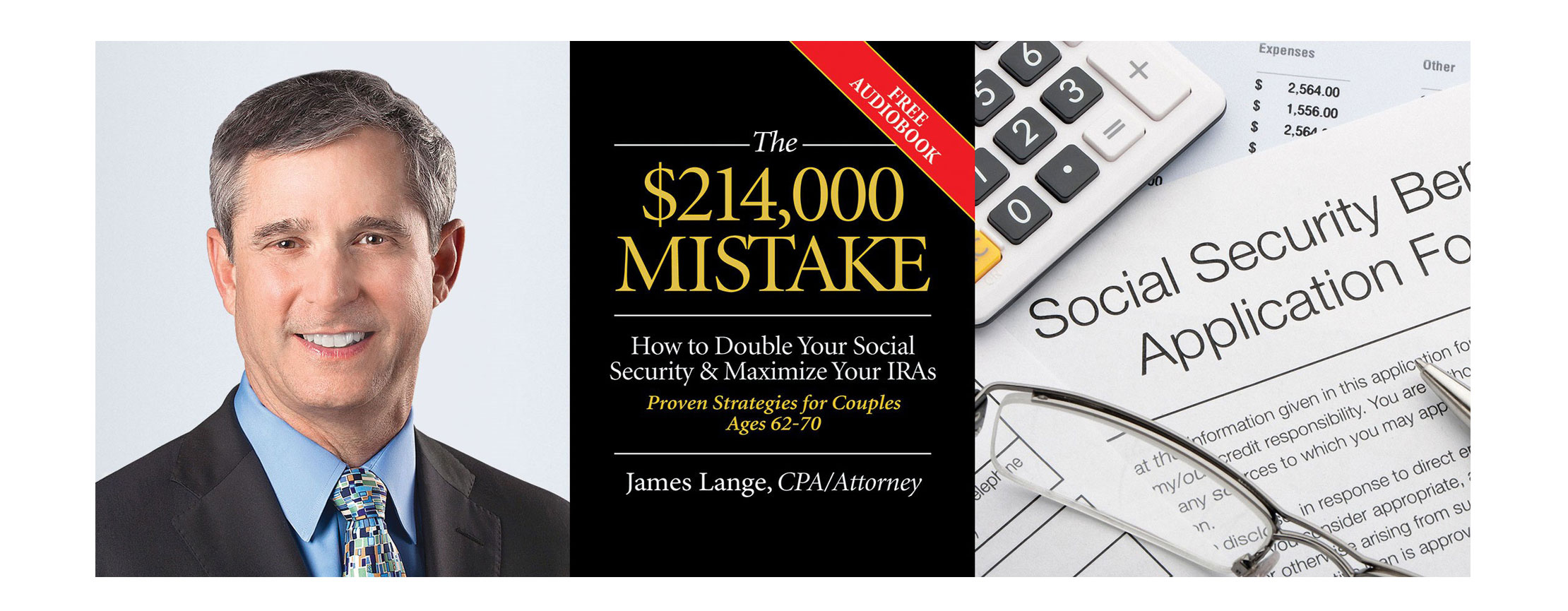

The $214,000 Mistake

How to Double Your Social Security and Maximize Your IRAs

Hit #1 in Three Categories on Amazon

Thank you! We could not have done it without you. Our newest book, The $214,000 Mistake, How to Double Your Social Security and Maximize Your IRAs, hit #1 in three categories on Amazon’s Kindle Store.

#1 Amazon Best-Sellers Rank:

- #1 in Kindle Short Reads>Two hours or more (65-100 pages)>Business & Money

- #1 in Kindle eBooks>Business & Money>Personal Finance>Retirement Planning

- #1 in Kindle eBooks>Business & Money>Taxation>Personal

We now have six best-selling books. We are proud of our accomplishments. But we have no intention of slacking off. Our publicity efforts are just beginning.

I put a lot of time and effort into creating what I consider valuable content that will help people live more prosperous and comfortable lives. This book has tremendous value for affluent readers…but the book has even more value for readers of moderate means.

Please, request copies to give away to your housekeeper, your favorite waitress, your gardener, anyone you know who you think might benefit from our recommendations. I want these best practices for getting the most out of your Social Security to be widely disseminated and acted upon. As one reviewer said:

“It is the most important numbers game most people will ever play.”

Don’t be shy. I genuinely love getting requests for our materials. We would be pleased to give you as many copies as you like. In addition, we would also be happy to give you as many copies of the DVD we recently produced, New Tax Laws Create Unintended Benefits for Savvy Retirement Plan Owners Who Act Quickly, or for that matter our flagship book, Retire Secure!, or our dedicated Roth IRA conversion book, The Roth Revolution.

And, just in case you missed it…Tim Grant from the Pittsburgh Post-Gazette came to my office, interviewed me for over two hours, and published a lengthy article. Here is the link, http://bit.ly/The214kMistakePG, if you want to go online and read the article. Below are short excerpts that I feel really capture the spirit of the book:

“Mr. Lange…calculates that someone who waits until age 70 to file will break even by age 82 with the person who started collecting at age 62.”

“Assuming they both live to age 95, not only will the person who waited until age 70 be earning close to double to amount of monthly income as the earlier filer, he also will end up collecting $214,000 more over his lifetime than someone who starts collecting at age 62.”

“Even if we make a wrong call and we die early, we’re dead. And dead people don’t have financial problems,” Mr. Lange said.

“That is a really important point. We should not fear dying for financial purposes. We should fear being old and broke. That’s the legitimate fear.”

Once again, I would like to thank you for making our book a #1 best-seller. Now we are going to do everything we can to get this information into the hands of people who can really use it.