Table of Contents

Special Advisory Report for Parents of a Child with a Disability Three Critical Steps to Protect Your Child’s Financial Security

After You Are Gone…And More

James Lange, CPA, Attorney with Julieann Steinbacher, Esq., LLM

My daughter Erica has a disability that will prevent her from providing for herself. My wife and I worried endlessly, as do most parents of a child with a disability, about ensuring her safety and prosperity after we are gone. Using just three strategies, we took care of that worry. Consequently, Erica will have close to an additional $1.9 million dollars measured in today’s dollars to support her over her lifetime. Using the same strategies, someone with a $500,000 IRA can provide their child with an additional $239,000.

The three strategies are:

- We formally established Erica’s status as disabled. This can be achieved after a successful processing of a Social Security Insurance (SSI) or Social Security Disability Insurance (SSDI) application. This critical step is what qualifies her as an Eligible Designated Beneficiary (EDB) thus enabling her to stretch distributions from the inherited Roth IRA and IRAs over her lifetime.

- We optimized our Roth IRA planning. Roth IRA conversions can make the biggest difference for many families with a disabled child. $1,297,500 of the $1,890,544 savings for Erica came from us doing one large Roth IRA conversion and a series of backdoor Roth IRA conversions and from making Roth 401(k) contributions.

- We drafted an optimized estate plan with appropriate wills, trusts, and IRA, 401(k), and Roth IRA beneficiary designation forms. After we successfully established Erica’s status as disabled and she qualified as an EDB who can “stretch” distributions from her inherited retirement accounts over her lifetime, we drafted a trust for her benefit. The trust must also qualify as an EDB. To do that, the trust must be drafted to meet four specific technical conditions. The four conditions apply to all trusts when the underlying asset is an IRA, Roth IRA, or most retirement plans. If even one of the conditions is not met, the trust could lose its EDB status. Unfortunately, this type of drafting oversight is more common than not. If the trust loses its EDB status, it will trigger a massive tax acceleration for the beneficiary. An error of this type will jeopardize all your efforts to protect your beneficiary. For grandparents of a special needs child, one of our favorite estate plans is to combine our classic Lange’s Cascading Beneficiary Plan and a Special Needs Trust (we ensure that the trust meets the four conditions) for a grandchild with a disability.

In concert with optimized estate planning, we are also taking measures to ensure that our estate is administered appropriately after our death. Effective estate administration is a critical element of securing Erica’s inheritance.

Plan now to protect your disabled child after your death. Some additional strategies to consider:

- Sometimes, the best solution is to have a Special Needs Trust that allows your child to receive benefits from your inheritance without jeopardizing his/her eligibility for government aid.

- Use an ABLE account—a tax-advantaged savings account that can fund disability expenses—to save and invest money for your disabled child without affecting eligibility for government benefits. (An ABLE account is somewhat similar to a Section 529 Plan.)

- Plan for your child to inherit certain 401(k), 403(b), or other types of non-IRA retirement plans. In some situations, you can have your child to convert the balance or a portion of the inherited retirement plan to an Inherited Roth retirement plan when you pass. This little-known strategy is particularly profitable if you are in a high-income-tax bracket and your disabled child will be in a low-tax bracket. Incidentally, this is often a great strategy even if your child is not special needs.

Additional information is available at https://DisabledChildPlanning.com.

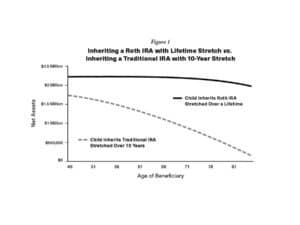

Assumptions: Figure 1

- Starting balances: $65,000 after-tax investments; $250,000 traditional IRA in 1998.

- 28 percent income tax rate on distributions for parents; 15 percent for a disabled child.

- 28 percent Roth conversion tax rate (1998) – $249,000 Roth conversion done in 1998.

- 15 percent tax on the growth of after-tax investments.

- Distributions are not spent by parent.

- 5 percent rate of return (3.5 percent inflation).

- Parent converts traditional to Roth in 1998 – $249,000 (parent age 41; child age 2).

- The parent dies at 85 in year 2041 when disabled child is age 46.

- Figure shows child stretches retirement plan for 40 years when child is age 86.

- Annual expenses for child after parent dies in $138,200 in today’s dollars.

- Maximum 401(k) contributions by parent in years 1998 – 2026 (age 70).

- Maximum IRA contributions by parent and spouse in years 1998 – 2026 (age 70).

- We do not include any government benefits the child has received already or may receive in the future.

- In year 2042, when the child is age 46, the child will pay his/her expenses using inheritance.

- Since this is 20 years from now, we used $275,000 in annual expenses for the disabled child which equates to $138,200 in today’s dollars or $11,500/month.

- Inheritance taxes, estate taxes, and any state income tax on a Roth conversion have not been included in the analysis as Pennsylvania does not tax retirement distributions.

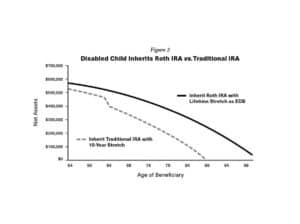

- 5 percent rate of return.

- Traditional IRA assets = $500,000 + $152,000 after-tax dollars at death.

- Roth IRA assets = $557,000 + $0 in after-tax dollars at death.

- Owner dies age 85.

- Child inherits at age 54.

- In “inflation-adjusted” dollars.

- Tax rates = per AGI.

- Child Social Security = $25,000 (plus 3 percent inflation).

- Expenses = $103,000 [18 years from now (plus 3.5 percent inflation) which is less than $4,650/month in today’s dollars].

- Child with a traditional IRA runs out of money when he is age 88.

- Child with Roth IRA has money through age 100.

About James Lange, CPA/Attorney/Registered Investment Advisor

Jim’s tax and estate planning strategies have been endorsed by The Wall Street Journal (36 times). He wrote 8 best-selling books including The Roth Revolution: Pay Taxes Once and Never Again and The IRA and Retirement Plan Owner’s Guide to Beating the New Death Tax: 6 Proven Strategies to Protect Your Family from The SECURE Act.

Having Roth IRA conversion and SECURE Act expertise was critical in developing Jim’s solution for his daughter and this report. Jim’s registered investment advisory firm advises on $950 million in client assets under management. Jim’s estate planning law firm has completed 2,951 estate plans including wills, trusts, and beneficiary designations of IRAs and retirement plans. Jim’s CPA firm prepares 760 tax returns annually.

Some of Jim’s books have been endorsed by the country’s top experts. Retire Secure! was endorsed by Charles Schwab, Larry King, Jane Bryant Quinn, Roger Ibbotson, and 50 other experts; The Roth Revolution, endorsed by Ed Slott, and Bob Keebler; The $214,000 Mistake, How to Double Your Social Security and Maximize Your IRAs endorsed by Larry Kotlikoff, Jonathan Clements, and Paul Merriman; and The Retirement Plan Owner’s Guide to Beating the New Death Tax endorsed by Burton Malkiel, Larry Swedroe and Stephan Leimberg.

Julieanne E. Steinbacher, Esq., CELA, is the founding shareholder of Steinbacher, Goodall & Yurchak, an elder care and special needs planning law firm, with offices in Williamsport, State College, Wyalusing and Wysox, PA. As a former social worker, she has seen the devastating effects the lack of planning for long-term care can have on a family. As an attorney, her goal is to educate the community and empower them to make planning decisions. Each of her law offices has social workers on staff to help families coordinate care and benefits. She can represent people appealing SSI or SSDI rejections in 50 states. Julie is founder and president of Estate & Long-Term Care Planning, an organization that educates estate attorneys from across the nation in areas of law and best practices. She has over 20 years of experience drafting special needs planning documents for families and administering estates.

Big News!

Deborah L. McFadden, who was appointed by President George H. W. Bush as U.S. Commissioner of Disabilities (1989–1993) and was instrumental in writing and passing the Americans with Disabilities Act of 1990 is joining our team to contribute and promote our Special Advisory Report for Parents of a Child with a Disability.

Debbie is probably the most connected person in the disability community. She is the mother of Tatyana McFadden who has won 20 Paralympic medals, including eight gold medals. Tatyana is also offering us her full support to promote the report.

The media is writing about our movement to help parents with a child with a disability. Please read the below articles.

| Jim Lange spoke with CNBC Senior Personal Finance Correspondent Sharon Epperson about the information and strategies in this Special Advisory Report for Parents of a Child with a Disability. Click here to read her article, 1 in 4 adults in the U.S. lives with a disability. Having a financial plan to address care is critical. |

| The disability dilemma: How to use retirement tools for a special needs child published in Financial Planning features Jim Lange discussing his personal life changing journey of securing the financial future of his disabled daughter. Click here to read more. |