What's New for 2025?

Below are some of the main provisions effective for 2025 from the passing of One Big Beautiful Bill Act (OBBBA) in July of 2025. Several of the provisions were made retroactive to 1/1/25 which has made the year-end tax planning process a little tricky. We aren’t going to provide much information on changes that are not impactful to our client base. advice in this article. That said, if you are like me, you won’t read this article beginning to end but will look for the topics you are most interested in reading.

Jim’s Note: Jen, the primary author, did a great job on this update. Jen wrote this herself—no AI. She used AI to double check her work, but this is all Jen! The OBBBA should be called the CPA Full Employment Act. It has made planning much more difficult not only for year-end planning, but also Roth IRA conversion calculations. Many of the strategies recommended in this newsletter can be further explored in our book, Retire Secure for Professors and TIAA-Participants, where Jen made major contributions. If you would like us to mail a printed copy or email a digital copy of this important year-end planning report to any of your friends or associates, please call Erin at our office at 412-521-2732.

-

- The tax rates from the TCJA from 2017 were made permanent into tax law. By the lower tax rates made permanent vs. the older tax rates coming back from the pre-TCJA Act, our clients will have additional time to execute lower-cost Roth conversions.

-

- The standard deduction for 2025 has increased slightly to $15,750 for single filers, $23,625 for head of household filers, and $31,500 for married filing jointly filers. The standard deductions were $15,000, $22,500, and $30,000 respectively prior to this bill passing.

-

- One of the most notable changes is the introduction of the Senior Tax Deduction of $6,000 each for individuals over age 65. The Senior Tax deduction is temporary and is effective retroactively for years 2025 through 2028. The deduction phases out when a taxpayer's MAGI is higher than $75,000 for a single filer and completely phases out at $150,000. For married filing jointly filers, the deduction phases out when a taxpayer's MAGI is higher than $150,000 and completely phases out at $250,000. With the introduction of the senior tax deduction and the already existing deduction of $1,600 per filer who is over age 65, a married filing jointly couple can receive a standard deduction of up to $46,700 so long as their MAGI is $150,000 or less. This is a great example of the complications that CPAs now must deal with.

-

- We've all been hearing about the SALT tax limit which has been a much-publicized controversy since the passing of the Tax Cut and Jobs Act in 2017 when the limit on state and local taxes was capped at $10,000. With the passing of the OBBBA, there is a temporary limit up to $40,000 so long as your MAGI is below $500,000 for single filers and married filing jointly filers and completely phased out at $600,000 of MAGI. The thresholds will be indexed by 1% annually through 2029, and if this temporary provision is not extended, it will be gone in year 2030.

-

- Beginning in 2026, itemized deductions for clients in the top 37% tax bracket will be limited to the 35% tax rate vs. the 37% tax rate. The income thresholds triggering this limitation are $626,350 for single filers and $751,600 for married filing jointly filers. The deductions most impacted by this change include the state and local taxes (SALT), charitable contributions, and mortgage interest.

-

- The estate tax exemption limit has been permanently increased to $15 million for single filers and $30 million for married filing jointly filers beginning in year 2026. In future years, the exemption amount will be adjusted for inflation annually.

-

- Beginning in year 2026, for taxpayers who do not itemize, there will be an above-the-line charitable contribution deduction of $1,000 for single filers ($2,000 for married filing jointly) filers for cash contributions (not non-cash contributions) to qualified charities. This new provision may help clients reduce their IRMAA exposure, especially those nearing the next IRMAA tier.

-

- Also effective in 2026 is the inclusion of a floor of .5% on charitable contributions for taxpayers who itemize. This means for taxpayers who are charitably inclined and making significant charitable contributions through Donor Advised Funds, they will now have the first one-half percent be non-deductible. This concept is like the 7.5% floor on medical expenses. In summary, charitable taxpayers have severe limitations. Please see the section on Qualified Charitable Deductions (QCDs) for those over age 70 and ½, as this is the most tax-effective way to provide for your favorite charities.

-

- A new federal credit was included in the OBBBA for donations to Scholarship Granting Organizations (SGOs) that fund K-12 education scholarships. The credit per individual (not per return) is up to $1,700 per taxpayer, $3,400 for married filing jointly filers. This is a tax credit, and not a deduction and one cannot double dip by taking the SGO credit and a charitable contribution deduction. Unused credits can be carried forward for up to 5 years and the credit is eligible beginning in 2027.

-

- There are newly eligible expenses for 529 plans beginning on distributions made after July 4, 2025. The broadened expenses include textbooks and workbooks, online educational platforms and subscriptions, tutoring services (so long as they are with accredited professionals and cannot be family members), standardized test fees including SAT, ACT, and AP, dual enrollment college courses taken during high school, and educational therapies, including speech, occupational, and physical therapy for students with disabilities. Other qualified distributions include tuition and fees for job training programs, exam fees for professional licenses and certifications (CPA, bar exam - oh no, they are subsidizing more lawyers, CDL), books, supplies and equipment for credentialing programs, and continuing education required to maintain a license.

-

- Starting in tax year 2026, the annual withdrawal limit for K-12 expenses increases from $10,000 to $20,000 per beneficiary.

-

- The ability to roll over 529 funds to ABLE accounts for individuals with disabilities has now been made permanent without incurring any taxes or penalties.

-

- The act makes permanent the TCJA's increased limitation on contributions to ABLE accounts to align with the annual gift tax exclusion amount of $19,000 in 2025 and indexed annually for inflation. Prior to OBBBA, the provision was temporary but now it is permanent.

-

- Individuals with a disability who work can now permanently contribute additional funds beyond the current $19,000 to their ABLE account up to their earned income. In addition, contributions to an ABLE account now qualify for the Saver's Credit. Beginning in 2027, the maximum eligible contribution for the credit increases to $2,100 with a maximum credit of $1,050.

-

- The age in which a disability must have occurred to qualify for an ABLE account increases from age 26 to age 46 beginning in 2026.

-

- Jim's Note: Some of these provisions for people with disabilities are mildly favorable. That said, the extreme cuts in Medicaid have the disability community up in arms. In addition, the just passed work requirement that, subject to exceptions if you file the appropriate paperwork and prove you can't work, will be devastating to people with significant challenges but haven't qualified for SSI or SSDI.

- Jim's Note: Some of these provisions for people with disabilities are mildly favorable. That said, the extreme cuts in Medicaid have the disability community up in arms. In addition, the just passed work requirement that, subject to exceptions if you file the appropriate paperwork and prove you can't work, will be devastating to people with significant challenges but haven't qualified for SSI or SSDI.

-

- Effective 1/1/25, personal interest expense incurred for the purchase of a new vehicle that have the final assembly in the United States qualify for a deduction up to $10,000 per year. The deduction phases out for taxpayers with MAGI in excess of $100,000 for single filers and $200,000 for married filing jointly filers. To confirm that you are eligible for this automobile loan interest deduction, please check your Vehicle Identification Number (VIN) and then visit https://www.nhtsa.gov/vin-decoder.

-

- The higher exemption amounts set by the TCJA for alternative minimum tax exemption (AMT) have been made permanent and will be adjusted annually for inflation. The phase-out thresholds will be reset beginning in 2026 to $500,000 for single filers and $1 million for married filing jointly filers.

-

- The OBBBA made permanent the qualified residence mortgage interest deduction limitation for up to $750,000 of mortgage indebtedness. It also makes permanent the exclusion of interest expense on a home equity loan.

-

- The child tax credit increased to $2,200 per child beginning in 2025 and will now be indexed annually for inflation. Previously, the credit was $2,000 per child. The phaseout limit for the credit is $200,000 for a single filer and $400,000 for a married filing jointly. These limits apply to the $500 non-refundable other dependent credit for a qualifying child.

-

- The child and dependent care credit has been expanded to include elderly dependents living in your home and in-home care providers or babysitters who are relatives so long as they are not tax dependents. As with most credits, the credit decreases as AGI increases. Taxpayers with AGI over $105,000 for single filers and $210,000 for joint filers will receive the minimum 20% rate. For taxpayers with lower AGIs, the credit is typically 35%. The qualified expenses remain the same at $3,000 for one dependent and up to $6,000 for two or more dependents.

-

- Dependent care assistance programs increased the maximum annual amount that is excludable from income to $7,500 instead of the previous $5,000.

-

- The Qualified Business Interest deduction of 20% has been made permanent and increasing the phase out limit for SSTBs to $75,000 for single filers and $150,000 for married filing jointly filers (previously $50,000 and $100,000, respectively).

-

- Several of the clean energy tax incentives have been eliminated including the clean vehicle tax credit (terminated 9/30/25), energy efficient home improvement tax credits (terminated 12/31/25), and the new energy-efficient home tax credit (terminates 6/30/26).

-

- Gains on the sale of qualified small business stock after July 4, 2025, will be excluded from income up to 75% if the stock was held for at least four years. If the stock was held for five years or more, the exclusion percentage is increased to 100%.

-

- A new individual retirement account was introduced called the 'Trump account.' These accounts function like IRAs (not Roth IRAs) and are for children under age 18. Children born between 1/1/25 and 12/31/28 will receive a one-time $1,000 deposit from the federal government which is automatic unless the parents opt out when filing their taxes. Annual contributions are limited to $5,000 per child and will be adjusted for inflation after year 2027. Contributions are NOT tax-deductible and anyone can contribute, including employers (limited to $2,500 per year, and it is not taxable income for the employee). There are investment restrictions and annual fees are capped. No withdrawals are permitted before age 18 and after age 18, the funds can be used for education, first-time home purchases, etc. The US Treasury will be managing these accounts initially. Early withdrawal penalties apply before age 59 ½, similar to an IRA. While distributions of after-tax contributions are not taxed when withdrawn, the earnings are taxed as ordinary income. Jim's Note: This is more complicated and less favorable than it is worth.

-

- We won't go into much detail on the no tax on tips or overtime income. The deduction for tip income is up to $25,000 for qualified tips. The deduction on overtime income is $12,500 for individual filers and $25,000 for married filing jointly filers. Both credits phase out when a taxpayer's MAGI exceeds $150,000 for single filers and $300,000 for married filing jointly filers. Both deductions are retroactive to 1/1/25 and expire at the end of 2028.

-

- The 1099 reporting threshold will be increased from $600 for services paid in a calendar year to $2,000 beginning in year 2026 with annual inflation adjustments thereafter. The new reporting provision does not mean taxpayers do not have to report their income from sources below the 1099 reporting threshold. All income remains taxable.

- The 1099 reporting threshold will be increased from $600 for services paid in a calendar year to $2,000 beginning in year 2026 with annual inflation adjustments thereafter. The new reporting provision does not mean taxpayers do not have to report their income from sources below the 1099 reporting threshold. All income remains taxable.

-

- In 2026, third-party platforms like PayPal, Venmo, etc. were required to report payments of $600 or more. The OBBBA changed the threshold to $20,000 and 200 transactions which will reduce the number of 1099s that will be issued annually.

-

- The OBBBA did not make any changes to contribution limits, withdrawal rules or plan rules for traditional retirement accounts.

-

- We would like to remind you of several important provisions contained in the SECURE Act 2.0 that was passed in December 2022. Some of the changes were effective immediately, and others began in 2025 or will become effective in 2026 or later. Being informed about these updates may help with more effective planning for retirement and attaining financial goals.

-

- 529 plan to Roth IRA rollovers allow beneficiaries of 529 plans to rollover up to a lifetime maximum limit of $35,000 to a Roth IRA. The 529 plan must have been established for at least 15 years, and the rollovers are subject to the annual Roth IRA contribution limits. The beneficiary must have earned income up to the rollover amount. Surprisingly, the rollover is not restricted by the income limits imposed upon individual Roth IRA contributions. We are recommending this strategy for many clients with leftover money in 529 plans.

-

- As in 2024, Roth contributions are now permitted in Simple and SEP plans.

- As in 2024, Roth contributions are now permitted in Simple and SEP plans.

-

- Required Minimum Distributions (RMDs) from Roth accounts from employer-sponsored plans, including 401(k)s, 403(b)s, and governmental 457(b) plans are now eliminated while the employee is still living. Previously, annual RMDs applied to these Roth accounts, but not Roth IRAs.

-

- While heirs of an inherited IRA from a decedent who died in 2020 or later did not incur a penalty for missed RMDs in the inherited account in years 2020-2024, the beneficiary must still empty the account by the original 10-year deadline.

-

- Spousal beneficiaries who leave the retirement account in the decedent's name are now permitted to use the Uniform Lifetime Tables to calculate their RMDs if they choose to keep the account in the decedent's name for any reason. Previously, the surviving spouse had to evaluate the tradeoffs between an inherited account and a spousal rollover account. This option reduces the consequences of making the incorrect decision. For many reasons, we still generally prefer a spousal rollover option.

-

- We do not usually recommend distributions from retirement plans, but with the passing of SECURE Act 2.0, an expansion of penalty-free withdrawals, including emergency personal expense distributions up to $1,000 are now permitted. There are restrictions around the distribution relating to necessary personal or family emergency expenses and only one distribution may be made every three years unless the distribution has been repaid. Penalty-free distributions in case of domestic abuse, terminal illness, or due to qualified disasters are also now permitted. That said, we still don't like premature distributions from an IRA if there is any other money that can be used.

Employer’s Share of Retirement Plan Contributions Can Be Roth

- The option of employers adding a change to their plan document to allow the employer matching contributions to be contributed into a Roth account vs. a Pre-Tax Traditional account for employer-sponsored plans has been extended to year 2026 due to the administrative burden of implementing the change. This is a great new law that has been botched administratively. Hopefully, this will change and many employers will adopt it. As of right now, we don’t know of any employers where this is in place. We tried to make it available to our employees but failed.

Other Provisions

- Increased RMDs age to age 73 if you were born between 1951 and 1959, and age 75 if you were born in 1960 or later.

- There is no age limit for IRA contributions, meaning anyone working who has earned income may contribute to a traditional IRA regardless of their age.

- Catch-up provisions for employees 50 and older remain at $7,500. Catch-up provisions for employees ages 60-63 are $11,250 per year. For Simple IRA plans, the catch-up limit is $5,000 or $5,250 if age 60 to 63. The catch-up amounts will be indexed for inflation starting in 2026. The provision is optional for employers, as the employer must opt in to offer the increased limits. Once an employee turns 64, the standard catch-up limit of $7,500 applies.

- Effective 1/1/26, higher income employees (earning more than $145,000 in FICA wages) who are aged 50 and older who make catch-up contributions to employer-sponsored plans, must contribute the catch-up contributions in the form of a Roth vs. a Traditional Pre-Tax account. This is for employer-sponsored plans only (not IRAs). Plans must offer a Roth contribution option to comply with this rule. If the employer-sponsored plan does not have a Roth option, the employees earning more than $145,000 will not be eligible to make catch-up contributions. This rule applies to the following employer-sponsored plans: 401(k), 403(b), 457(b), and 401(a) plans.

- If you are age 70 ½ or older, you can make a one-time charitable distribution of $54,000 to a Charitable Remainder Trust (CRAT/CRUT) or a charitable gift annuity. These rules are complicated, and we strongly encourage you to consult your tax professional before considering this option. This is an expansion of the type of charity that can receive a QCD. Forgetting the change for a minute, subject to rare exceptions, we love QCDs as the most tax-effective method of making a charitable donation.

What Does This All Mean and What Are the Year-End Tax Strategies?

Let’s examine ways to reduce your AGI before the end of 2025: Many taxpayers, especially W-2 wage earners, have less control over their AGI when compared to self-employed taxpayers or even those in retirement. The following year-end moves may be ideal if any of these situations apply. If you have earned income from self-employment or an employee, one of the best ways to manage AGI is through retirement plan contributions. There are many alternatives to choose from that enable individuals to make retirement plan contributions. Now is an ideal time to make sure you maximize your retirement plan contributions for 2025 and start thinking about your strategy for 2026. Examine your year-to-date elective deferral contributions on your most recent pay stub. While your intentions may have been to maximize current year contributions to your 401(k) or 403(b), you may find out that you have not hit the maximum amounts as anticipated. There is still time to have your employer increase your contributions from your remaining paychecks to reach the maximum level of contributions allowable for 2025.

Gaming the Standard Deduction Allowance Vs. Itemizing Deductions

Bunching Strategy: Bunching your itemized deductions is a technique that involves accumulating deductions, so they are high in one year and low in the following year. You can benefit from the “bunching” strategy. It’s very typical for most taxpayers to wait until tax time to add up everything and use the higher of the standard deduction or their itemized deductions. This year, it will be more work to project the total itemized deductions with the introduction of the higher SALT limit. Additional planning may be required.

Bunching Charitable Donations: Consider bunching charitable donations every other year while taking the standard deduction in the off years. Increasing your charitable deduction in 2025 may be more advantageous with the onset of the .5% floor on charitable deductions beginning in year 2026.

A popular vehicle for maximizing your charitable donations is the use of a Donor-Advised Fund (DAF). The DAF functions as a conduit. The taxpayer receives an immediate tax deduction up to certain limits when the money is directed into the fund. The donor decides what charities will receive the money and when it shall be paid out. In a high-income year, front loading the fund with a larger contribution can be quite nice. The assets within the fund also enjoy tax-free growth. Please note that the charitable contribution limit for 2025, including donor-advised funds, is 60% of AGI for contributions of cash, and 30% of AGI for contributions for non-cash assets if the assets were held more than one year.

We have found that charities are very active with their solicitations during the holiday season and would be happy to receive gifts near year-end or early in the new year. If it appears that you think you will be itemizing your deductions in 2025, but not next year, consider making last minute cash and non-cash charity donations before year-end. If you do not have the extra cash available today, you can use a credit card before year-end and still qualify for a 2025 tax deduction. If the gift is appreciated stock, the tax benefits are even greater as you qualify for the larger charitable contribution tax deduction and do not have to pay tax on the capital gains of the appreciated stock.

Also, you don’t necessarily have to donate cash. You could also consider non-cash contributions of household goods, clothing, and furniture to the appropriate charity.

We often like to recommend a Roth IRA conversion strategy for those taxpayers who have already or are still planning to make a large charitable contribution before year-end. For example, we had a client who consistently contributed $20,000 per year to their favorite charities. We recommended instead they ‘bunch three years’ worth of their contributions into one year ($60,000) by utilizing a Donor Advised Fund and funding it with appreciated stock. By combining these tax strategies, the client was able to increase their overall Roth IRA conversion. In utilizing the Donor Advised Fund, they were able to distribute the monies to their favorite charities over the three-year period and were able to accelerate the $60,000 deduction in the current year. Plus, the client did not have to pay the long-term capital gains tax on the appreciated stock!

To qualify for the charitable contribution deduction, contributions must be made to approved Section 501(c)(3) organizations. If you are uncertain if an organization is approved, please refer to https://www.irs.gov/charities-non-profits/search-for-tax-exempt-organizations.

Charitable Giving: Under the current tax system, a focus on controlling AGI can provide tax savings. Taxpayers ages 70 ½ and older can transfer up to $108,000 directly from their IRA over to a charity in 2025 ($115,000 in 2026), satisfying all or part of the RMD with the IRA-to-charity maneuver. For married couples, the limit is $216,000 for 2025 ($230,000 for 2026). It can be viewed as making a charitable donation with pre-tax dollars. This is especially fruitful when the alternative of using the after-tax dollars to fund the donations does not reduce your taxable income due to the higher standard deduction.

Caution: If you are over age 70 ½ and make a current year tax-deductible IRA contribution while also planning a current year QCD from your RMD, your plan becomes more complicated due to the “anti-abuse” provisions. The provision was enacted to prevent individuals from deducting the IRA contribution and subsequently using a QCD vehicle as a pre-tax charitable donation with the same dollars. Married couples with separate IRA accounts have additional flexibility in bypassing the rules.

This is a great time of the year to clean out your basement and garage. However, please remember that you can only write off these non-cash charitable donations to a charitable organization if you itemize your deductions. Please do yourself a favor and follow the substantiation rules to tilt the scale in your direction if the deduction is questioned by the IRS. Determining the value of non-cash donations can sometimes be challenging. It can never hurt to have pictures of the donated items (cell phone cameras make this much easier). The more detailed the receipt, the better. Please send cash donations to your favorite charity no later than December 31, 2025. Be sure to hold on to your cancelled check or credit card receipt as proof of your donation. If you contribute $250 or more, you also need an acknowledgement from the charity. Many taxpayers kindly help various charities by making non-cash donations.

Tax Tip for Coaches Who Still Itemize their Charitable Deductions: Many taxpayers have children who participate in youth, intermediate or even high school level sports. If dad or mom volunteers their time as coaches, assistant coaches, timekeepers, etc., they can be eligible for an income tax deduction for various out-of-pocket expenses incurred. For example, miles driven on their cars while performing their role as coach are deductible charity miles. Many teams travel out of town to compete. You are entitled to deduct certain travel expenses as a charitable deduction. See the IRS website Newsroom for “Tips for Taxpayers Who Travel for Charity Work” for a list of qualifying deductions. Of course, you must be eligible to itemize your deductions vs. taking the standard deduction to benefit from this strategy.

My favorite substantial charitable gift is leaving a portion of your IRA or retirement plan to a charity of your choice after you and your spouse die. Few taxpayers do this. What is much more typical is to leave money to charity through a bequest (after-tax dollars). Please see Who Gets What? in our books and presentations.

If you want to give money to a charity and get the deduction this year, but don’t know which charity you want to benefit from your donation, you should consider donor directed funds that could be set up by a group like The Pittsburgh Foundation or a donor advised fund as discussed earlier.

As mentioned earlier, if you plan to make a significant gift to charity this year, consider gifting appreciated stocks that you have owned for more than one year rather than cash. Review your tax brackets to help determine how you can maximize the deduction. Doing so boosts the savings on your tax returns. Your charitable contribution deduction is the fair market value of the securities on the date of the gift, not the amount you paid for the asset, and therefore, you never have to pay taxes on the profit! If you really like the appreciated stock that you donated, use the non-donated cash to repurchase the donated securities. Essentially, you still own the same stock except with a higher tax basis in the newly acquired shares.

Do not donate stocks that have lost value. If you do, you can’t claim a loss. In this case, it is best to sell the stock with the loss first and then donate the proceeds, allowing you to take both the charitable contribution deduction and the capital loss.

Higher 401(k)/403(b) Contribution Limits: The elective deferral (contribution) limit for employees who participate in 401(k), 403(b), most 457 plans, and the federal government’s Thrift Savings Plan is $23,500 for 2025. In 2026, the annual limit amount has been increased to $24,500. The 2025 catch-up contribution limit for participants in 401(k), 403(b), most 457 plans, and the federal government’s Thrift Savings Plan for employees aged 50 and over is $7,500 and is increased to $8,000 for 2026, except for employees age 60 to 63. Employees aged 60 to 63 can contribute a catch-up limit of $11,500 vs. $7,500 for 2025 and $12,000 vs. $8,000 for 2026.

Planning Note: We are big proponents of using Roth 401(k) and Roth 403(b) plans for elective deferral contributions. We also love gifting to your children who then use those gifts to fund their Roth accounts. Considering the current increased tax rate structure on certain investment income and the Section 199A deduction for business owners, an increased focus on reducing both adjusted gross and taxable income can be beneficial. Higher income taxpayers should consider switching back to making tax-deductible retirement plan contributions instead of funding their Roth accounts. An ideal strategy may be to split your contributions during the year if you’re in overlapping tax brackets. For example, consider making tax deductible contributions to reduce your income to the bottom level of your upper tax bracket and contribute the remaining balance into your non-deductible Roth account that is in the lower tax bracket. You have flexibility in making these types of changes during the year if your financial circumstances should change. If you’re interested in this strategy, be sure to discuss this with your professional tax preparer so any adjustments can be made to your quarterly tax estimates if necessary. A practical approach is to simply hedge against higher future tax rates by splitting your current year 401(k)/403(b) contributions equally into deductible and non-deductible Roth contributions.

Make a Tax-Deductible IRA Contribution: For those taxpayers who qualify, you can make a tax-deductible contribution of $7,000 with a catch-up (for taxpayers 50 or older) of an additional $1,000. The contribution can be made until April 15, 2026, and still be a deduction on your 2025 tax return. There are income limits to this strategy so please check with your tax preparer to make sure you qualify.

Planning Note: Since the IRA contribution can be made after the end of the calendar year, calculating the actual tax savings provides a great advantage and should not be overlooked.

Back-Door Roth IRA Contributions: We love back-door Roth IRA contributions. For those of you who don’t qualify for a regular Roth IRA contribution (because your income is too high) and who have no traditional IRAs, you can still take advantage of a nice loophole in the tax code (back door Roth). Consider making a traditional IRA contribution and converting it immediately to a Roth IRA. You will run into complications with this strategy if you have other traditional IRAs. Once again, if this strategy fits your situation, make your 2025 contribution as soon as possible and repeat the process with your 2026 IRA contribution in early January 2026. If you are married with adequate earned compensation, the back-door Roth IRA strategy will be applicable to your non-working spouse.

Caution: If you are planning to do a rollover from a qualified plan to an IRA account prior to the end of the year, the above strategy will be unsuccessful, and the conversion will result in unexpected taxable income. It will not matter if the IRA contribution and the immediate Roth conversions occurred earlier in the year before the rollover date. If both transactions occur in the same year, you could trigger taxable income.

For those of you who can afford it, we encourage establishing and funding a Roth IRA for your children or even grandchildren and get a tax-free retirement fund started for their benefit. The longer period of tax-free growth provides a greater benefit. Like any IRA, the child or grandchild must have earned income to qualify for a contribution.

Funding Self-Employed Retirement Plans: If you are self-employed, you have other retirement savings options. We will review these alternatives with you when you come in for your appointment. One of my favorites for many one-person self-employed businesses is the one-person 401(k) plan.

Most self-employed retirement plans allow for contributions to be made as late as October 15th of the following year, assuming you filed a tax extension. Having this deferred funding benefit allows you to calculate various levels of savings based on various contribution amounts. For taxpayers ages 50 and older, the 2025 and 2026 maximum contribution amounts can be as high as $77,500 and $80,500, respectively. Beginning in 2026, for those between ages 60 and 63, the maximum contribution amount can be as high as $84,500.

Another note to consider for 2025, if you implement a Solo 401(k) in 2025, you may be eligible for the Auto-Contribution Credit of $500 per year for 3 years (for the self-employed owner) or the 401(k) Startup Cost Credit of $5,000 per year for 3 years if you have non-owner employees. Please contact your tax professional to see if you are eligible for either one of these tax credits.

Increase Tax-Favored Income: Converting taxable interest to tax-exempt interest will serve to reduce AGI. For example, moving money from CDs or money market accounts will not create any taxable income. Alternatively, selling corporate bonds may produce a taxable gain and reduce or offset the benefits. Note: Tax-exempt interest is included for calculating your IRMAA rates.

Required Minimum Distributions (RMDs) in 2025: This is very useful. As a result of SECURE Act 2.0, the ages for taking RMDs changed. For those born between 1951 and 1959, RMDs now begin at age 73 vs. age 72. And for those born in 1960 or later, RMDs will now begin at age 75. The changes to the RMD ages can significantly impact and increase your Roth IRA conversion planning opportunities by giving you more years to make conversions before you need to begin drawing down on your IRAs. Interesting planning point: while the IRS continues to increase the RMD age from 70 ½ to 73 or 75, you are still able to take advantage of Qualified Charitable Distributions (QCDs) at age 70 ½. This means, you do not have to be of RMD age to take advantage of QCDs. If you are making charitable contributions and are age 70 ½ or more, we strongly suggest you consider the merits of utilizing QCDs as part of your tax strategy in your charitable giving. This is especially important if you are someone who does not qualify for itemizing your tax deductions. By doing so, the charitable contribution is sent directly from your IRA to the charity without any income taxes being paid. If you are the beneficiary of an inherited IRA and you are age 70 ½ or more, you may use it to make QCDs. This is a simple summary, and we encourage you to consult your tax practitioner on the merits of this strategy if it makes sense for you.

Sometimes during the planning process, we discover if you make a larger QCD, you may reduce your Income-Related Monthly Adjustment Amount (IRMAA) bracket and benefit your charity at the same time. The question comes up, “Would you rather pay Uncle Sam additional money or your charity?” That question seems simple, but proper planning can identify those opportunities.

As a reminder, your RMD needs to be taken before any Roth IRA conversion can be executed.

A Helpful Tip: If you are currently using QCDs, please make sure you receive acknowledgement letters from the charitable organizations for any single donation of $250 or more before filing your tax return. The IRS requires the letter under the Substantiation and Disclosure requirements for the donation to be tax-deductible.

Alert: If you are subject to 2025 RMD rules and your pension income is entirely from qualified plans such as 403(b)s and 401(k)s, you should consider an IRA rollover or partial rollover before December 31, 2025. This will enable you to take advantage of QCDs by using pre-tax retirement money for the 2025 donations instead of using after-tax cash, and for 2026, the QCDs will make some of your 2026 RMDs non-taxable.

Caution: For those seniors still working and doing back-door Roth conversions, an IRA rollover would dilute the intended benefit of the back-door strategy.

Important Early Thought for 2026: If you are considering using your RMDs from your IRA to make QCDs, try to be proactive. Advanced planning with your tax advisor and investment advisor (if you have one) will ease the process while achieving your charitable giving goal and maximizing the income tax savings.

Maximize your HSA Contribution: HSAs are better than Roth IRAs or regular IRAs or anything else other than an employer’s contribution to your retirement plan. If you are enrolled in a Health Savings Account (HSA) plan, it is not too late to maximize your 2025 tax deductible contribution to the account. You have until April 15, 2026, to fund your HSA account and still receive a 2025 tax deduction. The 2025 contribution limits are $4,300 for self-only coverage and $8,550 for family coverage. Those who are age 55 and older can contribute an additional $1,000 as a catch-up contribution. This means a total of $10,550 may be able to be contributed to your HSA account if both spouses are age 55 or older. Note: the additional $1,000 catch-up contribution limit needs to be contributed to separate spousal HSA accounts. Like an IRA contribution, the exact amount of tax savings can be calculated. It is the only section in the Internal Revenue Code (the Triple Crown if you will) that allows a tax deduction on the way in tax-free growth and tax-free qualifying distributions. For those who can afford it, fully funding the HSA account and never using the funds to pay for current medical expenses (using other monies to pay for medical expenses incurred) can allow for a big pot of tax-free money to accumulate overtime to be used for future medical costs. These funds can come in handy during retirement when you normally experience more medical expenses while having less annual income. Also, once you reach age 65, you can use the money for reasons other than medical expenses. These non-qualifying distributions will be penalty-free but subject to income taxes. It is analogous to owning an extra IRA account without being subject to RMD rules.

Planning Note: Currently, there is not a ‘timing’ requirement for qualifying distributions to occur in the same year as the qualifying expenses were incurred. So if you wanted, while you are still working and under a high deductible health plan, you could pay for your qualified health expenses outside of the HSA, save the receipts, and sometime in the future, so long as the IRS still permits, you could withdraw the funds from your HSA equal to the amount of the qualified health expenses that you have receipts for, and take a distribution income-tax free. The only caveat is the HSA withdrawal cannot be for an expense incurred prior to the date the HSA was established.

What if you do not have enough money to fund your HSA in a year but have significant money in your IRA? There is a once-in-a-lifetime rollover option from an IRA to fund your HSA account. This technique is called a Qualified HSA Funding Distribution (QHFD). Since HSAs have a triple tax benefit, it could be a good tax planning strategy for someone who does not have enough cash to fund their HSA. There are specific conditions for utilizing this technique, however, so we encourage you to contact your professional tax preparer before considering this option. Where we see this tax strategy being the most beneficial is for someone under the age of 59 ½ who would not otherwise qualify for penalty-free distributions from their IRA.

Pennsylvania 529 Plan Contribution Deduction: Don’t miss out on the state tax deduction for contributions to a Section 529 College Saving Program. A taxpayer can reduce their PA taxable income up to $19,000 per plan beneficiary (kids, grandkids, nieces, nephews, etc.). Married couples can deduct up to $38,000 per beneficiary per year, provided each spouse has taxable income of at least $19,000. If your child is currently in college and you are writing checks to the college for tuition or qualified expenses, you should open the 529 plan immediately. You can deposit the college-expense money into the account and immediately write the check to the college. You have just generated an immediate 3.07% rate of return on the deposit, assuming you file a Pennsylvania state income tax return.

Grandparents: Consider the state tax savings available before proceeding to establish and fund a 529 education plan for your grandchildren. If the parents live in a high-income tax state that allows a tax deduction for 529 plan contributions, consider gifting the money directly to the parents and let them establish and fund the 529 plan.

With the recent passing of the SECURE Act 2.0, beginning in 2024, any unused funds in a 529 Plan may now be eligible to be rolled over into a Roth IRA for the 529 Plan beneficiary. To be eligible, the 529 account must have been opened for more than 15 years. The rollover amount cannot exceed the annual IRA contribution limits ($7,000 in 2025) and the rollover amount must have been in the 529 account for at least 5 years. The beneficiary must have had taxable income earned in the year of rollover, but there are not any higher income threshold limitations on the rollover. This is great news for the higher income earners who may otherwise be precluded from making Roth IRA contributions. There is also a $35,000 lifetime maximum rollover limit.

Medical Expenses: The 2025 threshold for deducting out-of-pocket medical expenses on Schedule A must exceed 7.5% of your AGI. Most taxpayers don’t typically incur significant deductible out-of-pocket medical expenses due to medical insurance coverage.

Your net medical expense deduction is linked directly to your AGI. Eligible expenses include health insurance premiums, long-term care premiums (limits apply), prescription drugs, medical, dental and eye care services. If you have incurred higher medical expenses and believe that you will qualify to itemize your deductions in 2025, you should consider paying any last-minute medical, dental, or eye expenses before December 31, 2025. If one spouse has larger medical expenses and lower income than the other, analyze if filing separately reduces your overall tax bill.

If you or a parent is looking to move to an assisted living facility or continuing care community, there is often a large buy-in cost. Much of this cost qualifies for a large medical deduction. This is an overlooked opportunity for many of our clients’ parents. That medical expense could potentially offset the taxes on a Roth IRA conversion.

State and Local Tax (SALT) Deductions: The overall deductible limit for 2025 has increased to $40,000. This limit applies to a combined total that will include state and local income taxes, real estate taxes, sales tax, personal property tax, etc. There is a strategy for increasing this expense in 2025 because of the increase in the cap from $10,000 to $50,000. A large portion of this deduction is typically filled with a combination of income tax withholdings from employee wages and larger real estate tax costs. If you don’t have employee wages but are expecting higher taxable income from other sources of taxable income (i.e., self-employment income, capital gain income/investment income), paying an increased 4th quarter estimate by December 31, 2025, can generate additional tax savings. As stated above, for those taxpayers whose MAGI is in excess of $500,000 for single and married filing jointly filers, the deduction is reduced by 30% of the excess income over the threshold up to $600,000, wherein it reverts back to $10,000. If you can capitalize on this deduction, we encourage you to accelerate your real estate tax payments and any state and local income tax estimates into 2025, keeping in mind the income thresholds.

Residential Energy Efficient Improvement Credits: If you are considering making residential energy efficient updates to your primary residence, including new exterior doors, exterior windows, furnace, air conditioner, hot water tank, insulation, etc., we encourage our clients to accelerate those expenditures into 2025 vs. 2026. We are not suggesting you make unnecessary purchases. Rather, we would like to see you benefit from the energy efficient home improvement tax credit for those updates that are already contemplated. A taxpayer can earn up to $1,200 in tax credits (not tax deductions) by making those expenditures in 2025 vs. 2026 when the credit is no longer available. In some cases, for heat pumps, biomass stoves or water heaters, the credit can be up to $2,000. We encourage you to consult with your professional tax preparer on the eligible purchases.

Business Owners: The OBBBA made permanent the complicated 20 percent tax deduction (also known as the Section 199A deduction) for eligible business owners such as sole proprietorships, LLCs, S Corporations, Partnerships, and Trusts. The deduction is also available to certain real estate rental property owners. The details of this deduction are beyond the scope of this letter. It is a valuable tax deduction for those who qualify. The business owner will enjoy an extra reduction of taxable income without additional capital outlay. Certain deduction limits are imposed when taxable income exceeds threshold amounts. Keeping taxable income below these thresholds will preserve more of the qualifying deduction.

Utilize Installment Sales: If appropriate, reporting taxable gains using an installment sale will allow you to spread the gain over several years rather than recognizing the entire gain in the year of sale. In many instances, this type of gain is also subject to the 3.8% Medicare surtax on “net investment income” thus managing your AGI can save additional taxes. Keep in mind that Medicare Part B premiums are determined by looking at your tax return from two years prior to the current year. An installment sale may enable you to spread the gain over several years while never crossing the threshold that would trigger increased Medicare premiums in any one year. Opting out of installment sale treatment allows you to recognize the entire gain in the year of sale even though payments would be received over multiple tax years. Consider this option if it’s the appropriate tax strategy. Caution: While the IRS recognizes installment sales, not all states recognize installment sales and require you to report 100% of the gain in the year of sale. Pennsylvania is one of the states who do not recognize installment sales. Installment type sales apply in limited types of transactions. We encourage you to contact your tax advisor on your state’s rules regarding installment sales before making the decision.

Utilize Your Home Office: It may be the right year to switch back to deducting the actual cost of home office expenses as opposed to using the simplified method. If you are one of the many who will be using the standard deduction in 2025, enjoying some tax benefits of deducting a portion of your real estate and mortgage interest as a home office deduction can help ease the pain. Caution: If you sell your home in the future that had a ‘home office’ deduction using the actual cost method, you could be required to recapture depreciation on your home office if you are required to report and pay capital gains taxes on the sale of your home. Please consult your tax professional on this provision before electing the actual cost method.

Reduce Business or Rental Real Estate Income: Make full use of depreciation including bonus depreciation and Section §179 expensing allowances for property and equipment placed in service before the end of the year. You have more control attaining the desired profit or loss level if properly analyzed. The tax law permits full expensing of certain improvements to nonresidential rental property. Improvements such as a full roof replacement on an existing building is eligible for full write-off under Code Section §179. These types of expenditures have historically been subject to much longer depreciation recovery periods. Expensing certain asset purchases under the de minimis expensing rules, while convenient, may end up reducing the Qualified Business Income deduction. Important Note: 100% bonus depreciation deduction was restored for purchases made after 1/19/25. For property acquired before 1/20/25 even if placed in service later, only 40% bonus depreciation applies for 2025 and only 20% bonus depreciation applies for property placed in service in 2026 if acquired before January 20, 2025. You still have the Section 179 depreciation rules which allow maximizing deductions up to $2,500,000 for 2025. And $2,560,000 for 2026 is projected with inflation. Be careful when selling depreciated nonresidential property, as depreciation recapture is pure misery.

Defer Income and/or Accelerate Expenses: Many taxpayers don’t have much control in choosing whether to defer or accelerate income from year to year. However, the new tax law provides businesses and business owners (including pass-through entities), with incentives and deductions to lower their overall tax costs. Smart timing of income and expenses can be fruitful while poor timing may result in paying a larger tax bill. Being able to estimate income for 2025 and 2026 can help with the decision of either accelerating income before the end of 2025 or deferring the income into 2026. The same is true for deductions. Try and use this flexibility to your advantage. Our goal is to “manage the tax brackets” between the various years to smooth out your income and deductions to pay the overall lowest income tax.

Let’s say for example, your deductions are greater than your income, and you will have a negative taxable income, with a tax liability of zero. This is often the case with seniors who receive tax-free Social Security income. In this case, it would be a good strategy to increase your income from negative taxable income to zero taxable income, because the tax on zero taxable income is still zero! One of the best ways to do this is to do a partial Roth IRA conversion up to the amount that brings your negative taxable income up to zero. Depending on your tax bracket, you may wish to convert even more, especially if you or your children expect to be in a higher income tax bracket in the future. If a Roth conversion is not appropriate or desirable, taking additional retirement account distributions in one year while lowering the amount in the following year may save tax dollars. This strategy is comparable to bunching itemized deductions while using income instead of expenses.

Try to avoid paying unnecessary penalties. If you face an estimated tax shortfall for 2025, consider having the extra tax withheld from sources such as wages, non-suspended regular IRA, and pension distributions. Withheld taxes are treated as if you paid them evenly to the IRS throughout the year. This can make up for any previous underpayments, which could save you penalties.

Tax Loss Harvesting: We saw the advantages of capital loss harvesting during the 2022 tax year due to the market’s poor performance. This means selling certain investments that will generate a loss—converting them from unrealized losses to realized losses. You can use an unlimited amount of capital losses to offset capital gains. Since the stock market has performed very well in 2025, there may not be many opportunities for “loss harvesting,” but we wanted to bring it to your attention.

For details about tax-loss harvesting, please see Chapter 7, page 103, of The IRA and Retirement Plan Owner’s Guide to Beating the New Death Tax book which you should have already received.

Large long-term capital gain income has often triggered Alternative Minimum Tax (AMT) in past years. On a good note, for the most part AMT has virtually disappeared. For those higher income taxpayers, lowering current year’s investment income by loss harvesting will generate even greater savings. These taxpayers can potentially lower the net investment income tax (the additional 3.8% tax) assessed on net investment income above certain levels.

The Hidden Tax Trap: Larger tax balances due or smaller than expected refunds can often be traced to Capital Gain Distributions. Quite often the bulk of these taxable distributions will not be known until late November and December. These taxable capital gain distributions occur when the mutual fund portfolio managers recognize gains in the managed funds that get passed onto the fund investors. It is very important that you or your investment advisor review your investment portfolio(s) for any “Loss Harvesting” opportunities. You do have until the end of December to sell securities at a loss.

Please note that if you sell an investment with a loss and then buy it right back, the IRS disallows the deduction. The “wash sale” rule says you must wait at least 30 days before buying back the same security to be able to claim the original loss as a deduction. However, you can buy a similar security to immediately replace the one you sold—perhaps a stock in the same sector. This strategy allows you to maintain your general market position while capitalizing on a tax break.

If you are planning to write off a non-business bad debt, be sure to establish that it is a bona fide debt and document unsuccessful efforts to collect. Form over substance matters in these instances.

Tax Gain Harvesting: Tax Gain Harvesting is the opposite of Tax Loss Harvesting. If you have any highly appreciated stock that you have been holding onto for many years because you did not want to accelerate additional capital gains, this may be the year you want to sell. By selling your highly appreciated stock and offset the capital losses that you harvested, you can minimize your overall ‘net’ capital gain/loss. Remember, you are limited to a net capital loss of $3,000 annually for both joint filers and single filers. Any additional capital losses carry over to the following year indefinitely until they are used. If you should die before the carryforward capital losses are fully utilized, those capital losses are lost. By consulting with both your investment advisor and professional tax preparer, you will be able to determine the best tax strategy for handling your capital gains and losses each year.

Dealing with Stock Loss Carryovers and Roth IRA Conversions in the Year of Death for a Surviving Spouse: From a tax point of view, it is important for the surviving spouse to consult with his/her tax advisor on strategies that would use the deceased spouse’s loss carryovers on the final joint tax return. In addition, this will be the final year that the married couple can file married filing jointly. This is often a great year to make a Roth IRA conversion. But you have to do it before the spouse kicks. We have literally made “death bed” Roth IRA conversions. We have actually gone to a hospital to get a final signature that saved the family a lot of money. The surviving spouse could sell their own securities or other capital assets at a gain to use the deceased spouse’s expiring capital loss carryover. If there is time, evaluating the ill spouse’s portfolio before the date of death may also be helpful.

Zero Percent Tax on Long-Term Capital Gains: If you are in the 10% or 12% tax bracket, the tax rate for long-term capital gains is zero percent! To qualify for the zero-tax rate, your 2025 taxable income cannot exceed $48,350 for single filers and $96,700 for married filing jointly filers.

If you are eligible for the 0% capital gains tax rate, here is a cool maneuver to take advantage of the federal tax-free rate. Sell some appreciated stocks recognizing just enough gain to push your income to the top of the 12% tax bracket. If you want to continue owning these investments, use the sales proceeds to purchase new shares in the same company or companies. The newly purchased shares will now have a higher cost basis than the shares you sold. If you eventually decide to sell the new shares, the capital gains will be smaller due to the higher cost basis. Please also note that you do not have to wait 30 days before you can buy the stock back when there is a taxable gain. This technique is referred to as ‘gains-harvesting.’ The 30-day period only applies to securities sold at a loss.

If you are eligible for the 0% capital gains tax rate, here is a cool maneuver to take advantage of the federal tax-free rate. Sell some appreciated stocks recognizing just enough gain to push your income to the top of the 12% tax bracket. If you want to continue owning these investments, use the sales proceeds to purchase new shares in the same company or companies. The newly purchased shares will now have a higher cost basis than the shares you sold. If you eventually decide to sell the new shares, the capital gains will be smaller due to the higher cost basis. Please also note that you do not have to wait 30 days before you can buy the stock back when there is a taxable gain. This technique is referred to as ‘gains-harvesting.’ The 30-day period only applies to securities sold at a loss.

Consider this strategy: If you’re ineligible for the 0% capital gains tax rate, but you have adult children (not subject to the kiddie tax rules) in the 0% bracket, consider gifting appreciated stock to them. Your adult children will pay a lot less in capital gains tax than if you sold the stock yourself and gifted the cash to them. This is especially true if you are subject to both the Medicare surtax on net investment income, and you’re in the 37% tax bracket. In this scenario, you are paying 23.8% tax on your long-term capital gains. Modest amounts of low-basis stocks can still be gifted and sold by younger children while avoiding the new Kiddie tax rules in effect.

But be careful—you cannot ‘go back in time’ if you subsequently discover you would have fared better had you identified different shares before you made a particular sale. If you don’t specify which shares you are selling at the time of the sale, the tax law treats the shares you acquired first as the first ones sold. In other words, it uses a First-In, First-Out (FIFO) method. This may not produce the optimal result that you had wished for.

Hidden Gem: When a parent’s income is too large to claim education tax credits (the American Opportunity and Lifetime Learning), shifting income to the kid’s return can generate tax savings. In this tax-planning strategy, the parent is eligible to claim the child as a dependent but chooses not to do so. The child indicates that he or she can be claimed as a tax dependent on someone else’s tax return thus by default not claiming a personal exemption. Due to income limitations, the parent(s) do not qualify for the education tax credit on their tax return. Also, since the personal exemption deduction is currently suspended, no tax benefits associated with the child are lost. The child utilizes the education credit up to $2,500 on their own tax return depending on which education credit they qualify for. This holds true even if the parent pays for the college tuition and qualified expenses. Ideally you would shift enough income from the parent to the child to be offset by the education tax credit. Caution: Consider the changes to the Kiddie Tax rules when calculating the optimal amount of income to shift.

Step-Up-In-Basis Rules: Another very important but often overlooked item is a step-up-in-basis which occurs when a taxpayer inherits certain assets. The new cost basis is the fair market value as of the date of death, which is often much greater than the original basis that the decedent had in this investment. However, the step-up-in-basis rule does not apply to certain investments, such as IRAs and other tax-deferred accounts.

Remember that if someone gifts you an appreciated asset while they are alive, the tax basis of the giver becomes your tax basis.

Another opportunity that is often missed is the 50% step-up-in-basis rules for jointly held property. Even better is the 100% step up in basis for jointly held property in community property states.

Kiddie Tax Planning: Considering hiring your child as an employee. It is prudent to review the child labor laws in your state and the Fair Labor Standards Act. Maintain good records that substantiate wage payments. A child can use their standard deduction to shelter up to $15,750 of wages from federal income tax. There are also Social Security tax savings in certain situations. The child becomes eligible to contribute up to $7,000 to a Roth IRA in 2025 and $7,500 in 2026. The wage income may enable the child to escape the kiddie tax rules that would otherwise be imposed on unearned income. It is such a great strategy some parents have been noted to pay their infant child for modeling. This is a little too aggressive for our blood. We prefer to have the child do real work. There are also studies showing the benefits of a child doing chores or actual work growing up.

In prior years, shifting income to children was a popular strategy to reduce overall family tax costs. The new kiddie tax rules can often create more tax than what the parent would have paid on their own tax return.

More Roth IRA Conversion Details: In general, we like Roth IRA conversions for taxpayers who can make a conversion and stay in the same tax bracket they are currently in and have the funds to pay for the Roth conversion from outside of the IRA. Unfortunately, the qualification is likely critically important. It is best to ‘run the numbers’ to determine the most appropriate conversion amount for the current year and to plan for possible future conversions in your situation. We often develop a long-term Roth IRA conversion plan that usually involves multiple years of partial conversions. In addition, since hardly any clients ever spend their Roth IRA, we usually take the child’s tax bracket and additional tax-free investment time into account which often results in a larger Roth IRA conversion recommendation.

When a conversion plan is developed, we often recommend a conversion up to certain income limits to avoid additional Medicare premium cost increases or to avoid high rates of income tax on amounts of Roth conversion income over certain amounts. And for 2025 and later years, we are taking into consideration the new temporary Senior Tax Deduction that was made retroactive to 1/1/25.

But again, in ‘running the numbers’ we have also found that in some circumstances, it may be advantageous to make a Roth conversion that will push the taxpayer into a higher tax bracket.

It often makes sense for a parent to gift money to their children or grandchild either to make a Roth IRA contribution or to pay for a Roth IRA conversion.

Sometimes, it goes the other way too. In certain situations, utilizing a parent’s IRA and lower tax rates to do Roth conversions can be beneficial. The adult child (eventual beneficiary) having sufficient financial resources can make a monetary gift to the parent to pay the tax on the conversion. Since the parent wouldn’t be receiving annual RMDs from the converted portion of the IRA, the child can make annual gifts to replace the lost income distributions to cover living expenses. Without future IRA income, the parent’s Social Security income in future years can be received tax-free. Friendly Caution: Keep in mind that you are expecting your child to make those monetary gifts to you each year. It also gets trickier if there is a living sibling. That said, I have never seen this work in practice, though in theory it can save a lot of money.

Going forward, Roth conversions under the permanent current tax laws may present a better opportunity to make conversions at the lower tax rates. The historical benefits of Roth IRAs and Roth conversions that grow in value have not changed. It is more important than ever to develop a Roth conversion plan considering your unique situation.

Inherited IRA distributions generally must now be taken within 10 years: Under the terms of the draconian SECURE Act, for IRAs inherited from original owners who have passed away on or after January 1, 2020, the new law requires beneficiaries, subject to exception, to withdraw assets from an inherited IRA or 401(k) plan over 10 years following the death of the account holder.

Exceptions to the 10-year rule include assets left to a surviving spouse, a minor child, a disabled or chronically ill beneficiary, and beneficiaries who are less than 10 years younger than the original IRA owner or 401(k) participant.

Further guidance issued clarified that an RMD on an inherited traditional IRA must be taken for the first nine years and then the balance in year ten. This means a taxpayer cannot wait until year ten to take a distribution, except for the Roth IRA.

If you were the beneficiary of an inherited IRA in 2020, 2021, 2022, 2023, and 2024, and did not take any distributions from these IRAs, you will not be imposed with the penalty tax on any missed RMDs. For 2025, you are now required to take the RMD from your inherited IRA and may want to consider even more to ‘smooth’ out the income over the years instead of having a large distribution in year 10 with a higher tax bill.

With the passing of SECURE Act 2.0, the penalty for failing to take a required IRA distribution is now reduced from 50% to 25% of the amount that should have been taken out. Note, if the required minimum distribution is timely corrected within 2 years, the penalty may be reduced to 10%.

As a comprehensive financial services firm, Lange Financial Group, LLC is committed to helping our clients improve their long-term financial success and to pass their money on in the most tax-efficient manner possible. Of course, since every situation is different, not all strategies outlined will be appropriate for you. Please discuss all potential tax strategies with your tax preparer or CPA who works with your money manager. We want you to get the benefit of true tax planning, not just receiving good historical reporting of what occurred during the year.

Our entire team at Lange Financial Group, LLC is available to provide you with updated information that can help with all your financial planning needs. If you would like us to mail a printed copy of this important report to any of your friends or associates, please call Erin at our office at 412-521-2732.

It should be noted that one of the topics of recent webinars has been transferring money from the taxable environment to the tax-free environment. Roth IRA conversions are one example of this strategy.

What may be even more important for many families is transferring money from the taxable environment to the tax-free environment outside of your estate. This is where you withdraw money from your IRA and then gift the net proceeds to an heir who invests in something that is tax-free. We mentioned gifts to children and grandchildren for their Roth IRAs and Roth 401(k)s above.

Taxes on Social Security Income: Social Security income may be taxable, depending on the amount of other income a taxpayer receives. If a taxpayer only receives Social Security income, the benefits are generally not taxable, and it is possible that the taxpayer may not even need to file a federal income tax return.

If a taxpayer receives other income in addition to Social Security income, and one-half of the Social Security income plus the other income exceeds a base amount up to 85% of the Social Security income may be taxable. The base amount is $25,000 for a single filer and $32,000 for married taxpayers filing a joint return.

A complicated formula is necessary to determine the amount of Social Security income that is subject to income tax. IRS publication 915 contains a worksheet that is helpful in making this determination.

Social Security income is included in the calculation of MAGI for purposes of calculating the Medicare contribution tax, as discussed earlier. Therefore, taxpayers having significant net-investment income will have a reason to delay receiving Social Security benefits.

Assuming a reasonable or long-life expectancy, it is generally beneficial for an individual who is eligible to receive Social Security on or after age 62 to delay payments until full retirement age (FRA). Assuming a full retirement age of 66, an individual who elects to receive Social Security benefits at age 62 will see benefits reduced by 25%.

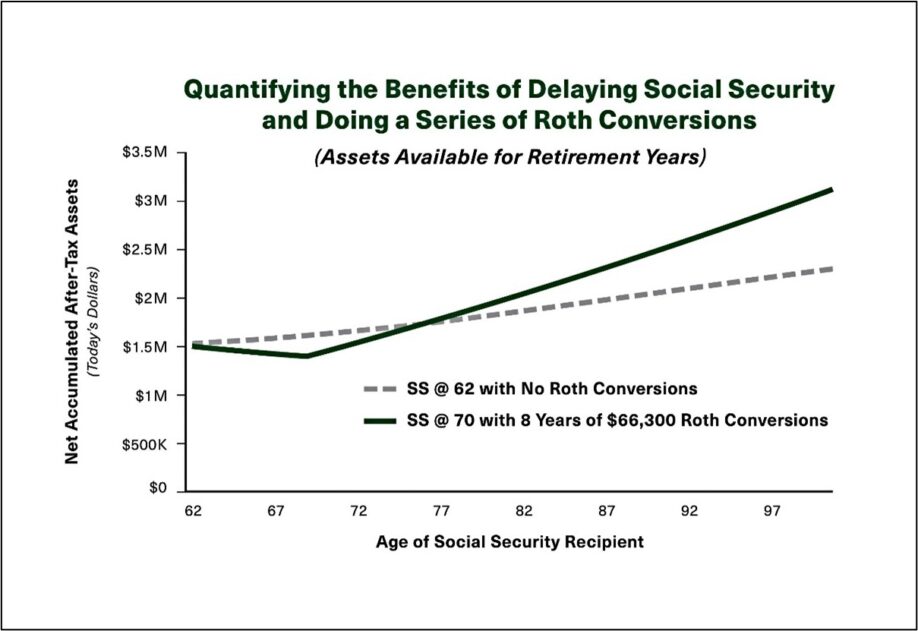

An interesting wrinkle in long-term planning related to the taxation of Social Security is the synergy of developing a good long-term Social Security maximization plan and a good long-term Roth IRA conversion plan. We often enjoy tremendous benefits using the following combination strategy under the right circumstances.

One effective strategy is holding off on Social Security and making Roth IRA conversions in the years after you retire and you don’t have wages, but before age 70 when you will have full Social Security and before age 73 or 75 when you begin receiving taxable RMDs. Make those Roth IRA conversions while your marginal income tax bracket is at an all-time low. Please note a Roth IRA conversion increases income which could increase the tax on Social Security, the addition of net investment income tax and increase Medicare premiums.

- Graph Assumptions

- Age 62 as of January 2026 with required minimum distributions starting at age 75 in 2039.

- $1.2 million pre-tax assets, $600,000 after tax-assets, $300,000 tax allowance for pre-tax assets = $1,500,000 of net assets.

- 6% rate of rate of return with annual inflation of 3%.

- Income tax rates remain constant.

Other Provisions

Medicare Tax

Many higher income taxpayers have larger tax bills due to the 3.8% Medicare contribution tax on net investment income. The focus must be on reducing your AGI to help mitigate the additional tax costs. Try and manage your AGI by keeping it as close to the threshold as possible. Going well below the threshold provides no additional benefit as it relates to computing the 3.8% surtax. With a few strategic moves, you may be able to reduce your AGI enough to mitigate the impact of these new taxes.

The Medicare contribution tax is imposed only on “net investment income” and only to the extent that total MAGI exceed $200,000 for single individuals and $250,000 for taxpayers filing joint returns. The amount subject to the tax is the lesser of:

- Net investment income; or

- The excess of MAGI over the applicable threshold amount listed above.

Estate and Gift Tax Opportunities: The game of estate planning for most clients has changed from trying to reduce gift or estate tax to trying to reduce income taxes. For 2025, each taxpayer can pass $13,990,000 (minus past taxable gifts that he/she has made) to children or o

Estate and Gift Tax Opportunities: The game of estate planning for most clients has changed from trying to reduce gift or estate tax to trying to reduce income taxes. For 2025, each taxpayer can pass $13,990,000 (minus past taxable gifts that he/she has made) to children or o

ther beneficiaries without having to pay gift or estate taxes. If you are married, you will be able to pass $27,980,000 without any federal gift or estate taxes. For 2026, the limit has been increased to $15,000,000 or $30,000,000 for a married couple. The top tax rate for estates is 40% on gifts or estates of deceased persons exceeding the limits. This is the exemption amount for federal estate tax, not for PA inheritance tax, which is a flat 4.5% to lineal heirs (children and grandchildren).

Many people believe that with the estate tax exemption set at over $15,000,000 per person beginning in 2026, they don’t need to worry about shrewd, tax-wise ways to give wealth. However, these people might want to rethink their strategy. Congress can change the law (and has changed the law in the past), and your wealth could grow faster than expected, thereby subjecting you to estate tax. Perhaps more importantly, it is usually a better use of your money to give more gifts to your children while they are still young and need it more than an even larger inheritance later in life. Nevertheless, before you make gifts, you need to consider the income tax effects of making certain gifts. Giving away the wrong asset can cost your family some unnecessary taxes. However, if you have an estate that is worth less than $3,000,000, I recommend focusing on long-term planning to reduce income taxes, not estate taxes. Planning appropriately for your IRA, Roth IRA, Roth IRA conversions, and your retirement plan should be your biggest concern.

In 2025, you and your spouse can each give $19,000 per calendar year ($38,000 for couples) to as many individuals as you would like without reducing your lifetime gift tax exemptions. Depending on your circumstances, it may be smart to make a gift before the end of this year. Gifts to medical or educational providers directly are not included in the $19,000 limit. In fact, there is no limit on qualified gifts if the checks are made directly to a school or medical facility. For 2026, the annual gift tax exclusion remains the same.

If you are going to make a gift, it is important to determine which asset is the best one to gift. It is usually best to give high-basis assets or cash, especially if the taxpayer is in poor health. In most cases, it is best not to give low-basis assets because the basis of gifted assets is the same for the recipient as it is for the donor, and the gifted assets will not usually receive a step-up-in-basis when a taxpayer passes.

Before making sizable gifts to children or other family members, keep in mind that in some cases, these gifts may unfortunately backfire. For example, a gift might make a student ineligible for college financial aid, or the earnings from the gift might trigger tax on a senior’s Social Security benefits.

Congress has created several tax breaks over the last few years to help pay for education. One of the most popular types of savings plans is the Section 529 plan. Withdrawals (including earnings) used for qualified education expenses (tuition, books, and computers) are income-tax free.

The amount you can contribute to a Section 529 plan on behalf of a beneficiary qualifies for the annual gift-tax exclusion. However, the tax law allows you to give the equivalent of five years’ worth of contributions up front with no gift-tax consequences. The gift is treated as if it were spread out over the 5-year period. For instance, you and your spouse might together contribute the maximum of $190,000 (5 x $38,000) on behalf of a grandchild this year without paying any gift tax.

Making Trust Distributions: Net investment income tax also applies to trusts and estates. With compressed tax brackets for trusts compared to individual tax brackets, making permitted discretionary distributions to beneficiaries can reduce overall taxes. By making the proper election, trusts can distribute current year’s income up to 65 days into the following year and still have the income taxed to the beneficiary in the current tax year. This is known as the 65-day rule. With the highest trust income tax rate being 37% for taxable income over $12,750, proper planning can go a long way to reduce the overall income taxes paid in a year.

As always, if you have any questions about your specific situation before our next scheduled meeting, please feel free to call your tax preparer or person who is working with your money manager for assets under management.

Sincerely,

Jennifer A. Hall,

CMA, CPA, CFP®, CRPC®

P.S. We covered what we believe are the most important year-end tax planning strategies for our clients, but we did not go into detail regarding the OBBBA. You deserve the best information regarding this massive new legislation, and I have been fortunate to secure reprint rights to distribute a private URL to what I consider to be the best article on the subject. Our special link, https://Kitces.com/OBBBA, contains the article, Breaking Down the “One Big Beautiful Bill Act”: Impact of New Laws on Tax Planning by Ben Henry-Moreland, Senior Financial Planning Nerd at Kitces.com.

About Jennifer Hall, CMA, CPA, CFP®, CRPC®: Jen is a member of our tax and retirement planning team. Jen brings 30+ years of experience as a tax, accounting, and retirement planning professional.

About James Lange, CPA/Attorney: Jim is President of Lange Financial Group, LLC and has 35+ years of experience working with retirees and those about to retire. Jim can be reached by calling (412) 521-2732.

This article is for informational purposes only. No information provided should be construed as advice, and it is not intended to be a substitute for specific individualized tax, legal, or investment planning advice as individual situations will vary. No system is immune to risk, including the potential for loss of principal. There is no guarantee that any investment plan or strategy will be successful. Consult with a qualified professional prior to implementation.