Table of Contents

Photo: Steve Forbes was one of the speakers at an event Jim attended in Dallas. Steve likes to meet Forbes and Forbes.com contributors. He even signed one of the articles,

Photo: Steve Forbes was one of the speakers at an event Jim attended in Dallas. Steve likes to meet Forbes and Forbes.com contributors. He even signed one of the articles,

“Good writing! – Steve Forbes”

New Trump Tax Laws Make 2019 the Best year to Do a Roth IRA Conversion

by James Lange, CPA, Attorney, and Financial Advisor

Reprinted with permission by Forbes.com

Last month, I told you about a Forbes magazine article on Roth IRA conversions in which I was the featured expert. You can expect to receive a reprint of that article in the mail very soon. The following article, reprinted with permission by Forbes.com, is a companion piece on the same topic.

Your traditional IRA has a silent partner named Uncle Sam. Whenever you withdraw money from your IRA, voluntarily or because of required minimum distributions, your partner gets a big bite of every withdrawal. A Roth IRA conversion essentially buys Uncle Sam out of your partnership through an up-front tax payment. The amount you convert is added to your current income and taxed at the appropriate rate, after which the money in the Roth IRA is all yours—no more taxes will be collected on the principal or on the growth.

See where I said the “appropriate rate?” That is the key. Because of today’s lower income tax rates—which are not likely to remain sustainable—now may be the opportune time to make a Roth IRA conversion.

The Benefits of a Roth IRA Conversion.

Roth IRA conversions can leave you and your spouse better off by hundreds of thousands or even a million dollars during your own lifetimes, but those benefits pale in comparison to those that your children or grandchildren could enjoy over their own lifetimes. Ashlea’s article ends with a quote from me about how I’d love to see my own Roth IRA grow tax-free for 100 years. Why? Because a hundred years of tax-free compounding could leave my daughter and even my grandchildren millions upon millions of dollars better off.

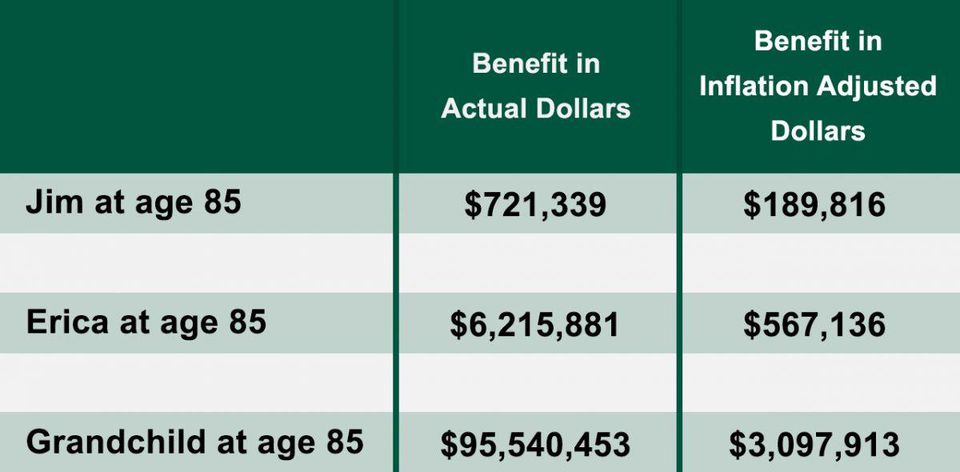

If you are a long-term investor—particularly if you are someone who sees themselves as responsible for protecting and growing the family wealth, the “family stewards” so to speak―a Roth IRA conversion could benefit your heirs for generations to come. So, let’s get into some of the nitty-gritty numbers that support that claim. My wife, Cindy and I made a $239,000 Roth IRA conversion in 1998. The following chart shows the benefit to my wife and me, our daughter, Erica, and our future grandchildren. This assumes a 7% rate of return for actual dollars, and I also show the benefit in inflation-adjusted dollars.

The chart above shows the benefit to my wife and I along with our daughter, Erica, and our future grandchildren.

These numbers are based on the current tax laws, and they also assume no one ever spends my Roth IRA or the income my Roth IRA generates. The point is meant to be dramatic to catch your attention.

You might not think it is realistic nor even advisable that my heirs will not spend any of my Roth IRA. But even if my daughter needs the money after I’m gone, my family will benefit by hundreds of thousands of dollars and, in the long run, could be more than a million dollars better off because of my conversion.

You may also think 7% is an unrealistically high rate of return. I actually think you could do better for the reasons given below. Subject to some exceptions, most of my clients plan on spending their Roth IRAs only after they run out of all other funds. Then when they die, they will leave the Roth IRAs to their heirs who will hopefully allow the inherited Roth IRA to grow income-tax-free for as long as possible. What this means is that a Roth IRA, for most investors, produces better results if it is invested for the long run.

I like to think of dividing your portfolio in a number of buckets with each bucket invested differently. The first bucket or money that you need to use in the short term for routine expenses should be invested very conservatively – with cash, CDs, maturing bond ladders, etc. On the other end of the spectrum, the longest-term bucket is money that you plan to spend last and probably won’t ever spend unless all of your other resources are completely exhausted. We treat Roth IRAs as part of your longest-term bucket. Given that scenario, a 7% rate of return on a Roth IRA could be a conservative estimate.

The Best Time to Do a Roth IRA Conversion

Ideally, the best time to convert your traditional IRA to a Roth IRA is when you are in your lowest tax bracket and when the stock market is down. But no one has consistently predicted market highs and lows, and they don’t ring a bell at the bottom or top. The good news is that you do know your current tax bracket and you can take your best estimate at your future tax brackets. Armed with that information, you can begin to build a Roth IRA conversion plan that is part of your master plan.

What should you do next? How do you know if a Roth IRA conversion would be a good idea for you? How much should you convert? When is the best time to make the conversion? Should you do it all at once or perhaps make a series of smaller Roth IRA conversions over a period of years?

Unfortunately, there’s no “one-size-fits-all” answer to those questions. That’s why I recommend “running the numbers.” “Running the numbers” involves constructing plausible scenarios using reasonable assumptions for your current and future tax brackets, your spending, earning, and investing patterns, and then testing different courses of action. It is a combination of art and science.

The first projection may exclude all Roth conversions, which allows you to see where your finances will stand at the end of your life and what maintaining the status quo will mean for your heirs. A second projection might use the same assumptions but show the outcome if you convert your entire traditional IRA to a Roth IRA in one tax year. A third projection might include a series of partial conversions, perhaps over four years during the years after you retire, but before you turn age 70 when you will have required minimum distributions and will be receiving your full Social Security benefits. Taking the time to construct different scenarios is critical because the best time to do a Roth IRA conversion is not the same for everyone.

One major consideration that is overlooked by many advisors is Social Security. Ashlea correctly points out that the classic “sweet spot” to make a Roth conversion is after you retire but before age 70. At that point, you won’t have income from your job or required minimum distributions from your retirement plans. But I go so far as to recommend that the primary wage earner of the family delay applying for their full Social Security benefits until age 70. When planned and orchestrated, all of these factors can come together in a perfect symphony of financial opportunity, leaving your income tax bracket at an all-time low, and cued-up for a Roth IRA conversion.

An additional benefit of “running the numbers” is that you may find you are not a good candidate for a Roth IRA conversion. Many IRA owners will have higher Medicare Part B premiums if their taxable income is increased because of a Roth conversion. Other IRA owners will suffer a reduction in the benefits of the qualified dividend exclusion, and others will face additional tax in the investment income area. Many of these disadvantages may pale compared to the benefits, but the only way to know is to run the numbers first.

Ultimately, the new tax laws mean that Roth IRA conversions can benefit many more people even before retirement or who are currently in retirement. This is because, if you are married and file a joint return, you can have up to $315,000 in taxable income and still fall within the expanded 24% tax bracket. Many taxpayers who are still working, or who are over age 70 but previously sat in a high enough tax bracket to make a Roth IRA conversion unprofitable, may now find that this is the best possible time to make the change. This is especially true if you believe tax rates are likely to increase in the future.

So, what is the big takeaway? It would be a smart move for many taxpayers to analyze the merits of a Roth IRA conversion. And, if previously you determined that a Roth IRA conversion was not in your best interest, you should probably revisit the idea—times have changed.

Let’s be clear. This isn’t just about dying with the most money—you must also evaluate your priorities. One of the benefits of creating a master plan is to determine how much you can safely spend, and with a very high probability that you will never run out of money. Perhaps it won’t matter to you that your heirs could be a million dollars better off because you want to spend more money yourself. Perhaps you want to buy a second home in your dream location even if, God forbid, you have to use part of your Roth IRA to do it. These are personal decisions and each piece needs to fit into your retirement and estate planning puzzle. Roth IRA conversions, although financially beneficial for many people, are only one piece of the puzzle.

This is a complicated topic, but an important one. If you would like our help in developing your Master Plan, please call the office at 412-521-2732.

Free Workshops

Cut Taxes on Your IRA Withdrawals with the New Trump Tax Laws

Saturday, April 27, 2019

Hilton Garden Inn Pittsburgh/Cranberry

2000 Garden View Lane

Cranberry, PA 16066

9:30 – 11:30 AM

Who Says You Can’t Control From the Grave? Using Trusts to Protect Your Family.

1:00 – 3:00 PM

Cut Taxes on Your IRA Withdrawals With the New Trump Tax Laws.

3:15 – 4:00 PM

Solving the Investor’s Biggest Dilemma: How to Stop the Current Market Volatility from Threatening Your Long-Term Security.

To attend any or all of our 3 FREE retirement workshops, call 412-521-2732 or follow the link for how to reserve your seat here.

Saturday, May 4, 2019

Wildwood Golf Club – Alison Park

2195 Sample Road

Allison Park, PA 15101

9:30 – 11:30 AM

Who Says You Can’t Control From the Grave? Using Trusts to Protect Your Family.

1:00 – 3:00 PM

Cut Taxes on Your IRA Withdrawals With the New Trump Tax Laws.

3:15 – 4:00 PM

Solving the Investor’s Biggest Dilemma: How to Stop the Current Market Volatility from Threatening Your Long-Term Security.

Again, to attend any or all of our 3 FREE retirement workshops, call 412-521-2732 or follow the link for how to reserve your seat here.

Soduko

Jim with Host, Alex Steiniger, of The Morning Blend, an ABC-TV affiliate in Tucson, AZ.

Jim with Host, Alex Steiniger, of The Morning Blend, an ABC-TV affiliate in Tucson, AZ.

On March 13, 2019, Jim was invited to be a guest on The Morning Blend, an ABC-TV affiliate in Tucson, AZ.

Jim strives to educate as many Americans as possible so they, too, can get the most out of what they’ve got!

Jim’s segment focused on Roth IRA conversions and why now is the time to take advantage of this wealth-creation opportunity…buy out Uncle Sam today at 24% and lock in tax-free income that could enrich your family for generations!

Due to the 24% tax bracket in Trump tax laws, more IRA owners than ever before have the potential to benefit from a Roth IRA conversion. Traditional IRA owners who were good candidates for a Roth IRA conversion before the tax reform are now more likely good candidates for even larger Roth IRA conversions.

You can view Jim’s segment at www.paytaxeslater.com/morningblend.