“CPA and attorney Jim Lange (in his book Retire Secure!) provides a road map for tax-efficient retirement and estate planning.” — Charles R. Schwab

New Trump Tax Laws Create Unintended Benefits for

Savvy IRA and Retirement Plan Owners Who Act Quickly

Make your IRA last longer. Retire secure for life. And leave a legacy of wealth for your children and grandchildren. Do this now…and help secure your and your family’s financial future. (Even if you are age 55 or older, there’s still time – when you act NOW!)

Saturday, July 28, 2018 – Crowne Plaza Pittsburgh South

164 Fort Couch Road (across from South Hills Village) · Pittsburgh, PA 15241

Reserve your place today for any or all of our FREE workshops by calling 412-521-2732. Seats fill fast. Reserve as soon as possible. Both spouses are encouraged to attend. Refreshments available at the event.

» View Workshop Invitation (PDF)

| The new tax laws are going to create opportunities and minefields for IRA and retirement plan owners. This set of workshops will also cover our classic planning recommendations that have not lost their luster—despite the tax law changes. You’ll discover the best estate plan for married IRA and retirement plan owners. And you will receive our fundamental primer on required minimum distributions, smart trust planning, and the advantages of lowcost index investing. Plus, I will also present a compelling new analysis of why Roth IRA conversions are so profitable for married IRA owners under the new tax laws. The new historically low tax rates combined with the inevitable tax raises in the near future create a mathematically compelling case for married couples to closely look at Roth IRA conversions before it is too late. I will quantify the benefits of making conversions, and frankly address who is and who is not a suitable candidate for Roth IRA conversions. You and your family could be hundreds of thousands of dollars better off. So don’t jump to the conclusion that, “Roth IRA conversions are not right for me,” before you get the facts. My analysis has been peer-reviewed by the American Institute of CPAs, I wrote a best-selling book about Roth IRA conversions, and I have had 15 IRA experts on my radio show who all believe that most taxpayers, at some point, will benefit from a Roth IRA conversion— and that was before the favorable new tax environment. Traditionally, the best time to do a Roth IRA conversion is after you no longer have an income from your job or business, but before you turn 70,when required minimum distribution and Social Security benefits boost your income again. Put another way, the time for a conversion is while you are in your lowest tax bracket. Even more exciting, multiple years at lower tax rates, which the new tax law may give us, could present a golden opportunity to gain long-term protection from inevitable tax increases. Frankly, neither I nor any authoritative source I know believe the new lower tax rates will be permanent, so the time to lock in those savings is now. Remember, Roth IRA conversions are not one-size-fits-all. For instance, what if your Roth IRA conversion pushes your income above $170,000 and increases your Medicare Part B premium? It might not be worth it. Another wrinkle is that the new law disallows Roth IRA conversion recharacterizations. You will no longer be able to “undo”a Roth conversion. Further, capital gains and dividends must be considered. As I said, get the facts, then decide. But whatever you do, don’t let this opportunity pass unexamined. |

Who Says You Can’t Control From the Grave? Using Trusts to Protect Your Family.

- Should your heirs inherit your IRA directly, or would naming a Trust be safer? Is it worth the aggravation of setting it up and more importantly administering it after you are gone?

- Is Trust planning still appropriate for your family? Which Trust should you use?

- No Ferrari at 21! Trusts for minors.

- I Don’t Want My No Good Son-in-Law to Inherit One Red Cent of My Money! Trusts to protect family inheritances.

- Trusts for children or grandchildren with special needs.

- Spendthrift Trusts – How to protect adult children from their own bad judgement and creditors.

- The Cruelest Trap of All – The new laws make outdated Trusts and Wills pure misery for the surviving spouse.

- The pros and cons of avoiding probate.

- Lange’s Cascading Beneficiary Plan – The best and most flexible estate plan for married couples, more crucial than ever with the proposed new tax laws.

New Tax Laws Create Unintended Benefits for Savvy IRA and Retirement Plan Owners Who Act Quickly

- How the new tax legislation creates opportunities and pitfalls for IRA owners.

- Lange’s Cascading Beneficiary Plan – The best and most flexible estate plan for married couples, more crucial than ever with the proposed new tax laws.

- How IRA owners can get the most from their IRA while they are alive and after they are gone.

- The peer-reviewed math behind Roth IRA conversions and why they are good for seniors.

- A true understanding of required minimum distributions while you are alive and after you are gone.

- Tax-free conversions of after-tax dollars in IRAs and retirement plans (a specialty topic).

- Maximizing your Social Security.

- The synergistic calculation of optimal Social Security and Roth IRA conversion strategies.

What Makes More Money: The S&P 500 or Active Money Managers?

Here’s a statistic that your money manager may not want you to know: according to the Mid-Year 2017 SPIVA U.S. Scorecard,“Over the five-year period, 82.38% of large-cap managers, 87.21% of mid-cap managers, and 93.83% of small-cap managers lagged their respective benchmarks.” The truth is you’re likely better off with an optimized portfolio of index funds. In this bonus workshop we will cover:*

- The differences between active and index money management.

- The statistics on active managers’ performances relative to their benchmarks.

- An introduction to Dimensional Fund Advisors (DFA) —Index funds engineered using Nobel Prize winning research.

* Past performance is no guarantee of future results. All investing involves risk, including the potential for loss of principal. There is no guarantee that any strategy will be successful. Indexes are not available for direct investment.

» Videos: Educational workshops can be fun!

Discover Strategies to Retire Secure for Life and Create a More Comfortable Financial Future for Your Heirs—for FREE!

You and your spouse are cordially invited to attend any or all of our FREE workshops listed below:

Who Says You Can’t Control From the Grave? Using Trusts to Protect Your Family

Problems and Solutions for Naming Trusts as Beneficiaries of IRAs or Retirement Plans

Trusts can offer a level of control and ensure your hard-earned money is handled responsibly, long after you are gone. Perhaps you are worried that your no-good son-in-law will divorce your daughter and walk away with half of the money you let her?

Learn about the “I don’t want my no-good son-in-law to inherit one red cent of my money,” Trust. Want to stop your grandson from blowing his inheritance on a Ferrari when he is 21? Learn about Trusts to protect younger beneficiaries from irresponsible spending.

This workshop addresses Trust strategies that can keep your wealth intact and help protect your heirs from their creditors and their own poor judgement. Trusts for adult children, however, are often not appropriate – and this workshop helps distinguish when you should and should not have a Trust.

Trust scan also cause massive income tax acceleration after your death if they don’t meet five specific conditions. Yet the vast majority of attorneys don’t include those provisions in their trusts. This tax acceleration could cost your children hundreds of thousands, maybe millions of dollars.

So it pays to know the facts. Another perplexing issue this workshop address is whether the extra time, effort, and expense of avoiding probate is worth it.

New Tax Laws Create Unintended Benefits for Savvy IRA and Retirement Plan Owners Who Act Quickly

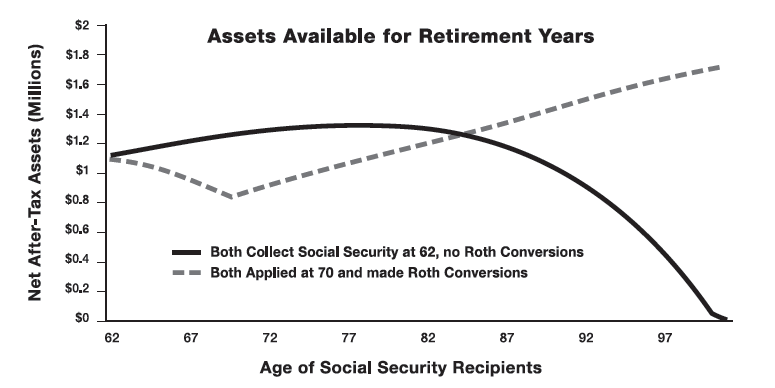

As demonstrated by the adjoining graph, optimizing your Social Security and Roth IRA conversion planning can make a difference of over a million dollars.It could be even more with the new tax laws.

Chart Assumptions:

- There are two couples with the same investments, the same earnings record for Social Security, and tax rates. But, there are significant differences in their Roth IRA conversion and Social Security strategies. Please note: the new tax law is likely to increase the difference between the two outcomes

- Couple #1 (represented by the solid line) takes their Social Security as soon as they can, at age 62. They do not make any Roth IRA conversions.

- Couple #2 (represented by the dashed line) optimizes Social Security and Roth IRA conversions. They wait until age 70 to file for Social Security benefits, and they make annual $50,000 Roth IRA conversions from the age of 62 to age 70.

Why would you pay taxes up-front and convert a portion of your traditional IRA or retirement plan to a Roth IRA? Step back and look at the big picture. The new Roth IRA could grow income tax-free for the rest of your life, your spouse’s life, your kid’s lives, and even your grand kid’s lives.

With a Roth conversion, you are buying out Uncle Sam, your traditional IRA “partner.” After Uncle Sam is bought out, all future profits go to the family without any future income taxes.

The benefit to future generations is impressive…But, the real eyeopener is that Roth IRA conversions are great for older IRA owners during their lifetime.

For married couples, Roth IRA conversions protect the surviving spouse who will be faced with higher tax brackets as singles—and potentially even higher taxes with the new tax laws. Women, who are likely to live longer, are particularly vulnerable. Roth conversions coupled with smart Social Security decisions could increase your and your family’s purchasing power by tens of thousands, potentially hundreds of thousands or even a million dollars.

This information-packed workshop, with Roth IRA analysis, peer-reviewed and vetted by the number crunchers at the American Institute of CPAs, can help you get more tax benefits from a Roth IRA conversion, and more security for your family. It’s jam-packed with cutting-edge tax strategies!

We strongly encourage you to reserve your seat now.

What Makes More Money? The S&P 500 or Active Money Managers?

Another great strategy to build your retirement wealth and estate: invest in no-load, low-cost, well-diversified, and tax-efficient index funds. Our preferred sets of funds, Dimensional Fund Advisors (DFA), were previously only available to institutional investors. In fact, only 0.15% of asset management firms are approved to offer clients access to these funds. Lange Financial Group is one of them, empowering our clients to own Dimensional Fund Advisor funds.

Over the long term, we believe DFA index funds will have an advantage over their Vanguard counterparts, even after subtracting a modest 1% annual management fee. Paul Merriman, a well-known retired investment advisor who used both Vanguard and DFA during his career, says he has his own money in DFA funds for two reasons. First, he likes the wide array of DFA investment options. Secondly, DFA funds come with an accredited expert personal advisor who custom-tailors your asset allocation and balances and rebalances your portfolio.

In addition to gaining access to DFA funds, clients who work with us also benefit from our exhaustive “running of the numbers” to come up with a master plan. We offer long-term projections. We assess different scenarios. We factor in important retirement and estate planning decisions, including Roth IRA conversion planning, rates of return, estate planning, Social Security planning, how much you can spend without running out of money, and other complex and confusing variables. So you can confidently seek to maximize your returns at a risk level that you are comfortable with while taking steps to protect your wealth.*

* Past performance is no guarantee of future results. All investing involves risk, including the potential for loss of principal. There is no guarantee that any strategy will be successful. Indexes are not available for direct investment.

| The new tax laws are going to create opportunities and minefields for IRA and retirement plan owners. In these FREE workshops, you will discover how to use cutting edge, peer-reviewed, tax-reduction strategies. You’ll discover how to maximize Roth IRA conversions… Social Security benefits… Trusts… index investing… and many other strategies designed to significantly bolster your retirement savings and estate. These workshops are designed to help you:

So act NOW! Learn how you can benefit from the new tax legislation. Attend Jim’s FREE workshops in March. Discover his effective—and 100% legal—tax-saving strategies. |

About James Lange, CPA, Attorney and Financial Advisor

Jim’s strategies have been endorsed by The Wall Street Journal (36 times), Newsweek, Money magazine, Smart Money, Reader’s Digest, Bottom Line, and Kiplinger’s. His articles have appeared in Bottom Line, Financial Planning, The Tax Adviser, Journal of Retirement Planning, and 5 articles in the peer-reviewed Trusts & Estates.

Jim is the author of six best-selling books, including three editions of Retire Secure!, endorsed by Charles Schwab, Larry King, Ed Slott, Jane Bryant Quinn, Roger Ibbotson, The Roth Revolution, endorsed by Ed Slott, Natalie Choate, Bob Keebler, and 50 other experts, The Little Black Book of Social Security Secrets, endorsed by Jonathan Clements, Paul Merriman, and Elaine Floyd, and The Ultimate Retirement and Estate Plan for Your Million-Dollar IRA, endorsed by Bill Flanagan, Paul Merriman, and Burton Malkiel.

4 Bonus Gifts: Yours FREE When You Attend Our FREE Workshop!

To claim your 4 bonus gifts worth over $575, call 412-521-2732 today. Investment advisory services offered by Lange Financial Group, LLC.

Free Bonus #1

Register todayand youwill get a copy of James Lange’s 420-page hardcover book, Retire Secure!Third Edition. (Cover Price: $24.95)

Free Bonus #2

Attendees also receive a copy of James Lange’s 276-page best-seller,The Roth Revolution: Pay Taxes Once and Never Again, in which Jim shows how to use a series of Roth IRA conversions to grow income from your IRAs tax-free not only for the rest of your life, but for your children and grandchildren after you are gone. (Cover Price: $18.99)

Free Bonus #3

Attendees will receive my new book on Social Security, The $214,000 Mistake: How to Double Your Social Security and Maximize Your IRAs. (Cover Price: $9.95)

Free Bonus #4

Attendees interested in the preparation of Wills and Trusts, retirement and estate advice, or other financial services may be eligible for a FREE Second Opinion Consultation. (Value: $525.00)

Experts Praise Jim Lange’s Book, Retire Secure!

Charles R. Schwab calls Retire Secure! “an invaluable resource for investors.” In its pages, you will get the facts on funding your retirement plans, traditional vs. Roth IRAs and 401(k)s, optimal spending strategies for retirees, withdrawing retirement plans funded with company stock, Trusts, estate planning, maximizing Social Security, IRA strategies, and much more.

“Think of Retire Secure! as a GPS for your money,” raves Larry King (Larry King Now).“You may know where you are and where you want to go, but you don’t know how to get there. Jim offers the best route.”*

“James Lange’s book, Retire Secure!, covers two areas particularly well—Roth IRA conversions and estate planning for IRA owners.”*

— Jane Bryant Quinn, Newsweek, AARP, Bloomberg.com

“Retire Secure! is a very practical investment guide on how to defer taxes and efficiently plan for retirement and your estate.”*

— Roger B.Ibbotson, Professor, Yale School of Management

“Keeping your investment expenses low and following Jim Lange’s tax savings strategies are the surest routes to a comfortable retirement.”*

— Burton G.Malkiel, Professor of Economics, Princeton University, Author, A Random Walk Down Wall Street

“James Lange is a genius at making the most difficult subject of estate and retirement planning easy to understand.”*

— Eleanor Schano, Host, LifeQuest, WQED Multimedia

“In today’s volatile market, the peril of building wealth on short-term growth strategies has never been more evident. James does a great job of explaining the how and why of a long-term view with an eye to building money and protecting it when you are ready to spend it.”*

— Peter M. Vessenes, RFC, CEO, Vestment Advisors, Inc.

“Jim Langeisaclearand concisecommunicator. Hetakesthe complicated and makesitsimple.”*

— Diane L.McCurdy, CFP, Author, How Much is Enough?

*All reviews are for Jim’s books, not his services.