How It All Started: Retire Secure!

Back in 2003, one of my advisors, Dan Kennedy, told me that to have a seat at the high stakes table of influencers, I needed to write and publish a book. Dan pictured a short book filled with stories that were meant to inspire readers to call and ask if my firm and I were available for services. The book that I ended up writing, Retire Secure! involved two years of blood, sweat, and tears and included the best advice gathered and collected from my twenty years of practice as a CPA and estate attorney.

The book included my best thinking on wealth accumulation, wealth distribution, and estate planning. It included an update of some material that I published in a peer-reviewed article with an explanation of my mantra “Don’t pay taxes now, pay taxes later—except for the Roth.” The book included lots of graphs and charts that backed by countless spreadsheets and mathematical proof that my recommendations, especially regarding Roth IRA conversions, were sound. There is no question that writing and publishing a book provides tangible evidence of credibility—your work can be cross checked and verified by your peers—which mine was.

Retire Secure! was published by Wiley in 2006 which was a good publisher for me. The book was distributed in Barnes & Noble and other bookstores throughout the country. Buoyed by testimonials from Charles Schwab, Larry King, Ed Slott and 50 other financial luminaries, the book did quite well in terms of sales and attracting clients. I did a second edition with Wiley in 2009. I self-published the third edition in 2015. All books did well and in conjunction with my (former) radio show, this newsletter, and subsequent books, I have a small national following.

Dan thinks I am nuts and that I spend too much time educating readers and workshop attendees both in my writing and in my speaking. He may be right, but I love what I do. (Please see the inside of the newsletter to learn about our October in-person workshops for professors in Oakland.)

NOW AVAILABLE: Retire Secure for Professors and TIAA Participants

Dan then recommended I author a book for college professors because I had hundreds of professors as tax and estate planning clients. After writing a few books that didn’t explicitly address professors, I finally got started on Retire Secure for Professors (that was the working title), and the plan was to publish in 2022. Though all but two chapters of the book are relevant for most IRA and retirement plan owners, I wanted to do a specialty book for professors.

I was going to follow up with a book for TIAA Participants which, in fact, would have contained nearly identical information. (Most professors I know have or had TIAA as part of their retirement plan.) So, I decided to combine the professor and TIAA books into one book titled Retire Secure for Professors and TIAA Participants.

Then, there were a slew of new laws and new tax rates. Much of the content had to be updated. That job was a bear, but we finished and now we have our magnum opus—our best book by far. And I say “our” because I had a lot of help from the number crunching CPAs who are part of our team, estate attorneys from the law firm, a CPA/writer freelancer, and my long-time editor. It is 450-pages long, not including introductory material and appendices. We are particularly proud of our detailed and extensive Table of Contents. It makes it easy to find what you are looking for or gives you an idea you had not thought about.

Retire Secure for Professors and TIAA Participants will be available on Amazon on October 2, 2023. If you are an assets-under-management or professor client, you should have already received a copy. All other clients will receive a copy within the next two months. If you are not a client, we highly recommend you buy the book—as of now, you can get a digital copy of the book for $1.99 on Amazon.

May We Ask You for a Favor Please?

Retire Secure for Professors and TIAA Participants, our magnum opus, will be available to the public on Amazon on October 2nd.

Now, we have a favor to ask. Reviews of the book posted on Amazon propel sales and help us reach the broadest audience possible. To post a review, you must purchase a book. Currently the digital copy is available for $1.99. Would you kindly buy a copy from Amazon, read at least a chapter of the book, and post an honest review? You would be doing me, your fellow IRA and retirement plan owners, professors, and TIAA participants a huge favor. For step-by-step instructions on how to post a book review on Amazon, please go to https://PayTaxesLater.com/AmazonReview.

Coming Soon: Retire Secure for Parents of a Child with a Disability

If you have been reading these newsletters, you know that Cindy and I have a wonderful daughter who has a disability. Erica has dysautonomia and in her case, it is unlikely that she will ever be able to financially support herself. With the official diagnosis, Cindy and I were able to begin the arduous process of getting her qualified for SSDI. But we also knew that SSDI would never amount to enough money to provide for her in a way we would be comfortable with.

So, I figured out a “solution” for the best way to provide for Erica, even long after we are gone. Our deliberations and planning stoked my passion to help educate parents of a child with a disability about how to provide for their child financially.

This book is a bit different in another way too ― I have two co-authors. This dream team has been hard at work writing Retire Secure for Parents of a Child with a Disability. I must add that Erica fully supports this project and hopes that other children and young adults with disabilities will benefit from the book. So, next month be on the lookout for information about that book, and its imminent publication date.

My Passion: Helping Others Achieve Financial Security

Little did I know that Dan’s advice would spur such a book writing passion. I love that my books have the potential to really help people, and more recently parents and their children with a disability.

Retire Secure for Professors

Get the most out of your TIAA, IRAs, and other retirement plans.

Learn how by attending out FREE October workshops.

Live In-Person Workshops

Tuesday, October 24, 2023

Wyndham Pittsburgh University Center

100 Lytton Ave., Pittsburgh, PA 15213

Call 412-521-2732 or register online at Faculty-Advisor.com/Workshop

Reserve your seats for any or all of our FREE workshops. Seats fill quickly. If you are married, both spouses are encouraged to attend. Free refreshments will be served.

Session One: 9:30 – 11:30 AM

Optimal Distribution and Estate Planning for Your TIAA and Other Retirement Accounts

Accumulation planning sets the stage, but it’s a breeze compared to distribution and estate planning.

We offer our best recommendations for resolving one of the greatest mysteries of life…what is the optimal withdrawal plan when you have Traditional TIAA? (Our recommendations are somewhat unique and off the radar for most advisors.)

The SECURE Act is no friend to many professors with $1M+ in TIAA, IRAs, and other retirement plans. Unless you take aggressive action, it is likely that your loved ones will take a massive income tax hit upon inheriting any money from those plans. We will provide strategies to avoid massive taxation. We will also delve into a disclaimer-based estate planning system that we consider to be the best estate plan for most married IRA owners.

This workshop combines our newest thinking with some of our classic strategies for protecting you and your family.

In this session, you’ll discover…

- How Required Minimum Distributions (RMDs) of Inherited IRAs and retirement plans were so advantageous under the old law in sharp contrast to the onerous rules in the SECURE Act.

- How SECURE Act and SECURE Act 2.0 changes could impact your family and your legacy.

- How to ensure financial security for the surviving spouse, and potentially save hundreds of thousands to pass on to your heirs after the SECURE Act.

- The details of the best (and most flexible) estate plan for married professors known as Lange’s Cascading Beneficiary Plan™.

- We’ll solve one of the great mysteries of academic life: What is the most advantageous way to get your money out of TIAA and CREF when you retire?

- You’ll learn about the distribution rules and options at retirement for Traditional TIAA, and what, if anything, you should do about it now.

We’ll also dive into Trust planning strategies, including…

- The pros and cons of having your heirs inherit your TIAA, IRA, and other retirement assets directly versus through a trust.

- Why, under certain circumstances, naming a charitable trust as the beneficiary of TIAA, IRAs, and retirement assets might be an excellent strategy for altruistic professors.

- The growing popularity of the “I don’t want my no-good son-in-law to inherit one red cent of my money” trust.

- A rarely discussed strategy―Who Gets What? evaluates the tax consequences of leaving different asset types to children who are in differing tax brackets. We will cover a similar strategy for charitable giving. By optimizing your strategies using who gets what analysis, you could save hundreds of thousands of dollars in taxes.

Session Two: 12:30 – 2:30 PM

Roth IRA and Roth 403(b) Contributions and Conversions for Professors

Both foundational and advanced Roth IRA conversion techniques are included in this session.

With new tools and opportunities at your disposal, we encourage you to attend this workshop to learn how to defend yourself against the dreaded SECURE Act and take advantage of SECURE Act 2.0.

In this session, we will cover foundational Roth conversion techniques…

- How professors born between 1951 and 1959 can profit from SECURE Act 2.0.

- How to move a portion of your taxable investments (TIAA, IRAs, and other retirement plans) to the tax-free investing environment (529 plans, your children’s Roth IRAs, Roth 403(b)s, and more). This shift could potentially be more valuable to your children than you making Roth IRA conversions in your own accounts.

- Capitalizing on Roth IRA conversions through 2025 while favorable income tax rates remain and before the 2017 Tax Cut and Jobs Act’s Sunset Provisions take effect in 2026 and tax rates go up substantially.

- How you could benefit from the new rules allowing employers to contribute to an employee’s Roth retirement plan. (Previously, employers were only allowed to contribute to tax-exempt Traditional plans.)

- The peer-reviewed math and optimal timing for Roth IRA conversions.

- We will also examine the timing synergy between when you begin taking Social Security and making Roth conversions.

And we’ll also cover advanced concepts for Roth IRA conversions including…

- How to transition after-tax dollars in retirement plans to a Roth IRA at no cost—potentially saving hundreds of thousands of dollars in taxes down the road.

- How to convert an Inherited retirement plan to a Roth at your beneficiary’s tax rate, not your own, after you die. (This is a little-known strategy with big tax savings for those who qualify.)

Session Three: 3 – 5 PM

Taming Parents’ Financial Fears for their Child with A Disability

We present Jim’s personal financial strategies that he developed for his own daughter, Erica, who has a disability, and who is unlikely to be able to earn an independent living. Ultimately, Erica will be better off by $1,890,544** in today’s dollars and that does not include any government benefits she is eligible to receive than if Jim didn’t implement these strategies he will cover.

Jim and his wife, Cindy, felt a constant dread about Erica’s financial fate after they were gone. The immediate thought for protecting her future was to work longer, save more, spend less, and leave more.

Then, Jim figured out a three-pronged solution to the problem that he will present at this session. Applying these same three strategies could potentially be life changing for your family.

In this session, you’ll learn...

- The enormous benefits of optimizing your Roth IRA conversion strategy for you and your child with a disability.

- For parents with an IRA of $500,000, optimizing Roth IRA conversions could make a difference of $239,000** in today’s dollars for your child with a disability.

- Why you should almost certainly establish an ABLE account for your child.

- Rollover possibilities for 529 and Roth plans into an ABLE plan which, in many ways, is better than a Roth IRA.

- The importance of drafting a Special Needs Trust to protect your child’s government benefits and preserve the enormous tax benefits that qualified children with disabilities can benefit from.

**Jim and his wife capitalized many years ago on Roth conversions. Full assumptions available at PayTaxesLater.com/Assumptions

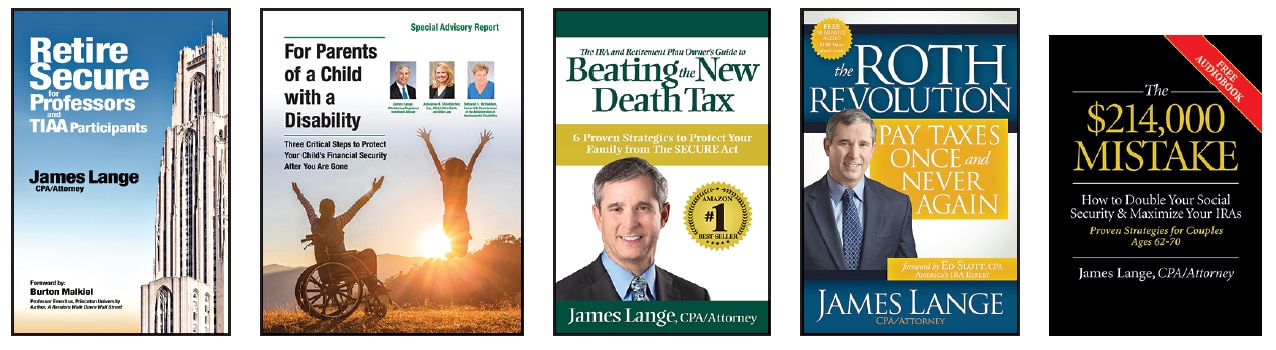

6 Valuable Bonus Gifts: Yours FREE When You Attend Any Workshop! (Eric, please insert photos of book covers and Special Advisory Report)

Bonus #1: Register today and you will receive a free hardcover copy of Jim’s magnum opus, Retire Secure for Professors and TIAA Participants, the best book Jim and his team have ever written.

Bonus #2: Attendees also receive our 56-page Special Advisory Report for Parents of a Child with a Disability: Three Critical Steps to Protect Your Child’s Financial Security After You Are Gone.

Bonus #3: Your next gift is a hard cover copy of Jim’s best-selling book, Retirement Plan Owner’s Guide to Beating the New Death Tax, detailing how to respond to the SECURE Act.

Bonus #4: You will receive a copy of Jim’s 276-page best-seller, The Roth Revolution: Pay Taxes Once and Never Again. Jim shows how to use a series of Roth IRA conversions to grow income from your IRAs tax-free.

Bonus #5: You will receive Jim’s book on Social Security, The $214,000 Mistake: How to Double Your Social Security & Maximize Your IRAs.

Bonus #6: Qualified attendees are eligible for a FREE Retire Secure Initial Consultation with Jim Lange and one of his number-crunching CPAs.

Attend Jim Lange’s Retirement and Estate Planning Workshops for FREE

Tuesday, October 24, 2023

Wyndham Pittsburgh University Center

100 Lytton Ave., Pittsburgh, PA 15213

These university faculty workshops are free, but seats will fill quickly.

Call 412-521-2732 or register online at Faculty-Advisor.com/Workshop

Disclaimer: Please note that if you engage Lange Accounting Group, LLC for our Financial Masterplan service or receive Financial Masterplan services as part of our assets under management arrangement, there is no attorney/client relationship in this advisory context. Lange Accounting Group, LLC offers guidance on retirement plan distribution strategies, tax reduction, Roth IRA conversions, saving and spending strategies, optimized Social Security strategies, and gifting plans. There is no solicitation being made for legal services by James Lange nor by Lange Legal Group, LLC. Although we will bring our knowledge and expertise in estate planning to meetings with clients, all recommendations are offered in our capacity as a financial planning professional and not as an attorney. We will, however, potentially make recommendations that clients could have a licensed estate attorney implement.

Lange Financial Group, LLC is a registered investment advisory firm registered with the Commonwealth of Pennsylvania Department of Banking, Harrisburg, PA. In addition, the firm is registered as a registered investment advisory firm in the states of AZ, FL, NY, OH, TX, and VA. Lange Financial Group may not provide investment advisory services to any residents of states in which the firm does not maintain an investment advisory registration. This does not in any way imply that Lange Financial Group is failing to preserve its rights under the respective states’ de minimis rule. The presence of Jim’s book shall not in any direct or indirect fashion, be construed, or interpreted to suggest that the firm is offering to sell or soliciting to provide investment advisory services to residents of any state or states in which the firm is not maintaining an investment advisory registration. Again, Lange Financial Group preserves all rights under each state’s de minimis rule but wishes to emphasize that it is not directly or indirectly soliciting investment advisory clients in states where it has no legal right to do so. All investing involves risk, including the potential for loss of principal. There is never any guarantee extended that any investment plan or strategy will be successful. Asset location, asset allocation, and low-cost enhanced index funds are provided by the Lange Financial Group, LLC’s affiliated investment firms. This referral is offered in our role as an investment advisor representative and not as an attorney.