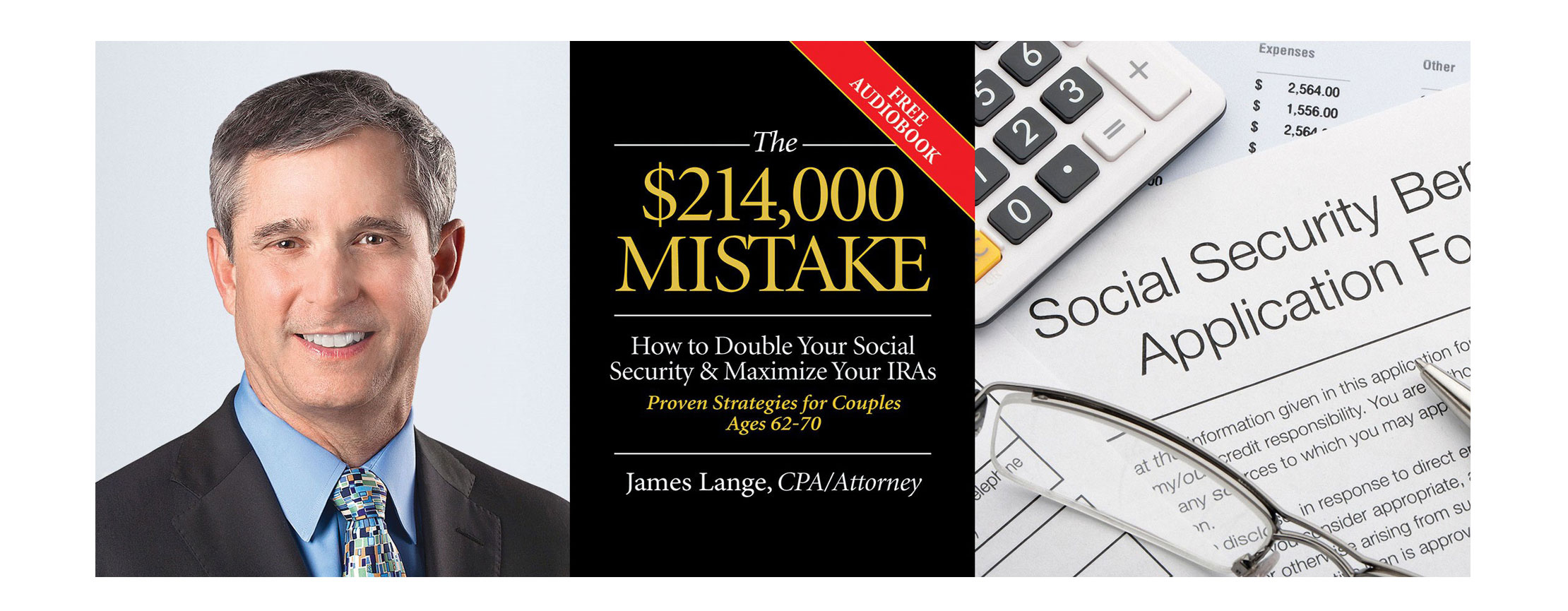

The $214,000 Mistake: How to Double Your Social Security & Maximize Your IRAs—Proven Strategies for Couples Ages 62 – 70

Our new book, The $214,000 Mistake: How to Double Your Social Security & Maximize Your IRAs—Proven Strategies for Couples Ages 62-70, is hot off the press.

You can purchase it on Amazon. For a limited time, the electronic version is available for 99 cents. All proceeds of this book go to charity: water, a non-profit organization bringing clean and safe drinking water to people in developing countries.

The $214,000 difference referred to in the book title is shown in Figure 3 on page 19. The math for doubling your Social Security can be found on page 20. We also cover combining optimal Roth IRA conversion strategies in conjunction with the best Social Security strategies. Pro-active planning for Roth IRA conversions in conjunction with your Social Security can easily make a difference of $1,000,000 or more. Under the newly passed Trump tax bill, the difference could be $1,500,000 or more. (See p. 5).

Here are some of the takeaways from the book:

- If you apply at age 62, or as soon as you are eligible, your benefit amount starts lower and stays lower for the rest of your life.

- Cost of living adjustments (COLAs) magnify the benefits of delayed claiming, as well as the detriments of early claiming.

- Delaying your application for benefits becomes more advantageous the longer you live. And remember, protecting yourself in the event of a long life is most critical. Nobody wants to be old and destitute.

- Since the surviving spouse will get the higher of the two benefits, it generally makes sense to plan for one benefit to be as high as possible. This can also be a game-changer for the surviving spouse.

- If you are married (or were married, but are now divorced), filing a Restricted Application for benefits could be a way for you to get more money from Social Security.

- Even if you started with one strategy—perhaps claiming benefits too early—it doesn’t necessarily mean that it is too late to make a change.

Here are the key points you need to remember about Roth IRA conversions:

- The best years to make Roth IRA conversions is when you are in a low tax bracket and you expect your tax bracket to go up in subsequent years. For example, a retired 66-year-old taxpayer who is holding off on taking Social Security and not yet taking his Minimum Required Distribution (MRD) will probably be in a lower tax bracket than he will be at age 70 when he will be required to receive both Social Security and his MRD.

- The 2017 tax reform reduced tax rates for many individuals. If you believe, as I do, that this reduction is temporary, then it may be beneficial to consider a series of Roth IRA conversions sooner than later.

- A series of Roth IRA conversions executed in conjunction with optimal Social Security strategies is a powerful combination.

One of the reasons we are giving the book away is because we not only want wealthy readers to do even better, but we also want to help make a huge impact on less fortunate readers. For example, if you are pretty set for retirement, an extra $214,000 is nice, but it may not radically change your life. If you are broke, a $214,000 difference could be the difference between being comfortable and living in poverty.

So, when considering who you could give this book to, consider not only your well-to-do friends and colleagues but also your house cleaner, your favorite waitress, your secretary, your handyman, etc.

Again, we would be delighted to give you as many copies as you like. You can either call the office at 412-521-2732 or stop by at 2200 Murray Avenue in Squirrel Hill.