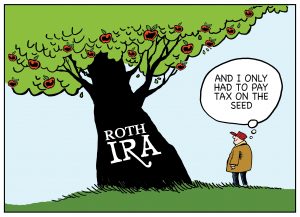

Now Is the Best Time in History to Do a Roth IRA Conversion

Reprinted with permission from Forbes.com where Jim is a regular contributor.

This article received 130,000 views within two days of posting on Forbes.com.

Randy Bish

Currently, six factors are converging to make Roth IRA conversions more promising for more IRA owners than ever before.

No Required Minimum Distributions (RMDs) For 2020

The $2 trillion dollar Coronavirus Aid, Relief, and Economic Security Act (CARES Act) temporarily suspends the RMD requirement from Traditional IRAs and retirement plans. If you were required to take minimum distributions from your IRAs in the past, consider foregoing that distribution in 2020 unless you need the money and depend on it for your cash flow. That will help stem losses from having to take your RMD while the market is down. If you are receiving your RMDs through monthly automatic transfers from your IRA to your checking, you might want to stop those transfers too. With respect to Roth IRA conversions, not taking distributions from a Traditional IRA can make doing a Roth IRA conversion even more desirable because it might keep or put you in a favorable tax bracket by reducing your taxable income.

Converting to Roth While the Market Is Low

Though I am not a market timer, history suggests that after a crash, even if it takes years, there will be a significant recovery. If the market does go up after you make a Roth IRA conversion, you will in effect be getting your Roth IRA at bargain rates. Let’s say you have a Traditional IRA that is invested in a low-cost index fund that was valued at $133,000 at its peak and today its value is $100,000. You can make a Roth IRA conversion on the $100,000 and pay tax on $100,000. The market rebounds to its pre-crash level and now your Roth IRA is worth $133,000. You just got a great bargain by paying tax on $100,000 and getting a $133,000 tax-free Roth IRA in return.

Our Current Low Tax Rates Are Likely to Go Up

Between our current deficit and the new $2 trillion bailout, it isn’t a huge leap to think tax rates will go up in the future. In addition, we are already in a historically low tax environment. In 2017, a married couple filing jointly with a taxable income of $326,600 was in the 33% tax bracket. Thanks to the Tax Cuts and Jobs Act of 2017, today that couple would be in the 24% tax bracket. If you make a Roth IRA conversion now and income tax rates go up in the future, you will have made a Roth IRA conversion at bargain rates. If you think tax rates will increase over the long run and specifically increase for you, then Roth IRA conversions can be a great idea.

Roth IRA Conversions Are A Great Defense to The SECURE Act

The SECURE Act took effect January 1, 2020, and accelerates the income tax on Inherited IRAs within, subject to exceptions, ten years of the owner’s death. This could devastate your financial legacy. Roth IRA conversions are one of your family’s best defenses against The SECURE Act.

Love or Not, You Won’t be Married Forever

If you are married, you are most likely taking advantage of the favorable “married filing jointly” tax rates. But what happens when one spouse dies? Other than the fact the survivor will only receive one Social Security benefit rather than the current two benefits, the household income itself will likely be similar. But, the year after the first spouse dies, the survivor will likely be filing as a single taxpayer, at higher income tax rates. The fact that you are filing jointly now and either you or your spouse will likely be filing as single later, means that now might be a good time to make a Roth IRA conversion.

You Get A Big Bang for Your Roth IRA Conversion Buck

Many financial advisors are recommending you rebalance your portfolio by putting more money in the market right now, when it is low. I am not saying that is wrong, but it is certainly uncomfortable. If the market stays low for a long time, there might not be much of a short-term benefit from rebalancing. On the other hand, even if the market stays low, a Roth IRA conversion will likely still be beneficial for you and your family over the long term. It is also a way of leveraging your money to lock in tax-free gains because the gains in the Roth IRA are tax-free for the remainder of your own and your spouse’s lives and beyond.

For many taxpayers, now might be the best time in history to execute a Roth IRA conversion.

Note of Caution: Please consider that you are no longer permitted to “recharacterize” or undo a Roth IRA conversion.

The foregoing content reflects the opinions of Lange Financial Group and is subject to change. Content provided herein is for informational purposes only and should not be used or construed as investment advice. There is no guarantee that the statements, opinions or forecasts provided herein will prove to be correct. Past performance may not be indicative of future results. Securities investing involves risk, including the potential for loss of principal. There is no assurance that any investment plan or strategy will be successful, or that markets will recover or react as they have in the past.