Jane Bryant Quinn joked in a 2004 Newsweek column that my mantra was “Pay Taxes Later.” It was true then, it is true now. My fundamental tax strategies have not changed because they work; that’s the beauty of time-tested strategies. Although, it is more complete to say: Don’t pay taxes now, pay taxes later, except for the Roth.

This advice is critical for each stage of your retirement planning. We broadly define three critical stages:

1. The Accumulation Stage when you are saving for retirement.

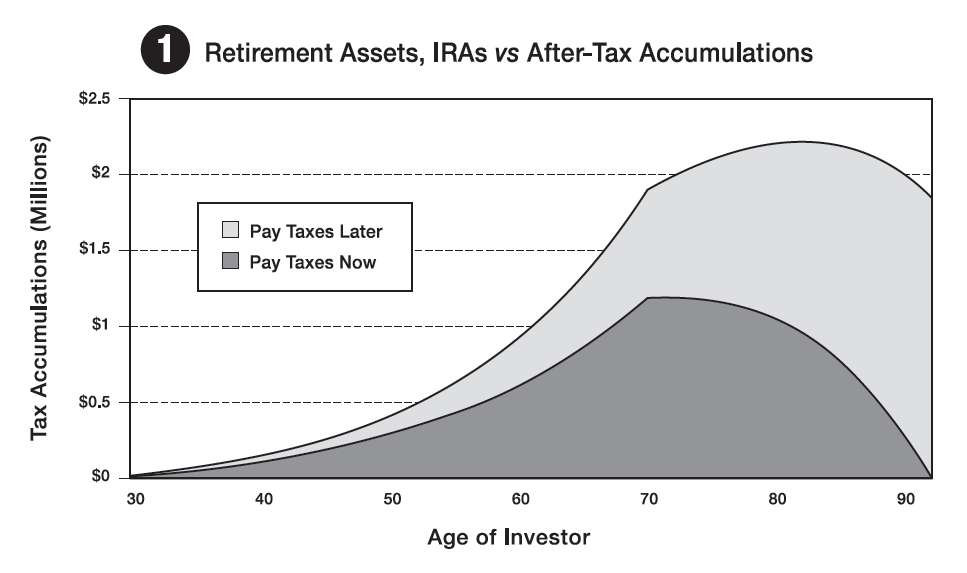

While you are working, (subject to the Roth exception which we will explain), we generally recommend you contribute as much as you can afford to your retirement plan at work, assuming you have one available to you. If you are self-employed, start your own retirement plan, like a one-person 401(k) plan. The first graph quantifies the difference between accumulating money inside a retirement plan versus saving money outside a retirement plan.

Imagine a $1.5 million dollar difference and the difference isn’t saving or not saving, it is saving in a retirement plan versus saving outside a retirement plan. (For details please see Chapters 1-3 in our flagship book, Retire Secure!).*

2. The Distribution Stage when you are withdrawing money from your portfolio after you retire.

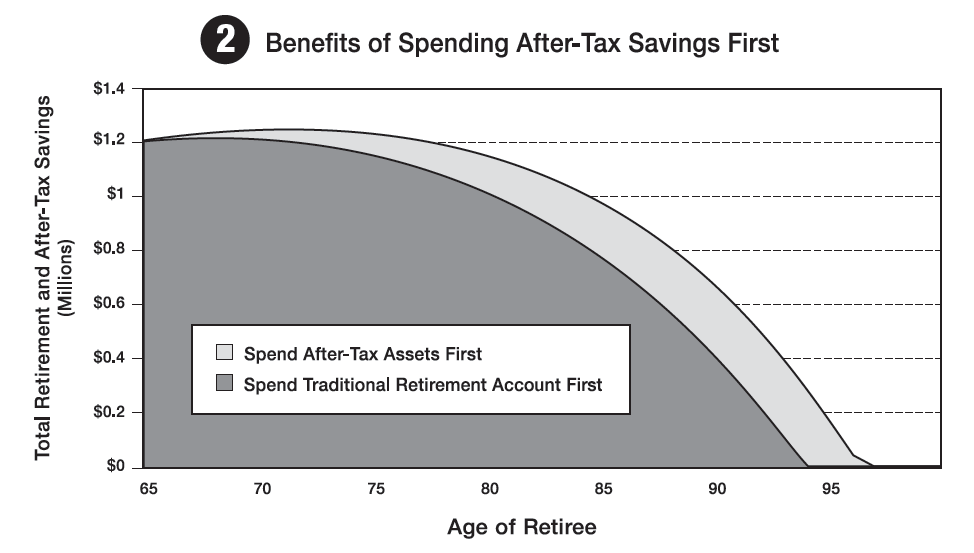

Let’s assume that you are retired and you have two stacks of money. The first is IRA or an equivalent that will be taxed upon withdrawal (pre-tax). The second stack is money you have paid taxes on (after-tax). Generally speaking, we recommend that you spend the after-tax stack before you spend your IRA money. The second chart dramatically plots the different outcomes depending on which stack you spend first. (For full details, please see Chapter 4 in the most recent update of our flagship book, Retire Secure!).*

3. During the Estate Planning Stage when you are considering your heirs.

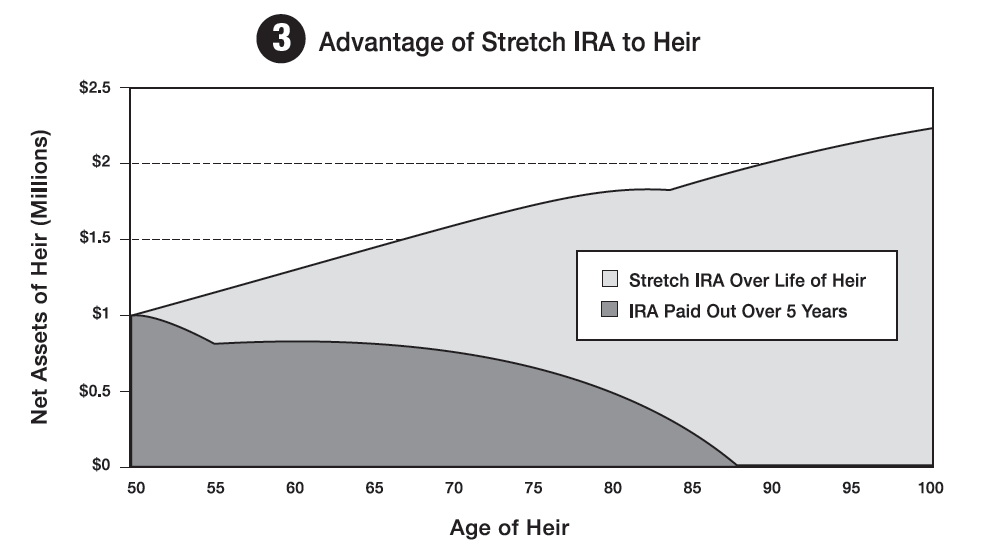

We are big advocates of planning to “stretch” your IRA and Roth after you are gone (i.e., keep as much as allowed in the pre-tax environment for as long as possible). Your heirs (children and even grandchildren) could potentially be hundreds of thousands of dollars better off if they“ stretch” the Inherited IRA. The third chart presents a convincing graphic.

Stretching will become trickier if Congress kills the stretch IRA as we know it (which is the recommendation of the Senate Finance Committee), though we do have recommendations of what to do now to prepare for the pending law change. Please see our book, The Ultimate Retirement and Estate Plan for Your Million-Dollar IRA.*

Why do I exclude the Roth? What is so Special about Roths?

Roths grow tax-free. If you plan strategically, paying the taxes up-front to benefit from long-term, tax-free growth creates a unique opportunity to generate wealth. This is a complicated topic. We offer limited information about Roth IRAs and Roth IRA conversions in Retire Secure!, but for a complete analysis of Roths and Roth IRA conversions (a fantastic strategy most retirees miss) please see our book, The Roth Revolution, Pay Taxes Once and Never Again.*

P.S. If you are interested in more financial information (we have written 5 best-selling financial books, many peer-reviewed articles, have 185 hours of our radio archives, etc.), we encourage you to visit our website, www.paytaxeslater.com. It has a wealth of valuable free material of special interest to IRA and retirement plan owners, or please call (412) 521-2732 to see if you qualify for a free second opinion consultation.

* To download FREE copies of all our books, please visit paytaxeslater.com/books/