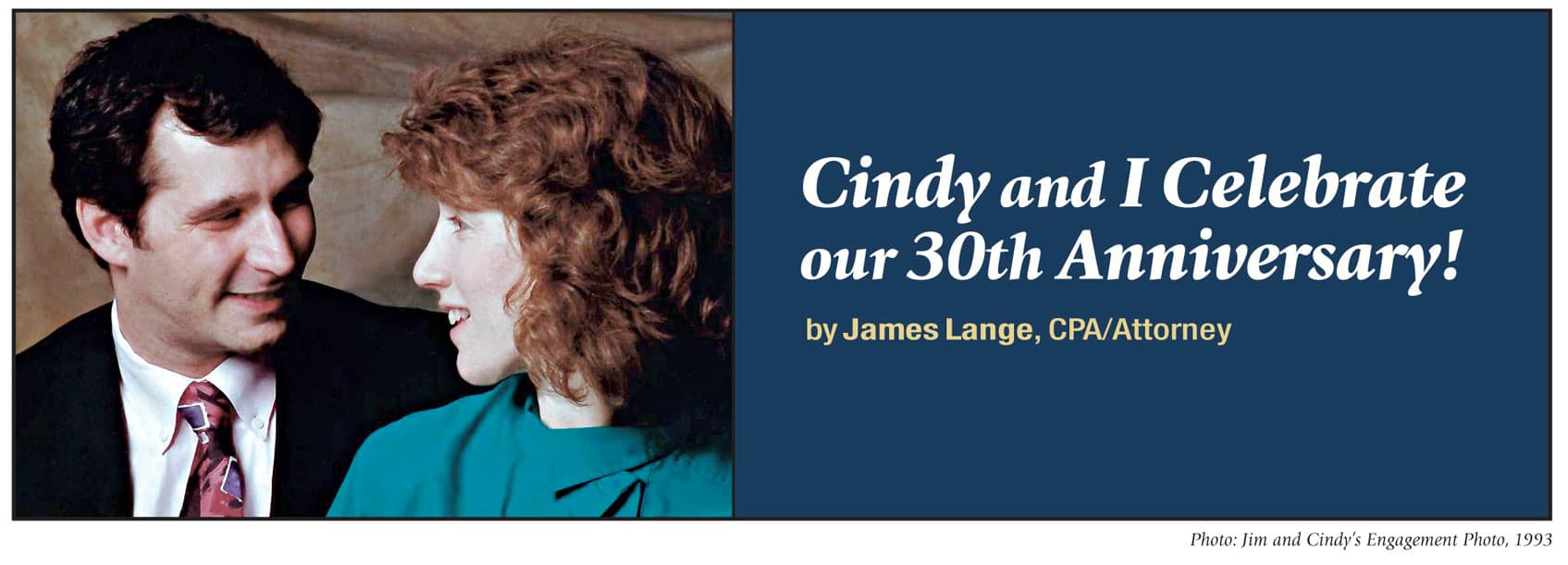

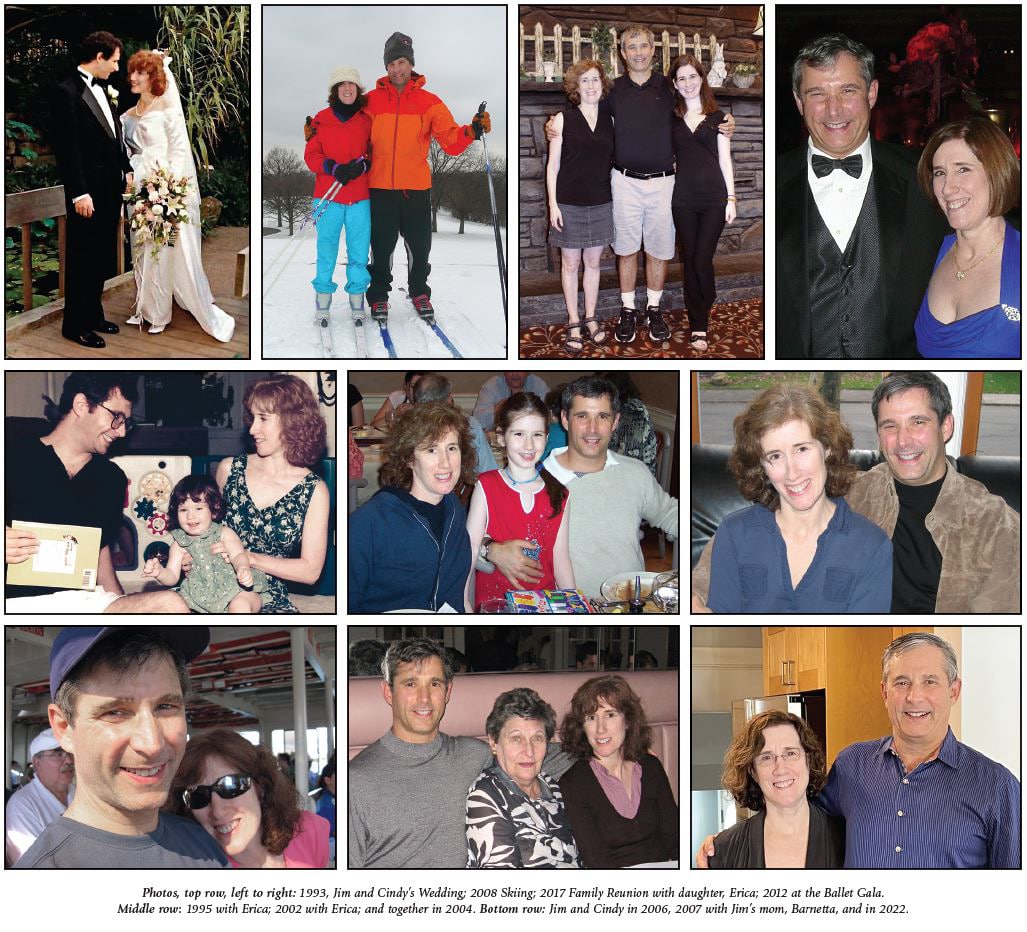

On September 4, 2023, Cindy and I marked our 30th wedding anniversary. And I am so grateful that I made the choice I did and that she agreed we would make a good team.

Marrying Cindy was the best decision I have ever made. Our wedding day and the day our daughter, Erica, was born continue to stand out as two of the happiest days of my life.

The key to our happiness? Who knows. I think it has a lot to do with who you choose in the first place. But I don’t think it hurts to enhance our compatibility by periodically using sayings like “Whatever you like, dear.” Most of the time, I am genuinely sincere. Sometimes I like to get my way. (She would tell you that is usually what happens.)

We also share a total commitment to providing for Erica—who has a disability—for the rest of her life. Our values are closely aligned.

I couldn’t have asked for a better partner for all our marriage’s successes and challenges.

The path we have traveled together hasn’t been all blue skies and warm breezes. When I met Cindy, I had a fledgling business, and she was a hotshot CMU grad with a masters in electrical engineering who enjoyed her work.

A dilemma that many working couples face when conversations about children arise is who will take care of the child on a day-to-day basis? Is daycare an option—family support or a commercial operation? Will one parent stay home?

With us, Cindy gave up a lucrative career as a software engineer to be home with Erica. It was her choice, and I fully supported her decision. As I said, my business was just starting which meant long hours and lots of work. And, as anyone who has raised a child knows, long hours at work can pale to long hours alone with a child!

There have been other challenges too. Relatively recently, Erica was diagnosed with dysautonomia. Her disability will prevent her from earning an independent living. Coming to terms with her diagnosis was difficult for all of us. These were some rough waters. Our experience made us realize just how difficult it is to navigate the bureaucracy and lack of resources of long-term planning for a child with a disability.

Cindy does so much more than run the household and take care of Erica and me. When I was working on the first edition of Retire Secure!, I thought I was just about finished. I was expecting Cindy to read it and tell me it was wonderful. Instead, she said, “You don’t think this is anywhere near done, do you?” She was right. The subheads throughout the book and the Table of Contents were a mess.

So, she took it upon herself to organize the content. She understands the concepts, is detail oriented, cares, and has proofread and significantly improved many of my books since.

We have been fortunate that with Cindy’s diligence and problem-solving skills and my financial expertise, we have come up with a good solution for Erica’s long-term well-being.

That experience also motivated me to find two co-authors who complement my knowledge and together we wrote Retire Secure for Parents of a Child with a Disability, which will be published shortly ― coming just on the heels of Retire Secure for Professors and TIAA Participants.

Thirty years is a long time. But we continue to love each other, and we look forward to spending our future together.

Thank you, Cindy, for 30 wonderful years. I love you.

Excerpt from Retire Secure for Professors and TIAA Participants

Who Gets What? Maximizing Bequests to Charity and Children with Different Financial Needs

by James Lange, CPA/Attorney

The content of this article (with some edits) was originally published in an article I wrote for Forbes.com. Published with permission from Forbes.com where Jim is a regular contributor.

An Obvious but Frequently Missed Drafting Error

After reading this chapter, you are likely to think—that is so obvious. How could I and my estate attorney both have missed this? Don’t feel bad. We have reviewed thousands of wills and trusts, and in our experience, hardly anyone gets this right. The mistake often costs families tens or hundreds of thousands of dollars or more.

I’m referring to the decisions that you make when you are crafting your estate plan and are trying to figure out Who Gets What. In this chapter, I want to focus on the smartest solution for donations or inheritances that you leave to a charity and children with different needs after you and your spouse pass.

There are several critical ideas to cover, but the most fundamental is: what are the tax implications to each recipient if they inherit your money? By being very selective about who receives which type of money, you can dramatically cut the share that goes to the IRS and increase the amount going to your family or your favorite charity.

A tax-exempt charity does not care in what form they receive an inheritance. They never have to pay taxes on the money they receive. To them, a dollar is a dollar. Your heirs are tax-paying entities, and it makes a huge difference what type of assets they inherit.

So, if you want to leave $100,000 (or any significant amount) of money to a charity, do it through the beneficiary designation of your IRA or retirement plan, not your will or revocable trust. This is a simple tweak to your estate plan that can be very beneficial to your heirs.

What if My Children Have Different Needs?

The different income tax brackets of your beneficiaries may create an opportunity for tax savings by simply changing who gets what. For example, imagine you have two adult children, and one child is in the 32% tax bracket and the other in the 12% bracket.

Let’s keep it simple and assume you have a $1 million Roth IRA and a $1.4 million Traditional IRA. The status quo is each child will receive 50% of both assets. If you forget growth, each child will get $500,000 Roth IRA and $700,000 Traditional IRA. The IRS will get $308,000 which represents the taxes both kids will have to pay on the inherited Traditional IRA ($700,000 times 12% = $84,000, and $700,000 times 32% = $224,000).

Let’s assume instead you leave the $1 million Roth IRA to the child in the 32% bracket and the $1.4 million Traditional IRA to the child in the 12% bracket. The IRS would only get $168,000 in taxes. This means your children would get an extra $140,000 worth of purchasing power, which is the difference between the amount paid to the IRS in the two scenarios. In addition, since hopefully, your children aren’t planning on blowing their inheritance the year that you die, the extra $140,000 will continue to grow after you die.

Secure Your Financial Future –

a Must-Read Coming Soon!

Do yourself and your family a valuable service & keep an eye out for our upcoming book.

Do yourself and your family a valuable service & keep an eye out for our upcoming book.

Set to launch on Monday, October 2nd on Amazon.com, our magnum opus, Retire Secure for Professors and TIAA Participants, promises to be a comprehensive guide not just for professors and TIAA participants, but for anyone with an IRA or retirement plan.

Clocking in at nearly 500 pages, this resource contains a user-friendly Table of Contents to help you effortlessly navigate to the information most relevant to you.

While reviews can't be posted just yet, you can sign up to be reminded to purchase the book on October 2nd.

Go to Faculty-Advisor.com/Reminder to sign up for a release day reminder to purchase the book for just $1.99.

We're grateful for your interest and are confident this book will be a game-changer in your financial planning journey. Thanks for taking the first step toward securing your future!

Roth IRA Conversion Possibility for Non-Spouse Beneficiary

An Excerpt from Retire Secure for Professors and TIAA Participants

by James Lange, CPA/Attorney

“This is a sleeper advantage of keeping money in a 403(b) or 401(k) or opening your own 401(k) that I have never seen anyone execute in practice, with the exception of clients of our firm. Notice 2008–30 from the IRS provides a unique opportunity for a non-spouse beneficiary to do a Roth IRA conversion of an Inherited 401(k) or 403(b) plan. Non-spouse beneficiaries of Inherited IRAs are not allowed to do an Inherited Roth IRA conversion of an Inherited IRA. This ability for non-spouse beneficiaries of qualified plans to convert is an additional reason to retain assets in a qualified plan.

This could be a huge opportunity if you are in a higher income tax bracket than your beneficiaries. That is, die with your 403(b) and have one or more of your beneficiaries make a conversion from an Inherited 403(b) to an Inherited Roth 403(b).

Further discussion on this strategic concept is discussed in Chapter 13 when the beneficiary is a disabled or chronically ill beneficiary where this strategy can be enormously favorable, even sometimes measuring in additional tax savings of tens, sometimes hundreds of thousands of dollars.”

Clients

If you are an assets-under-management client, your book is in process, and you should receive a copy in the mail within the next two weeks.

If you are an income tax preparation or an estate planning client, you should receive your book in the mail within the next two months.

Prospects

If you are a newsletter subscriber but not a client, you can join our launch team by going to PayTaxesLater.com/ProfessorBookLaunch, and you will receive a digital copy of the book immediately.