Table of Contents

- Oh No, Not Another Book!

- Should Stock Investors Worry About Changes in Interest Rates?

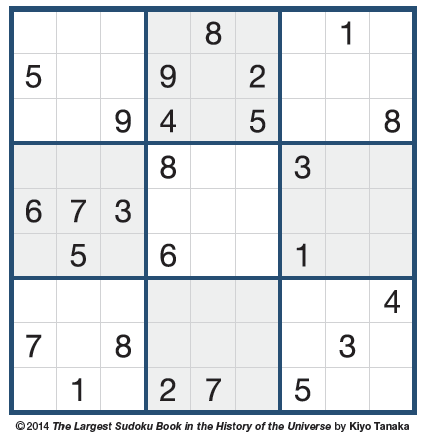

- Sudoku Puzzle

- Recipe: Saturday Night Sushi

Oh No, Not Another Book!

by James Lange, CPA/Attorney

“The 5 Greatest Tax-Saving Strategies for Protecting Your Family from the New Tax Law consolidates my last book, The Ultimate Retirement and Estate Plan for Your Million-Dollar IRA, with the addendum that I wrote after it was published. The book correctly predicted that the death of the stretch IRA is imminent.”

These are the exact words of a neighbor as he recognized that I was about to give him my most recent book. I thought I was doing him a favor. First, he and his wife are at the age and financial stage that the information in my books, if absorbed and appropriately applied, would be extremely beneficial to him and his family. Secondly, he is in financial services, and his clients could also benefit from the information. I had not realized, however, that rather than doing him a favor by giving him my latest book, he saw it as a burden.

On the one hand, I genuinely want my neighbor, and frankly, even his clients, to have the benefit of this information. I see his kids struggling and know they would be in much better shape if their Dad would actually read the book and take action on some of the recommendations.

On the other hand, as I am walking over to him with a new book in hand, he says “Oh no, not another book.” Perhaps I should have put the book in my pocket, but since he knew what I was about to do, it would have been awkward to quickly hide it away. I was, however, quite tempted to slide it discreetly in my pocket and try to avoid the situation altogether. After all, I know people far smarter than I who would never present an even slightly unwelcome message. I ended up giving him the book anyway while he smiled politely and said thank you.

Now, I have a dilemma. In the next two or three months, it will be even harder for me to know what to do in these situations because we are coming out with two new books. The first book, really a mini book, The 5 Greatest Tax-Saving Strategies for Protecting Your Family from the New Tax Law, is our most up-to-date analysis on what IRA and retirement plan owners should be doing to get the most out of their retirement plans and how to best provide for their families in light of the looming death of the stretch IRA. I can surmise enough about my neighbor to know this information is directly on point for him. He needs this book, and his family would benefit from it. And even though he concentrates on financial products in his business, I know his clients would benefit from him reading and absorbing the material.

The 5 Greatest Tax-Saving Strategies for Protecting Your Family from the New Tax Law consolidates my last book, The Ultimate Retirement and Estate Plan for Your Million-Dollar IRA, with the addendum that I wrote after it was published. The book correctly predicted that the death of the stretch IRA is imminent. Shortly after the book came out, the Senate Finance Committee voted 26-0 to kill the stretch IRA. I knew this was going to happen, of course, but I didn’t foresee one caveat the Committee included in their recommendations – which is why I wrote the addendum. Anyway, I combined what I consider to be the latest and greatest IRA and retirement plan strategies with the addendum, and have produced one integrated book. The 5 Greatest Tax-Saving Strategies for Protecting Your Family from the New Tax Law was written as if the law had already passed. That way, when the final legislation is passed, which I believe will happen when Congress produces the next major piece of tax reform, the book will be ready to go.

Since there are actions that should be taken now, making the information available to IRA owners as soon as possible is critical. The book also includes steps you should not take until after the law passes, but tells you why you must be prepared to act.

The second book I mentioned is an update on our book on The Little Black Book of Social Security Secrets. 2015 was a big year for changes in our Social Security program. A little known technique called Apply and Suspend that had allowed you to maximize your and your spouse’s Social Security benefits in a big way was coming to an end. But the Social Security Administration was allowing some people to take advantage of it before it disappeared. However, you had to be born in the right years and proactive about making an application before the deadline – otherwise, you lost the chance to do it forever.

I was anxious to keep my clients, readers, or even followers of my information from missing that critical deadline. So, characteristically, I did a bunch of workshops and articles, and I wrote the above mentioned book about Social Security, with an emphasis on this vanishing technique. I also included some Roth IRA conversion analysis in that book since I have found there is a synergy between getting the right Roth IRA conversion strategy and the right Social Security strategy.

Well, the deadline to sign up for the Apply and Suspend technique has long come and gone. Luckily, many of my clients and readers, including 10,000 email subscribers, took my advice in its various forms and were able to use the Apply and Suspend technique to their advantage. Many will be hundreds of thousands of dollars better off because they took action. As an aside, to this day, it is very gratifying when I meet new clients and they tell me that they benefited from the Apply and Suspend technique because of information that they received from our firm.

That Social Security book, as impactful as it was, literally became dated on April 30, 2016.

So what do I do with an outdated Social Security book? Even my flagship books, Retire Secure! and The Roth Revolution obviously become somewhat dated over time, but the fundamental principles still apply. Of course tax rates, contribution limits, and rules change, but the vast majority of the material in both of those books is still current. Since the Apply and Suspend technique was such a major part of the Social Security book and we heavily recommended that married couples use it, it was clear that I had to update it.

Of course updating a book always turns out to be one heck of a lot more work than you think it will be when you start the process. But, I will soon have two new books fresh off the presses.

Now, back to my dilemma…should I offer my friend copies of the books?

Well, regardless, I certainly will offer them to you! If you would like a copy of either book, please call 412-521-2732 or email our office at admin@paytaxeslater.com and request either book or both. We will send them to you as soon as they are available.

But you know me… I can’t resist sharing life-changing information. So don’t be surprised if a new book, or two, magically appears in your mailbox – even if you didn’t request them!

Should Stock Investors Worry About Changes in Interest Rates?

by Dimensional Fund Advisors

Research shows that, like stock prices, changes in interest rates and bond prices are largely unpredictable. It follows that an investment strategy based upon attempting to exploit these sorts of changes isn’t likely to be a fruitful endeavor. Despite the unpredictable nature of interest rate changes, investors may still be curious about what might happen to stocks if interest rates go up.

Unlike bond prices, which tend to go down when yields go up, stock prices might rise or fall with changes in interest rates. For stocks, it can go either way because a stock’s price depends on both future cash flows to investors and the discount rate they apply to those expected cash flows. When interest rates rise, the discount rate may increase, which in turn could cause the price of the stock to fall. However, it is also possible that when interest rates change, expectations about future cash flows expected from holding a stock also change. So, if theory doesn’t tell us what the overall effect should be, the next question is what does the data say?

Recent research performed by Dimensional Fund Advisors helps provide insight into this question. The research examines the correlation between monthly US stock returns and changes in interest rates. While there is a lot of noise in stock returns and no clear pattern, not much of that variation appears to be related to changes in the effective federal funds rate.

For example, in months when the federal funds rate rose, stock returns were as low as –15.56% and as high as 14.27%. In months when rates fell, returns ranged from –22.41% to 16.52%. Given that there are many other interest rates besides just the federal funds rate, Dai also examined longer-term interest rates and found similar results.

So when rates go up, do stock prices go down? The answer is yes, but only about 40% of the time. In the remaining 60% of months, stock returns were positive. This split between positive and negative returns was about the same when examining all months, not just those in which rates went up. In other words, there is not a clear link between stock returns and interest rate changes.

Conclusion

There’s no evidence that investors can reliably predict changes in interest rates. Even with perfect knowledge of what will happen with future interest rate changes, this information provides little guidance about subsequent stock returns. Instead, staying invested and avoiding the temptation to make changes based on short-term predictions may increase the likelihood of consistently capturing what the stock market has to offer.

Resources:

Fama 1976, Fama 1984, Fama and Bliss 1987, Campbell and Shiller 1991, and Duffee 2002.

Wei Dai, “Interest Rates and Equity Returns” (Dimensional Fund Advisors, April 2017).

From The Autoimmune Solution by Dr. Amy Myers.

Serves: 2

- 6 sheets of nori (dried seaweed wrap, available at many local grocery stores and the Food Co-op)

- 1 large avocado, pulp removed and mashed

- 6 oz. of smoked salmon

- 1 mango, peeled and thinly sliced

- 1 cucumber, (peeled if the skin is tough) thinly sliced

- 3 spears of steamed asparagus, sliced in half lengthwise (optional)

- 3 scallions, sliced in half lengthwise (optional)

Place a nori sheet on a sushi mat (a woven bamboo mat) or cutting board. With the back of a spoon, spread the avocado very thinly over the entire surface of the nori sheet. Place a one-ounce strip of smoked salmon along the bottom edge of the avocado-covered nori sheet. Above the salmon, place a couple of thin slices of mango. Then, place slices of cucumber above the mango. If desired, place a half-spear of asparagus and a length of the scallions above the cucumber.

Starting from the bottom, fold the nori over all the ingredients, and roll tightly until you have a compact nori roll. With a very sharp knife, cut the roll into about 8 pieces. Set them aside and repeat the process with the remaining ingredients to create more rolls.

Serve!

Or…you can follow Jim’s lead and walk into the New Dumpling & Sushi House on Murray Avenue across from his office and order the sashimi (no rice) with gluten free soy sauce! Whichever choice, it will be delicious.