I had the great privilege of working with Jonathan Clements on 34 of his personal finance columns published in The Wall Street Journal. That gave me a “behind-the-scenes” view of him that most readers never saw or heard.

I had the great privilege of working with Jonathan Clements on 34 of his personal finance columns published in The Wall Street Journal. That gave me a “behind-the-scenes” view of him that most readers never saw or heard.

Jonathan was old school in the best sense—thorough, thoughtful, caring, and never one to take shortcuts. He combined writing excellence with a good heart. He cared deeply about his readers, not just the rich and powerful, and always aimed to deliver practical, actionable information. He believed that good financial writing wasn’t about impressing peers—it was about genuinely helping everyday people make wiser, more confident decisions.

Though best known as a personal finance columnist, Jonathan often wrote about the intersection of money and happiness. He reminded readers that spending money on experiences usually brought more joy than endlessly buying “more stuff.” He had an uncanny ability to translate research and real-world behavior into simple, meaningful lessons readers could apply immediately.

I always enjoyed reading his columns. On one occasion, I left him a voicemail on how he could have improved a particular column—never expecting a reply. To my surprise, Jonathan called back. I suggested an idea for a future column that he liked, and he graciously included me as a source.

Later, while in New York on personal travel, I asked if I could stop by his office to present additional ideas. Jonathan agreed. My wife, Cindy, came along and acted as a scribe while I presented ideas for columns, and we brainstormed for hours. That meeting began a true lifelong professional relationship. He never pretended to know everything. He believed the best journalism came from testing and refining ideas with others.

From there, we developed a rhythm: he would often email me when he was considering a new topic, usually giving me a week to respond. I would spend hours developing ideas. Many didn’t make the cut—but many did, forming the foundation of those 34 published pieces.

Jonathan was meticulous, thorough, and determined that everything he published was accurate, well-reasoned, and useful. Although The Wall Street Journal had a policy prohibiting writers from sharing columns before publication, Jonathan still wanted to ensure his work was airtight. He would often call me about a specific passage. Sometimes I’d confirm it was correct as written; other times I’d suggest an edit or a relevant related idea. He always welcomed that feedback. He wasn’t seeking praise—he was seeking the best possible column. That is rare in journalism, and rarer still in personal finance journalism.

Jonathan had a charming English accent that made his thoughtful insights even more engaging. Jonathan was also one of my favorite guests. He was gracious enough to appear eight times on my former radio show, The Lange Money Hour: Where Smart Money Talks. All these interviews are still available both in audio and typed transcript form at PayTaxesLater.com/Guests/Jonathan-Clements/. Most of the content in our radio show discussions is as relevant today as it was during the interview.

In addition to his Wall Street Journal columns, I also admired his books. While I would recommend them all, my personal favorite is The Little Book of Main Street Money. It captures his core philosophy: that financial security—and even happiness—comes more from smart habits than from chasing the latest investment fad.

Jonathan Clements was my favorite personal finance columnist of our era, and his influence will continue to guide readers and writers for years to come.

Optimal retirement and estate planning is ultimately about getting the most out of what you’ve worked so hard to build and providing your family with long-lasting financial security. You accomplish this by implementing tax-savvy strategies, thoughtful withdrawal planning, and estate structures that align with your personal goals.

If you want 2026 to be the year you finally create a clear, confident, tax-savvy retirement plan, attending our January webinars will be one of the most important learning opportunities available.

Visualize being on your way to achieving lifelong financial security and gaining the clarity you need to make smarter long‑term decisions. Join us for these breakthrough January webinars to learn exactly how to do it.

Tuesday, January 27, 2026

Register to attend 1, 2, or all 3 Free Webinars at:

If you are married, both spouses are encouraged to attend.

Session One: 10:00 AM – Noon (Eastern)

Roth Conversions After the OBBBA: New Opportunities and New Pitfalls

Led by James Lange, CPA/Attorney with Guests:

Jen Hall, CMA, CPA, CFP, CRPC and Dominic Bonaccorsi, CPA, CRPC

The One Big Beautiful Bill Act (OBBBA), signed into law on July 4, 2025, permanently extends the federal income tax reductions set by the 2017 Tax Cuts and Jobs Act (TCJA), which were previously scheduled to sunset at the end of 2025.

Get the most up-to-date guidance on adjusting your conversion strategy for maximum tax efficiency under the new rules.

In this session, Jim Lange will cover classic principles of Roth IRA conversions (with additional support from two “number-crunching” CPAs who work with Jim), plus seldom-used and little-known advanced Roth conversion techniques.

In this session, you’ll discover how to develop a Roth conversion plan that dramatically improves long‑term after‑tax wealth for you and your family while reducing lifetime tax drag.

You will learn:

-

-

- Key tax provisions of the OBBBA that affect Roth conversions, retirement withdrawals, charitable giving, and estate planning.

- The time-tested peer-reviewed concepts that still work—and the ones that don’t—under the new tax law.

- Proactive multi-year tax planning: How to develop the ideal long-term Roth IRA conversion plan for today’s tax policy environment.

-

Optimal Timing for Roth Conversions:

-

-

- Why optimal conversion timing can add hundreds of thousands of dollars to your family’s long-term wealth.

-

Advanced Strategies You Will See Demonstrated:

-

-

- Tax-free conversions: How to convert after-tax dollars in IRAs and other retirement plans to Roths at no cost.

- How your heirs can convert inherited retirement plans to their own Roths—at their tax rates, not yours. Please note only some people will qualify and others may, but often not worth the aggravation, but great when it does apply.

-

Session Two: 1:00 – 3:00 PM (Eastern)

If You Retired Tomorrow, How Much Could You Safely Spend?

This session features the most important retirement spending chart ever created for determining what you can truly afford to withdraw without fear of running out of money—the one that reveals your true safe withdrawal rate based on your personal time horizon and portfolio design. Jim will walk you through this chart.

We also delve into why Bill Bengen increased his recommended safe withdrawal rate for a 30-year time horizon from 4% to 4.7%.

-

-

- Hear highlights from Jim Lange’s exclusive interview with Bill Bengen on time horizon and the change to 4.7%.

- Please note the increase from 4.0% to 4.7% equates to a 17.5% raise in safe withdrawal retirement distributions.

-

Jim will also address other pressing retirement questions that directly affect your monthly spendable income:

-

-

- How can you optimize Social Security for greater security and income?

- What is the impact of annuitizing?

- Should you count home equity as part of your safe spending calculation—and if so, how much?

-

Session Three: 3:30 – 5:00 PM

Best Estate Plan for Most Married Couples

In this session, you’ll learn:

-

-

- The details of the best and most flexible estate plan for most married couples.

- Lifetime Gifting Strategies: How increasing lifetime gifts to your heirs now can reduce future tax burdens and provide financial assistance when it matters most.

- Who Gets What? The seldom-discussed strategy of matching the right assets to the right beneficiaries based on tax brackets and family circumstances.

- Risks and rewards of delaying Social Security benefits for the primary wage earner—and the impact on the surviving spouse.

-

About Your Presenter: James Lange, CPA/Attorney

Jim is the author of 10 best-selling financial books including Retire Secure for Professors and TIAA Participants, with a foreword by Burton Malkiel. Please note 90% of this book applies to all IRA and retirement plan owners. The book has received 73 glowing reviews on Amazon. Jim has been quoted 36 times in The Wall Street Journal and is a paid contributor to Forbes.com.

Attend Jim Lange’s Webinars for FREE — Reserve Your Seats Today!

Tuesday, January 27, 2026

Register at: PayTaxesLater.com/2026Webinars

Yours FREE!

2 Valuable Bonus Gifts

(When You Attend Any Session)

Bonus #1: A free hardcover copy of Jim’s 472-page book, Retire Secure for Professors and TIAA Participants.

Bonus #2: The Retire Secure Safe Withdrawal Kit which includes:

-

-

- The Retire Secure Safe Withdrawal Card, a laminated chart of the different safe withdrawal rates based on your investment horizon along with a wealth of other helpful financial information.

- A reprint of my article, Bill Bengen’s New 30-Year Safe Withdrawal Rate: A 17.5% Raise for Retirees, originally published on com.

-

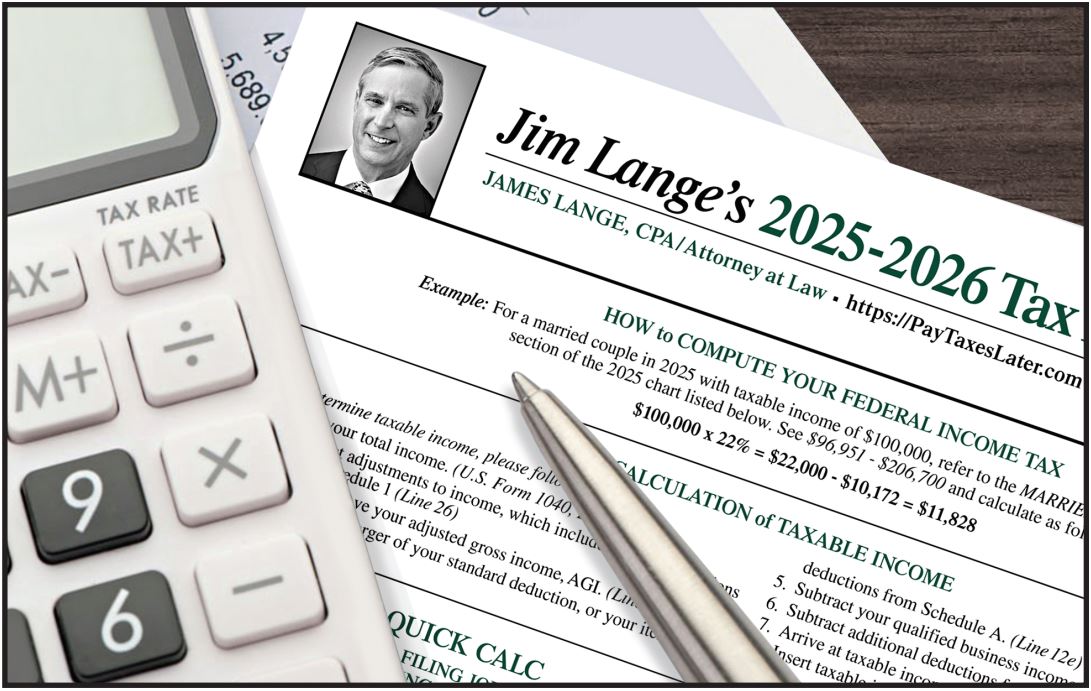

2025-2026 Tax Planning Card

This handy tax card has been helping investors—and most especially our clients—save time and money since 2005. Without fail, it is the most popular item our office produces. Please download and print your copy at:

The tax card can only offer a rough guide to optimizing your tax strategy. For example, a quick look might make it seem like Roth IRA conversions will be advantageous, but after you take other taxes into consideration for instance, additional premiums for Medicare Part B, the differences in capital gains taxes and qualified dividends and interest income, it may not be favorable.

You can’t rely on the tax card without a much deeper analysis for Roth IRA conversions as well as many other tax planning techniques. That said, it is a great starting point, and we are always available to run your numbers to assist you in making your financial decisions.

Simply call Justin Pape at 1-800-387-1129 to schedule your appointment.

Disclaimer: Lange Accounting Group, LLC, offers guidance on retirement plan distribution strategies, tax reduction, Roth IRA conversions, saving and spending strategies, optimized Social Security strategies, and gifting plans. Although we bring our knowledge and expertise in estate planning to our recommendations, all recommendations are offered in our capacity as CPAs. We will, however, potentially make recommendations that clients could have a licensed estate attorney implement.

Asset location, asset allocation, and low-cost enhanced index funds are provided by the investment firms with whom Lange Financial Group, LLC is affiliated. This would be offered in our role as an investment advisor representative and not as an attorney.

Lange Financial Group, LLC, is a registered investment advisory firm registered with the Commonwealth of Pennsylvania Department of Banking, Harrisburg, PA. In addition, the firm is registered as a registered investment advisory firm in the states of AZ, FL, NY, OH, and VA. Lange Financial Group, LLC may not provide investment advisory services to any residents of states in which the firm does not maintain an investment advisory registration. Past performance is no guarantee of future results. All investing involves risk, including the potential for loss of principal. There is no guarantee that any strategy will be successful. Indexes are not available for direct investment. If you qualify for a free consultation with Jim and attend a meeting, there are two services he and his firms have the potential to offer you. Lange Accounting Group, LLC, could offer a one-time fee-for-service Financial Masterplan. Under the auspices of Lange Financial Group, LLC, you could potentially enter into an assets-under-management arrangement with one of Lange’s joint venture partners.

Please note that if you engage Lange Accounting Group, LLC and/or Lange Financial Group, LLC for either our Financial Masterplan service or our assets-under-management arrangement, there is no attorney/client relationship in this advisory context.

Although Jim will bring his knowledge and expertise in estate planning to this workshop and to the meetings, it will be conducted in his capacity as a financial planning professional and not as an attorney. This is not a solicitation for legal services.