Author’s Note – This article is presented as it was written in 1998. Much has changed in the tax laws since then, with lower tax rates and special rates on long-term capital gains and qualified dividends. These changes may reduce the advantages Roth monies have over after-tax dollars as shown in the examples in this article, but certainly Roth IRAs continue their significant relative advantages. Furthermore, the prospect of future tax rate increases and the advent of Roth 401(k)s and Roth 403(b)s makes Roth savings even more compelling.

*********

With the advent of the Roth IRA, financial and estate planners have been given a new tool to optimize retirement and estate plans for individuals with significant assets in their retirement plans. A Roth IRA has the potential to provide a great source of wealth for your clients and their heirs. This article will quantify the exceptional value a Roth IRA has as part of an estate.

An in-depth analysis of the merits of converting a regular IRA to a Roth IRA is beyond the scope of this article. [1] However, we do believe that, for individuals who qualify, it is definitely worth considering a Roth IRA conversion. Jim Lange’s peer reviewed article IRAs After the TRA ’97 – What Hath Congress Roth? provides conclusive evidence that the benefits of a Roth IRA conversion extend to both the owner during his/her lifetime and to his/her heirs. This article focuses on quantifying the benefit to the heirs.

For the purposes of this article, we compare and contrast the estates of two individuals:

One individual elects to convert $100,000 of his IRA into a Roth IRA. We assume that the client will preserve the Roth IRA investment with its tax-free status and no minimum distribution requirements, and spend other assets first to provide for his/her retirement. As such, when the time comes to distribute this estate, the Roth IRA owner continues to have significant holdings in his Roth IRA, and fewer assets in other after-tax investments.

The second individual elects to retain his conventional IRA (the no conversion scenario). If the client lives long enough, the IRA is substantially diminished due to the minimum distribution requirements. When the time comes to distribute this estate, we assume that the IRA holdings are substantially reduced but that the owner still has significant assets in after-tax investments, such as cash, stocks, bonds, mutual funds, CDs, and savings accounts.

The “Hidden” Value of a Roth

To quantify the advantages of a conversion, it is necessary to “run the numbers” to see how our clients’ money will grow and be used throughout their lifetime. We do this by comparing the projected outcomes from our two scenarios – converting $100,000 of the IRA to a Roth IRA versus maintaining the status quo or not converting the IRA. In most cases, using reasonable assumptions, it is clear that the Roth IRA conversion will generate substantial additional wealth for the owner and their surviving spouse during his/her lifetime. [2] Occasionally the projections for both scenarios do not seem appreciably different. That is to say, at the end of the client’s and their spouse’s life expectancies, the two estates contain roughly the same value of assets measured in immediate purchasing power.

However, simply comparing the total number of dollars available to each estate at the time of the client’s death is not a very sophisticated analysis. Too frequently the estate planning stops here and the client makes the inappropriate decision not to convert to a Roth IRA. This estate planning decision may result in the loss of a valuable opportunity. To fully appreciate the merits of inheriting a Roth IRA, we need to project the analysis over a much longer time scale.

Let’s assume we have run the numbers and the two estate projections contain the same purchasing power measured as if all the money were to be spent the day after death. Measured in immediate purchasing power, the estate containing the Roth IRA has no advantages over the estate comprised primarily of after-tax investments. An after-tax dollar in your pocket will buy the same cup of coffee as the dollar in your pocket from a Roth IRA. The same holds true for your client’s heirs upon inheritance of those assets. [3] On the face of it, the two projections seem equal. If your client’s heirs intend to immediately liquidate their inheritance for reasons such as debt retirement or for spending purposes, there are no advantages to inheriting a Roth IRA over after-tax investments. However, if your client’s heirs maintain the investment and take only the minimum required distributions through their lifetime, then your client’s Roth IRA conversion will provide his heirs with a monumental benefit.

The inherited Roth IRA has a “hidden” value in the estate. The value of an estate should be measured in the hands of your client’s heirs. If the heirs spend or withdraw the Roth IRA money immediately upon inheritance, the strategic value of passing on the Roth IRA is lost. If the heirs are interested in providing for their future, they will choose to let the Roth IRA continue to grow, income tax-free, perhaps only depleting the Roth IRA funds by their required minimum distributions based on the heir’s life expectancy. This exceptional tax-free growth potential makes converting to a Roth IRA a significant estate-planning tool. The dollar value of the inheritance at the time of death is paltry compared to its potential worth when it is kept in the tax-free environment for as long as possible. So, how do you measure the potential value of a Roth IRA?

The Sustained Significance of a Roth IRA

For our scenarios, the heir is an only child who is 50 years old when the second parent dies. At fifty years old an individual has an actuarial life expectancy of 33.1 years. Assuming the beneficiary makes an election to receive distributions over his or her lifetime, the minimum required distribution for the first year would be the balance in the Roth IRA divided by 33.1, or roughly 3% of the balance. The minimum distribution for the second year would be the balance at the end of the previous year divided by 32.1. For the third year, the minimum distribution would be the balance at the end of the previous year divided by 31.1, etc. This is analogous to the term-certain distribution method based on a single life expectancy.

The following examples show that, over time, your heirs can realize appreciably more value from a Roth IRA inheritance than an inheritance of after-tax investments. The projected advantage of the Roth IRA is expressed as a percentage of the value of the inherited after-tax funds. For example, if the Roth IRA funds will produce 10% more in benefits for the heir, then the value will be 110% of the value of the after-tax fund inheritance, and therefore, have a 10% advantage.

Example I

Let us compare an heir who inherits $100,000 in a Roth IRA to an heir who inherits $100,000 in after-tax investments. The investment rates of return and other basic assumptions include:

- An overall return on investment (ROI) of 8% per year. Of the overall rate of return, 70% is capital appreciation and 30% is ordinary income from interest, dividends, and short-term capital gain.

- Of the accumulated capital appreciation, 15% of the beginning of year balance is realized as long-term capital gains from portfolio turnover. (Please note that the previous two assumptions, while probably realistic, diminish the value of the conversion. If the child invests in taxable bonds so that there would be no capital appreciation and 100% ordinary income, the benefit of the Roth conversion would be significantly higher than the numbers indicate).

- A 50 year old has a standard life expectancy of 33.1 years, and this establishes the annual required minimum distributions from the Roth IRA. Each year both heirs will withdraw and spend only an amount equal to the minimum required distributions from the Roth IRA.

- The income tax rates on investment income produced by the after-tax funds are 28% federal and 3% state for ordinary income, and 20% federal and 3% state for long-term capital gain income.

The results of the calculations are outlined below. It shows the age of the beneficiary and the total funds available for the beginning of each of the first five years and each five-year period thereafter. Also shown is the annual spending amount for these years based on the minimum required distribution from the inherited Roth IRA. Additionally, we include a column that estimates the income taxes that would have to be paid on the after-tax investments for the year presented.

Chart I

| Beneficiary’s | Available Balance at Beginning of Year | Taxes on | ||

| Age at Start | Inherited | Inherited | Annual | After-Tax |

| Of Year | Roth IRA Funds | After-Tax Funds | Spending | Funds |

| 50 | $ 100,000 | $ 100,000 | $ 3,021 | $ 780 |

| 51 | 104,979 | 104,199 | 3,270 | 1,039 |

| 52 | 110,107 | 108,225 | 3,540 | 1,268 |

| 53 | 115,375 | 112,075 | 3,833 | 1,473 |

| 54 | 120,772 | 115,735 | 4,150 | 1,657 |

| 55 | 126,283 | 119,187 | 4,494 | 1,822 |

| 60 | 154,807 | 132,206 | 6,702 | 2,443 |

| 65 | 181,553 | 133,152 | 10,031 | 2,781 |

| 70 | 197,895 | 110,291 | 15,106 | 2,768 |

| 75 | 186,618 | 42,671 | 23,039 | 2,106 |

| 80 | 113,499 | 0 | 36,613 (a) | 0 |

Spending during age 80 is available from the Roth IRA inheritance only, since the after-tax inheritance is fully depleted by age 77.

As time goes on, the value of the remaining Roth IRA inheritance is greater than the remaining after-tax inheritance due to the tax-free growth of the Roth IRA. A graph of the balances remaining at different ages for the beneficiary follows:

For the non-conversion scenario, income taxes must be paid on the investment income of the after-tax funds. The combination of the tax withdrawals and spending withdrawals (at the same rate as the tax-free spending withdrawals from the Roth IRA) reduce the principal to zero by age 77, whereas the Roth IRA would still have $167,647 available. The Roth IRA funds “run out” at age 84 because of the minimum distribution requirements. We can continue the comparison past the time the after-tax inheritance is gone by showing, as an annual benefit, the minimum distribution from the Roth IRA until it is gone as well. However, one should not determine value by how long the minimum distributions last because the minimum distribution amounts increase significantly during these last years.

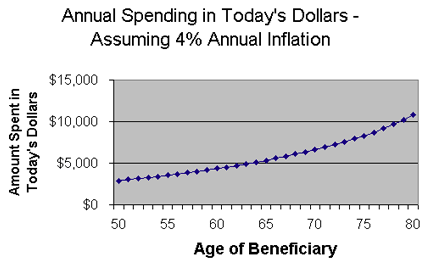

Even considering the effects of inflation, the required minimum distributions from the inherited Roth IRA increase significantly. Assuming 4% inflation as a conservative, i.e. high, approximation of the long-term inflation rate, a graph in constant dollars of the annual amounts spent follows:

This graph shows that the last years of minimum distributions are the greatest. From Chart I, the $36,613 annual spending amount during age 80 translates into $10,854 in today’s dollars, as is reflected in the graph above. We have assumed the above spending pattern for distributions from both the conversion scenario and the non-conversion scenario.

Obviously, the heir who received the Roth IRA funds has received more than the other heir. How do we measure this additional value?

Measuring Value with Present Value Calculations

Present value calculations provide a way to figure out how much money you would need to have today, invested at a typical interest rate, to give you the same amount of money that, in the case of our example, will be inherited. In other words, for our example, the present value calculation tells you how much you should be willing to pay now to buy your future inheritance: how much should you be willing to pay for the Roth inheritance vs. the after-tax inheritance.

By simply projecting the dollar amounts, as illustrated above, the amounts received in the future seem very large, but that is because there is a long time lapse between now and then – you could achieve the same large numbers by investing a small amount now, and that smaller amount is the “present value” of the future income.

The present value discount rate we will use is 7%, which estimates an expected rate of investment return of about 8%, less about 1% for income taxes on the investment income that would have to be paid if the money was not invested in a Roth IRA.

We also examine the effects on the inheritance should it grow at a higher than expected rate such as 11%. However, we do not change the present value discount rate used in valuing future spending withdrawals since it is an expected growth rate. We increase both the Roth IRA inheritance and the after-tax inheritance by this 11% annual growth rate and compare the results using the present value discount rate. This projection demonstrates that the comparative advantage of a Roth IRA inheritance is greatly increased if an above-average rate of investment return is achieved. In other words, if your heirs are able to achieve an 11% return on the inherited Roth IRA, then it will be an even more valuable inheritance than after-tax funds earning the same return.

An inherited Roth IRA has a minimum distribution requirement that is calculated based on the beneficiary’s life expectancy. Assuming that each year both individuals spend an amount equal to the minimum distribution from the Roth IRA, the Roth IRA inheritance lasts longer. The beneficiary of the after-tax investments has to withdraw additional amounts from the after-tax inheritance to pay the taxes on investment income to end up with the same amount of spending money as the beneficiary of the Roth IRA.

Beginning in the first year, the remaining balance in the Roth IRA becomes higher than the after-tax funds. Therefore, measured through any given time in the future, the present value of the inheritance can be measured by the total of all the present values of each annual withdrawal plus the present value of the remaining balance at the time the Roth IRA will be depleted.

Using the information from our example above, the following chart shows the results measured through the end of each five-year period into the future:

Chart II

| Beneficiary’s | Present Value of Available Balance at the Beginning of the Year |

Present Values of | |

| Age at Start of Year |

Inherited Roth IRA Funds |

Inherited After-Tax Funds |

Spending Withdrawals |

| 51 | $ 98,111 | $ 97,382 | $ 2,824 |

| 56 | 87,885 | 81,564 | 17,448 |

| 61 | 76,248 | 63,490 | 32,980 |

| 66 | 63,020 | 44,372 | 49,530 |

| 71 | 47,969 | 24,451 | 67,252 |

| 76 | 30,738 | 3,606 | 86,411 |

Please note that in Chart I, the Roth IRA funds seemed to grow substantially for 20 years after inheritance because it shows the actual dollar balance. But Chart II, measures the funds in terms of present value.

By adding the cumulative present values of the spending to the present values of the beginning of year total funds available, we can now measure the percentage by which the value of the Roth IRA inheritance exceeds an inheritance of the same amount of after-tax funds.

| Beneficiary’s Age at the | Percent Advantage Achieved by |

| Beginning of the Year | Roth IRA Funds |

| 56 | 6.38% |

| 61 | 13.22% |

| 66 | 19.86% |

| 71 | 25.65% |

| 76 | 30.14% |

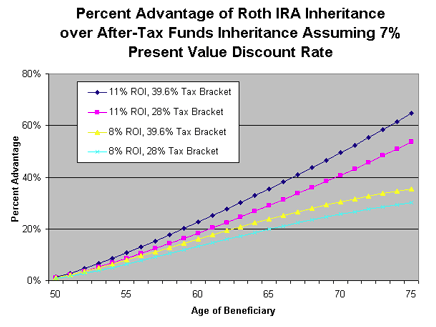

This tells us that by successfully keeping the distributions from the Roth IRA funds to a minimum for 25 years, the 50 year old beneficiary has achieved a value from the Roth IRA 30% greater than after-tax funds. This would indicate that $1.00 of Roth IRA money in an estate is really worth $1.30 if the beneficiary takes only minimum distributions over his/her life expectancy. This is a reasonable assumption since it is to the beneficiaries advantage to not withdraw any more than the minimum from the Roth IRA that is growing income tax free. But we like to see other “what-if” scenarios, so let’s play with the numbers.

The famous Ibbotson study, which detailed the history of investment returns from 1926 onward, concluded that money invested in the S&P 500 Index from the beginning of 1926 to the end of 1998 earned 11.2%. Even if we round down the 11.2% to 11%, and use an 11% investment rate of return instead of 8%, with all other factors being the same, the 30% advantage by age 75 becomes a large 53% advantage. This means that given a rate of return less than the historical S&P 500 Index, and assuming the beneficiary withdraws only the minimum distribution from the Roth IRA, $1.00 of a Roth IRA in an estate is really worth $1.53 to a 50 year old beneficiary.

Using the original 8% rate of return, if the beneficiary’s federal tax rate on ordinary income is 39.6% instead of 28%, the 30% advantage becomes a 35% advantage.

Combining both these new assumptions, i.e. 11% return on investments and the 39.6% tax bracket, the 30% advantage becomes a more significant 65% advantage. Stated another way, this means that inheriting $100,000 in a Roth IRA is actually worth $165,000 to the heir.

The graphic portrayal of the Roth IRA advantage for all these scenarios is as follows:

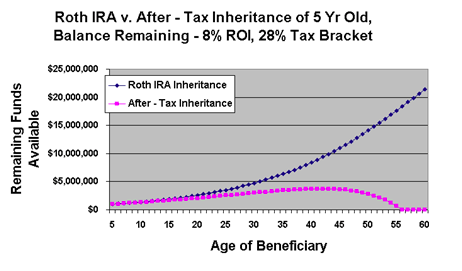

Now let’s have some real fun. Please assume that the beneficiary is a five year old grandchild, not a 50 year old adult child. Naming a five year old (of course in trust) increases the life expectancy upon inheritance from 33.1 years to 76.6 years. The higher life expectancy allows the beneficiary to continue Roth IRA tax-free growth for much longer, as well as decreasing the required distributions in the earlier years. The minimum required distribution, for the grandchild, for the first year would be the balance divided by 76.6 (years) versus the balance divided by one 33.1 (years) for the 50 year old adult child.

Keeping the original assumptions of an 8% return on investment and the 28% tax bracket, the Roth IRA inheritance advantage for the five year old grandchild for the initial 25 year period is somewhat better than for the 50 year old adult child – 37% instead of 30%. However, the time horizon for comparison can be much longer. After the interval between 50 and 55 years of age, the advantage the Roth IRA inheritance has over the after-tax inheritance, is a tremendous 71%. Continuing the analysis until all Roth IRA funds are withdrawn (and assumed spent) until age 81, we find the advantage peaks at 80%.

These analyses incorporate the present value discount rate. Representing the gains in future dollars would make the total dollar amounts much greater. If the five year old child is fortunate enough to be in the 39.6% tax bracket and to achieve an 11% return on investments, he/she will achieve a maximum advantage of 329% just prior to the time the Roth IRA inheritance is fully spent at age 80. This means for a five year old grandchild, an inherited Roth IRA may be worth well over three times the value of inherited after-tax funds.

The graph that follows plots the Roth IRA advantage for both scenarios; with 8% and 11% returns on investment and the 28% and 39.6% tax brackets:

We could go on and on with variations on the assumptions, but it becomes clear that in the hands of a child, or better yet a trust for a grandchild, an inherited Roth could dwarf the value of the same funds in the after-tax environment.

Conclusion

These illustrations graphically demonstrate the potential value Roth IRAs have in an estate. Making a significant Roth IRA conversion is usually very beneficial for both your clients and their heirs. This article supports arguments in favor of a Roth IRA conversion even if the conversion does not significantly alter the total dollar value of the estate at the time of death. The point is that even in the case where the conversion results in a breakeven for the original IRA owner, when the child or grandchild beneficiary elects to take only minimum distributions from the Roth IRA, the Roth IRA’s value is substantially greater than the value of the same amount of after-tax funds. However, the challenge of turning the inherited Roth IRA into a gold mine will fall to your heirs. It is essential that your clients and their beneficiaries understand that the value is achieved over time, and that the Roth IRA should be preserved in its tax-free environment as long as possible.