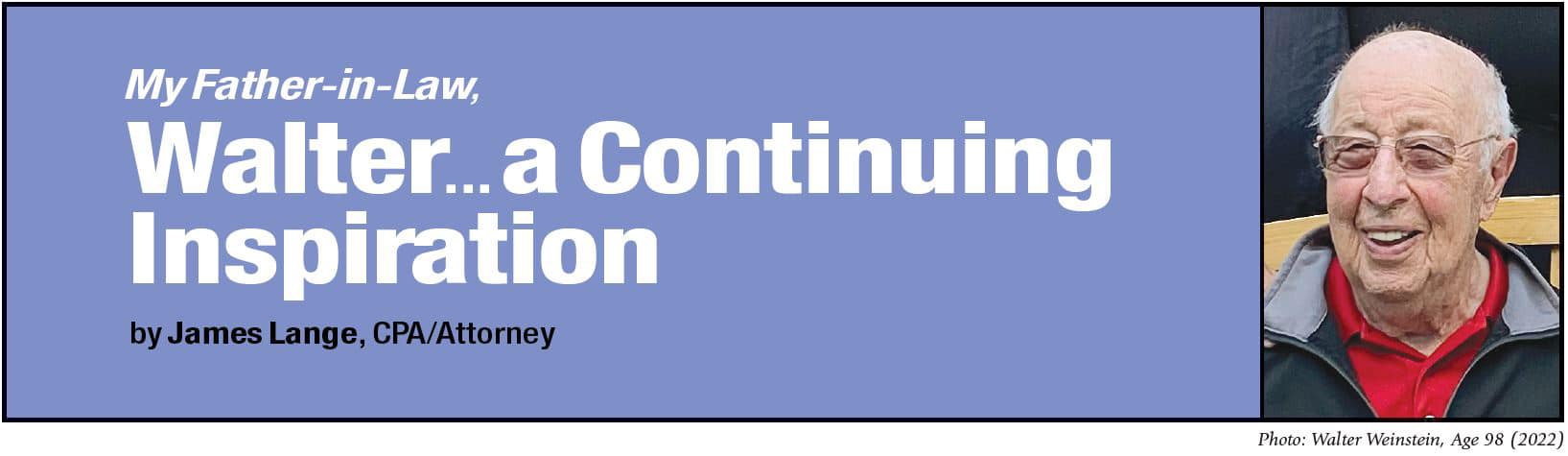

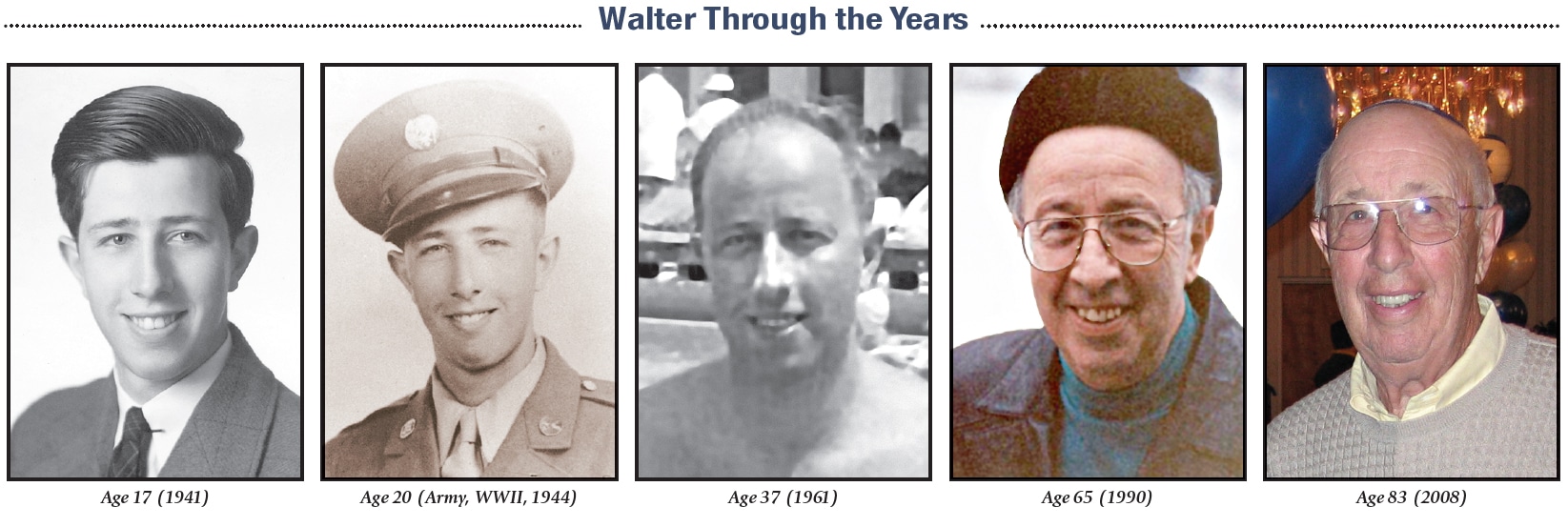

My wife’s dad, Walter Weinstein, just celebrated his 99th birthday with his entire family. As he has for years, Walter sponsors the entire gang for a 5-day vacation where we all convene at the Woodloch resort in the Poconos. It’s quite a crowd: two children and their spouses, six grandchildren and their spouses, five great grandchildren, and the family of his partner, Myrna.

My wife’s dad, Walter Weinstein, just celebrated his 99th birthday with his entire family. As he has for years, Walter sponsors the entire gang for a 5-day vacation where we all convene at the Woodloch resort in the Poconos. It’s quite a crowd: two children and their spouses, six grandchildren and their spouses, five great grandchildren, and the family of his partner, Myrna.

Walter’s mind is still sharp as a tack. We wonder how many more years these family vacations will continue but we will cherish what time we get. Walter and many of us, including me, teared up when we relayed our anecdotes of his kindness and generosity. But what we really celebrated was his role in fostering a deep sense of family; that is a priceless gift.

For our daughter, Erica, these vacations are certainly the highlight of her year. She loves hanging out with her cousins as they engage in a mix of playing with the great grandkids, playing games, and competing in contests organized by the resort, as well as private family games. She feels she is part of a clan because of these gatherings. We eat virtually all our meals together and everyone enjoys good food, but more importantly we enjoy the comradery we experience hanging out together for almost a week.

With the exception of sponsoring family vacations, I have been relatively unsuccessful in getting clients to spend more money when they can afford to do so. Many, however, report they have at least loosened the purse strings! During a recent review with one client, he bragged about how he has been spending more. He proudly told me he now pays for ad-free YouTube videos. It’s a step. I suggested to the client that he consider buying or at least renting a place near where their only daughter and grandchild live. Mom loved that idea and, in all fairness, so did he.

That said, I am very pleased when I learn that my stories of Walter’s generosity have motivated clients and readers to sponsor family vacations of their own and to buy experiences, not things.

Thank you, Walter.

Workshop News

We had our first live in-person workshops since the pandemic on July 6th and 8th. I forgot how much I missed making live presentations. The workshops were very well attended, and 18 people scheduled initial consultation appointments with me.

True to form, many of the people who scheduled appointments had previously attended at least one workshop in the past. I can’t pull up the statistics, but hearing the information more than once seems to be highly motivating, so don’t hesitate to attend one of my workshops more than once.

We videotaped the workshops. If you are interested in receiving a video of the event, please visit the following web site and request one.

A Book for Parents of a

Child with a Disability

We are also not too far from completing our next book, Retire Secure for Parents of a Child with a Disability. Our one-page highlights (summarizing our best recommendations) and our 55-page detailed report are getting a lot of attention. If you or someone you know would benefit from some excellent advice and recommendations, distilled and culled from three experts in the area, they can now be accessed at no charge at:

We are also not too far from completing our next book, Retire Secure for Parents of a Child with a Disability. Our one-page highlights (summarizing our best recommendations) and our 55-page detailed report are getting a lot of attention. If you or someone you know would benefit from some excellent advice and recommendations, distilled and culled from three experts in the area, they can now be accessed at no charge at:

It's almost here.

Book Update

On August 4, 2023, we will receive the first batch of our latest book, Retire Secure for Professors and TIAA Participants. Though the title of the book highlights professors and TIAA participants, don’t feel left out. The content will be of great value to most IRA and retirement plan owners. It is loaded with tax-cutting gems. I highly recommend you plan to spend some time with it. The information on when and how to get a copy are detailed below.

Thanks to a great team, it is far and away the best book I have ever produced. It includes the best material from my eight previous books for IRA and retirement plan owners. The team of number-crunching CPAs and estate attorneys (including me) added critical new strategies in response to the new tax laws. The calculations, graphs, charts, and explanations were meticulously updated. The book also benefited from the work of a fine CPA/writer and my long-time editor who collectively spent over a thousand hours updating and clarifying the material.

Though the book is 526 pages, the very detailed Table of Contents will help you hone in on whatever is of interest to you. I might add, since AI is so much in the news lately, not one word came from ChatGPT.

We are planning to send a hard copy of the book to all our assets-under-management clients as well as our college professors and retired professor clients. We are also planning on sending it to a number of other “friends of the firm.” It should arrive sometime around the middle of August. If you just can’t wait to dig in or prefer a digital copy or if you are an income tax preparation or legal client and would like a copy, please go to Faculty-Advisor.com/BookRequest and we will email you a digital copy.

We anticipate the book being available from Amazon between early and mid-September. There are 5 million TIAA participants with over a trillion dollars in assets-under-management. A Google and Amazon search for books on managing and accessing TIAA retirement accounts reveals a lack of literature and nothing very current. We are expecting to get crushed with work.

If you are interested in becoming an assets-under-management client, developing your own Financial Masterplan, or having your wills and trusts updated, I highly recommend you give our office a call soon. This isn’t hype. I think we will be overwhelmed with work, and I would rather serve my existing clients before serving people I don’t know.

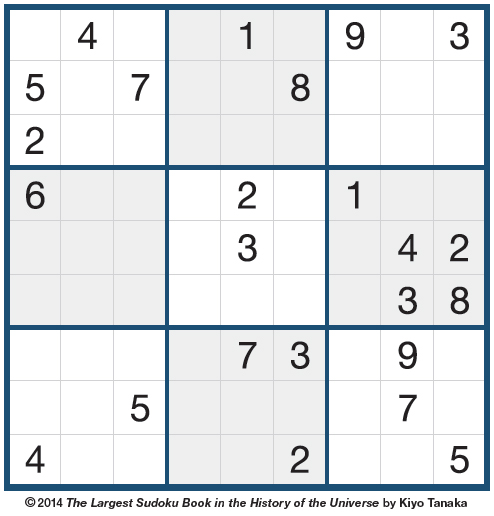

Click here for Sudoku answers.