Table of Contents

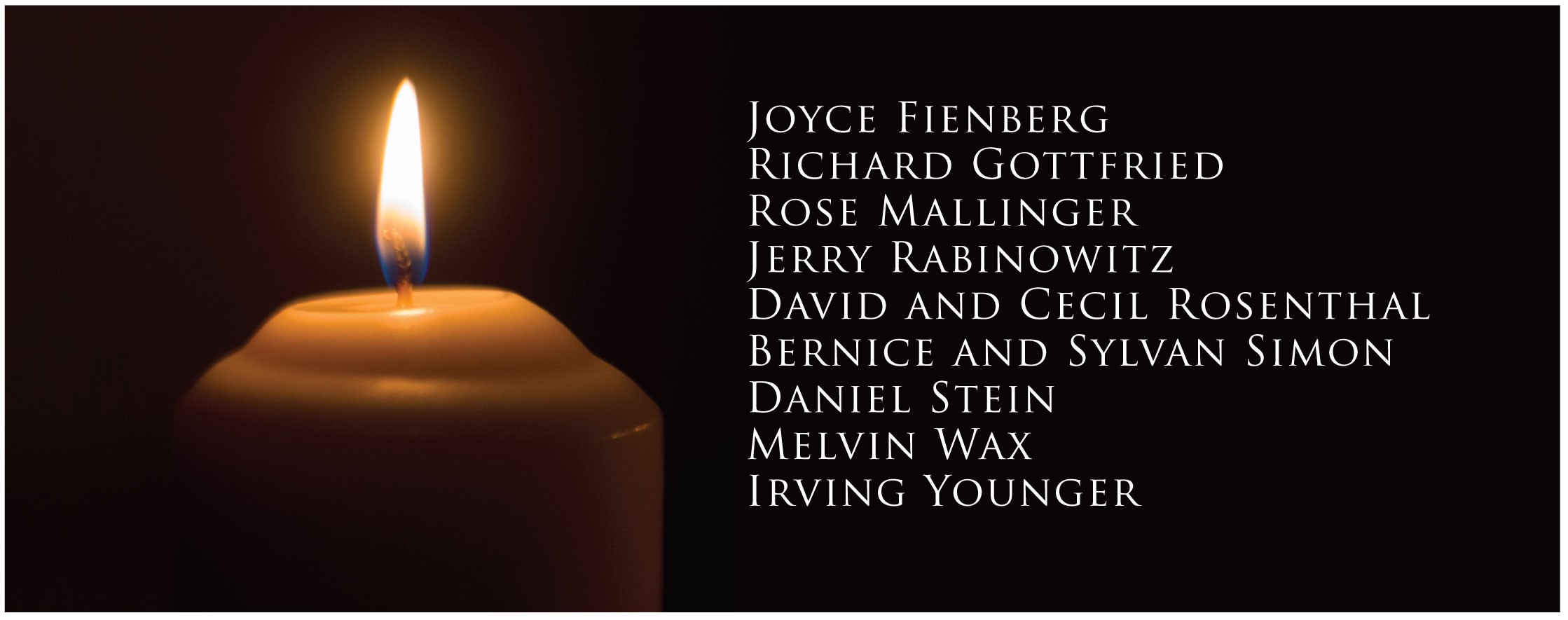

Remembering Where We Were on October 27, 2018

by James Lange, CPA/Attorney

On Saturday morning, October 27th, I was presenting three workshops in Squirrel Hill at the Pittsburgh Golf Club. We heard about the shooting at the Tree of Life Synagogue roughly around 11:00 a.m.

For those of us who live and work in Squirrel Hill, we know that there are never more than three degrees of separation among our neighbors and friends, so everyone present was shaken and anxious mirroring the uncertainty and horror of the extended community that is Pittsburgh. But we made the decision to go forward with the two remaining workshops. Whether we proceeded or not, the wait for more information was going to seem interminable.

Sunday morning, the list of victims was released and sadly I learned my long-time client, Joyce Fienberg, was among them. While many of the eulogies for Joyce will be more extensive, I have to say she was one of the nicest women I have worked with. She was all about giving, whether the cause was her family, her Temple, or worthy charities.

In closing, I would like to offer my deep condolences to friends, family members, and the three congregations of the Tree of Life, Dor Hadash, and New Light synagogues. Our Pittsburgh community is tight-knit, and we all have suffered from the aftermath of this horrific event.

Rabbi Danny Schiff wrote an excellent opinion piece for The Washington Post (Anti-Semitic attacks share a pattern. Pittsburgh is different.) distinguishing Pittsburgh’s reaction to this atrocity from other acts of anti-Semitism. If you are interested, the article can be found at https://paytaxeslater.com/washington-post-article.

Charitable Giving, Good for You and Good for Others

“Happier people give more and giving makes people happier, such that happiness and giving may operate in a positive feedback loop (with happier people giving more, getting happier, and giving even more) says a Harvard Business School study, Feeling Good About Giving: The Benefits (and Costs) of Self-Interested Charitable Behavior, 9/2009.

If you choose to be charitable—and potentially benefit from the positive feedback loop—there is no harm in being tax-smart too.

Effective 2018, how we claim deductions has changed substantially. We now are entitled to a higher standard deduction ($12,000 for an individual, $24,000 for married filing jointly, $26,600 if 65 or over) but are limited to $10,000 in deductions for real estate and income taxes. Charitable contributions are deductible as an itemized deduction, but to itemize, a taxpayer’s combined itemized expenses for the tax year must be greater than their standard deduction amount.

One tax-advantaged solution for those who are receiving required minimum distributions from IRAs and retirement plans is the qualified charitable deduction. Using this strategy, you can take the new higher standard deduction plus lower your adjusted gross income on the front page of your tax return by making charitable contributions directly from your IRA. This gives you a double tax break on the same charitable contribution. For more information on that topic, please see our year-end tax letter at https://paytaxeslater.com/2018yearendtaxplanning/.

If you are considering a substantial ($50,000 or more) gift, we have a special report available at https://paytaxeslater.com/philanthropic-giving that discusses a variety of options. The biggest concerns that the report addresses are not only the tax-saving opportunities, but also the issue of control which many want, and complexity which many do not want. It isn’t always an easy balance.

Also, I would be remiss if I didn’t mention charitable giving at death. The vast majority of wills and trusts and beneficiary designations that we review that have been drafted by other law firms are remarkably misguided and that is being generous—they leave the wrong dollars to the wrong beneficiaries.

Here’s a simple example of which dollars to leave to charity. Assume you have both IRA and non-IRA assets. Let’s also assume you want to leave $100,000 to your favorite charity or charities after you and your spouse have died. Most of the documents we review will leave the $100,000 bequest in the clients’ will or revocable trust—which is non-IRA money—and money that client has already paid income tax on. Charities don’t care in what form (IRA, after-tax, highly appreciated dollars, Roth IRA, etc.) they get their money because they do not pay income taxes. Individuals do care because of the different tax implications of the different types of inherited funds. Under most circumstances, it makes sense to give the IRA to charity. Mechanically, this charitable bequest, usually upon the second death for a husband and wife, would come from the IRA or retirement plan beneficiary designation, not the will or revocable trust. Remember, your heirs will have to pay income tax on an inherited IRA and a charity won’t. Granted that is an oversimplification, but it is critical that it be handled correctly!

New Video Available

From our most recent workshop, we taped and recorded the session that addresses the universal investing dilemma of managing the risk of a market downturn versus losing purchasing power to taxes and inflation by investing too much in fixed income. I would like everyone who might have missed the workshops to know that the recorded versions will be available on a DVD that we will be sending out, and, ultimately on an USB thumb drive. As soon as they are ready, they will be available to anyone who makes a request. Simply call 412-521-2732, speak with Alice and request that we send you the information.

Alice Davis, who most of you will recognize as the voice of “Lange Financial Group” is working too hard! One of the best things about having a great business with happy clients is that we continue to grow. Consequently, we ask Alice to take on more responsibility, and it is now time to hire someone to work with her. If we could clone Alice, we would, and we would hire the clone. Most of the work would be what I would call high-level administrative work, meaning it would take some judgment, not simply following directions. It would also involve intensive client contact and a lot of phone calls. Representing the “face/voice” of the company with professionalism and grace will be paramount.

We know from our past experiences that referrals and recommendations for potential employees from our clients and business associates are extremely valuable. I am completely aware that the success of our firm is due to our great and long-standing staff. We are looking for someone who is interested in building a long-term career with our company. I could tell you how wonderful we are to work with, and about salary, health benefits, etc., but at this stage, when we are putting out feelers for good candidates, I prefer to let our employee’s longevity represent our commitment to an excellent work environment—not to mention a growing practice.

Glenn has been with us for 30 years; Sandy, 27 years; Steve, 24 years; Donna, 21 years; Daryl, 20 years; Diane, 20 years; Matt, 16 years; Alice, 16 years; Karen, 11 years, etc. (I don’t mean to leave anyone out, but everyone else has been under 10 years). As for me, I started doing tax returns “on the side” in 1979, and we now have 17 employees, as well as numerous subcontractors. Some of you remember climbing to the third floor of my mother’s house (which is now my house) where I had my first office. As much as I like to play and travel, I love what I do and intend to work for a long time. In addition, the company will not end when I retire (if I ever do) or die, though obviously, it will be different.

If you know of someone who you think would be a qualified candidate, please refer them to www.paytaxeslater.com/client-service-coordinator for a complete job description. I thank you for your help, but Alice will really appreciate it!

Lauri’s Cauliflower Turmeric Flatbread

Lauri Lang has potentially life-changing information about how to reduce inflammation with a “yummy” diet. Jim thought her information was so valuable that he interviewed her from the Lange Kitchen, and we’ve posted the video at www.paytaxeslater.com/lauri. It’s well worth your time to watch.

Lauri cooks this flatbread for Jim and Cindy. Jim particularly likes it.

- 2 cups riced caulifloweror use broccoli, cabbage; get creative!

- 4 eggs

- 1 cup mixture almond flour and ground flaxseed

- 3 tsp ground turmeric

- ½ tsp Himalayan or sea salt, or to taste

- Black pepper to taste, to activate turmeric

- Chopped fresh herbs of choice: cilantro, dill, basil, chives, tarragon, etc.

- Optional: chopped olives, scallions, onions, capers, garlic, etc.

Instructions:

- Preheat oven to 350-375 degrees, depending on oven.

- Combine mixture thoroughly.

- Line a baking sheet with parchment paper and spread evenly about 1 centimeter thick.

- Bake for 25-30 minutes, or until cooked through with edges browning.

- Allow to cool, cut and store in refrigerator for up to a week, freezes well.

EVERY INGREDIENT IS A SUPER FOOD. MAKE THIS ONE OF YOUR STAPLES!!!

Year-End Tax Planning

by James Lange, CPA/Attorney and Glenn Venturino, CPA

Please visit https://paytaxeslater.com/2018yearendtaxplanning/ for Glenn Venturino’s excellent comprehensive year-end tax planning letter. But I want to highlight a few essential year-end items.

Roth IRA Conversions: If you want to make a Roth IRA conversion for 2018, you must do it before year-end. Many of you should. Despite this warning, many readers who should make a Roth IRA conversion before year end won’t. Why? Because they don’t know they should, or they think Roth IRA conversions are good, but not for them. That could be true, but you should be making an informed decision. You could be making an extremely expensive mistake. It is best to make an informed, educated decision of whether you are a good candidate for a Roth conversion and if so, how much and when.

You should have received our DVD called Unintended Benefits of the New Trump Tax Law. That DVD reveals an unprecedented opportunity for many IRA owners to make a series of Roth IRA conversions starting in 2018.

If you think you may be a candidate for a Roth conversion and you didn’t watch the video, I would urge you to do so immediately. If you didn’t receive the video or you misplaced it, please call us. Also, remember if your retirement plan at work offers a Roth 401(k) or Roth 403(b), it is likely you will be able to make a Roth conversion with the money in your existing retirement plan, not just with your IRA.

Itemized Deductions: We now have a higher standard deduction allowance ($12,000 for individuals, $24,000 for married filing jointly, $26,600 if 65 or over) and are limited to $10,000 in real estate and income taxes. Miscellaneous itemized deductions are gone. Charitable contributions are deductible as an itemized deduction, but to itemize, taxpayers combined itemized expenses for the tax year must be greater than their standard deduction amount.

One solution for those who are taking required minimum distributions from your IRAs and retirement plans is the qualified charitable deduction. Using this strategy, you can take the new higher standard deduction plus up to $100,000 in charitable deductions while lowering your adjusted gross income on the front page of your tax return.

Required Minimum Distributions: Please note that distributions must be made before year-end. Be sure you have taken all the required distributions from all your retirement accounts.

Open Enrollment: Many companies have open enrollment for employee benefits in November and December. If you have access to a Health Savings Account, subject to exceptions, contribute the maximum. Same with Roth 401(k)s and Roth 403(b)s. Review other benefit options as well.

Beneficiary Designations: Make sure all your retirement plans, IRAs, and other assets that have beneficiary designations are filled out appropriately. For many if not most of our clients, the beneficiary forms for these types of accounts control more money than wills and trusts.

If you would like us to “run your numbers” for a series of Roth conversions and much more, please call quickly. We will try to schedule an appointment before year-end—but we can’t guarantee an appointment unless you are an assets-under-management client. Alternately, if the timing isn’t good for you this year, we have availability between January 1st and February 15th, 2019.