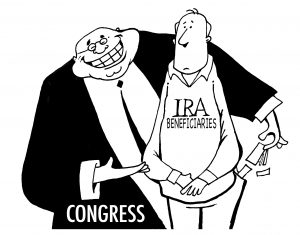

It’s Here. Congress and the President Killed the Stretch IRA

Randy Bish

The recently passed SECURE Act should infuriate you and motivate action. This new law, unless you literally make a seismic shift in your thinking and take significant action will, subject to exceptions, allow the IRS to confiscate up to one-third of your IRA and retirement plan after you die. This is the final nail in the coffin for the stretch IRA as we have known it.

The ticking time bomb in the SECURE Act is the provision that triggers new rules governing Required Minimum Distributions (RMDs) for Inherited IRAs and retirement accounts. An Inherited IRA or retirement plan will have to be distributed and taxed within 10 years of the original owner’s death.

To put it bluntly, this law stinks. Tim Grant just quoted me in the Pittsburgh Post-Gazette on the topic of the SECURE Act: “The deal all along was if you put money in an IRA after you die, your kids get favorable tax treatment. Now, the government is saying ‘we changed our mind—too bad for you.’ I think that’s a betrayal.”

These changes will be especially brutal if IRAs and retirement plans are your family’s biggest asset. You made major sacrifices to contribute to our IRAs and retirement plans. On top of mortgages, car payments, living expenses, kids’ braces, and college tuition, you diligently contributed the maximum you could afford into your company-sponsored retirement plans. You did this for 30 or 40 years to secure a bright financial future for yourself and your family.

Now, the government pulls the rug out from under us. We were promised a benefit and acted on that promise in good faith. In contract law, that is called detrimental reliance. We are now being told “sorry, the rules have changed.” We can’t sue the government, but we can radically change our planning to protect our families.

I have been warning about “the death of the stretch IRA” and making recommendations for over five years. I wrote about it in my book, Retire Secure!; I wrote three peer-reviewed articles in 2016 and 2017 for Trusts & Estates; I gave dozens of workshops on the topic. I published two articles this year in Forbes.com, including an article published after the legislation passed on December 26th which earned an Editor’s Choice and over 50,000 views.

There isn’t room for a full description of the pro-active steps IRA and retirement plan owners should be taking. In a nutshell, here are some, but not all, of the important steps to consider:

- Redo wills, trusts, and IRA and retirement plan designations.

- Consider a much more aggressive long-term Roth IRA conversion plan.

- Rethink a gifting program in the form of straight forward gifts, 529 plans, gifts for your children’s and grandchildren’s Roth IRAs and 401(k)s and reconsider life insurance.

- Rethink Social Security.

- Take your family on a vacation every year. The experiences and memories created on those vacations are a much more valuable form of wealth than leaving a big IRA that will get clobbered with taxes.

- Consider a major “location shift” in your asset allocation. Different allocations should now be considered for after-tax dollars, IRA and retirement plan dollars and Roth IRA dollars.

Free Resources for Subscribers

- Call to reserve your seat at our free educational workshops to be held on the first, second and last Saturdays in February. Details at paytaxeslater.com/workshops. Please note we anticipate these workshops will fill.

- Request a copy of my book, Retirement Plan Owner’s Guide to Beating the New Death Tax, available in hard copy for free by calling my office at 412-521-2732 or a digital copy for 99 cents on Amazon at paytaxeslater.com/secureactbook. At a minimum, read the overview and skim the table of contents for the information most relevant for you.

- Go to our website, paytaxeslater.com or Forbes.com and read the article I just published with Forbes.com.

Contact Us if You Need Help

What does my history with predicting and analyzing the consequences of the death of the stretch IRA mean to you?

You will be hearing a lot about the SECURE Act from a rash of Johnny-come-latelies who won’t have the background or experience to provide you with the best strategies. We have “run the numbers” for hundreds of clients in anticipation of some variation of the SECURE Act and have developed peer-reviewed and proven strategies that IRA and retirement plan owners can use to blunt the consequences of this devastating tax law change. If you are interested in having us help you avoid the disastrous consequences of this change, please call Alice at 412-521-2732 to see if you qualify for a free Retire Secure! consultation. It might prove to be your best decision of 2020.