The bipartisan Senate Finance Committee in a stunning 26-0 vote recommended that Congress kill the stretch IRA. The recommendations could be devastating to you if the combined value of your and your spouse’s IRAs, Roth IRAs, and retirement plans, hereafter lumped together and called IRAs, total more than $450,000. If Congress follows through, which we firmly believe will happen in 2017 or 2018 when the next major tax reform passes, and you don’t take the appropriate steps, your IRA will be taxed to oblivion after your death.

I published three articles in the peer-reviewed Trust & Estates journal and wrote two mini-books on the death of the stretch IRA. Please take this article seriously.

Let’s review the meaning of a “stretch IRA.”

A stretch IRA is an IRA that your beneficiaries (children and grandchildren) inherit, and then they choose to maintain the tax-deferred status of the account after your death. The “stretch” refers to your children keeping as much money as possible for as long as possible in the tax-deferred inherited account by limiting distributions to the required minimums. The distributions are calculated based on the child’s life expectancy, and as such can extend for many, many years. Stretching your IRA after your death, assuming appropriate planning and estate administration, can provide true financial security for your children. But that is under the current law.

The recommendations of the Committee, however, subject to exceptions, would require your beneficiaries to pay income taxes on your IRA within five years of your death. There are two major exceptions that we will point out:

1) Your spouse will not be affected by the new rule. He or she will still be permitted to do a spousal rollover or a trustee-to-trustee transfer, as is the case currently. 2) Each IRA owner is allowed to exclude $450,000 from the five-year income tax acceleration regulation, i.e., the first $450,000 of your IRA (or if relevant, the combined total of multiple accounts with the same owner) can pass to a non-spouse beneficiary and be stretched.

Quantifying the Difference between the Current Law and the Proposed Law

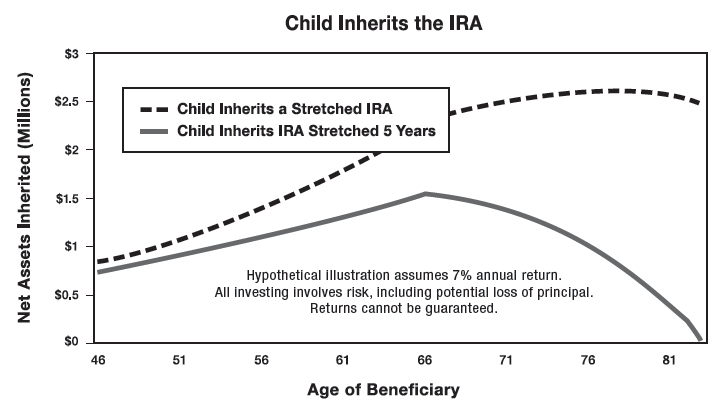

The following graph shows the difference between a child inheriting $1 million from an IRA that could be “stretched” over a lifetime (the current law) vs. a child who inherits $1 million that is subject to the five-year rule (straight line). For the purposes of this graph, we are ignoring the $450,000 exclusion.

Wow. Being forced to pay taxes sooner rather than later makes an incredible difference. Remember our mantra from the last column? Pay taxes later… it is true for you and true for your beneficiaries. The dotted line represents the beneficiary who was able to stretch or defer the taxes on the inherited IRA over his lifetime; at roughly age 83, your beneficiary would still have $2,500,000. If the five-year rule is passed, your beneficiary will be broke.

So, facing this potentially devastating blow to your estate, what should you do? Though we believe the proposal will become law, you don’t want to take any action that will hurt your family if the proposal doesn’t become law.

I have been anticipating the death of the stretch for years. Killing the stretch will be a boon for federal tax revenue. So, over the years I have been preparing an action plan for IRA owners. We have developed a 5-point plan for what you should do now to protect your family. The first step is flexible estate-planning documents, preferably Lange’s Cascading Beneficiary Plan.The second step is to relook at Roth IRA conversions. Obviously, I can’t explain the entire 5-point plan within the space of this column. I did, however, just finish our second mini-book on this subject (46 pages) filled with our recommendations. We are waiting for the Committee’s proposal to become law before officially publishing the book.

If you and your spouse have more than $450,000 in your IRAs, I strongly urge you to act now to protect your family.

Take advantage of this offer and learn about what you can do now to protect your family from the death of the stretch IRA.

Please call (412) 521-2732 and request your free Advance Reader Copy of The 5 Greatest Tax-Saving Strategies for Protecting Your IRA from the New Tax Law.

If you would prefer to watch a DVD that explains the details of the law and our 5-point plan, please call our office and request the DVD. Finally, you could see if you qualify for a free second opinion. In either case, please call us and learn how you can protect your family.