The Little Black Book of Social Security Secrets evaluates options for collecting Social Security benefits and recommends the most advantageous strategies for them.

Changes to Social Security Rules: File & Suspend vs Restricted Applications and Social Security Benefit Strategies for Married Couples

Social Security Options after the 4/29 Apply and Suspend deadline

A couple of people who have written in want to know why I’m taking such a passionate interest in the changes to the Social Security rules. “What’s in it for you?” they ask. When I wrote The Little Black Book of Social Security Secrets, my plan was to make it available as a resource to my own clients. It received such an overwhelming response, though, that I quickly realized that I should make it available to as many people as possible – even though it’s unlikely that I’ll ever derive a benefit from doing so.

I am a CPA and an attorney, and my area of expertise lies in retirement and estate planning. As part of our services, we have always evaluated our client’s options for claiming Social Security benefits. Social Security is an integral part of retirement planning. If your income from all sources is high enough, your Social Security benefits will be taxed. Required minimum distributions from traditional retirement plans, which begin at age 70 ½, will compound that tax problem. It seems obvious to me that, if I want to give clients good advice about the money they will have available to spend during their retirement years, I must evaluate their options for collecting Social Security benefits and recommend what I believe are the most advantageous strategies for them. From the feedback I’m getting, though, it seems that many of the professionals in my field are quite happy to refer their clients to their local Social Security office for advice. Frankly, this is one topic on which I’m more than happy to hold the minority opinion!

But let’s go back and look at some real-life questions presented by people who have read my book, and who want to know what they should do with their own Social Security benefits. Ralph is 67, and hasn’t applied for Social Security yet because he wants his monthly benefit to grow by Delayed Retirement Credits (DRCs) of eight percent every year, and Cost of Living Adjustments (COLAs). His Primary Insurance Amount (PIA) is $2,400. His wife, Alice, just turned 65. She worked for most of her life, and her PIA is $1,800. What is the best Social Security strategy for this couple?

Social Security Options

Ralph has several options. If he files for his own benefit now, he would be eligible to collect about $2,600 (his PIA, plus the years’ worth of DRCs that he has already earned, plus COLAs) every month. He can also delay filing for benefits until age 70. Not filing will allow his benefit to grow by additional DRCs and COLAs, but he will need to file when he turns 70 because he cannot earn additional DRCs after that. Ralph can even change his mind. If he started to collect his benefit at age 67 and later regrets his decision, he can suspend his benefit and earn DRCs every month that his benefit is suspended, until he turns 70.

What about Alice? She is eligible to collect a benefit based on her own record, but, if she wants to collect it now, her benefit will be permanently reduced because she has not reached her Full Retirement Age (FRA) of 66. If she waits until she is 70 to collect her own benefit, the outlook is much better. Like Ralph, she is eligible to earn DRCs and COLAs on her own benefit. Her PIA is $1,800 and, if she waits until 70 to collect it, her monthly benefit amount will be about $2,400. If she is already collecting her own benefit, she can also suspend it when she reaches FRA and earn DRCs until she turns 70.

Spousal Benefits Give More Options to Married Couples

Ralph and Alice have been married for at least a year, so both have another option – Social Security spousal benefits. Even if Alice had never worked outside of the home, she would be eligible to collect spousal benefits based on Ralph’s record. The general rule is that spousal benefits can be paid as early as age 62, but they will be reduced. In order for Alice to receive the maximum possible spousal benefit – which is 50 percent of Ralph’s PIA – she must wait until 66 to apply. (Note, Social Security has something called a deemed filing rule, discussed below, that could affect whether she will receive her spousal benefit or her own benefit.) There is no benefit to Alice waiting beyond age 66 to apply for spousal benefits.

Ralph can also apply for spousal benefits based on Alice’s earnings record. Why would he want to, when his own benefit would be higher? There are some situations where it might actually make sense for the person whose own benefit is higher than his spousal benefit, to apply for the lower spousal benefit. We’ll cover more about that in a minute.

Suppose Ralph and Alice were divorced, and that only Ralph has remarried. As long as their marriage lasted at least ten years, Alice would still be eligible to file for spousal benefits based on his record. Does that mean that his current wife can’t get spousal benefits? As long as they’ve been married at least one year, his current wife can, when she is eligible, also file for spousal benefits based on Ralph’s record. Ralph could have been married four or five times and, as long the marriages lasted at least ten years, all of his ex-wives would be able to collect spousal benefits based on his record. The interesting part is that none of his ex-wives’ spousal benefits will be reduced because others are claiming on the same record!

How are Spousal Benefits Calculated?

The spousal benefit calculation can be complicated, so let’s look at an example. Let’s assume that Alice didn’t work much outside of the home, and that her PIA is only $400. Her full spousal benefit would be half of Ralph’s PIA, or $1,200. The difference of $800 is what is often referred to as the “spousal excess” – and the distinction between that and her PIA is very important if Alice wants to apply when she turns 62. If she does, and if Ralph is already claiming, she will receive 75 percent of her PIA ($300), plus 70 percent of the spousal excess ($560), for a total of $860. Of course, if Alice waits until FRA to apply, she’d get the equivalent of 50 percent of Ralph’s PIA ($1,200).

In our original scenario, though, Alice worked for most of her life and her own PIA is $1,800 – higher than the maximum spousal benefit to which she’d be entitled. Why would she apply for a spousal benefit if her own benefit is higher? We’ll cover the reasons why in the next section but, before we do we need to take a look at how much she’d be eligible to receive as a spousal benefit. If she applies at FRA, she’s eligible for the maximum – or 50 percent of Ralph’s PIA. Alice can certainly apply for benefits now, but her age (65) presents a complication. Social Security’s deemed filing rule says that, since she is not yet FRA (for our purposes here, 66), she will be “deemed” to be applying for both her own benefit and her spousal benefit. In other words, if she applies at 65, she has no choice – Social Security will figure out how much she would receive as a spouse, and how much she would receive based on her own record, and pay her the higher of the two. In this case, her own benefit, even reduced because she applied early, is higher than her spousal benefit. She’ll get $1,679 ($1,800 x 93.3%).

Maximize your Social Security benefits by Combining the Apply and Suspend Strategy with Restricted Applications

So how can Ralph and Alice use the options they have available to maximize the amount they receive from Social Security? Let’s look at some ideas.

Suppose Ralph is currently collecting his own benefit or that he applied for and suspended his benefit by the April 29, 2016 deadline. What happens if Alice waits one year, and applies for benefits when she is FRA (66)? If she waits until FRA, Alice’s application will no longer be subject to the deemed filing rule. She can submit her paperwork and specify that she only wants to apply for whatever spousal benefit to which she might be entitled. This is also known as filing a Restricted Application. Since she’s now FRA, she’d be eligible to receive 50 percent of Ralph’s PIA, or $1,200. She can collect her spousal benefit until she turns 70 and, in the meantime, the benefit based on her own earnings record will continue to grow by DRCs and COLAs. When she turns 70, she can switch to her own benefit, which will have increased by at least 32 percent – or, to almost $2,400 every month. Note, in order to be able to file a Restricted Application for spousal benefits, you had to have been at least 62 years old as of December 31, 2015. If you weren’t, you’ll be in the same boat as I am. We’ll be subject to the deemed filing rule regardless of when we apply for benefits.

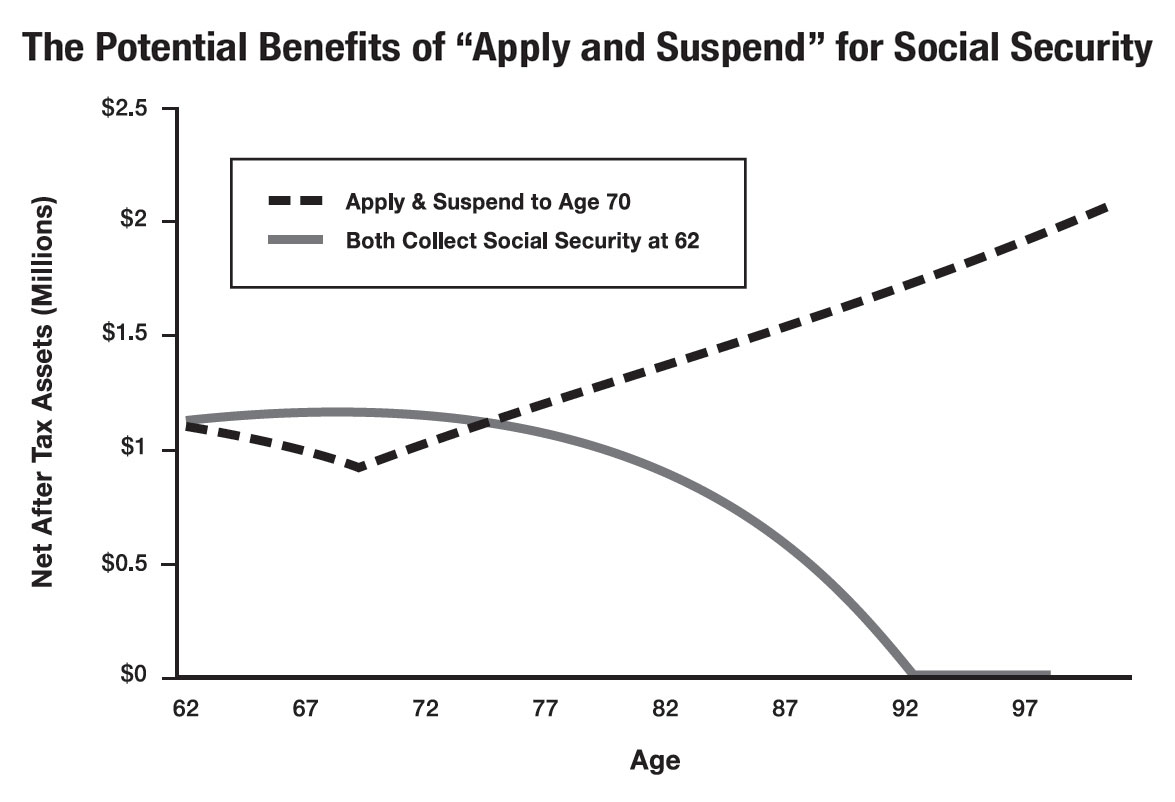

Best Social Security Strategy for Married Couples

What does this mean in terms of money? If Alice applies for her own benefit at 65, she’ll receive about $1,679 every month, for the rest of her life. If she waits until age 66 to apply for just her spousal benefit – filing that Restricted Application – she’ll give up all the money she could have received from age 65 to 66 – a little over $20,000 ($1,679 x 12 months). Her spousal benefit of $1,200 every month will give her some income from the time she is 66 to 70, but not as much as if she’d applied for her own benefit at age 65. The difference between taking a spousal benefit and her own benefit during that four year period is significant – she’ll miss out on about $23,000 ($479 x 48 months). If you’re keeping track, she’s already missed out on about $43,000! But once she turns 70 and starts to receive her own benefit that has been increased by DRCs, the outlook is different. From that point on, Alice will get about $700 more ($2,400 – $1,679) every month than if she had applied at 65 – and she will get it for the rest of her life.

Confusing? You bet! But I hope you understood the general idea that, even though Alice collected no money when she was 65, and collected less money than she could have from the time she was 66 to 70, the handsome payoff that she received after she turned 70 made up for her sacrifice – and the payoff happened in a little over 5 years ($43,000 / $700 = about 61 months).

There is one catch. In order for Alice to be able to collect that 50 percent spousal benefit from the time she is 66 to 70, Ralph either has to be collecting his own benefit, or had to have applied and suspended by the deadline of April 29, 2016. Suppose Ralph is 70 years old but has not applied for benefits yet. He should go ahead and do so, because he won’t earn any more DRCs beyond this point. And once he files, Alice will be able to file a Restricted Application for spousal benefits.

Suppose Ralph just turned 66, and was not eligible to file for and suspend his benefit. Well, he can certainly apply for and collect his own benefit and Alice can file a restricted application for her spousal benefit, but then Ralph won’t earn those DRCs that can increase his check by 32 percent. Unless there were very unusual circumstances involved, it probably wouldn’t make sense for Ralph to collect when he is 66, just so Alice can get a spousal benefit for four years.

Suppose Ralph is 65, and Alice is 64 – so neither has reached FRA yet. Both are allowed to apply now, but, if they do, we know that each will receive the benefit based on his or her own record, and that their benefits will be permanently reduced. But what happens if they wait until next year, when Ralph turns 66 and Alice turns 65? Ralph can apply for his own benefit and receive his PIA of $2,400. Alice, though, has to be FRA in order to submit a Restricted Application for spousal benefits. If she waits until she’s 66, she’ll get the maximum spousal benefit of 50 percent. But because she restricted the scope of her application to her spousal benefit, she can collect about $1,200 every month until she turns 70. Once she turns 70, she can switch from her spousal benefit and collect her own benefit, which by now has grown to $2,400 every month.

In reality, these calculations are oversimplified. Before we make specific recommendations to our clients about Social Security, we take in to consideration such factors as life expectancies, income taxes, other sources of income, and COLAs. But the one thing I wanted to make sure you understood by these examples is that the ability to file a Restricted Application and collect spousal benefits might be able to provide one of you with a source of retirement income while your own benefit still continues to grow. And, as long as you were at least 62 years old by 12/31/2015, it is an option that you can take advantage of when you finally do apply for Social Security benefits.

My next post will give some additional examples of how Restricted Applications can be useful. If you have questions or comments, please feel free to write them below. Stop back soon!

Go to www.paytaxeslater.com/ss to get your free digital copy of The Little Black Book of Social Security Secrets, and then talk to a professional about your options before it’s too late.

The Apply and Suspend strategy will be eliminated on April 29, 2016, so you must act now to take advantage of it. For those of you who cannot use the Apply and Suspend technique, there is another way that you may be able to maximize your benefits, though, which involves filing a Restricted Application (also known as Claim Now, Claim More Later). The great news is that you can take advantage of this strategy until December 31, 2019, assuming that you were at least 62 years old as of December 31, 2015.

The Apply and Suspend strategy will be eliminated on April 29, 2016, so you must act now to take advantage of it. For those of you who cannot use the Apply and Suspend technique, there is another way that you may be able to maximize your benefits, though, which involves filing a Restricted Application (also known as Claim Now, Claim More Later). The great news is that you can take advantage of this strategy until December 31, 2019, assuming that you were at least 62 years old as of December 31, 2015.  Apply and Suspend works this way. You file an application for benefits at age 66 (or later) and then suspend them – meaning that you will not receive monthly checks. There’s good reason to consider doing this. For each year that your benefit remains suspended, it grows by 8 percent (up to a maximum of 32 percent), plus cost of living adjustments. When you finally begin collecting checks at age 70, they’re significantly higher than they would have been if you had begun collecting them at age 66 – and they stay that way for the rest of your life. If you change your mind and want to start receiving your checks after you’ve suspended them, you can do so at any time.

Apply and Suspend works this way. You file an application for benefits at age 66 (or later) and then suspend them – meaning that you will not receive monthly checks. There’s good reason to consider doing this. For each year that your benefit remains suspended, it grows by 8 percent (up to a maximum of 32 percent), plus cost of living adjustments. When you finally begin collecting checks at age 70, they’re significantly higher than they would have been if you had begun collecting them at age 66 – and they stay that way for the rest of your life. If you change your mind and want to start receiving your checks after you’ve suspended them, you can do so at any time.