As we go to press, markets remain turbulent, primarily due to the confusing and unpredictable tariffs, the concerns over a slowing global economy, the threat of inflation and/or a recession. The president’s sweeping tariffs and subsequent adjustments to those plans continue to generate confusion and volatility.

Economic analysts might have some disagreements about the wisdom of tariffs, but the vast majority seem to be strongly against the strategy as implemented to date. Elon Musk notably criticized White House trade advisor Peter Navarro, calling him “truly a moron” and “dumber than a sack of bricks,” before humorously apologizing—to the bricks.

But as investors we have very little control over these big picture concerns. This can generate a lot of anxiety. So, the ongoing question is “Now What?”

In a recent communication to our email newsletter subscribers, I discussed the concept of “personal inflation.” I am concerned about a sharp rise in inflation, which means we’ll pay more money for goods and services precisely when our stock portfolios are down. Ideally, we have sufficient income and/or non-equity investments to cover our expenses until markets stabilize.

However, there is no guarantee of a quick or even long-term recovery even if historically, trends generally support eventual rebounds.

That said most analysts I’m reading continue to advise against a significant sell-off of U.S. equity positions.

To present a more balanced perspective, I searched for respected economists supporting the administration’s current tariff strategies. Even the economist initially cited by the White House to justify the tariff plan now says Trump has “got it very wrong.”

The tariffs and their tumultuous roll-out have strained Sino-American relations and alienated many of our traditional allies as well. Notably, The Wall Street Journal op-ed page, typically cautious in its economic criticisms, recently published an editorial titled U.S. Tariffs Make Xi Jinping’s Day, underscoring global tensions exacerbated by our trade policies.

While we confront internal debates and uncertainty, China is aggressively investing in its future, and exerting its economic influence across the globe, including in many of the nations that may be hardest hit by our (currently temporarily suspended) tariffs.

With Chinese government backing, Huawei has spent the last three years constructing a massive new research complex roughly the size of 225 football fields, capable of housing labs for 35,000 scientists, engineers, and technology specialists. In contrast, we are currently in the process of making huge cuts to scientific research, healthcare, higher education, and AI development. That doesn’t bode well for our long-term competitiveness and innovation. But once again, as individual investors we have little control over these major setbacks or advances. So, “Now What?”

Jason Zweig of The Wall Street Journal recently wrote an insightful piece titled Trump Just Shredded the Economic Playbook. Here Are Your Next Investing Moves. Zweig emphasizes the importance of avoiding hasty actions that we might later regret. Among his cautions is the regret investors could feel down the line if they were to exit the market entirely right now or put too much money in. Selling in a falling market locks in your losses, conversely, aggressively pouring money in amid uncertainty assumes your ability to judge when a stock is offering a great deal.

Interestingly, Zweig suggests one prudent step would be temporarily reducing your expenditures. While that advice sounds very reasonable, most of our clients already spend far less than they can comfortably afford. And I hate the idea that the current economic climate might cause them, or even my wife Cindy, to defer meaningful experiences like family vacations out of financial anxiety.

Zweig does offer some long-term hope, noting historical market recoveries typically follow periods of tariff reductions or policy stabilization. To some extent, that just happened when the market jumped up in reaction to Trump’s tariff pull back, although the increased tariffs on China, triggered another fall. As we have been saying, the unpredictability is causing extreme volatility.

Holding a long-term perspective was also the recommendation of Jack Bogle, the late founder and CEO of Vangard, spoke frequently about “reversion to the mean,” observing that down markets usually bounce back over time. While these insights offer some comfort, certainty remains elusive in the current environment.

That said, I still think the best strategy you can follow now is to develop a thoughtful financial plan, avoid rash decisions in times of stress (that goes for life decisions as well as financial decisions), and try to stay focused on your long-term goals. I really wish I could predict the future, but neither I nor the analysts nor the pundits have a crystal ball.

Given the seemingly constant barrage of unsettling news, perhaps it is a good time to revisit a strategy I suggested in a prior newsletter: consider taking a short “news fast” and focusing, at least temporarily, on more uplifting and personal priorities.

So, Jim, Did You Alter Your Own Portfolio?

Actually, my wife and I reduced our U.S. stock holdings by 5%.

During our last webinar of 2024, my guest, Larry Swedroe, basically said if you were appropriately diversified, not to move one way or another because of actions by President Trump and the new administration. I asked Larry whether he was making any changes. Larry indicated that he had moved 5% out of U.S. stock at the end of 2023, but he didn’t recommend it.

I decided to move 5% out of U.S. stock. In other words, do as I say, not as I do!

“...the best strategy you can follow now is to develop a thoughtful financial plan, avoid rash decisions in times of stress, and try to stay focused on your long-term goals.”

The foregoing content reflects the opinions of Lange Financial Group and is subject to change at any time without notice. Content provided herein is for informational purposes only and should not be used or construed as investment advice or a recommendation regarding the purchase or sale of any security. There is no guarantee that the statements, opinions or forecasts provided herein will prove to be correct.

Past performance may not be indicative of future results. Indices are not available for direct investment. Any investor who attempts to mimic the performance of an index would incur fees and expenses which would reduce returns.

Securities investing involves risk, including the potential for loss of principal. There is no assurance that any investment plan or strategy will be successful or that financial markets will act as they have in the past.

At the risk of re-offending one of my physician clients, and perhaps a few more who haven’t spoken up, I offer a few health-related ideas that I have adopted, and which could potentially make a big difference in your life. Of course, I only offer these reflections and observations based on my experience and you should speak with your health care providers about their advice and recommendations.

Water Pick

I finally started using a water pick in addition to brushing and flossing my teeth. It is amazing to me how much cleaner my mouth is even after brushing and flossing. My dentists have been telling me that for years, and after two root canals, two crowns, and a bridge, I am finally listening. If you are not already using a water pick you could consider adding it to your routine.

Nasal Rinse

An ENT doctor recommended that I do a nasal rinse twice a day. He then commented, “Everyone should do this like brushing their teeth twice a day.” I have been doing a nasal rinse of salt water and baking soda for years, but only once a day and only when needed. (You must use distilled water or cooled boiled water because tap water could potentially introduce allergens or pathogens.)

I started with a neti pot—which is quite gentle and uses gravity to rinse out the nasal passages. Then I graduated to a sinus rinse that uses a little more force with a squirt bottle. Though it is more complicated and has “harder to clean” parts, I recently switched to Navage which uses suction to do an even better job clearing out the sinus passages. I find it very helpful in reducing allergy symptoms and it definitely helps me breathe easier. For those with allergies or stuffy noses, I highly recommend using it twice a day.

Tame Your Allergies for the Long Run

The nasal rinse helps. I also use a prescription nasal inhaler that helps. I also wear a mask (like the ones I sent to clients and friends during Covid) when I am outside, and the allergen counts are high. But all these measures do not address the root of the allergies and aren’t designed to “cure” you of allergies.

Allergy shots have been around for a long time. You can do your own research, but I would say they are pretty effective. According to a Cleveland Clinic report about 80% of people see significant improvement in their allergy symptoms. This means there’s a reduction in their symptoms, though they won’t necessarily completely go away. About 60% of people have permanent benefits after three to five years of allergy shots.

But in my experience, you must go to the doctor’s office to get the shots, which is inconvenient.

There have been some advances on the medical front. You can now receive treatment for allergies through sublingual drops (drops you put under your tongue). Though opinions differ, my ENT and I have looked at some of the literature which seems to indicate they are effective. The big advantage is you don’t have to visit a doctor’s office for the treatment, you can do it yourself…if you can get the serum. Many offices don’t offer sublingual serum.

Chinese Herbal Pills for Allergy Relief

Several years ago, an acupuncturist recommended a Chinese herb for allergy relief called Magnolia Flower Teapills. These pills helped with my allergy symptoms. I recommended these pills to others who also reported reduced allergy symptoms.

Gut Health

Now for the nuttier stuff. I have long believed appropriate respect for gut health and fostering a good gut environment has significant health benefits—I was on the probiotic bandwagon years and years ago. A good diet can go a long way to improving gut health. There are a lot of recent peer reviewed articles that come to a similar conclusion. I have spent significant time and money and deprived myself of foods that I like to develop and maintain what I and my nutritionist believe is a healthy diet, and specifically a gut healthy diet.

But frankly, the literature available on foods and gut health applies to a general audience. It wasn’t written with me in mind. I recently joined a program called Viome. (There are several other companies that offer a competing service.) I paid $279. They send you a kit and you provide them with a sample of your blood, saliva, and stool. You also fill out a long questionnaire. They then send you a long list of foods that they categorize as either Superfoods, Enjoy, Occasional, and Avoid which is the order they grade the different foods, presumably unique to me.

Based on these results, my nutritionist developed meal plans where I eat as many Superfoods as possible as well as some Enjoy foods. Many of the recommendations were predictable. For example, arugula and beet greens were considered Superfoods for me. Other recommendations didn’t make sense. For example, brussels sprouts and broccoli were on my Avoid list. Supposedly, the recommendations are unique to me. However, I plan to retest and expect the recommendations to change.

The thing I dislike about Viome is that it is AI powered, and the recommendations don’t have the oversight of a real expert, something that I think is mission critical when using AI. They don’t provide sufficient explanation for why they are making the recommendations they make.

To be fair, they have general reasons for why you should or should not eat certain foods. But there is little transparency about how AI is coming to its conclusions, so it is hard to trust the recommendations. They offer some support, a Q&A page, and a Facebook group, but it isn’t the same as having a nutritionist review the recommendations.

In my case, I am also consulting with my regular nutritionist who has the results of the test in front of her when working with me.

I have also ordered Viome’s mix of custom supplements. I like the idea of having personalized supplements, presumably picked with my particular gut in mind. They supplement the supplements I already take. I considered it a major victory when I convinced my daughter Erica to try the program. (Only the diet, not the supplements.)

However, it is too early to truly determine whether this product and service lives up to its promise. I am still doing research. Viome has received mixed reviews online. But, if you are interested, you could go to www.Viome.com. As I mentioned earlier, there are competing products and services.

Qualia Senolytic Supplements

I also started taking a supplement called Qualia Senolytic. Senolytics aim to reduce and remove senescent cells.

From the Cedars Sinai blog: “Senescent cells, sometimes called ‘zombie cells,’ stop replicating over time and can be removed by the immune system but otherwise do not die. Instead, they pile up in the body and, through inflammation and other biological processes, speed up aging and physical deterioration.”

It has a lot of reported benefits that you can readily find online. Many of the “longevity experts” are recommending it. It receives good reviews on Amazon. There is research being conducted that looks quite promising: https://pmc.ncbi.nlm.nih.gov/articles/PMC10875739/.

I take 8 capsules/day for two consecutive days a month. Though I am doing a lot of stuff at once, one benefit that I think I can associate with Qualia Senolytic is I have more vivid and pleasant dreams than I did before. That may not be the most earth-shaking endorsement, but sweet dreams now—see the lead article—are always welcome!

Finally, I am keeping up with resistance training three times a week with a personal trainer. I am also continuing to receive stem cell injections twice a year.

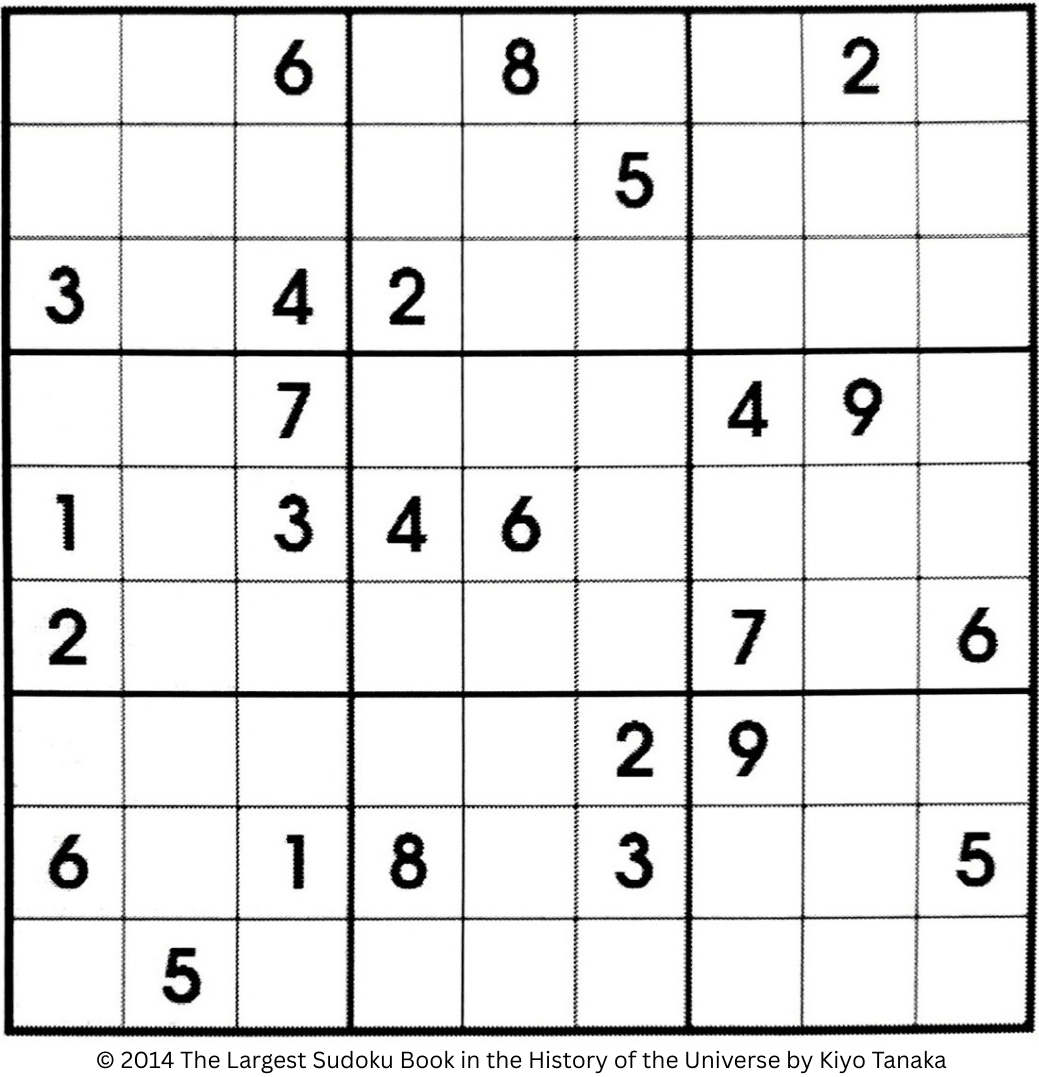

Click here for Sudoku Puzzle Answers

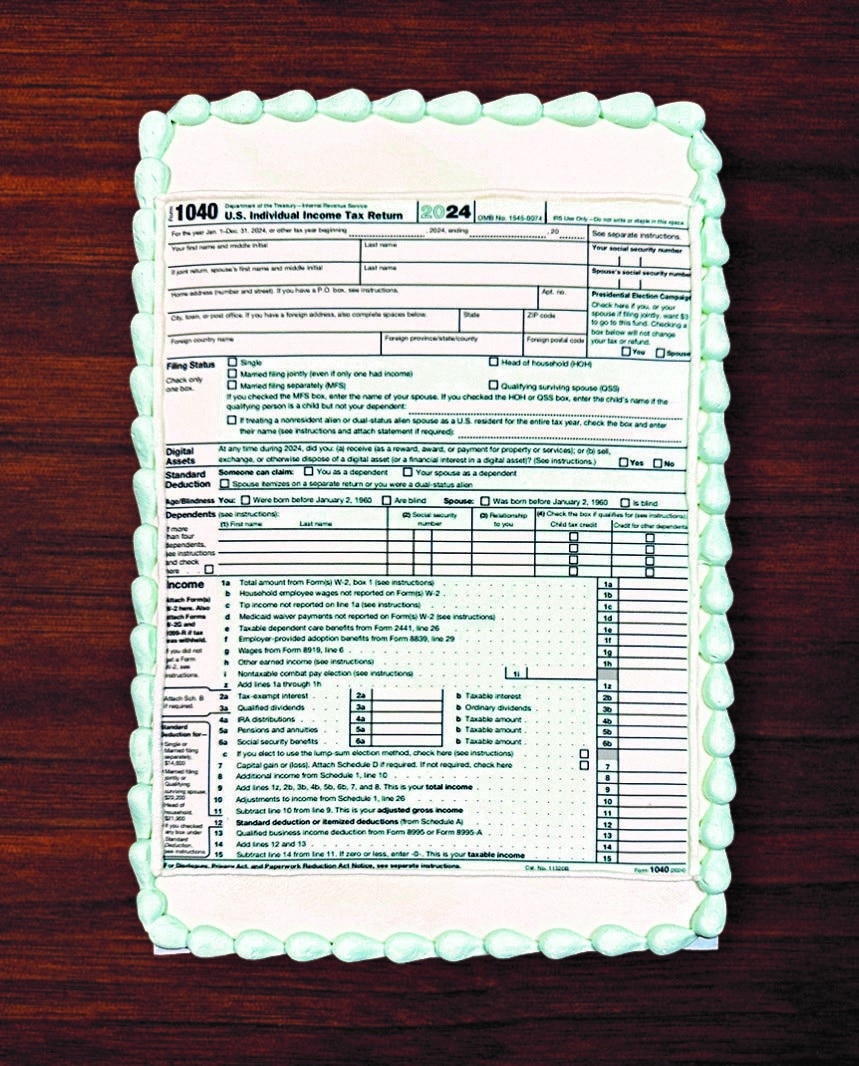

After-Tax Season Celebration for Our Hard-Working Employees!

After several months of working long hours preparing tax returns, we like to celebrate our team. Thank you to our CPAs, tax preparers, and our administrative team for a job well done!

Donna Master, our bookkeeper, organized a luncheon to remember. She hired Jaden’s Catering in Monroeville and worked with the Oakmont Bakery to create the coolest cake ever―topped with a fondant version of the 2024 IRS Form 1040 (see photo)!

Thank you, Donna, for organizing such a fun and memorable event!

Investment advisory services offered by Lange Financial Group, LLC. Investing involves risks, including the potential for loss of principal. There is no guarantee that any investment plan or strategy will be successful. Visit our website paytaxeslater.com for more information on our investment advisory services. Please see paytaxeslater.com/