Table of Contents

- Striving to be the Best Influence

- A Point-by-Point Summary of the Whole Retirement & Estate Planning Process

- charity: water

- Recipe: Green Beans and Almonds

Striving to be the Best Influence

by James Lange, CPA/Attorney

The April edition of Time magazine’s annual list of the 100 most influential people inspired me to think of ways I could be more influential. Trust me, I don’t have any delusions about making Time’s list but thinking about the challenge is food-for-thought.

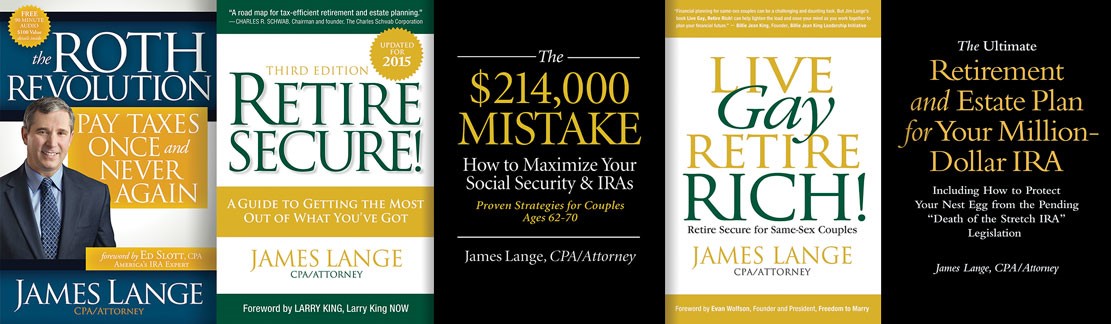

I believe my commitment to financial education (books, radio shows, 10,000 email newsletter subscriptions, articles, workshops), has been and is influential. The work my team and I perform for our clients has also had a significant impact on people’s quality of life.

But, I also believe that the demographic I reach is not all that broad. The people I influence are predominantly affluent, middle and upper middle class. I help them get the most out of their assets while they are alive and after they are gone. That is a worthwhile endeavor and lots of readers and clients and their families will be much better off. But much of my effort is aimed at helping people cut taxes. If cutting taxes because you are broke is the least of your concerns, my tax advice will be only minimally relevant.

I did try to expand my range of influence by writing two good books focused on tax and Social Security strategies for same-sex couples—I wrote them before same-sex marriage was legal in all 50 states. No other author quantified the benefits of the marriage. Today, one of those books could be repurposed and called Get Married for the Money. We received some great endorsements from a lot of CPAs, attorneys, and financial experts and even some celebrity endorsements from Billie Jean King, Evan Wolfson, and Martin Sheen, they did not translate into generating more clients, or even questions from couples who might have benefited. I was even quoted in The Wall Street Journal, Bloomberg and many other media. I thought I did everything right, but fear that book did not have enormous influence.

Undaunted, I thought who else could use some good advice? In 2015, I wrote a book on maximizing Social Security benefits. Some of my business advisors didn’t think Social Security was a great topic for me because my target audience is people who regard Social Security as a supplement to their income, not their main income. They thought the book would attract people who frankly didn’t have enough money to meet our investment minimums or be able to afford our fees. From a pure business standpoint, I think they are right—but I needed to write the book.

The book was a moderate success. At the time there was a technique called “apply and suspend” that was a great deal for anyone who qualified. But, as a strategy, it was on its way out. You had to put all the pieces in place before the expiration date. I also wanted to teach people who didn’t qualify for apply and suspend how to maximize their benefits too. For too many people, Social Security is their only safety net. According to an AARP report , Social Security is the principal source of income for nearly half of older Americans. The Social Security Administration estimates that 43% of seniors rely on Social Security for 90% or more of their income.

Adding insult to injury, according to a 2018 Retirement Savings survey conducted by GOBanking, 42% of Americans are at risk of retiring broke! Nearly half of Americans have less than $10,000 stashed away for retirement. Average annual spending for adults age 65 and older is $46,000. As I mentioned above, generally speaking, these individuals are not going to benefit from much of my classic tax advice. But, keeping people abreast of changes in Social Security and helping people maximize their Social Security benefits is an area where I can help make a difference for an audience that I might not otherwise reach.

Three years later, another Social Security technique for maximizing benefits, filing a “restricted application” is on the chopping block. I had already identified a need, so it made sense to update our Social Security book. Our new book is titled: The $214,000 Mistake—How to Maximize Your Social Security & IRAs—Proven Strategies for Couples Ages 62-70. And let me point out, if you have upwards of two million dollars to support your retirement, then an additional $214,000 is welcome, but it will not be life-changing. If you are on the margin, however, $214,000 will be life-changing. Smart decisions by people dependent on Social Security are essential, but rarely done right.

The advice in the book is relevant for most married couples between the ages of 62 and 70, but it also includes recommendations for divorcees and singles. But, for people who will need to rely more significantly on Social Security, it could make the difference between being broke and being able to comfortably get by. The group that faces the greatest financial peril is older women. Their husbands, traditionally the primary wage earner, often decide to begin receiving their Social Security as early as possible. The consequences for the surviving wife (statistically the odds) will be disastrous—they will be broke for the remainder of their lives—alone and broke, a miserable combination. Well, maybe my book can prevent that, or at least give some people a fighting chance.

I want my new book, which should be available in July 2018, to reach the audience that might need it most. So, one effort I am going to make to become more influential is to promote the new book more broadly to people who will never be clients or prospective clients. I will give anyone as many copies as they can use. I am trying to use celebrities as voice talent for the audio version.

I hope you will help me. Think of people in your life that you do business with, or perhaps work with, and feel free to ask us for additional copies to share. Write a review on Amazon if you think the book has helpful information. As my schedule permits, I will be happy to speak to civic/social groups that do not reflect my target audience for business. Oh, and just so you know, 100% of any profits from the book will be donated to charity: water, an important charity dedicated to providing drinkable water to people all over the world.

I have two other book projects in the works that will be directed at my target audience. I intend to keep working for many years yet! But, for right now, I would like to expand my area of influence. With your help and my marketing team, I think I really can make a difference in people’s lives. I am truly grateful for all that I have, and I embrace this opportunity to help others.

A Point-by-Point Summary of the Whole Retirement & Estate Planning Process

by James Lange CPA/Attorney

If you are still working, please:

Contribute at least the amount to your retirement plan that your employer is willing to match or partially match.

If you can afford to, contribute the maximum allowed to your retirement plan even if your employer does not match.

Once you have maximized contributions to your plan at work, contribute the maximum you can to an IRA, even if you cannot take a tax deduction for it.

Consider your personal tax bracket when trying to decide if you should contribute to a Roth or a traditional IRA/retirement plan.

Do not take loans against your retirement plan. Allow the tax-deferred or tax-free status of the account to maximize the growth of your money.

If you don’t need the income, don’t take distributions from your retirement plan until you are required to.

At retirement, when you need money:

Understand the advantages and disadvantages of moving your old company retirement plan. If you do move it, consider using a trustee-to-trustee transfer to move it to an IRA or a one-person 401(k).

Look for opportunities to make tax-free transfers of after-tax contributions to a Roth IRA.

If you have company stock in your retirement plan, look for opportunities to transfer it while avoiding capital gains tax on the appreciation.

When you need to spend money, spend non-retirement assets (money you already paid income tax on) first.

When your after-tax assets run down, spend your traditional retirement plans and Roth plans strategically, to minimize the impact the withdrawals will have on your income taxes.

Plan for needed or Required Minimum Distributions from retirement plans during your lifetime.

Keep distributions from retirement plans to a minimum.

If you don’t need the income from the minimum distributions, consider improving your tax situation by directing that all or part of the distribution be sent to a qualified charity.

Take advantage of the years after you retire, but before you are required to take minimum distributions, to convert some of your traditional retirement assets to Roth accounts.

Consider using annuities if you want a guaranteed lifetime income.

When planning for your heirs:

If you have not had your wills and/or trusts reviewed in the past five years, do so as soon as possible. Changes in the laws have made many older documents obsolete.

These legislative changes also make it necessary that you review your beneficiary designations.

Make your estate plan as flexible as possible by incorporating the use of disclaimers.

Consider implementing a formal gifting strategy to benefit your children, grandchildren and favorite charities.

663 million people in the world live without clean water. That is nearly 1 in 10 people worldwide or twice the population of the United States. The majority live in isolated rural areas and spend hours every day walking to collect water for their family. In Africa alone, women spend 40 billion hours a year walking for water. Not only does walking for water keep children out of school or take up time that parents could be using to earn money, but the water often carries diseases that can make everyone sick. Diseases from dirty water kill more people every year than all forms of violence, including war. Access to clean water means education, income and health – especially for women and kids. When a community gets water, women and girls get their lives back. They start businesses, improve their homes, and take charge of their own futures.

charity: water works in 20 developing countries in Africa, Asia, Latin America, and the Caribbean. They work with local experts and community members to find the best sustainable solution in each place they work. And with every water point they fund, their partners coordinate sanitation and hygiene training, and establish a local Water Committee to help keep water flowing for years to come. *

100% of the non-profit’s public donations go directly to clean water technologies that range from wells to water filtration. It is a platinum-level GuideStar participant demonstrating its commitment to transparency, and it receives a full four-star rating from Charity Navigator.

As mentioned in lead article, Striving to be the Best Influence, 100% of all profits from the sale of The $214,000 Mistake—How to Maximize Your Social Security & IRAs—Proven Strategies for Couples Ages 62-70 will be donated to charity: water, a non-profit organization bringing clean and safe drinking water to people in developing nations. For people in developing countries, clean water can change everything. We are happy to be part of their mission to bring clean water to undeveloped countries.

*All information taken directly from the charity: water website, https://www.charitywater.org/global-water-crisis/

Green Beans and Almonds

Serves: 4

Prep Time: 10 minutes

Cook Time: 5 minutes

- Sea salt and freshly ground pepper

- 1 ½ pounds green beans, trimmed and halved

- 2 teaspoons Dijon mustard

- ½ shallot, minced

- 1 garlic clove, minced

- 2 tablespoons extra-virgin olive oil

- 1 tablespoon walnut or hazelnut oil

- ¼ cup slivered almonds

Bring a 5-quart pot of water to a boil over high heat. Add 1 tablespoon salt. Add the green beans and book until crisp-tender, 3 to 4 minutes. Drain and immediately rinse with cold water.

Whisk together the mustard, vinegar, shallot, and garlic in a small bowl. Whisk in the olive oil and nut oil until combined. Season with a pinch each of salt and black pepper.

Drain the cooled beans, pat them dry and then transfer them to a serving bowl. Toss the beans with the dressing, and then gently mix in the almonds. Serve.