Table of Contents

Wealth Preservation Solutions for Million-Dollar IRA Owners:

The Best Estate Plan, Roth IRA Conversions, Investment Strategies, & More

Tuesday & Wednesday, March 8 & 9, 2022

Register to Attend 1, 2, 3, or all 4 FREE Webinars at:

https://PayTaxesLater.com/Webinars

“Investment and tax ‘experts’ have always been active in offering their services, but their advice has often been designed to maximize their fees rather than to optimize results for their clients. Conflicted and misleading information existed long before the Internet, but social media has vastly increased the scale, severity, and impact of misinformation as digital platforms have extended their reach and become more central to our lives. As a retired college professor, let me assure you that if you follow the sound advice provided by Jim Lange, you will be sure to know that you are taking the right financial steps to increase your and your family’s financial security.”*

– Burton G. Malkiel

Professor of Economics Emeritus, Princeton University

Session 1: Tuesday, March 8th (10 am-Noon Eastern)

How IRA and Retirement Plan Owners Can Protect Themselves and Their Families from Massive Taxation

- Strategic planning recommendations to defend retirement plan owners and their families from massive taxation in the post-SECURE Act era.

- Gifting strategies to maximize family wealth.

- A quantitative analysis of combining multiple long-term financial planning strategies.

- How retirement plan owners should respond to the sunset provisions in the Tax Cuts and Jobs Act of 2017.

- Which assets you should spend first and which assets you should spend last during retirement? Please note the answer has changed since the SECURE Act.

If you have significant assets in your IRAs and other retirement plan accounts, you will learn Jim’s practical strategic solutions to the disastrous consequences of the SECURE Act’s accelerated taxation formula…solutions that hundreds of our clients have already implemented to defend their wealth and their financial legacies.

Retirement plans have specialized distribution rules both while you are alive and after you are gone. Understanding these rules is critical for effective planning.

This session will cover our strategic recommendations for what you should be doing while you’re working and at retirement, though the emphasis will be on those retiring within the next several years or already retired. Please note this session will not cover Roth IRA conversions as there is an entire session on Roth IRA conversions at 1 pm.

Session 2: Tuesday, March 8th (1 pm – 3 pm Eastern)

Roth IRA Conversions: Pay Taxes Once and Never Again

“I have not seen a better discussion of the advantages and potential pitfalls of converting your IRA into a Roth.”*

– Burton G. Malkiel

Professor of Economics Emeritus, Princeton University

- The peer-reviewed math of Roth IRA conversions.

- Effects of the SECURE Act on your retirement plans and how Roth IRA conversions defend against the SECURE Act.

- Optimal timing for Roth IRA conversions.

- Why it may make sense to pay for a Roth IRA conversion with a home equity loan.

- The one single financial decision that can get you bigger Social Security checks.

- The implications of the back-door Roth and what to do about it in 2022.

The passage of the SECURE Act and inevitable tax rate increases make Roth IRA conversions more important than ever to protect your and your family’s financial security.

Roth IRA conversions are a critical tool to cut taxes for you and your family. Not only do many economists feel that tax rate increases are inevitable, even if no additional tax legislation is passed, but the sunset provisions of the Tax Cuts and Jobs Act of 2017 will also dramatically increase income taxes in 2026.

The benefits of a series of well-timed Roth IRA conversions can mean tens, or hundreds of thousands, of dollars difference to retirement plan owners and their families. This isn’t a matter of opinion. It is a matter of math based on our article that was published in The Tax Adviser, the peer-reviewed journal of the American Institute of CPAs.

Making a series of Roth IRA conversions over a period of years, perhaps between now and 2026, can be an incredibly advantageous strategy for many retirement plan owners. In addition, Roth IRA conversions can reduce estate and inheritance taxes.

We will also examine the synergy between timing when you begin taking Social Security and making Roth conversions.

We will also explore other methods of transferring money from the tax-deferred world (like IRAs) to the tax-free world (like Roth IRAs). We get a lot of questions on the back-door Roth IRA contributions and conversions. Though we fear the elimination of this wonderful tax strategy, there still may be an opportunity to save a significant amount of taxes for you and your family, and we will cover how this works and what action, if any, you should take now.

Session 3: Wednesday, March 9th (10 am-Noon Eastern)

The Best Estate Plan for IRA and Retirement Plan Owners including Trust Planning

“Guidance is given on charitable giving, family gifting, life insurance, and estate planning strategies. The practical and tested advice that is offered will serve college professors and other educators extremely well. No one does it better and explains it more clearly than Jim Lange.”*

– Burton G. Malkiel

Professor of Economics Emeritus, Princeton University

- How do required minimum distributions of inherited IRAs and retirement plans work under the old law versus the enacted SECURE Act?

- How will this change impact your family and your legacy?

- How to ensure financial security for the surviving spouse, and potentially save hundreds of thousands to pass on to your heirs after the SECURE Act.

- The details of the best estate plan for married retirement plan owners known as Lange’s Cascading Beneficiary Plan.

Trusts:

- Should your heirs inherit your IRA and other retirement assets directly, or would naming a trust to be wiser?

- Charitable trusts as beneficiaries of your IRAs and retirement assets.

- Do you need the ever more popular “I don’t want my no-good son-in-law to inherit one red cent of my money trust?”

We will delve into the nitty-gritty of what happens to your IRA and retirement plan at death under the SECURE Act. We will explore an estate planning system based on a series of disclaimers. Disclaimers allow enormous flexibility for planning for your estate, and we believe should be used routinely, but in practice rarely is.

You will be able to see the benefits of some of our strategies and decide if it is appropriate for you. The tax hit on your IRAs and retirement plans will be unprecedented unless you take aggressive action. This workshop will concentrate on what you could do to preserve your estate, especially around wills, trusts, and beneficiary designations of your IRAs and other retirement plans.

We will combine our newest thinking with some of our classic strategies for protecting your children or grandchildren from themselves, but also creditors, possibly including their spouse.

Please note that most existing trusts have language that could prove devastating to your family and most IRA and retirement plan owners don’t know anything about them.

Session 4: Wednesday, March 9th (1 – 3 pm Eastern)

A Live Q&A with Larry Swedroe & Adam Yofan of Buckingham Strategic Wealth: Your Questions Answered on Investing, Tax Minimization, Retirement Planning, & More

Larry, Adam, and Jim will answer attendees’ questions submitted in advance of these online workshops as well as those submitted during the webinar. Take advantage of this opportunity to have your most nagging investment questions answered.

- Larry Swedroe is one of the top financial authors in the world. His books include Successful & Secure Retirement and Reducing the Risk of Black Swans.

- Adam Yofan works closely with Jim to ensure their mutual clients get the most out of what they’ve got.

Larry Swedroe, Chief Research Officer of Buckingham Strategic Wealth, educates individuals on the benefits of evidence-based investing. He has authored nine books and co-authored seven books on investing, and has appeared on NBC, CNBC, CNN, and Bloomberg Personal Finance. Adam Yofan, CPA, PFS, leads the Pittsburgh office, navigating clients toward financial clarity.

Register to Attend 1, 2, 3, or all 4 FREE Webinars at: https://PayTaxesLater.com/Webinars

*Endorsements are for Jim’s books, not his services.

First and foremost, I want to thank Jim for giving me the opportunity to introduce myself to his newsletter subscribers. My name is Dominic Bonaccorsi, and I was raised in the South Hills of Pittsburgh. My wife, Lauren, and my two daughters, Olivia and Haley, currently live in Upper St. Clair. In my spare time, I enjoy spending time with family and golfing.

I began my journey at Lange Financial Group, LLC in 2020. Prior to joining the Lange team, I worked for a wonderful local CPA firm where I was treated very well, and I had a promising future. One of the selling points for me to come on board was that the team here loves to draft Financial Masterplans that save clients a lot of money and make a big difference in their lives. I hate to say it, but most CPA firms are more like financial historians than proactive financial planners.

Yes, like most typical CPA firms Lange Accounting Group does provide tax preparation services, but unlike most CPA firms, the scope of our services is not limited to that narrow and more reactive arena. In fact, the greatest value we provide is being proactive in tax planning, retirement planning, and estate planning. Sometimes recommendations for Roth IRA conversions, gifting, and changing the existing estate plan adds enormous value which as a professional, I love to do.

For PA residents, we offer will and trust preparation. For non-PA clients, we still look at the client’s wills and trusts, etc., and often make life-changing recommendations. Our Financial Masterplans offer enormous benefits. I love working in conjunction with the legal team and the excellent money managers to offer clients comprehensive coverage of their entire retirement and estate planning situation.

Let me also say that it was difficult to leave where I worked before to start this new journey with Jim. I was well regarded, clearly on the short track to partnership, made good money, and wasn’t looking for a job. The recruiter talked about the more fascinating work I would be doing and the much bigger impact I would have on helping clients realize their dreams. Jim told me before I started it would be a long training period before I could even do the work that we do. Luckily, training under Jim, Steve Kohman, Shirl Trefelner, and Matt Schwartz and being given sufficient time for self-study, I have made enormous progress and have enjoyed tremendous professional growth. It is extremely satisfying having so much of my work makes such a difference in the lives of the clients I serve.

I’ve enjoyed my time at the firm thus far. The work is engaging. The clients have been amazing to work with. And the team Jim has built around him through the years is second to none.

Jim is one of the leading experts in our practice’s niche IRA market in the country. It has been a tremendous learning experience to see how Jim operates and runs his business. As leading experts in the industry, Jim and our team stay on top of the latest laws and trends. This is evidenced and crystallized in Jim’s books. Jim has authored ten books over the course of his career. Jim has a way of taking very complex topics and boiling them down so that they are easy for his readers to understand. As readers of Jim’s newsletters, I assume you may have read some of his books. If you have not, I would encourage you to do so. I may be a bit biased, but there is some very valuable content presented.

While I’m at it, I’d be remiss if I did not shout out some of my other coworkers who have been instrumental in my integration into the team — Glenn Venturino and Jennifer Hall. Jen, like me, joined the team recently but comes to us with extensive knowledge and experience. Shirl and Steve are the two legacy CPAs in the group who support the financial planning side of the business. The planning techniques that Shirl and Steve have mastered and integrated into many of the plans we provide for our clients have the potential to save clients tens, and sometimes even hundreds, of thousands of dollars. For some of our larger clients, these techniques can even add over a million dollars in value.

Jen and I have a lot to live up to, but we are up to the challenge and have the benefit of learning from some of the best in the field. Matt is our lead attorney, and he also provides support on many of the finance projects that we service. Matt is as sharp an attorney as I have ever met and is more quantitative than most CPAs I know. Matt has a rare and powerful combination of skills, and we are lucky to have him on the team.

Over the past two years since the pandemic hit, our way of interacting and doing business has changed. In an already digital world, the pandemic has further accelerated that trend in many industries. Our industry is no different. Whereas prior to the pandemic, Jim used to host in-person workshops where he would present his subject matter expertise to the public. The pandemic put an end to those events. However, Jim (with a huge help from our marketing team) pivoted the business model and now hosts these workshops via webinars where he can now reach a national audience. We are now servicing clients from all around the country. Business had been good. To say that I have been busy over the past year is an understatement.

I am optimistic and look forward to my future with the firm. To any readers out there who are current clients, we thank you for your continued business and faith in us. To any readers who follow Jim but are not currently clients, we also thank you for following along and hope that you will keep us in mind in the future should you ever want or need tax, financial, or legal services.

Free At-Home COVID Tests

Every home in the U.S. is eligible to order four free at-home COVID-19 tests. Order your rapid results tests today so you have them if you should need them. Tests provide results within 30 minutes (no lab drop-off required). Testing is a great step we can take to protect others.

Order your four free tests at https://covidtests.gov.

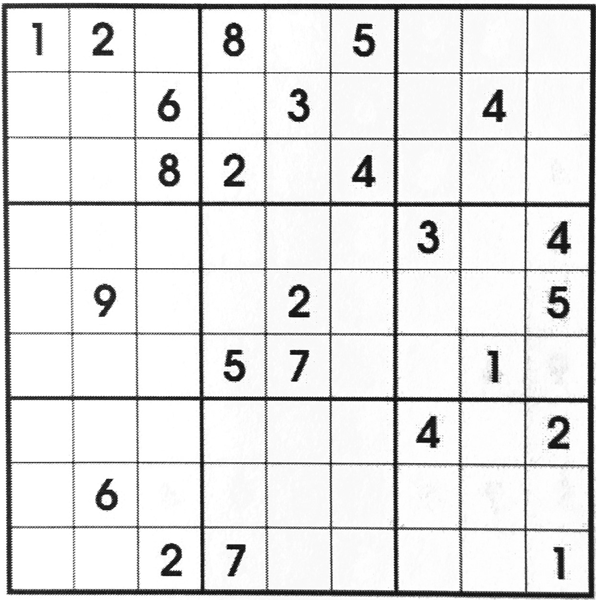

Sudoku