Start Planning Now for a Higher Tax Environment

by James Lange, CPA/Attorney Reprinted with permission PICPA’s CPA Now.

Presidential elections are often important re-evaluation moments for taxpayers. This is particularly true when the presidency shifts from one party to another. The strategies presented below work well with stable tax rates but can be life-changing in times of rising income tax rates … and taxes are going up.

Going Up?

President Joe Biden has said that there will be no income tax rate increases for married taxpayers making $400,000 or less. But even if his administration holds the line for couples making less than $400,000 during his first term, increases for all are on the horizon because of how the Trump administration’s Tax Cuts and Jobs Act (TCJA) was structured.

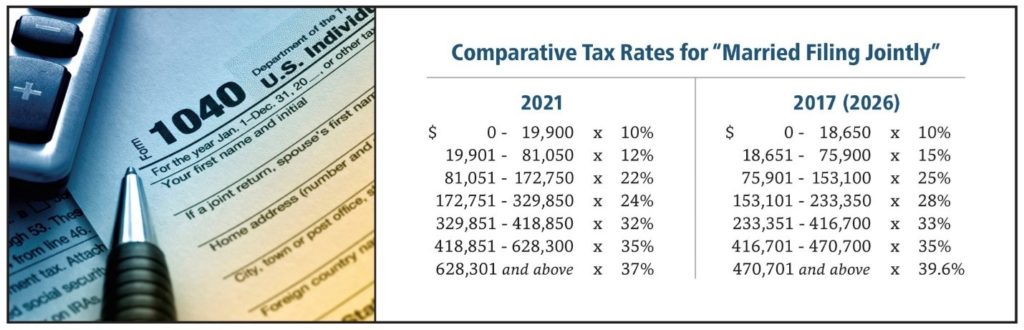

Sunset provisions are a part of the 2017 tax law, meaning income tax rate increases are scheduled for 2026 even if a new tax plan does not occur. To oversimplify, 2026 rates could be more like 2017 rates (adjusted for inflation).

Also related to the TCJA, there could be changes to the standard deduction and the rules for itemized deductions. TCJA increased the standard deduction while slashing the deductibility of previously itemized deductions, such as state and local tax payments.

For taxpayers who make more than $400,000 and are working, there could be an additional Social Security tax of 12.4%, their marginal rate could rise to 39.6%, and itemized deductions could be capped for a tax benefit of 28%. For those with income over $1 million, capital gains rates could be taxed at 39.6%.

Potential tax increases are far more likely with a Democratic President, House, and Senate. Also, our government holds enormous debt (about $3.3 trillion). You don’t have to be Nostradamus to foresee taxes are going up.

What should you do? I believe it would be wise to transfer some of your wealth from the taxable world to the tax-free world.

Taxable to Tax-Free

Roth IRA conversions should be the first thing to think of when transferring from taxable to tax-free. Roth IRA conversions are generally favorable if a taxpayer has the funds to pay the taxes on the Roth IRA conversion from outside the IRA.

There are other ways to move from the taxable to the tax-free. For example, taxable withdrawals from a standard IRA can be directed to a 529 plan for the education of grandchildren or in the form of gifts. Gifts can come in many tax-advantaged forms:

- The beneficiary could be encouraged to contribute that money to their own Roth IRA.

- Withdrawing a small amount, perhaps 1% of your IRA every year, paying income taxes on that withdrawal, and then using what is left to purchase a life insurance policy, a technique known as “pension rescue” that insurance professionals have advocated for decades.

With the SECURE Act of 2019, a beneficiary (subject to exception) must withdraw an inherited IRA by Dec. 31 of the 10th year following the IRA owner’s death making the pension rescue technique more attractive.

Gifts from Granny

The sunset provisions of the TCJA revert the estate tax exclusion to $5 million (adjusted for inflation) in 2026. Many estates will likely grow into the zone of federal estate taxation over the next several years.

For many taxpayers, making $15,000 gifts ($30,000 per couple) per beneficiary is a simple and effective strategy, assuming you don’t need the money. If you combine the strategies of paying tax on IRA withdrawals with making gifts, you could reduce both income taxes and estate taxes.

Life insurance as part of the gift could make sense, especially when combined with Roth IRA conversions, which reduce the size of an estate without reducing the value.

Don’t Trip on the Step-Up

It might be a mistake not to consider the implications of a likely increase in the capital gains tax for taxpayers with more than $1 million of income or the loss of step-up in basis that may apply to everyone. It is a good time to brush up on capital gains and capital loss harvesting.

To be clear, we don’t have any assurances or projected dates for these potential changes but understanding they could be coming might motivate individuals to consider selling a portion of their highly appreciated assets, even if they must pay tax on the capital gain. Paying taxes at the current favorable capital gains rates could potentially be more advantageous than doing nothing and losing the favorable capital gains position.

If you are interested in developing your personal Financial Masterplan or our asset under management services, please call Edie at 412-521-2732 to determine if you qualify for a free Retire Secure Consultation.