The Numbers Keep Pushing Retirees to Hold Off on Taking Those Social Security Checks Until 70

Tim Grant

Pittsburgh Post-Gazette

August 14, 2018

The retirement advice that James Lange has been offering people who have reached retirement age makes sense on paper, even if it’s a tough pill to actually swallow when it comes to planning their own strategy.

While the most common age that people choose to start collecting their monthly Social Security payments is 62, Mr. Lange believes — with few exceptions — anyone at risk of running out of money in their golden years should keep their hands out of the Social Security cookie jar until they reach the maximum filing age of 70.

“If you don’t have income from an investment portfolio; if you don’t have any pension; if you are basically broke and you are 62 years old, unless you want to be in poverty later in life, I don’t think you can afford to retire,” said Mr. Lange, a Squirrel Hill-based attorney and certified public accountant.

“A lot of people do not take kindly to that advice, especially if that was their plan,” he said. “They figure they can get by with Social Security at age 62, and they really don’t take into consideration how much it really costs to live.”

As the number of employer-provided pensions have declined for American workers and Social Security has become a more important contributor to retiree income, it’s little wonder millions of people struggle to decide when the time is right to collect those benefits.

Social Security payments are based on contributions that workers make into the system during their working years. They receive benefits when it is their time to retire. Contributions to Social Security come from Federal Insurance Contributions Act (FICA) taxes withheld from most paychecks.

Social Security will provide an enormous annual raise on the deferred benefits — about 7 percent to 8 percent — each year for those who wait until age 70 to start collecting payments. The downside of delaying the benefit is that those who die while waiting get nothing.

According to a 2017 report from the Center for Retirement Research at Boston College, more Americans begin collecting Social Security at age 62 than any other age.

Forty-two percent of men and 48 percent of women claim at 62, and well over half claim their benefits before reaching full retirement age of 66.

Just 1.4 percent of men and 2.5 percent of women waited until they were 70.

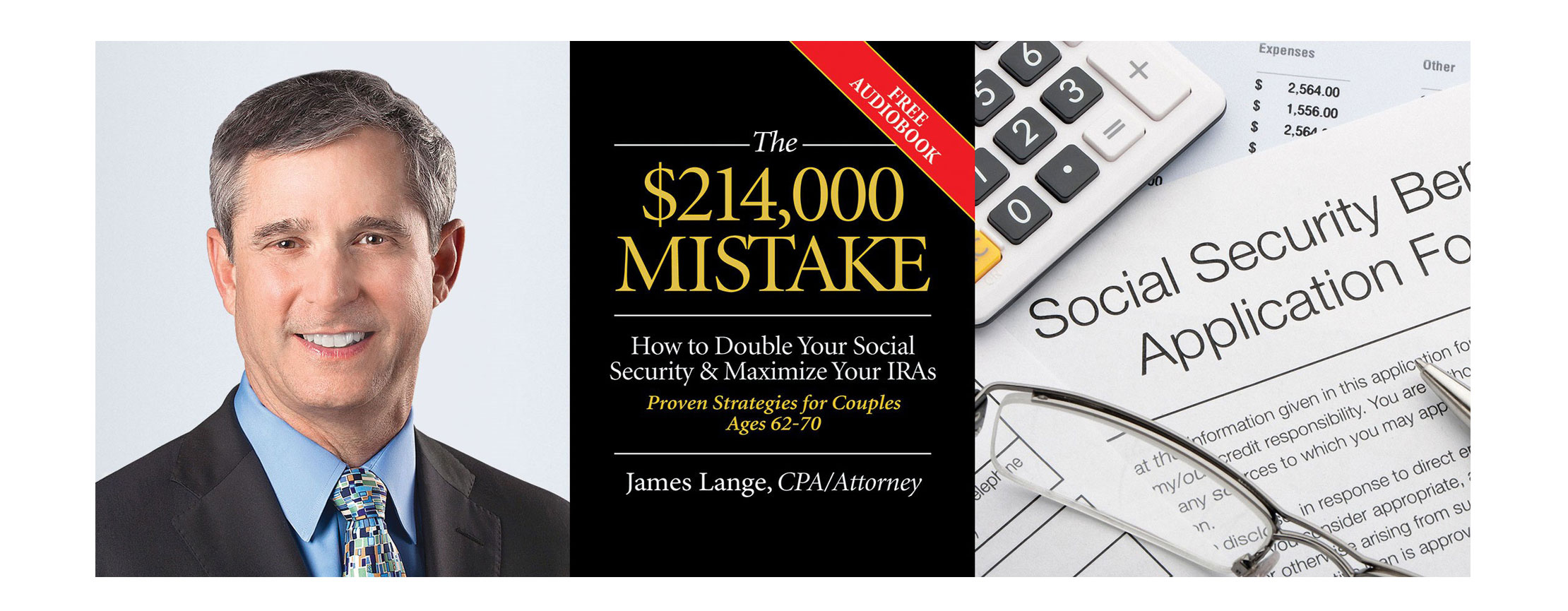

Mr. Lange, author of the book, “The $214,000 Mistake: How to Double Your Social Security & Maximize Your IRAs,” said the title of his book is based on his retirement income calculations.

He calculates that someone who waits until age 70 to file will break even by age 82 with the person who started collecting at age 62.

Assuming they both live to age 95, not only will the person who waited until age 70 be earning close to double to amount of monthly income as the earlier filer, he also will end up collecting $214,000 more over his lifetime than someone who starts collecting at age 62.

“Even if we make a wrong call and we die early, we’re dead. And dead people don’t have financial problems,” Mr. Lange said.

“That is a really important point. We should not fear dying for financial purposes. We should fear being old and broke. That’s the legitimate fear.”

Lawrence Kotlikoff, a professor of economics at Boston University, said people — in general — are leaving tons of money on the table by collecting Social Security benefits prior to age 70.

Retirees who start receiving benefits at age 66 will receive 100 percent of the monthly benefit they would be entitled to based on the amount of money they contributed to the Social Security system during their working years.

If they delay receiving benefits until after full retirement age, the monthly benefit continues to increase to a maximum 132 percent of the monthly benefit by age 70. The annual increase is due to having delayed getting benefits for 48 months past the full retirement age of 66.

“As the law stands, there is a big benefit to being patient,” Mr. Kotlikoff said.

He said there are reasons to choose a different game plan.

“If someone age 62 has a terminal illness, they may want to take their benefits early. There are several reasons why it’s not the case that everyone should be waiting until age 70. But I believe 70 percent of people should.”

Mr. Kotlikoff said his company, Economic Security Planning, Inc. in Boston, offers a program called MaximizeMySocialSecurity.com. It figures out a person’s lifetime Social Security benefits based on the retirement plan. It then recommends a strategy to maximize the benefit.

Eight decades after the Social Security benefit was signed into law, younger workers have reasons to doubt if the safety net will still be around to provide income for them when they retire.

The Board of Trustees of the Social Security Trust Funds issued the 2018 report earlier this year that said, for the first time since 1982, the total cost of Social Security retirement benefits paid in 2018 will exceed the total income generated by the fund, including tax revenue and investments.

As a result, it’s expected that the funds available to pay benefits to retirees and disabled workers will be depleted in 2034.

A depleted trust fund does not mean benefits will stop.

As long as there is a workforce paying into the fund, there will be money to pay benefits. However, those benefits are likely to shrink.

The full retirement age for people born after 1960 already has been increased to 67 — essentially a benefit cut for younger people. People born prior to 1960 can still collect full retirement benefits at age 66.

Mr. Kotlikoff said Congress also could raise taxes on the benefits but lawmakers are not likely to go too far in cutting Social Security benefits due to political pressure.

“It would be political suicide if Social Security benefits were cut to the point of middle Americans being forced to live on cat food,” he said. “We would default on our government debt before that.”

Go to the Pittsburgh Post-Gazette for the full article.

Copyright ©, Pittsburgh Post-Gazette, 2018, all rights reserved. Reprinted with permission.