Table of Contents

- Focusing on Family & Friends

- A Question of Balance

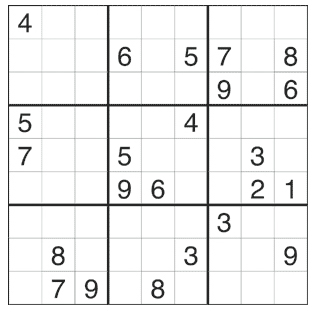

- Sudoku Puzzle

- Recipe: Taco Salad with Flank Steak

Focusing on Family & Friends!

by James Lange, CPA/Attorney

Red Rock Canyon, Las Vegas, Nevada

My newsletter that received the second highest response of all my newsletters had nothing to do with Roth IRAs, Stretch IRAs, index investing or estate planning. The title of the article was “The Best Way to Spend Your Money,” and it was about encouraging my readers to spend time and money on family vacations and family experiences.

Next to spending time with family, spending time with friends ranks right up there—and I don’t mean Facebook time.

I just got back from a week’s vacation with my best friends, and the importance of maintaining those relationships and going out of our way to get together cannot be overestimated.

For 30+ years, our gang from high school has been getting together for an annual “Boy’s Weekend.” We haven’t missed. We are all from Pittsburgh, and at first, the guys who were coming in from around the country would combine the trip with a visit to see their parents. As we aged and most of our parents passed, we continued the “Boy’s Weekend” but everyone stayed at my house.

Last year, one of us was sick during “Boy’s Weekend” so to make up for it, I suggested we have an extra one this year. I suggested we do it out west since the person who was sick lives in Houston. One of us said he had a tight schedule, but if we met in Las Vegas around the time he had to be there for business, he would make it.

I organized our week in Las Vegas. It was a bit like herding cats to get the six of us on the same page, but we rented a six-bedroom house, and everyone showed up. We played golf, went on hikes, played Frisbee golf, table tennis, and a lot of bridge, grilled steaks, and watched some of the NCAA basketball championships.

We hung out days and evenings, and ate 6 small pizzas from Mineos. You can buy half-baked pizzas from Mineos and have them shipped anywhere. I may have said “sugar, gluten and dairy all in one bite,” so I didn’t eat any. That meant there were 5 people who averaged 1.2 small pizzas per person during the trip (three lunches and snacks).

We also went to the Pinball Museum and played pinball (just twice). We visited the strip just to see a show. (Michael Jackson ONE by Cirque de Soleil which I would not recommend, even though it had its moments).

In other words, we spent time together much like we did when we were 15 (except Frisbee golf wasn’t invented and we didn’t grill steaks). And that is what keeps our bonds so strong. Friendships have to be cultivated and nurtured.

Did we get along perfectly? Absolutely. Unless you count the time when someone, who will remain nameless, didn’t get up until noon on the day we planned a desert hike. Mornings are the preferred time for hiking in the desert, they get very hot in the afternoon…or the fact that one of us took so much time for each golf shot you would have thought he was a chess grandmaster contemplating a tough position. I was constantly razzed for my “no sugar, no gluten, no dairy” diet every time we went out to eat, and for my clear preference for a restaurant that was quiet enough that we could hear each other talk.

But we overlooked those issues. Good friends turn a blind eye to each other foibles (mostly) because the camaraderie outweighs the irritations. Friendships are important¾I can’t stress that enough, and forgiving each other for small transgressions is essential.

That reminds me of an event in my mother’s life. She inadvertently forgot to include one of her oldest friends on the guest list for my wedding. The offense was never forgiven, and neither one ever picked up the phone to call a truce. My Mom and this ex-friend were both widows and both bridge players who could have enjoyed 25 years of each other’s company. What a loss. And when I see similar grudges holding sway over family members, it is even more tragic.

Les Brown, a motivational speaker and author, has some great observations about friendship, and I am sharing two that I have paraphrased.

“Regardless of how much you love your family, you will always need friends. Remember to go out with them occasionally, do activities with them, call them.”

“Jobs come and go. Illusions, desires, attraction, sex…weaken. But, true friends are always there, no matter how many miles separate you.”

I hope this article motivates you to pick up the phone and get together with some of your friends and maybe even plan a trip with them—herding cats is worth the effort.

Sincerely,

James Lange

P.S. In case you were wondering, the newsletter that received the most comments included my reflections on my mother’s life after she died. If you are interested, the link to it is: https://paytaxeslater.com/lange-report-may-2012.pdf

A Question of Balance.

Adapted From an Article by Jim Parker

Volatile financial markets make us feel anxious. While we can’t control the ups and downs of financial markets, we can control the risk in our portfolios through broad diversification, astute asset allocation, and regular rebalancing.

A good advisor will help clients manage their investments, and help them manage their emotions.

Bad advice panders to human emotions by exploiting greed and fear. It means pursuing high returns in the good times with little attention to risk and fleeing from risk in the bad times with no regard for return.

Good advice takes the emotions out of the equation and shows us what we can and can’t control. Having a detailed plan designed for our own risk appetites, lifestyle needs and long-term goals goes a long way to removing the anxiety from the investment process. During volatile markets, knowing that we have a diversified portfolio offers a sense of confidence that we can weather the storm.

Bad advice attempts to time entry and exit points. We are either in or out of the market. Getting that decision right, however, is notoriously difficult.

Good advice stresses the virtues of discipline and patience. But, that doesn’t mean blindly sticking to a buy-and-hold strategy.

Regular portfolio rebalancing gives investors control over the risk in their portfolios. After a run-up in riskier assets, they can legitimately sell down the stronger performing asset classes and rotate into the poorer performers to return their asset allocation and their risk tolerance to the original plan. But you must get the balance right. Just as a lack of rebalancing can throw a portfolio out of whack and undermine the targets of the original financial plan, too frequent rebalancing can be costly. These costs include fixed costs such as administrative charges and potential platform costs, alongside proportional costs such as buy/sell spreads, broker commissions and capital gains taxes.

So, the decision for advisors about when to rebalance often comes down to a question of balancing the benefits of keeping the portfolio within the investor’s risk profile against the costs of changing the asset allocation. This decision is as much an art as a science. As such, there is no one ‘right’ answer and the issue often can be dealt with by creating a ‘hold’ range within the portfolio. For example, a balanced portfolio with a target ratio of 60% equities might allow for a 5% buffer on either side of this target to achieve a practical equilibrium between the need to maintain the broad asset allocation while minimizing costs.

Aside from setting a non-trading region, another consideration in rebalancing is to use natural cash flows from regular contributions by the investor and cash distributions. That way the advisor reduces the need to sell securities, thus avoiding some of the costs of rebalancing.

Unlike the actual movement of markets, all these decisions are within the control of advisors and their clients. But what other factors can we control?

Surely, managing investments with the help of a good advisor will allay many of the anxieties that accompany long-term financial planning. But you can take a more comprehensive view of your finances and begin to understand the interrelationships among investment planning, tax planning, Social Security planning, and optimal estate planning. Many of us have after-tax investments, as well as retirement plan investments and the tax treatment for those investments differ. While your money manager may be doing a great job with keeping your asset allocation and risk profile in balance, he might not be thinking about the tax benefits you might get from a Roth IRA conversion of a traditional IRA. But the timing of that is something you can and should control. And what about how you would like to leave your assets to your heirs? Wouldn’t it make sense to have an estate plan that accounts for the different assets you hold and how to distribute them with an acute awareness of the tax implications for all parties? But, while many people have a tax accountant, an estate lawyer, and a money manager, how often do your advisors communicate with each other?

Providing communication among and between advisors is what we offer that is so different from other models, and we think it makes so much sense. If you throw yourself back to your high school math class and recall those pesky Venn diagrams, you can easily imagine the overlapping circles with a confluence in the center. That center is where you want to be with all of your advisors contributing their piece to the complicated puzzle of your financial well-being.

So, yes, markets are unpredictable. We can’t control the market. But, along with the critical importance of regular rebalancing to keep risk and profit in balance, we can also be proactive and coordinate the elements that make up our total financial profile.

Current clients who are only using some of our services should feel free to call the team member they are working with to inquire whether a more integrated and coordinated approach would be something they should consider.

Or, call Alice who will be happy to direct you to the appropriate person (412-521-2732). As fiduciary advisors, we pledge to work in your best interest. If you know someone who might value a consultation or content-driven information on best strategies for retirement and estate planning, we would be happy to send them a package of free information. Just give us a call.

Serves: 4

Prep. Time: 20 minutes

Cook Time: 15 minutes

- 1 bunch cilantro, including stems

- 1 scallion, thinly sliced

- ¼ cup extra-virgin olive oil

- 2 tablespoons Mayonnaise or VegenaiseÒ

- 2 teaspoons white vinegar

- Grated zest and juice of ½ lime

- Sea salt and freshly ground black pepper

- 1 (1 pound) grass-fed flank steak

- 1 teaspoon ground coriander

- ½ teaspoon cayenne pepper

- 2 large romaine lettuce hearts, halved lengthwise and thinly sliced

- 1 pint cherry or grape tomatoes, halved

- 4 medium bell peppers (any color), seeded and thinly sliced into rings

- 1 avocado, pitted, peeled, and thinly sliced

- 2 tablespoons toasted pepitas

- Lime wedges, for serving

In a blender, combine the cilantro, 1 teaspoon of the sliced scallions, the olive oil, mayonnaise, vinegar, lime zest and juice, 2 tablespoons of water, ½ teaspoon salt, and a pinch of black pepper. Puree until very smooth, 1 to 2 minutes, and set aside.

Heat a well-seasoned stovetop grill pan over medium-high heat. Season the steak with ¼ teaspoon salt and ½ teaspoon black pepper. When the pan is very hot, cook the steak until charred, turning once, 12 to 15 minutes for medium-rare (about 135°F). Transfer the steak to a cutting board and immediately sprinkle both sides with the coriander and cayenne. Let stand for 10 minutes, then cut into bite-size pieces.

In a large bowl, toss the romaine with one-third of the dressing and divide among four plates. Arrange the tomatoes, bell peppers, avocado, and steak on top and drizzle with the remaining dressing. Sprinkle the pepitas and remaining sliced scallion on top. Serve with lime wedges on the side.

©2015 The Blood Sugar Solution 10-Day Detox Diet Cookbook by Mark Hyman, MD