Charitable Remainder Trusts Deserve a Second Look After the SECURE Act:

Even if Your Primary Goal is Protecting Your Family

The SECURE Act, effective January 1, 2020, contains a provision that could be financially devastating for the children of IRA, 401(k) and other retirement plan owners. The provision modifies the Required Minimum Distribution (RMD) rules for Inherited IRAs and retirement accounts. Subject to some exceptions, the most important being your surviving spouse, an Inherited IRA or retirement plan will have to be distributed and taxed within 10 years of the original owner’s death. Setting up a Charitable Remainder Trust (CRT) as the contingent beneficiary of your IRA or retirement plan (the primary beneficiary would be your spouse) is one strategy to offset the forced income-tax acceleration caused by the SECURE Act.

The Big Picture with Charitable Remainder Trusts (CRTs)

There are many situations where your children would get more money and a steadier income if you named a CRT as the beneficiary of your IRA than if you named your children directly. If you have a million dollars or more in your IRA, even if you aren’t very charitable, you should at least consider naming a CRT as the beneficiary of your IRA.

What is a CRT?

Here’s how a Charitable Remainder Unitrust (CRUT) works at the basic level. When you die or when both you and your spouse are dead, what remains of your IRA could be transferred to a CRUT and the Inherited IRA can then be liquidated without paying taxes. To be clear, this trust is a testamentary trust meaning that it isn’t funded before you and your spouse die. While you are alive, there is no tax return, no money goes into it, and other than some paper sitting in a fireproof drawer, it doesn’t exist. It is totally revocable meaning you can change it as long as you and/or your spouse are alive. But, after you and your spouse die, if you name it as the beneficiary of your IRA or retirement plan, it comes to life.

The conventional approach would be to leave your IRA directly to your child and all of it will be taxed in 10 years. With a CRUT, your child won’t get a lump sum of money when you die—but he also will not face a big tax bill immediately after you die or as big a tax bill even 10 years after you die. He would receive a regular “income” from the CRUT for the rest of his life.

The distribution from the CRUT (customarily somewhere between 5% or 10% of the assets depending on the age of the beneficiary and the Section 7520 rate under the Internal Revenue Code) to your child would be treated as ordinary income until the amount of the initial IRA plus any interest and dividends earned in the CRUT has been paid to your child. After the ordinary income has been distributed, then capital gains would be distributed from the CRUT to your child and that distribution would receive the more favorable capital gains rates. Finally, when your child dies, whatever is left in the CRUT goes to the charity of your (or your child’s) choice.

The CRT must be set up in a way that the charity receives at least 10% of the present value of the bequest at the date of death, but that leaves 90% for your child. When you take into account the enormous tax benefits of the CRUT, your child often gets more value, sometimes by hundreds of thousands of dollars, than if you just leave the IRA outright to your child.

Is a CRT an appropriate solution or even a partial solution to respond to the SECURE Act? Having charity in your heart is a major bonus, but given the right fact setting, it might be a great solution even if you are much more focused on your family than charity.

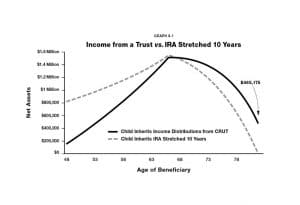

The graph below shows that your child will likely get more money over his lifetime as the beneficiary of a CRUT than if he receives your $1 million IRA outright.

Graph Assumptions

80-year-old parent dies with $1,000,000 IRA & $100,000 cash

7% rate of return

3.5% inflation on income and expenses

Child 48 when a parent dies

Annual distributions from Inherited IRA $143,000 for 10 years (32% tax bracket)

Total income distributed from IRA, $1,421,399

Total income distributed from CRUT, $1,946,227

Child’s wages $100,000 to age 65

Child’s Social Security at FRA, $27,000

Child’s annual living expenses $90,000

In many situations, it would make more sense to leave your IRA or a portion of your IRA to a CRT than to leave it to your child directly. It is possible, even likely, that your child would actually end up with more money if you left the IRA to a charitable trust than if you left it to him outright.

COMING SOON…Jim’s newest book, The IRA and Retirement Plan Owner’s Guide to Beating the New Death Tax: 6 Proven Strategies to Protect Your Family from the SECURE Act, will give you cutting-edge strategies to protect your family from the devastating new tax law ironically named the SECURE Act. Go to https://paytaxeslater.com/BeatDeathTaxBook to get your free pre-publication copy.