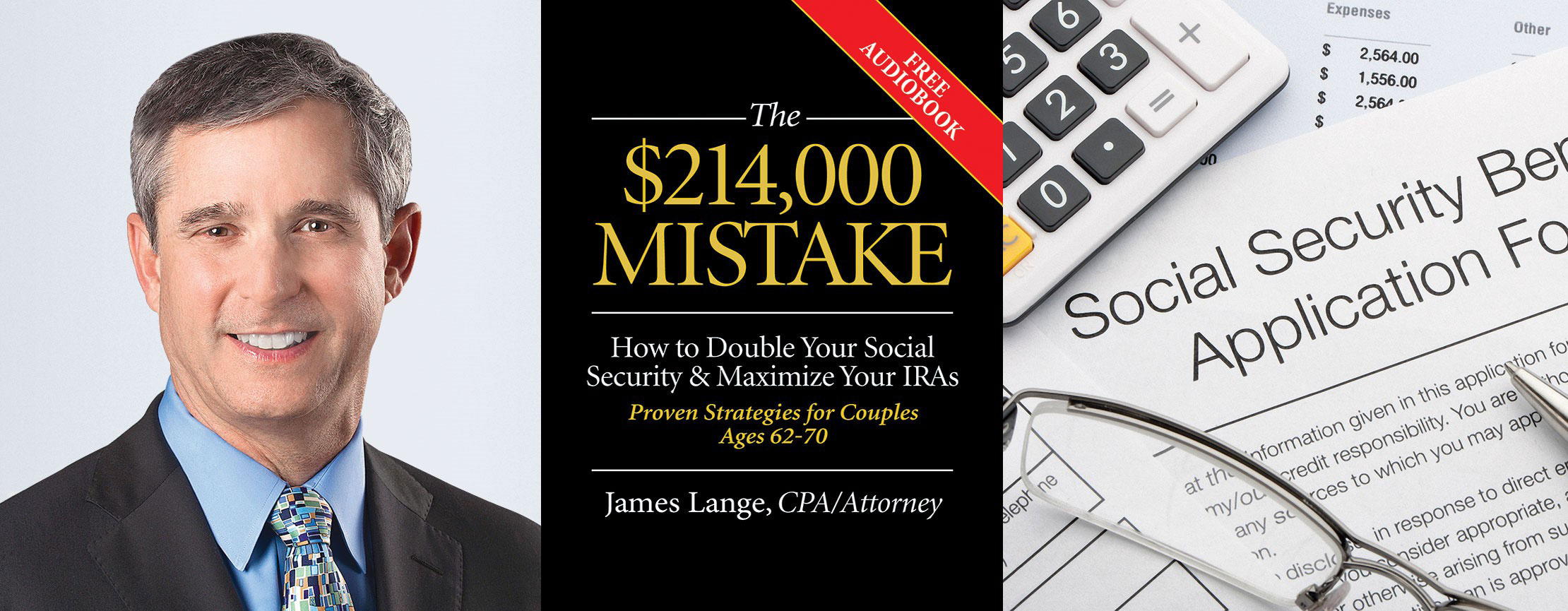

- How You Can Help 100,000 Retirees Avoid Making a $214,000 Mistake

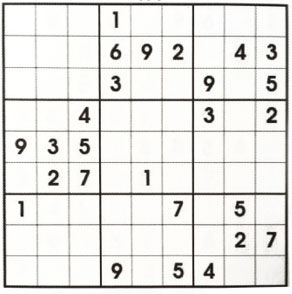

- Sudoku Puzzle

- Salmon Burgers with Pickled Radishes and Avocado

How You Can Help 100,000 Retirees Avoid Making a $214,000 Mistake

by James Lange, CPA/Attorney

Book number eight is hot off the press and we could not be more pleased. But, this book has a broader purpose. We are striving to reach a wider audience of retirees and married couples between the ages of 62 and 70 who might benefit from optimizing Social Security benefits even more than my regular readers and clients. While this information may be important for people like you and your friends and colleagues, it could be life changing for people you know who might be more dependent on Social Security over the long haul.

We would appreciate your help getting this information into the hands of people who might need it the most.

For someone who has a $2,000,000 portfolio and/or a healthy pension, optimizing Social Security benefits to get an extra $214,000 (which can be as much as double their unoptimized benefits) is a nice cushion, but not life-changing. For the 21% percent of married couples and 43% of single seniors who the Social Security Administration estimates are relying on Social Security to fund the greater part of their retirement, not receiving all the benefits they are entitled to will have a disastrous impact on their quality of life.

We are fully aware that many of the people who most need this information will never become our clients. That is fine. I am going all out to promote this book, and I genuinely hope it helps hundreds of thousands of people who will never do business with us.

And, so you know, we are donating 100% of the gross proceeds to charity:water, an organization that helps communities around the world develop access to clean drinking water.

I have hired a public relations firm to promote the book and help arrange appearances in the media for me to promote the book. And to reach an even larger audience, we hired a professional reader to create an audiobook. You can download the audiobook for free at www.socialsecurityaudiobook.com

We have an even more novel project in the works to have celebrity readers read and record chapters of the book. As of now, we have received a commitment from Ed Asner (Lou Grant of The Mary Tyler Moore Show). We are in the initial stages of this promotion, but we have high hopes!

So, how can you help? The firm I hired to promote the book said that they plan to hit media hard as soon as we have had a chance to get some 5-star reviews on Amazon. Amazon, however, doesn’t put much stock in reviews from readers who post reviews without purchasing the book. So, for a limited time, we are selling the e-version of the book on Amazon for 99 cents. We will, of course, be sending you a complimentary hard copy of the book. But, once you have read the book or parts of it, and if you find the information helpful, I would be grateful if you were to post a review on Amazon. For a mere 99 cents, you can help us further our cause to reach the widest audience possible—and remember all proceeds will be donated to charity:water.

This brings me to my next point.

If you have people you care about, either friends or colleagues whose finances might be similar to yours, we will be delighted to send you as many copies of the book as you want to give away. But, we will also be happy to send you copies for people you care about who can’t afford to make disastrous decisions regarding Social Security. Please, stop for a moment and think about the people not only in your circle of friends and colleagues but also some of the service providers in your life. Perhaps your favorite waitress or your gardener or someone who might not have that much money or financial expertise but frankly could benefit enormously from the advice in this book.

Getting Social Security wrong not only hurts the primary wage earner of the couple but could be devastating for the dependent spouse, usually the wife. Jane Bryant Quinn and other Social Security experts I interviewed all agree getting Social Security right is a woman’s issue. For example, if the primary-wage-earning-husband collects too early, not only will his benefit be less than half of what it could be, his wife will get less than half if he dies first. And, since statistically women live on average 7 years longer than men, a man making the wrong decision about Social Security could unnecessarily doom his wife to a life of poverty after he dies.

The following are just a few of the critical retirement game-changer strategies covered in this book:

• Why you should delay claiming your benefits—don’t forfeit $214,000 for all the wrong reasons.

• How to receive larger monthly checks with Cost of Living Adjustments (COLAs) and guaranteed annual 8% “raises.”

• How maximizing your benefit can provide your surviving spouse with a long-term security life-line.

• Optimal marital strategies including filing a restricted application.

• The financial synergy between Social Security and Roth IRA conversions—especially under the new laws.

Again, I would like to stress that we are committed to getting this information into the hands of as many people as possible. Don’t you, your friends and your acquaintances deserve to get the most from what they’ve got?

By the way, from among our testimonials, I am including this one from Larry Kotlikoff who has sold more books on Social Security than anyone on the planet.

“Read James Lange’s excellent book and learn how and when to take your Social Security and retirement accounts. Doing so will pay for itself hundreds if not thousands of times over.”

-Laurence Kotlikoff, Boston University Economist, Co-Author of Get What’s Yours: The Revised Secrets to Maxing Out Your Social Security

Since you have read this far, I am going to reward you with a few more particulars about optimizing your own Social Security benefits—naturally, you can find all the details in the book.

• If you apply at age 62, or as soon as you are eligible, your benefit amount starts lower and stays lower for the rest of your life.

• COLAs (cost of living adjustments) magnify the benefits of delayed claiming, as well as the detriments of early claiming.

• Delaying your application for benefits becomes more advantageous the longer that you live—and remember your long-term objective is to not run out of money.

• Since the surviving spouse will get the higher of the two benefits, it generally makes sense to plan for one benefit to be as high as possible. This can also be a game-changer for the surviving spouse.

• If you are married (or were married, but are now divorced), filing a Restricted Application for benefits could be a way for you to get more money from Social Security.

Here are the key points you need to remember about Roth IRA conversions:

• The 2017 tax reform reduced tax rates for many individuals. If you believe, as I do, that this reduction is temporary, then it may be beneficial to consider a series of Roth IRA conversions sooner than later.

• A series of Roth IRA conversions executed in conjunction with optimal Social Security strategies is a powerful combination.

All our clients and business friends who we think would benefit from this information are slated to receive a hard copy of this book. If for some reason you don’t get a copy, please call Alice at 412-521-2732, and request your copy of our new book.

If you know someone who you think would benefit from this information (friends, relatives, and colleagues), please feel free to ask us for additional copies to share. We will give you as many copies as you like, truly without a limit.

And, if you were to purchase the e-book from Amazon for 99 cents and write a review, that would provide enormous support for this project, and I would be truly grateful.

Thank you for your consideration.

Sudoku

See the answers to the Sudoku puzzle

Salmon Burgers with Pickled Radishes and Avocado

Serves: 4

Prep Time: 30 minutes

Cook Time: 6 minutes

Pickled radishes provide a zesty zing in this recipe. Enjoy their flavor while your body is flooded with cancer-fighting isothiocyanates and anti-oxidants like Vitamin C.

- 4 or 5 large red radishes, very thinly sliced

- 2 teaspoons fresh lemon or lime juice

- sea salt and freshly ground pepper

- 1 pound boneless, skinless wild salmon fillets, cut into 2-inch pieces

- 1/4 red onion, finely diced.

- 1/4 cup chopped fresh mixed herbs (such as parsley, mint, cilantro, and/or dill)

- 1/2 teaspoon minced fresh ginger

- 1/2 teaspoon ground turmeric

- 1/2 teaspoon ground cumin

- 1/2 teaspoon coriander

- 1/4 cup sesame seeds, preferably mixed black and white.

- 1 tablespoon extra-virgin olive oil

- 4 large lettuce leaves (green leaf or red leaf)

- 1 avocado, pitted, peeled, and sliced, for garnish

In a small bowl, toss the radishes with 1 teaspoon of the citrus juice and 1/2 teaspoon salt. Set aside.

Place the salmon pieces in a food processor and pulse about 8 times to coarsely chop. Don’t let the machine run and puree the fish; you want chickpea-size pieces.

Transfer the chopped fish to a bowl and fold in the onion and herbs. Add the remaining 1 teaspoon of citrus juice and 1/2 teaspoon salt, along with the ginger, turmeric, cumin, coriander, and a pinch of black pepper and mix well.

Spread the sesame seeds on a small plate. Wet your hands, and form the salmon into 4 equal-size patties. Press the sesame seeds onto both sides of each patty and set them on a plate.

Heat the olive oil in a large cast-iron skillet or sauté pan over high heat until shimmering. Gently place the salmon burgers in the pan and cook until browned on the outside and cooked through, about 3 minutes per side.

Place one lettuce leaf on each plate and place a burger on top. Garnish the burgers with the pickled radishes and sliced avocado and serve.