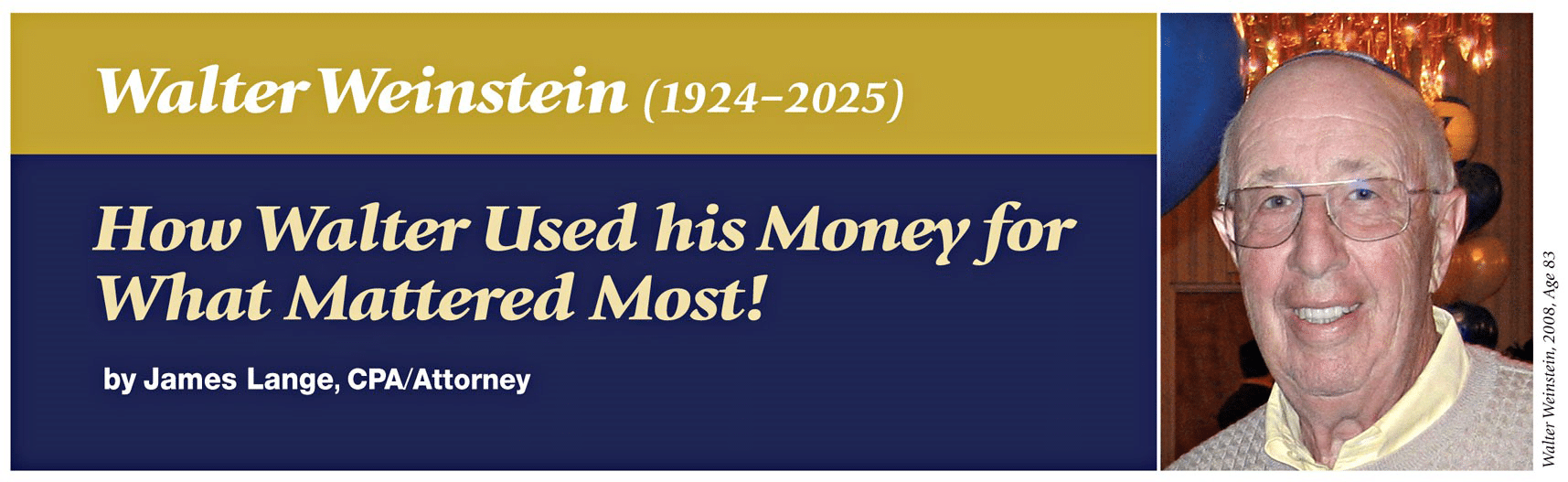

Walter Weinstein, my wife Cindy’s dad, passed on December 12th at the age of 101. He inspired one of my most popular articles, The Best Way to Spend Your Money. It was published first in Forbes.com and later in a prior edition of this newsletter.

Walter Weinstein, my wife Cindy’s dad, passed on December 12th at the age of 101. He inspired one of my most popular articles, The Best Way to Spend Your Money. It was published first in Forbes.com and later in a prior edition of this newsletter.

For more than 25 years, Walter planned, organized, and sponsored an annual vacation that brought together roughly 25 — children, spouses, grandchildren, and now great-grandchildren for a family gathering.

These vacations kept the family connected across generations and geography. Looking back, it’s hard to imagine a better use of time or money. In updated versions of that article, I’ve written about how much these annual gatherings meant to my daughter Erica, who feels a deep bond and sense of clan with her family. Many clients now proudly tell me that they, too, have begun sponsoring family vacations.

The original plan had always been that Walter would fund one final family reunion after his death — and that trip is already paid for and moving forward. This summer, all the children, spouses, grandchildren, and great-grandchildren will gather at Woodloch Pines, a resort in the Poconos, for five days of shared activities, meals, and family connection.

When Walter’s decline became imminent, the family came through for him. Cindy, her brother Barry, and his wife Amelia spent the last six weeks caring for him practically around the clock. All the grandchildren and great grandchildren traveled from all over the country to say goodbye—and then traveled again after his death to attend his funeral.

It also isn’t a coincidence that rather than leaving town after the funeral, the family rented several houses and spent a few days together in New Jersey.

There were discussions even when Walter was alive about keeping his tradition of the annual family vacation. Continuity of the family vacation tradition may not always be at Woodloch, and details may change, but everyone agrees this tradition should and will continue. That, to me, says everything about Walter’s values—and the legacy he created.

Side Trip to The Wall Street Journal and a Tax-Savvy Inheritance Strategy

While I was in New Jersey for Walter’s funeral, I also took advantage of being nearby to meet with Ashlea Ebeling, a reporter at The Wall Street Journal. Ashlea and I had collaborated on a front-page article on Forbes magazine several years ago, but we had never met in person. Since Ashlea began writing for the WSJ, we’ve been working together on an article about ABLE accounts—essentially 529-type plans for individuals with disabilities.

During our hour and a half conversation in The Wall Street Journal’s New York City offices, I shared a planning strategy that came directly from my own family. That strategy appeared on December 22, 2025, in The Wall Street Journal. The following is a shortened version of the planning strategy’s essence:

Assume Walter had a $1 million IRA (not the actual amount). Under a typical estate plan, he would have left the IRA to his two children, Cindy and her brother, Barry. If Cindy had inherited her share outright, she would have been required under the SECURE Act to withdraw the entire inherited IRA within 10 years—at our tax rates.

Instead, Walter agreed to a strategy I suggested and helped implement. Cindy was named as the primary beneficiary of her share of his IRA, with the right to disclaim that inheritance to a properly drafted Special Needs Trust for our daughter, Erica. Cindy plans to exercise that disclaimer, allowing her inherited IRA share to pass into a Special Needs Trust created for Erica’s benefit. Because Erica qualifies as an Eligible Designated Beneficiary under current law, the trust can receive required distributions from the inherited IRA over her lifetime—effectively preserving the long-term “stretch” treatment that existed before the SECURE Act.

The result: continued tax deferral, protection of Erica’s public benefits, and a planning outcome that aligns money with what mattered most to Walter—family first.

Not only does this dramatically reduce taxes—easily saving hundreds of thousands of dollars over Erica’s lifetime, but it also provides long-term protection, flexibility, and security for Erica, without jeopardizing important government benefits on which she relies. This is not a theoretical strategy. It’s real. It’s documented. And it is exactly the kind of planning that many grandparents with substantial IRAs should be considering.

I shared this idea with Ashlea. Even though her article focused on ABLE accounts, she and her editors liked the strategy so much that she decided to incorporate it into the piece. As is typical with major publications, she couldn’t send me the article in advance to review — so the final review happened the day of the funeral, over the phone, while I was at the memorial lunch with the family.

The meal was held in a noisy restaurant. Outside, it was freezing and windy. The only quiet place I could find to talk with Ashlea was in the men’s room. This was not the first time I’ve taken a call from a WSJ reporter in a men’s room. Like my many follow-up conversations with Jonathan Clements, I’ve learned that when the press calls, you take the call unless it is a true emergency. Ashlea and I went back and forth on the language until we were both comfortable.

The plan now is to write an article expanding this idea and publish it in Forbes.com. Then, I will send you a copy.

When I step back, what strikes me is the alignment of Walter’s values and the way he utilized money. Walter used his resources to bring family together. He was open to thoughtful planning that aligned with his values. And even after his death, those decisions are continuing to shape our family — emotionally and financially — in ways that really matter.

Optimal retirement and estate planning is ultimately about getting the most out of what you’ve worked so hard to build and providing your family with long-lasting financial security. You accomplish this by implementing tax-savvy strategies, thoughtful withdrawal planning, and estate structures that align with your personal goals.

If you want 2026 to be the year you finally create a clear, confident, tax-savvy retirement plan, attending our January webinars will be one of the most important learning opportunities available.

Visualize being on your way to achieving lifelong financial security and gaining the clarity you need to make smarter long‑term decisions. Join us for these breakthrough January webinars to learn exactly how to do it.

Tuesday, January 27, 2026

Register to attend 1, 2, or all 3 Free Webinars at:

If you are married, both spouses are encouraged to attend.

Session One: 10:00 AM – Noon (Eastern)

Roth Conversions After the OBBBA: New Opportunities and New Pitfalls

Led by James Lange, CPA/Attorney with Guests:

Jen Hall, CMA, CPA, CFP, CRPC and Dominic Bonaccorsi, CPA, CRPC

The One Big Beautiful Bill Act (OBBBA), signed into law on July 4, 2025, permanently extends the federal income tax reductions set by the 2017 Tax Cuts and Jobs Act (TCJA), which were previously scheduled to sunset at the end of 2025.

Get the most up-to-date guidance on adjusting your conversion strategy for maximum tax efficiency under the new rules.

In this session, Jim Lange will cover classic principles of Roth IRA conversions (with additional support from two “number-crunching” CPAs who work with Jim), plus seldom-used and little-known advanced Roth conversion techniques.

In this session, you’ll discover how to develop a Roth conversion plan that dramatically improves long‑term after‑tax wealth for you and your family while reducing lifetime tax drag.

You will learn:

-

-

- Key tax provisions of the OBBBA that affect Roth conversions, retirement withdrawals, charitable giving, and estate planning.

- The time-tested peer-reviewed concepts that still work—and the ones that don’t—under the new tax law.

- Proactive multi-year tax planning: How to develop the ideal long-term Roth IRA conversion plan for today’s tax policy environment.

-

Optimal Timing for Roth Conversions:

-

-

- Why optimal conversion timing can add hundreds of thousands of dollars to your family’s long-term wealth.

-

Advanced Strategies You Will See Demonstrated:

-

-

- Tax-free conversions: How to convert after-tax dollars in IRAs and other retirement plans to Roths at no cost.

- How your heirs can convert inherited retirement plans to their own Roths—at their tax rates, not yours. Please note only some people will qualify and others may, but often not worth the aggravation, but great when it does apply.

-

Session Two: 1:00 – 3:00 PM (Eastern)

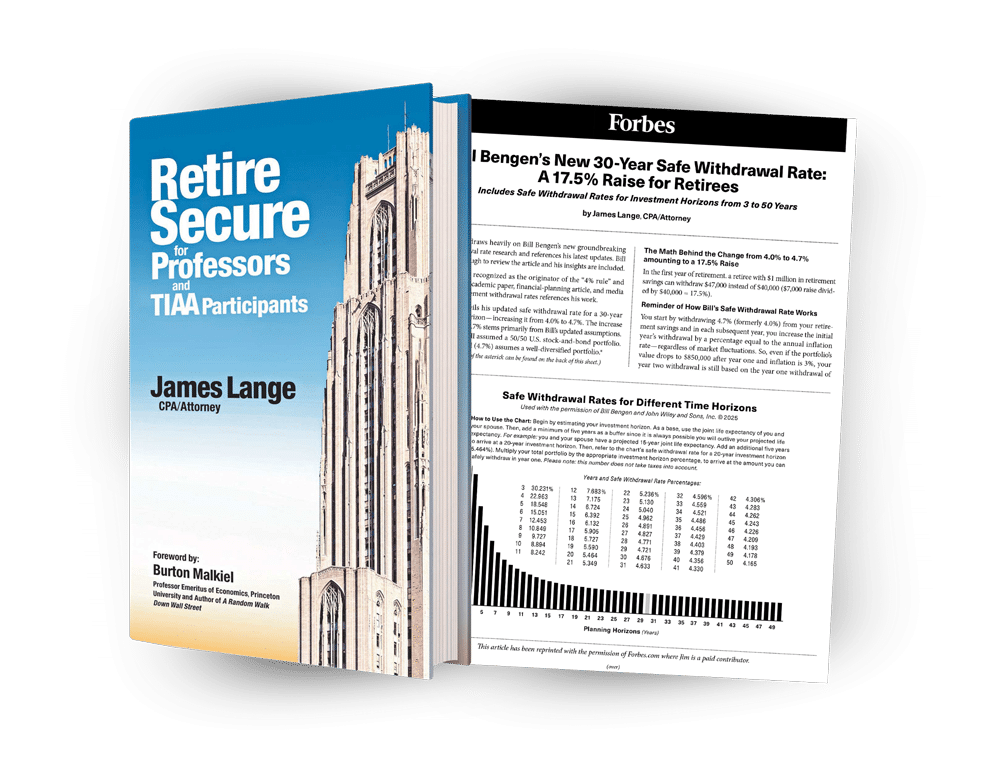

If You Retired Tomorrow, How Much Could You Safely Spend?

This session features the most important retirement spending chart ever created for determining what you can truly afford to withdraw without fear of running out of money—the one that reveals your true safe withdrawal rate based on your personal time horizon and portfolio design. Jim will walk you through this chart.

We also delve into why Bill Bengen increased his recommended safe withdrawal rate for a 30-year time horizon from 4% to 4.7%.

-

-

- Hear highlights from Jim Lange’s exclusive interview with Bill Bengen on time horizon and the change to 4.7%.

- Please note the increase from 4.0% to 4.7% equates to a 17.5% raise in safe withdrawal retirement distributions.

-

Jim will also address other pressing retirement questions that directly affect your monthly spendable income:

-

-

- How can you optimize Social Security for greater security and income?

- What is the impact of annuitizing?

- Should you count home equity as part of your safe spending calculation—and if so, how much?

-

Session Three: 3:30 – 5:00 PM

Best Estate Plan for Most Married Couples

In this session, you’ll learn:

-

-

- The details of the best and most flexible estate plan for most married couples.

- Lifetime Gifting Strategies: How increasing lifetime gifts to your heirs now can reduce future tax burdens and provide financial assistance when it matters most.

- Who Gets What? The seldom-discussed strategy of matching the right assets to the right beneficiaries based on tax brackets and family circumstances.

- Risks and rewards of delaying Social Security benefits for the primary wage earner—and the impact on the surviving spouse.

-

About Your Presenter: James Lange, CPA/Attorney

Jim is the author of 10 best-selling financial books including Retire Secure for Professors and TIAA Participants, with a foreword by Burton Malkiel. Please note 90% of this book applies to all IRA and retirement plan owners. The book has received 73 glowing reviews on Amazon. Jim has been quoted 36 times in The Wall Street Journal and is a paid contributor to Forbes.com.

Attend Jim Lange’s Webinars for FREE — Reserve Your Seats Today!

Tuesday, January 27, 2026

Register at: PayTaxesLater.com/2026Webinars

Yours FREE!

2 Valuable Bonus Gifts

(When You Attend Any Session)

Bonus #1: A free hardcover copy of Jim’s 472-page book, Retire Secure for Professors and TIAA Participants.

Bonus #2: The Retire Secure Safe Withdrawal Kit which includes:

-

-

- The Retire Secure Safe Withdrawal Card, a laminated chart of the different safe withdrawal rates based on your investment horizon along with a wealth of other helpful financial information.

- A reprint of my article, Bill Bengen’s New 30-Year Safe Withdrawal Rate: A 17.5% Raise for Retirees, originally published on Forbes.com.

-

Disclaimer: Lange Accounting Group, LLC, offers guidance on retirement plan distribution strategies, tax reduction, Roth IRA conversions, saving and spending strategies, optimized Social Security strategies, and gifting plans. Although we bring our knowledge and expertise in estate planning to our recommendations, all recommendations are offered in our capacity as CPAs. We will, however, potentially make recommendations that clients could have a licensed estate attorney implement.

Asset location, asset allocation, and low-cost enhanced index funds are provided by the investment firms with whom Lange Financial Group, LLC is affiliated. This would be offered in our role as an investment advisor representative and not as an attorney.

Lange Financial Group, LLC, is a registered investment advisory firm registered with the Commonwealth of Pennsylvania Department of Banking, Harrisburg, PA. In addition, the firm is registered as a registered investment advisory firm in the states of AZ, FL, NY, OH, and VA. Lange Financial Group, LLC may not provide investment advisory services to any residents of states in which the firm does not maintain an investment advisory registration. Past performance is no guarantee of future results. All investing involves risk, including the potential for loss of principal. There is no guarantee that any strategy will be successful. Indexes are not available for direct investment. If you qualify for a free consultation with Jim and attend a meeting, there are two services he and his firms have the potential to offer you. Lange Accounting Group, LLC, could offer a one-time fee-for-service Financial Masterplan. Under the auspices of Lange Financial Group, LLC, you could potentially enter into an assets-under-management arrangement with one of Lange’s joint venture partners.

Please note that if you engage Lange Accounting Group, LLC and/or Lange Financial Group, LLC for either our Financial Masterplan service or our assets-under-management arrangement, there is no attorney/client relationship in this advisory context.

Although Jim will bring his knowledge and expertise in estate planning to this workshop and to the meetings, it will be conducted in his capacity as a financial planning professional and not as an attorney. This is not a solicitation for legal services.