Table of Contents

How Should you Respond to the Recently Passed SECURE Act?

by James Lange, CPA/Attorney

The Stretch IRA is dead. The SECURE Act was included in the recent end-of-year Appropriations Act, and it put the final nail in the coffin. Many of our clients are justifiably alarmed. Everyone wants to know how they can protect their family and heirs from this 10-year tax grab that threatens to confiscate one-third of IRAs and/or retirement plans after the death of IRA owner—surviving spouses and some other “eligible designated beneficiaries” excluded.

Our office is responding. Here are some resources for you:

Our next set of workshops are scheduled for Saturday, February 29, 2020, at Courtyard by Marriott in Monroeville. You can register online at https://paytaxeslater.com/workshops. Please note that our workshop attendance is exploding. The February 8, 2020 workshop in the South Hills was held in a room with a 90-person capacity, and we still had to turn away 25 interested participants. If you want to attend our next workshop, please call right away—412-521-2732. If attending is not possible, we taped the entire day of our previous workshop, and we plan to release the DVD in May. Please email us at requests@paytaxeslater.com or call Alice at 412-521-2732 to put your name (and the names of family and friends) on the list to receive the DVD as soon as it is ready.

https://paytaxeslater.com/leimberg is a link to a reprint of an article called Guide To Beating The New Death Tax: The End Of The Stretch IRA recently published in Leimberg Information Services, Inc., a prestigious journal for tax professionals, estate attorneys, and other financial advisors.

Just this past fall, we mailed out copies of a green spiral-bound softcover book called Retirement Plan Owner’s Guide to Beating the New Death Tax. It was our “early warning” system for the incoming destruction of the SECURE Act. As many of you know, I have been warning of the death of the stretch IRA since 2015—and as they say, forewarned is forearmed. It has been my mission to offer strategic advice—and a tactical advantage—all these many years, and that was the message in the book. I wanted you to start taking action even before the law passed. Most of that book is still pretty much on point and that would be a great starting point for additional information and an introduction to why you need to act on these changes to IRA and retirement plan rules. Your family’s long-term security is at stake.

Now that the SECURE Act has passed and many of the details have been clarified (though there are still some gray areas), we are expanding and updating our “early warning system” with specific calculations and new insight. We are approaching the final stages of editing the new book to be published in the spring. All clients will be notified as soon as it is ready.

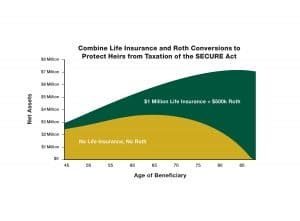

I hate to toot our own horn (well, maybe just a bit…), but our dedication to “running the numbers” continues to provide striking insights and valuable information. I knew from prior calculations that the combination of life insurance and Roth IRA conversions would be a great solution for many clients. I didn’t realize how great it was until we ran the numbers. The chart below quantifies the disparity between not engaging in any pro-active planning and making a series of Roth IRA conversions and buying life insurance.

The solid line reflects the same assumptions except the parents made five $100,000/year Roth IRA conversions and bought a million-dollar second-to-die life insurance policy with an annual premium of $22,000/year.

The difference is striking, to say the least. At age 85, the child of the parents who were proactive ends up with $7,000,000, and the other child is broke. While that scenario might have a greater difference for the child than your particular situation, it does offer a dramatic example of the effectiveness of thoughtful and strategic planning. Some clients might be in a position to afford an even bigger policy, others either a small policy or perhaps none at all. But the point is: careful quantitative planning can illuminate windfalls, as well as expose shortcomings in anyone’s long-term financial and estate plan.

If you are interested in having us “run your numbers” and/or “have a portion of your assets professionally managed in addition to having us run your numbers” for one low annual fee, and make recommendations for you, please call Alice at 412-521-2732.

Securities investing involves risks, including the potential for loss of principal. The chart is for illustrative purposes only. There is no guarantee that any specific return % will be achieved or that any investment plan or strategy will be successful.

2019 IRS Publishes Final Regulations Preventing the Clawback of Large Gifts

by Matt Schwartz, Esq.

EPSON MFP image

Do you think your estate will grow to more than $5,000,000 (indexed for inflation) by 2026? Are you worried about your kids having to pay federal estate and gift taxes if the federal estate and gift tax exemption amount is reduced in the future?

You may say based on the 2020 federal estate and gift tax exemption of $11,580,000 per person that there is no reason to worry about federal estate and gift taxes. Think again.

As part of the 2017 Tax Cuts and Jobs Act, Congress only temporarily doubled the federal estate and gift tax exemption amount (indexed for inflation) from $5,000,000 to $10,000,000 for the tax years from 2018 through 2025. After 2025, the federal estate and gift tax exemption is scheduled to sunset back to $5,000,000 (indexed for inflation).

Because of the real possibility that the federal estate and gift tax exemption will be reduced to pre-2018 levels, practitioners have been concerned about a concept called “clawback” for large gifts made between 2018 and 2025. If you die after 2025 with a combination of taxable lifetime gifts (gifts beyond annual exclusion gifts) plus the balance of your estate exceeding the reduced federal estate and gift tax exemption, will part of the gifts made between 2018 through 2025 above the future federal estate and gift tax exemption be added back into your taxable estate?

Fortunately, the IRS has answered this question with a definitive “no.” Final regulations were published in November 2019 permitting taxpayers to use the greater of the federal estate and gift tax exemption not to exceed the federal estate and gift tax exemption allowable on the dates of the gifts or the actual federal estate and gift tax exemption.

For example, if an unmarried individual made taxable gifts of $7 million between 2018 and 2025, all of which were sheltered from gift tax by the cumulative $10 million (indexed for inflation) federal estate and gift tax exemption allowable on the dates of the gifts, and the individual dies after 2025 when the federal estate and gift tax exemption is $5 million (indexed for inflation), the final regulations permit the taxpayer to use a federal estate and gift tax exemption amount of $7 million avoiding the “clawback” of any of these gifts.

As an additional bonus, the IRS clarified that a surviving spouse who received a Deceased Spousal Unused Exclusion (DSUE) amount from their spouse dying in years between 2018 and 2025 will preserve the full amount of the DSUE if that spouse dies after 2025.

We do not know if Congress will allow the increased federal estate and gift tax exemption sunset after 2025. However, we do know that taxpayers who can afford to make large gifts and get the appreciation of those gifts out of their estate should not be afraid to do so because of fear that the IRS will “clawback” such gifts if the federal estate and gift tax exemption does sunset.

In conclusion, the next six years are incredible years to transfer wealth if your estate is likely to have federal estate tax exposure or if you are in a position to pass wealth to your family while you are alive. Just be careful not to ignore step-up-in-basis and income tax issues as part of the process.

We’re Hiring!

We are looking for two new employees who are interested in building a long-term career with our company.

If you know of someone who you think would be a qualified candidate, please ask them to email their cover letter and resume to matt@paytaxeslater.com. Cover letter and resume can also be faxed to 412-521-2285, Attn: Matt Schwartz. Thank you for your help!

Assistant Bookkeeper

Seeking a full-time Assistant Bookkeeper who is hard-working, is independent, flourishes in a fast-paced work environment have strong communication skills and interacts well with a supportive and energetic team. The primary focus is learning from our bookkeeper with career advancement to primary bookkeeper in several years.

Personal Assistant & General Office Helper

Seeking a full-time Personal Assistant & General Office Helper to run errands, order office supplies, assemble folders and handle filing. Candidate must be able to lift 50 lbs., perform handyman duties, have a valid PA driver’s license and a dependable vehicle, have a cell phone and be willing to work one Saturday a month.

Sudoko

Turkey Burgers

Serves: 4

Prep. Time: 20 minutes

Cook Time: 15 minutes

- ¼ cup apple cider vinegar

- ¾ teaspoon sea salt

- ½ teaspoon freshly ground black pepper

- 12 ounces radishes, very thinly sliced

- 1 teaspoon fresh lime juice

- 2 tablespoons mayonnaise

- 1 pound ground turkey

- 1 large zucchini, coarsely grated

- 1 bunch chives, thinly sliced

- 1 large egg, beaten

- 1 teaspoon ancho chile powder

- 1 teaspoon ground cumin

- ¼ teaspoon cayenne pepper

- 2 tablespoons grapeseed oil

- 16 red leaf lettuce leaves

- 2 tomatoes, thinly sliced

Combine the vinegar and ¼ teaspoon each of the salt and black pepper in a medium bowl. Add the radishes, turn to coat, and let stand. In a small bowl, whisk the lime juice into the Mayonnaise; set aside.

Combine the turkey, zucchini, chives (reserve a little for the garnish), egg, chili, cumin, cayenne and remaining ½ teaspoon salt and ¼ teaspoon black pepper in a large bowl. Form into 4 equal-size patties.

Heat the grapeseed oil in a large nonstick skillet over medium heat until shimmering. Add the patties and cook, until cooked through, about 15 minutes.

For each serving, stack 2 lettuce leaves and place 1 burger in the center. Top each burger with some of the lime-mayo mixture, tomato slices, pickled radishes, and reserved chives. Sandwich with 2 more lettuce leaves and serve with any remaining radishes on the side.

Free Workshops

Saturday, February 29, 2020

Courtyard by Marriott Monroeville

Meeting Room A/B

3962 William Penn Highway

Monroeville, PA 15146

Reserve your seat today by calling 412-521-2732 or go to PayTaxesLater.com/workshops to RSVP.

Little-Known Tax Law Changes (Snuck Into Law by Congress Effective January 1, 2020) Will Confiscate Hard-Earned Retirement Dollars from Unprepared IRA Owners

9:30 – 11:30 a.m.

The Best Estate Plan for Married IRA Owners After the SECURE Act

1:00 – 3:00 p.m.

How to Stop Changes in Tax Laws from Taking Up to 1/3 of Your IRAs and Retirement Plans in Taxes After the SECURE Act

3:15 – 4:00 p.m.

Solving the Investor’s Biggest Dilemma: How to Stop Market Volatility from Crushing Your Retirement Nest Egg in the Next Downturn