Table of Contents

- Aloha from Hawaii!

- It’s not Rocket Science

- Crossword

- Recipe: Strawberry, Almond and Coconut Smoothie

Wow, invited to a destination wedding in Hawaii! Only I don’t love long flights and from everything I heard, the beaches aren’t really nicer than the beaches of Florida. But, how many times does your brother get married (in his case four, but whose counting)? Plus, I always say the best way to spend your time and money is on experiences with family and friends. So, I was all in. The wedding was to take place in Maui, and since I don’t like to hop all over the place on vacation, I decided to settle in for two weeks.

But, then I got some great news that would cut my vacation a little bit short. I was invited to give a speech at a prestigious estate planning conference in San Diego. The organizers recognized that the peer-reviewed articles I wrote for Trusts & Estates magazine on the “Death of the Stretch IRA” were important, and so they gave me a two-hour time slot.

This is a big deal and frankly, the timing worked out perfectly. It was a great opportunity and literally on my way home. For the first two days of the conference I was a “student” with some of the finest estate-planning professionals in the country.

Then, on the third day, I gave my talk on the pending “Death of the Stretch IRA” and how you can protect your family’s nest egg from Uncle Sam. And, as you can imagine…I threw in analysis of Roth IRA conversions and Lange’s Cascading Beneficiary Plan as I believe both techniques are valuable whether the laws on the stretch change or not. The fact that the organizers reimbursed all San Diego expenses is a bonus! The talk was very well received, in fact, I was immediately asked back to present next year.

Plus, Maui is wonderful, and I would recommend it highly. I rented a bicycle and started my trip on the eastern part of Maui, which is the rainier, but lusher side of the island. The beauty of the island blew me away. The road to Hana is one of the most spectacular roads I have driven or bicycled—one fabulous vista after another. One morning in particular, after an all-night rain, the waterfalls were spectacular. On my bike, I had the flexibility to stop and take pictures anywhere I wanted, on short walks to a waterfall, a beach, a lava tube, or whatever seemed of interest. You might be slogging your way up a hill and then, boom, a fabulous vista with waterfalls on one side of the road and the Pacific Ocean on the other. If you are interested in my amateur photography of the Hana Highway, with no fancy camera except for a new iPhone, please see www.paytaxeslater.com/picturesfrommaui

My brother’s wedding was on a beach that was picture-postcard perfect. The beautiful outside ceremony was followed by drinks, hors d’oeuvres and a wonderful dinner. And luckily, the weather cooperated perfectly.

It was great spending time with my brother and new sister in- law, Marie. Though they were busy with the wedding, we still managed to spend a lot of time together hanging out and hiking. My brother, Jon, is a college professor in a phased retirement. He wants to be with his wife, Marie, all the time. That, according to the Urban Dictionary, is one of the definitions of true love.

I hope this letter finds you well and planning your next experience with your family and friends.

It’s not Rocket Science

By Jim Parker

When the media raises the subject of beating the market through astute stock picking, the name Warren Buffett is usually cited. But what does this legendary investor actually say about the smart way to invest?

In fact, he has been quoted as saying, “Most investors, both institutional and individual, will find the best way to own common stocks is through an index fund that charges minimal fees. Those following this path are sure to beat the net results (after fees and expenses) delivered by the great majority of investment professionals.”

Buffett is considered to have such a track record of picking stock winners and avoiding losers that his annual letter to shareholders in his Berkshire Hathaway conglomerate is treated as a major event by the financial media.1

What does he think about the Federal Reserve taper? What could be the implications for emerging markets of a Russian military advance into Ukraine? What does an economic slowdown in China mean for developed markets?

Buffett has a neat way of parrying these questions from journalists and analysts. Instead of offering instant opinions about the crisis of the day, he recounts in one of his recent annual letters a folksy story about a farm he has owned for nearly 30 years.2

Has he laid awake at night worrying about fluctuations in the farm’s market price? No, says Buffett, he has focused on its long-term value. And he counsels investors to take the same sanguine, relaxed approach to liquid investments such as shares as they do to the value of their family home.

“Those people who can sit quietly for decades when they own a farm or apartment house too often become frenetic when they are exposed to a stream of stock quotations,” Buffett said. “For these investors, liquidity is transformed from the unqualified benefit it should be, to a curse.”

While many individuals seek to ape Buffett in analyzing individual companies in minute detail in the hope of finding a bargain, he advocates that the right approach for most people is to let the market do all the work and worrying for them.

“The goal of the non-professional should not be to pick winners,” Buffett wrote in his annual letter. “The ‘know-nothing’ investor who both diversifies and keeps his costs minimal is virtually certain to get satisfactory results.”

As to all the predictions out there about interest rates, emerging markets, or geopolitics, there will always be a range of opinions, he says. But we are under no obligation to listen to the media commentators, however distracting they may be.

“Owners of stocks…too often let the capricious and irrational behavior of their fellow owners cause them to behave irrationally,” Buffett says. “Because there is so much chatter about markets, the economy, interest rates, price behavior of stocks, etc., some investors believe it is important to listen to pundits—and, worse yet, important to consider acting upon their comments.”

The Buffett prescription isn’t rocket science, as one might expect from an unassuming, plainspoken octogenarian from Nebraska. He rightly points out that an advanced intellect and success in long-term investment don’t necessarily go together.

“You don’t need to be a rocket scientist,” he has said. “Investing is not a game where the guy with the 160 IQ beats the guy with 130 IQ.” 3

—-

1.“Buffet Warns of Liquidity Curse,” Bloomberg, Feb 25, 2014.

2. Berkshire Hathaway Inc. shareholder letter, 2013, www.berkshirehathaway.com/letters/2013ltr.pdf.

3.“The wit and wisdom of Warren Buffett,” Fortune, November 19, 2012, management.fortune.cnn.com/2012/11/19/warren-buffett-wit-wisdom/.

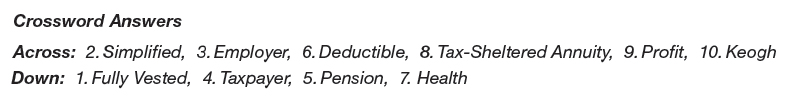

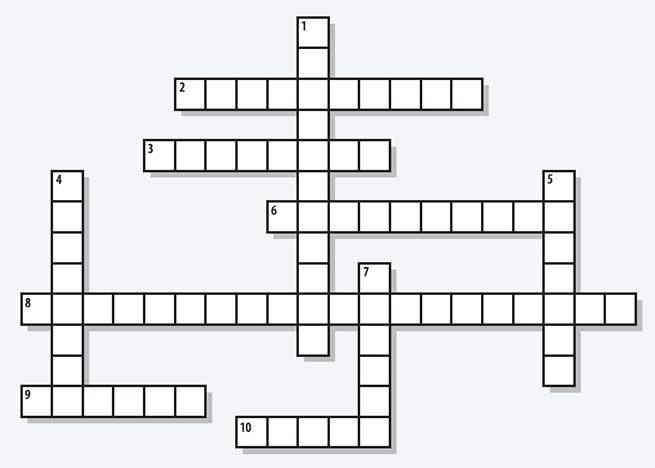

Across:

2. SEP stands for _______ Employee Pension.

3. Some people are lucky enough to have an _______-match their 401(k).

6. All or a portion of your Traditional IRA contributions may be tax-_______.

8. A 403(b) is a retirement plan offered by certain tax-exempt

organizations. It is also called a TSA which stands for ______________.

9. A _______-sharing plan is a retirement plan that gives employees a share in the company’s financial gains.

10. A tax-deferred pension plan available to self-employed individuals or unincorporated businesses.

Down:

1. Refers to an employee’s right to the full amount of some type of benefit. One example is when an employee becomes the full owner of the money

invested in his 401(k) by his or her employer.

4. Roth IRAs were first established by the _______ Relief Act of 1997.

5. Retirement income from an investment fund to which that person or their employer has contributed during their working life.

7. An HSA or _______ Savings Account allows those with a high-deductible medical insurance plan to save money tax-free for use on medical expenses.

>> Answer key located at the end of this page.

Strawberry, Almond & Coconut Smoothie

Ingredients:

- 1 or 2 large ice cubes

- 2 tablespoons unsalted almond butter

- ¾ cup light unsweetened coconut milk

- ½ cup unsweetened almond milk

- ½ cup frozen organic strawberries

- 2 teaspoons chia seeds

Directions:

When selecting berries, especially strawberries, choose organic to prevent overloading your system with toxic residue from fertilizers and pesticides. You can likely find frozen organic berries in your local supermarket yearround; they work great in your morning shake.

Combine all of the ingredients in a blender and blend on high until smooth, 1 to 2 minutes. If the smoothie is too thick, add a little water and blend again until it reaches the desired consistency. Drink immediately.

Preparation Time: 5 minutes • Serving Size: 1

Recipe courtesy of Dr. Mark Hyman’s book, The 10-Day Detox Diet Cookbook.