Table of Contents

The pandemic has spurred a lot of rethinking about priorities. What do you actually want to spend time on? Who do you want to spend time with? For many people, it was about evaluating jobs and family/work balance. And what was the huge motivator? Searching for happiness—or maybe just more happiness.

Those questions couldn’t be more relevant for retirees and people approaching retirement. While I have written about this topic before, I recently ran across another short article that I found fascinating and wanted to share with you. For Happiness In Retirement… was published online by Jennifer Lea Reed in Financial Advisor magazine (www.fa-mag.com).

Three Core Elements for Happiness

At a recent Morningstar’s Investment Conference, held in Chicago, a panel of “thought leaders” and, get this, an “actual retiree” gathered to explore what it takes to find happiness in retirement. Some of their findings were surprising to me, others made perfect sense and corroborated ideas I’ve shared with you before.

Michael Finke, a professor, and researcher of wealth management at the American College of Financial Services drew his observations from the University of Michigan’s longitudinal “Health and Retirement Study” tracking 20,000 people in America. Analyzing the data on life satisfaction revealed three core elements: money, relationships, and health.

- Having enough money is critical, but interestingly it seems to top out at about $4 million— “More money doesn’t hurt, of course, but it doesn’t correlate to greater satisfaction. With $4 million, most people will experience peak happiness. (Note, I think this is situational, but who am I to argue with a well-documented study.)

- Relationships with peers and community is very important.

- Health, pretty obviously, is also critical.”

But perhaps one of the most significant takeaways was thinking about these elements as “investments” that need to be developed and “built-up” before and during retirement. The money part is obvious. Exercising and healthful eating are investments in health. Cultivating rewarding friendships is an investment in relationships. Combined “investing” in all three elements seems to provide the key to retirement happiness.

Investing Isn’t Always about Money

As many of you know, my high school gang—best friends scattered across the country—are still a gang. Every year for 25 years (minus one for Covid), we have been getting together for long weekend reunions. When most of the gang had living parents, they combined the weekend with a visit to their parents and usually stayed with their parents. Now, only one of us has a living parent, and most of the gang stays at my house.

We used to play ultimate frisbee (which requires a lot of stop and start running) and stay up till two in the morning playing bridge. Now we play frisbee golf. Some of us even have a glass of wine with dinner. Then, we play bridge until 9 in the evening. We are a bunch of wild and crazy guys.

Bill Sikov, one of the gang, taught me an important lesson years ago. He said don’t miss important events like weddings, bar or bat mitzvahs, or funerals. Before that lesson, I did miss some of those events because the travel was inconvenient. That was a mistake. Luckily, after Bill’s lesson, I rarely miss any of those events.

Obviously, the past 18 months or so have seriously curtailed in-person visits. I proposed a weekly Zoom call with the gang. Now, once a week at 9:00 p.m. every Sunday, we hang out for an hour on Zoom. Most of the talk is inconsequential like sports, TV shows, bridge, and books we’ve read. But we also talk about the pandemic, politics, and what is going on in our lives. Occasionally, we even talk about feelings, but honestly not much. My wife sometimes asks what we talked about, and I usually say feelings, and she knows I am being sarcastic. But whatever we talk about, we almost always laugh and have a good time. It just feels good to stay in touch and know there are other people in the world who care about you.

Five of us also play bridge as a team on FunBridge, a website that hosts virtual bridge competitions.

I also try to stay in touch with family. I have even traveled to California to see my niece, great-nephew, cousin, and friends. As the pandemic has eased a little, and we have all had our third vaccine, we have a regular “cousins’ lunch” either at my house or outside. That includes two of my cousins, George Lange, a nationally renowned photographer of four presidents (and the shot below!), Burt Wald, my brother, Jeff, and my wife, Cindy, and me. Again, I am the organizer.

I also organize bicycle rides and hikes with friends. I am always sending out email invitations. I have and maintain four e-bikes. Not because I need four e-bikes, but at least partly because all my cyclist friends love riding e-bikes, but none have bought one for themselves! Just saying…

I hadn’t thought of what I have been doing over the years to organize gatherings and staying in touch with my good buddies from high school, my brothers, cousins, and friends as “investing.” But the expression caught my attention. It’s a handy way to encapsulate and place value on all the effort and, I might add, the satisfaction that comes from being “the organizer”—even if at times if feels like herding cats! But, even with the negatives, it is still rewarding and now I have a vocabulary for this type of activity—making an investment.

Cultivating Creativity and Curiosity

Two other attributes also seem to have a significant impact on happiness: creativity and curiosity. With more time available, the opportunity to tread a new path or revisit earlier accomplishments and interests opens new communities for interesting friendships, and importantly, stimulates your brain. My mother was a journalism professor and an accomplished pianist. She really loved teaching and performing.

Frankly, she wasn’t ready to retire, but for her, it was mandatory at age 70. So, I helped her find piano students. I also arranged for her to give performances in senior homes. She loved the “teaching performances” where she offered insights into the composition and the composer along with playing the piano. Teaching and performing, though no money was exchanged, kept her active and engaged, and I am sure contributed to her happiness and longevity. She lived to age 95. She did have a good income in retirement because she was required to annuitize her TIAA-CREF which gave her a solid and reliable income for life. (You can find more on annuitizing in my new book, Retire Secure for Professors.)

Money Is Important but How You Spend It Is Even More Important

In a previous newsletter and in my new book, I cite research conducted by Elizabeth Dunn and Michael Norton, that identified five important principles for ways to spend money to increase happiness. I know that following these principles has improved my life, and I am not close to being retired!

- Buy experiences.

- Make it a treat.

- Buy time.

- Pay now, consume later.

- Invest in others.

Fundamentally, the research points to being actively engaged in thinking about and planning your retirement life—not simply your finances.

According to Michael Finke, “The retiree’s job is to invest in the inputs that are actually going to result in the output of greater life satisfaction. And if they don’t, they’ll be less satisfied. I see people making a lot of mistakes in retirement that result in them not being as satisfied as they could be.”

It seems to me there is a huge overlap between the “three core elements” and the “five principles for ways to spend money to increase happiness.” It is like the five principles provide concrete and actionable guidance for investing in the core element “relationships.” I like the specificity they provide. And of course, spending according to the five principles presumes, in many ways, good health and adequate finances.

Prioritize What You Love to Do—Delegate the Rest

Finally, I will conclude with something that I learned in a business context but think it applies to non-business situations and contributes to happiness. I learned this from Dan Sullivan, perhaps the top business coach in the world. He said to separate your activities and the way you spend your time into three basic areas.

- Stuff you hate to do.

- Stuff that you neither hate nor love.

- Stuff that provides you true joy (which incidentally usually contributes to the lives of others).

Try to delegate as much of #1 and #2 as possible.

In my business, it has been many years since I prepared a tax return or drafted a will. I delegate a large part of the management responsibilities for my firms to another valued senior attorney. I step in, however, when needed to deal with a troublesome client (rare) because I believe it is my job to promote and protect my staff.

My wife and I have two personal chefs who do virtually all the shopping and cooking. Neither of us like to shop or cook so we delegate it. We also have regular help around the house for chores neither of us like doing.

My wife doesn’t like when I mention these things to friends—let alone my clients—because she feels it is bragging. But I am just throwing the ideas out there for people to consider. I have a lot of clients who have a lot more money that I will ever have, and it doesn’t occur to them to delegate some of the things they do but don’t enjoy on a regular basis. I know that getting help is sometimes as hard or harder than just doing it yourself. That said, if you are successful and develop a team of helpers, spend your time doing the things you like and “invest in your happiness.” I think life will be more fulfilling.

Filet Mignon with Garlic Sauce and Roasted Tomatoes

Serves: 4

Prep. Time: 15 minutes

Cook Time: 1 hour, 15 minutes

- 4 large heads of garlic, unpeeled

- 4 ½ tablespoons extra-virgin olive oil

- 2 pints cherry or grape tomatoes

- ¾ teaspoon sea salt

- ½ teaspoon freshly ground black pepper

- 2 tablespoons coconut oil

- 4 (1 to 1 ¼ inch thick) filet mignons

- 5 or 6 tablespoons low-sodium chicken stock

Preheat oven to 400⁰F.

Cut the top ½ inch or so off each garlic head, just enough to expose most of the garlic cloves. Place each head on a large piece of foil. Drizzle ½ tablespoon of the olive oil over each head; wrap the foil around each head to enclose it in its own pouch.

Place the tomatoes on a large rimmed baking sheet. Drizzle the remaining 2 ½ tablespoons olive oil and ¼ teaspoon each of the salt and black pepper and toss. Add the garlic pouches on the side of the baking sheet. Place the tomatoes and garlic in the preheated oven.

Roast the tomatoes until they burst and are caramelized, 45 to 60 minutes, making sure to stir midway through. Remove the garlic after about 50 minutes and let it sit until cool enough to handle. Tent the tomatoes with foil to keep warm.

Season the filets with ¼ teaspoon each of the salt and black pepper. In a large cast-iron pan or another oven-safe skillet, heat the coconut oil over high heat until shimmering. Sear the fillets until golden brown on each side, about 5 minutes total. Transfer to the oven and cook until the steaks reach the desired internal temperature, about 8 minutes for medium-rare and 10 minutes for medium (a meat thermometer should register 130⁰F for medium-rare, 140⁰F for medium, and 160⁰F for well-done). Remove the filets from the oven, tent with foil, and let rest for at least 5 minutes.

Meanwhile, grip the bottom of each garlic head and squeeze the roasted garlic into the bowl of a food processor. Add the remaining ¼ teaspoon salt and 5 tablespoons chicken stock. Puree until combined, adding another tablespoon of chicken stock if it is too thick. Transfer to a small saucepan and warm over low heat.

Place a filet mignon on each plate, along with some of the roasted tomatoes. Drizzle the warm roasted garlic sauce over the steaks and serve.

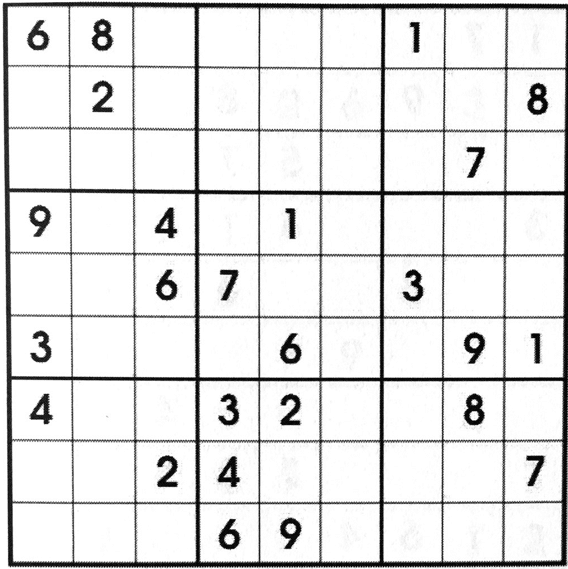

Sodoku

Answer Key