Table of Contents

- A Personal Look at: Stem Cell Therapy for Autoimmune Disease

- Lessons for the Next Crisis – The 10-Year Anniversary is Upon Us

- SOS: Save our Stretch! Stop the Sneaky Tax!

A Personal Look at: Stem Cell Therapy for Autoimmune Disease

by James Lange, CPA/Attorney

I’ve had psoriasis most of my life. One of the fears that psoriasis patients have is that it will develop into psoriatic arthritis. Thirty years ago, I received that diagnosis. Psoriatic arthritis presents much like rheumatoid arthritis which can be both painful and debilitating.

Initially, I tried a variety of alternative treatments. Nothing seemed to work, and I got to the point where it was extremely painful just to walk one city block. I finally gave in and consulted with a rheumatologist who recommended an autoimmune suppressant drug called Enbrel which targets inflammatory responses. Within several weeks, I was doing much better, and, as most of you know, I bike and hike long distances regularly, so clearly it has been effective for me. But, I still have some lingering issues. I’ve had problems with fluid build-up in my knees which requires draining, and inflammation in my shoulders, which so far, I am managing with physical therapy. As I have mentioned before, I think my strict diet of no sugar, no dairy, no gluten (no fun!) has significantly improved my health. I’m a big believer in Amy Myers’ book, The Autoimmune Solution.

But recently I’ve noticed a decline in my comfort level. While I am still going on 10-mile hikes, I am experiencing joint pain in my feet and shoulders. I switched to Humira, a drug similar to Enbrel, but that didn’t seem to help. Currently, I am taking Cosentyx, a newer drug, which I think works better for me than Humira. The truth is, without conventional medicine, I would be in big trouble.

I continue to seek out complementary therapies, as I have with diet and supplements. But I’m still in pain. Stem cell therapy is the latest medical advancement that has captured my attention.

There are many types of stem cell therapies available for different conditions and problems. One type of stem cell therapy that can be used for sports injuries, or problems associated with one spot, is an injection of stem cells retrieved from their own bone marrow directly into the site of the injury. Depending on your situation, you might be a good candidate for the procedure. But as it is still in the developmental stages, there are few insurance companies that will cover the treatment.

Another source of stem cells for therapy comes from human umbilical cord tissue—human umbilical cord-mesenchymal stem cells, to be precise. Apparently, these stem cells from the umbilical cord are known to help reduce inflammation and modulate the immune system. But there are significant legal restrictions on this type of therapy in the United States. There are a number of studies going on internationally and many of them seem promising. However, a review of the literature would probably lead one to believe that while it is a promising therapy, it is not quite ready for the treatment of autoimmune diseases. That was precisely the comment from one of my clients, a biology professor at the University of Pittsburgh, and another stem cell expert who wrote a book on the promise of stem cells.

But then I learned about a clinic in Panama called the Stem Cell Institute. The clinic is located in Panama because the FDA has not approved the use of this treatment for autoimmune diseases. It was very difficult to find objective information on the Institute. One company, BioInformant, found at www.bioionformant.com is a market research firm specializing in the stem cell industry that publishes unbiased advice. They have no financial relationships with stem cell treatment centers. I had a paid conference with their President/CEO, Cade Hildreth.

Based on resources I accessed through BioInformant, I believe the treatment I had in mind is appropriate for my condition and the clinic in Panama would be an appropriate facility to conduct my procedure. I learned through my research that mesenchymal stem cells (MSCs) from human umbilical cords pose a very limited risk of rejection—apparently, the body’s immune system does not see the cell as “foreign”—and that there are few risks to the procedure.

Of course, there is always going to be some risk when you have an IV transfusion. For instance, some people experience flu-like symptoms. However, I confirmed through my own research, discussions with third-party experts, and information from the Stem Cell Institute that there is limited downside risk in terms of actual harm that might come from the procedure.

The biggest risk is that it wouldn’t work, and I would be wasting a lot of time and money. But, the physician at the Panama clinic said roughly 90% of the people were helped significantly with this type of stem cell therapy if they had an autoimmune disease like rheumatoid arthritis or psoriatic arthritis.

There is another complication in my case. The clinic doesn’t really understand how to work with patients who are doing fairly well on an autoimmune suppressant drug, like I am. When should you stop taking the drug before the treatment? How long after the treatment should you resume taking a drug, if at all? They recommended consulting with my rheumatologist, but how could he know something like that? When I did consult with him about whether he thought it might be a reasonable therapeutic treatment he surprised me by not saying no. He was cautious, but indicated that there were potential benefits. Another downside is that this is not a one-time shot where you get treated, the stem cells multiply, and you are fine for the rest your life. The physician that I spoke with at the stem cell clinic said that while many of her patients have had very good results, many of them have chosen to return a year later for a subsequent treatment. One of the reasons they come back is because the improvement tends to slow down or even reverse. But, patients who return for a second treatment have better outcomes than they did at the peak of the results of the first treatment.

In any event, it is an exciting area of research that is receiving a lot of attention. Usually, I am fairly decisive when confronted with options and choices. However occasionally, like in this case, I go into fact finding mode and keep looking for more data that I can trust so I can try to make a well-informed decision.

Regardless, I believe we are headed for an unbelievably exciting time in the treatment of disease. Some people wistfully look back and talk about the good old days. I am grateful to be alive at the best time in history, notwithstanding many of our challenges.

The 10-year anniversary is upon us. In early October 2007, the S&P 500 Index hit what was its highest point before losing more than half its value over the next year and a half during the global financial crisis.

Over the coming weeks and months, as other anniversaries of major crisis-related events pass (for example, 10 years since the bank run on Northern Rock or 10 years since the collapse of Lehman Brothers), there will likely be a steady stream of retrospectives on what happened as well as opinions on how the environment today may be similar or different from the period leading up to the crisis. It is difficult to draw useful conclusions based on such observations; financial markets have a habit of behaving unpredictably in the short run. There are, however, important lessons that investors might be well-served to remember: Capital markets have rewarded investors over the long term, and having an investment approach you can stick with—especially during tough times—may better prepare you for the next crisis and its aftermath.

BENEFITS OF HINDSIGHT

In 2008, the stock market dropped in value by almost half. Being a decade removed from the crisis may make it easier to take the past in stride. The eventual rebound and subsequent years of double-digit gains have also likely helped in this regard. While the events of the crisis were unfolding, however, a future of this sort looked anything but certain. Headlines such as “Worst Crisis Since ’30s, With No End Yet in Sight,”[1] “Markets in Disarray as Lending Locks Up,”[2] and “For Stocks, Worst Single-Day Drop in Two Decades”[3] were common front page news. Reading the news, opening up quarterly statements, or going online to check an account balance were for many, stomach-churning experiences.

While being an investor today (or during any period, for that matter), is by no means a worry-free experience, the feelings of panic and dread felt by many during the financial crisis were distinctly acute. Many investors reacted emotionally to these developments. In the heat of the moment, some decided it was more than they could stomach, so they sold out of stocks. On the other hand, many who were able to stay the course and stick to their approach recovered from the crisis and benefited from the subsequent rebound in markets.

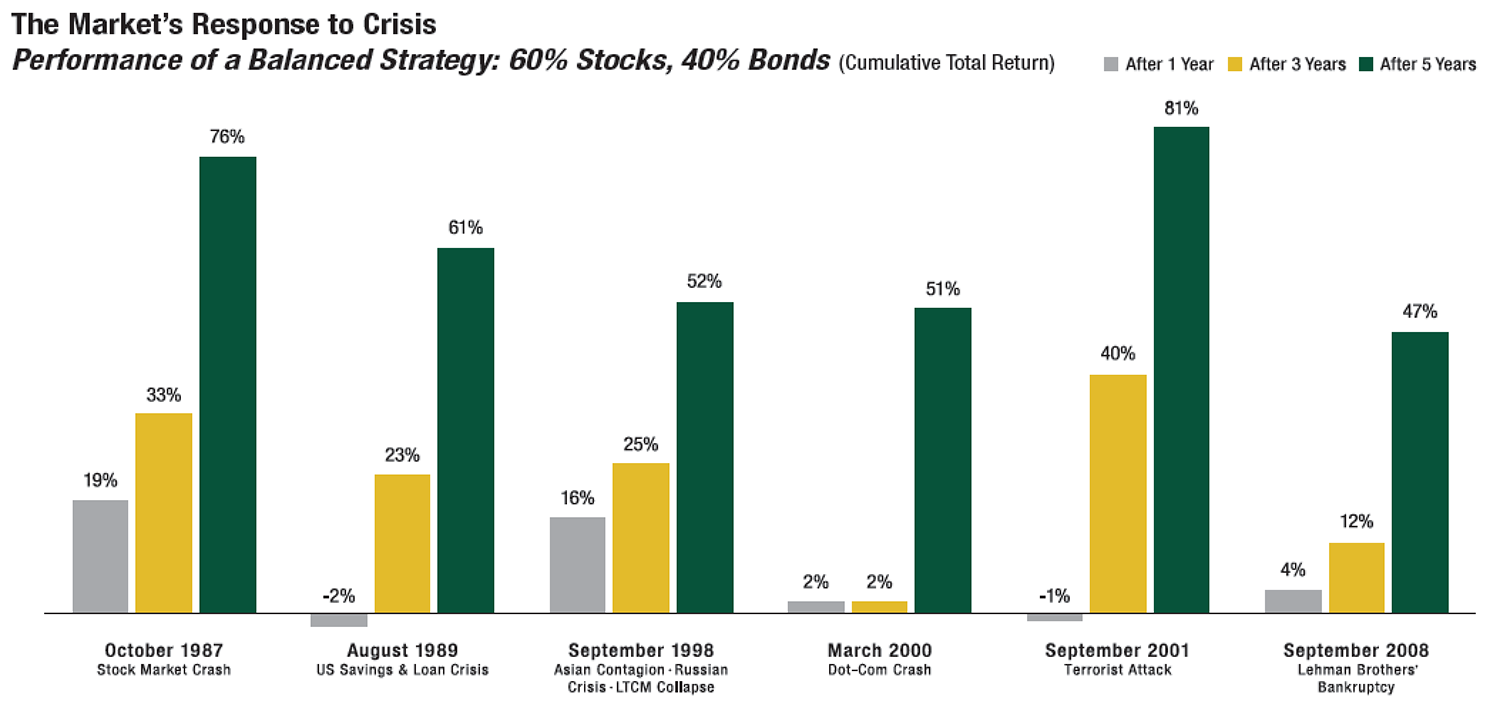

It is important to remember that this crisis and the subsequent recovery in financial markets was not the first time in history that periods of substantial volatility have occurred. The following table helps illustrate this point. It shows the performance of a balanced investment strategy following several crises, including the bankruptcy of Lehman Brothers in September of 2008, which took place in the middle of the financial crisis. Each event is labeled with the month and year that it occurred or peaked.

CHART INFORMATION

In US dollars. Represents cumulative total returns of a balanced strategy invested on the first day of the following calendar month of the event noted. Balanced Strategy: 12% S&P 500 Index,12% Dimensional US Large Cap Value Index, 6% Dow Jones US Select REIT Index, 6% Dimensional International Marketwide Value Index, 6% Dimensional US Small Cap Index, 6% Dimensional US Small Cap Value Index, 3% Dimensional International Small Cap Index, 3% Dimensional International Small Cap Value Index, 2.4% Dimensional Emerging Markets Small Index, 1.8% Dimensional Emerging Markets Value Index, 1.8% Dimensional Emerging Markets Index, 10% Bloomberg Barclays Treasury Bond Index 1-5 Years, 10% Citigroup World Government Bond Index 1-5 Years (hedged), 10% Citigroup World Government Bond Index 1-3 Years (hedged), 10% BofA Merrill Lynch 1-Year US Treasury Note Index. The S&P data are provided by Standard & Poor’s Index Services Group. The Merrill Lynch Indices are used with permission; copyright 2017 Merrill Lynch, Pierce, Fenner & Smith Incorporated; all rights reserved. Citigroup Indices used with permission, © 2017 by Citigroup. Bloomberg Barclays data provided by Bloomberg. For illustrative purposes only. Dimensional indices use CRSP and Compustat data. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio. Past performance is not a guarantee of future results. Not to be construed as investment advice. Rebalanced monthly. Returns of model portfolios are based on back-tested model allocation mixes designed with the benefit of hindsight and do not represent actual investment performance. See Appendix at us.dimensional.com for additional information.

Although a globally diversified balanced investment strategy invested at the time of each event would have suffered losses immediately following most of these events, financial markets did recover, as can be seen by the three- and five-year cumulative returns shown in the exhibit. In advance of such periods of discomfort, having a long-term perspective, appropriate diversification, and an asset allocation that aligns with their risk tolerance and goals can help investors remain disciplined enough to ride out the storm. A financial advisor can play a critical role in helping to work through these issues and in counseling investors when things look their darkest.

Conclusion

In the mind of some investors, there is always a “crisis of the day” or potential major event looming that could mean the beginning of the next drop in markets. As we know, predicting future events correctly, or how the market will react to future events, is a difficult exercise. It is important to understand, however, that market volatility is a part of investing. To enjoy the benefit of higher potential returns, investors must be willing to accept increased uncertainty. A key part of a good long-term investment experience is being able to stay with your investment philosophy, even during tough times. A well‑thought‑out, transparent investment approach can help people be better prepared to face uncertainty and may improve their ability to stick with their plan and ultimately capture the long-term returns of capital markets.

There is no guarantee investment strategies will be successful. All investing involves risks including possible loss of principal. Diversification does not eliminate the risk of market loss.

[1]. wsj.com/articles/SB122169431617549947.

[2]. washingtonpost.com/wp-dyn/content/article/2008/09/17/AR2008091700707.html.

[3]. nytimes.com/2008/09/30/business/30markets.html.

SOS: Save our Stretch! Stop the Sneaky Tax!

Sign our Petition. Join the Facebook Group.

Go to http://stopthesneakytax.com to add your name to the list of people who are unhappy with this proposed new law and send an email to your Congressmen asking them to say No! to the sneaky tax.

For a limited time, joining the Facebook group at www.saveourstretch.com will entitle you to a free Advance Reading Copy of Jim’s newest book – The 5 Greatest Tax-Saving Strategies for Protecting Your Family from the New Tax Law.