Roth IRA Conversions Can Benefit You, Not Just Your Kids

by CPA/Attorney James Lange

Reprinted with permission from Forbes.com where Jim is a regular contributor.

Many readers assume the best reason for doing Roth IRA conversions is that it will benefit their heirs. Now, as a result of the drop in the stock market due to COVID-19, many readers are more interested in just making sure they and their spouses are OK. So, they are questioning whether they should do Roth IRA conversions and hold off on applying for Social Security benefits.

So, in this post, I will examine the question, if your heirs are not even a consideration, should you still do a series of Roth IRA conversions and delay taking your Social Security benefits. I discussed the benefits of waiting as long as possible to apply for Social Security benefits in a previous post. And I will not discuss the timing of the Roth IRA conversions here, because I covered that in my latest post. As you may know, for the right people at the right time, I believe Roth IRA conversions are great for you and your spouse. True, it will likely benefit your heirs even more, but let’s forget about them for now.

Roth IRA Conversions Benefit You Too

What some readers miss is that they think my recommendations for doing Roth IRA conversions are mainly for the benefit of their heirs, not themselves. Yes, doing Roth IRA conversions are great for your heirs, but they are likely great for you too.

As you may expect, depending on the individual circumstances of a married couple, I usually advise the primary income earner to hold off on applying for Social Security benefits until age 70. By waiting, the eventual benefit he or she will receive increases every year. In addition, waiting until 70 to apply for Social Security lowers your taxable income. This can allow IRA owners to make a series of Roth IRA conversions in a potentially lower tax bracket or make a larger Roth IRA conversion in the same bracket because they don’t have the reported income from their Social Security. The lowered income that results from the combination of holding off on Social Security, not having wages or self-employment income from work, and not taking your Required Minimum Distributions (RMD) is a classic time to make a Roth IRA conversion. I know many advisors disagree with me.

At the risk of sounding arrogant, I don’t believe the disagreement I have with other advisors on the issue of holding off on Social Security and making a series of Roth IRA conversions is simply a difference of opinion that can never be resolved with clarity one way or the other. For many readers, Celine Dion is their favorite female singer. Personally, I prefer Whitney Houston, though I love them both. Holding a personal preference is totally legitimate in that situation.

But not with Social Security and Roth IRA conversions. You can “run the numbers.” You can use reasonable assumptions to make projections. You can see where you will be if you collect Social Security early and don’t make Roth IRA conversions, and contrast that with waiting until age 70 to take Social Security and making a series of Roth IRA conversions. You can also run the numbers using your children’s life expectancy as an endpoint, but we don’t consider that here.

Don’t Guess When It Comes To Your Money

Yes, you can have disagreements on the assumptions, but the way I resolve that issue in practice is to run the numbers with what I think are reasonable assumptions, or with the client’s input on what they feel are reasonable assumptions.

I love analyzing these issues with data-driven individuals. If you could prove it to them on a spreadsheet that they can closely examine, a data-driven person could change his mind.

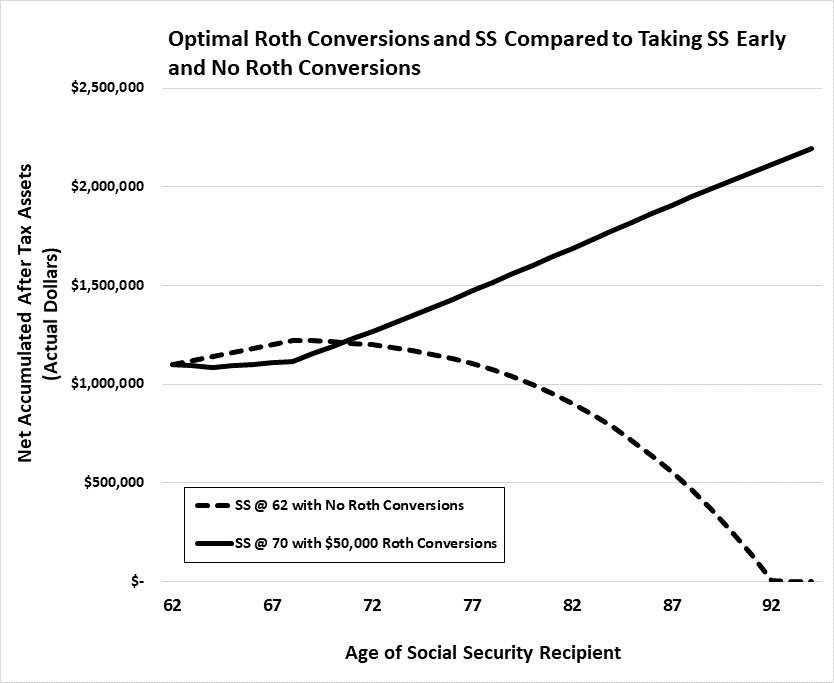

Anyway, to settle one disagreement, I “ran the numbers”. You can challenge the assumptions, but the math is the math and not a matter of opinion. You can get dramatically better results by “running the numbers” and comparing different strategies than by using guesswork. I ran the numbers and arrived at the conclusion I expected—that it was better for my client to delay applying for Social Security and make a series of Roth IRA conversions at a lower tax bracket. Please see the graph below that demonstrates the results of “running the numbers”.

*see assumptions for graph below

*see assumptions for graph below

This graph shows that optimizing Roth IRA conversions and Social Security strategies versus collecting Social Security at age 62 and not doing any Roth IRA conversions will result in a difference of over $2,000,000 for this family. Hopefully, some readers will begin to think differently about their financial strategy. That is the advantage of having skeptical IRA owners who are data-driven.

What is so exciting about this graph is that it shows that two of the major strategies we use to defend your legacy from the SECURE Act also can provide an enormous benefit to you and your spouse. Specifically, waiting to apply for Social Security benefits and making a series of Roth IRA conversions, can help you and your spouse as well as your family. You could look at the enormous savings for your children and grandchildren as a bonus, but the bottom line is that it is likely great for you as well.

Incidentally, the benefits of waiting to apply for Social Security and doing a series of Roth conversions, for many if not most IRA owners, was true both before and after the SECURE Act.

*Graph assumes that the client has sufficient after-tax savings from which the tax on the conversion are paid. He makes Roth conversions in the amount of $50,000 every year for eight years, earns a 6 percent rate of return, and spends $75,000 annually. The assumed rate of inflation is 3.5 percent.

Click here for disclaimer