Recent studies have shown that women, even those who worked outside of the home, are much more likely to slip below the poverty line in retirement than men are.

Recent studies have shown that women, even those who worked outside of the home, are much more likely to slip below the poverty line in retirement than men are. Approximately 8 percent of adults aged 65 and older must rely on food stamps to survive and, of those, two-thirds are women. Why is there such a financial inequity between men and women in their golden years?

In years past, women typically earned much less than men (fortunately, this has started to change). Because they earned less than men, women were not able to save as much for retirement. Federal law establishes the maximum percentages that workers can contribute to retirement plans. Assuming that two workers both contribute the maximum percentage to their retirement plans, a male worker who earns $60,000 will save more dollars than a female worker who earns $40,000. Women must also make what they can save last longer. According to the Social Security Administration, the life expectancy of a man who is 65 today is 84.3. The life expectancy of a female, who is 65 today, is 86.6—a difference of almost two and one-half years.

Many women who are now retired are not as educated about finances as women of subsequent generations. They let their husbands manage the money, and frequently are unintended victims of poor decisions made by their spouses. This is especially true when considering both defined benefit pensions and Social Security elections. Retirees generally have the choice of applying for a higher benefit that lasts for their own lifetime, or a reduced benefit that is paid over the course of both their and their surviving spouse’s lifetimes. Many insist on applying for the higher benefit under the premise that they need a higher income to live on. If they are the first to die, though, their spouses are cut off completely. Many of the primary wage earners also make bad decisions when applying for Social Security benefits, never considering how their actions will affect their spouses. The decisions they make can mean a difference of about $25,000 in Social Security income every year, for their surviving spouses.

The good news is that, even if you are retired now, there are steps that you can take to improve your outlook in retirement. Consider some of these options:

1. If you are saving for retirement, take advantage of qualified retirement plans such as 401(k)s, 403(b)s, and IRAs. These plans offer tax advantages that, in the long run, will provide you with a much larger nest egg in retirement than buying identical investments inside a non-retirement account. Make sure that you manage the money that you do save, well. Many women are afraid to invest their money in anything other than CD’s, and never consider that the low rates of return they offer may cause them to run out of money before they run out of time.

2. If your spouse is entitled to a defined benefit pension when he retires, or if he will receive payments from an annuity, make sure that he chooses the payment option that covers your life as well as his own – especially if you are younger than he is. If he chooses the option that covers only his life, the payments will stop when he dies. If you can’t afford to live on the reduced benefit amount that covers both of your lives, then you can’t afford to stop working.

3. If your spouse earned more money than you did, ask him to think twice about applying for Social Security benefits at age 62. If he does, his benefit will be reduced by 25 percent for the rest of his life. Your spousal benefit, as well as your survivor benefit if he predeceases you, will also be permanently reduced. If it’s possible, encourage your spouse to wait until age 70 to apply for benefits. If he does, his benefit will be increased by 32 percent. If you survive him, the benefit you receive after his death will also be significantly higher.

4. Many women are not educated about financial and tax strategies they can use to make their money last longer. Consider making a series of Roth IRA conversions during the years after you retire, but before you start taking withdrawals or Required Minimum Distributions from your retirement plans. The money you save in a Roth IRA is not taxable, and so lasts longer than money that is in a traditional retirement plan.

It is important to remember that there is no one-size-fits-all answer to this problem. In order to make sure that you are financially secure, it is imperative that you contact a financial professional that you can trust and discuss these points in detail. A good fee-based advisor will be able to guide you through the best possible choices for pensions, Social Security, investment planning, and retirement expenses.

For more information about the financial challenges affecting women in retirement, please listen to our radio show at “Women Don’t Ask: How Married Women Can Advocate for their Own Financial Protection”

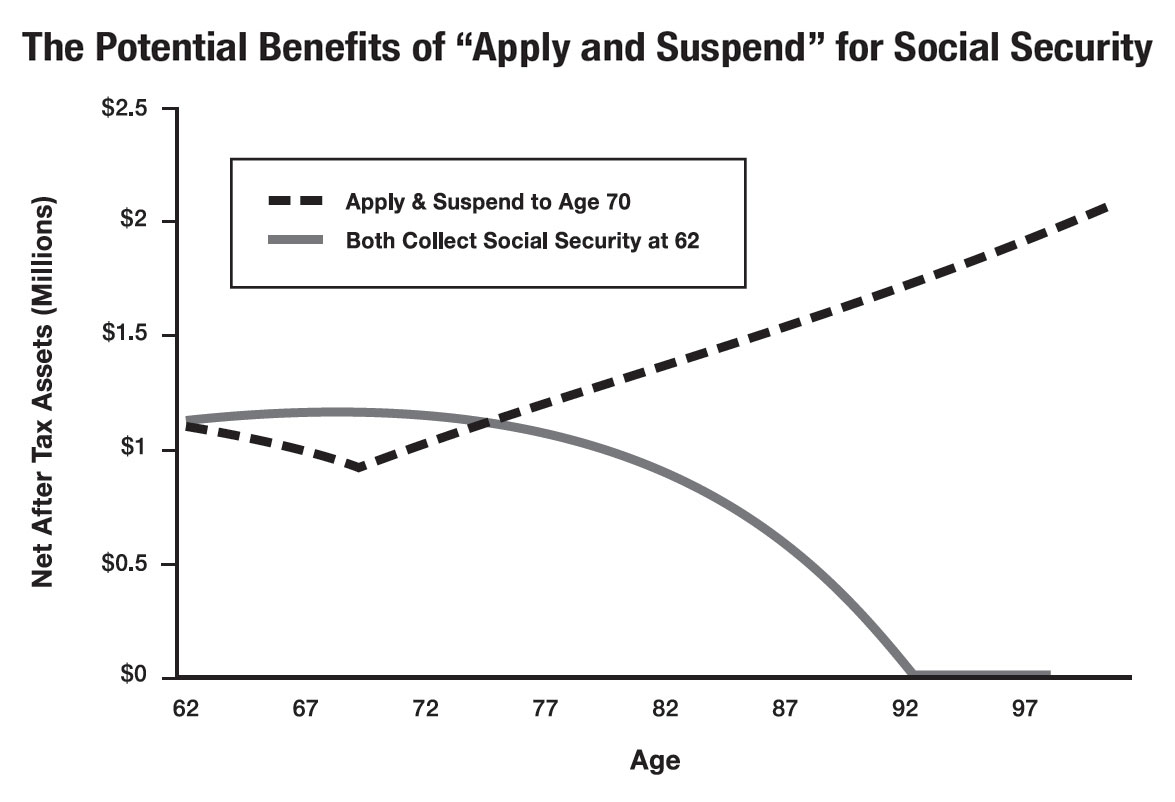

There were two married couples, the Rushers and the Planners, with identical earnings records and investments. The Rushers didn’t read this book and during retirement, they ran out of money. Bad news. The Planners, however, took the time to read this short little book, implemented the recommended strategies, and when the Rushers were barely scraping by, they still had $2,013,881.

There were two married couples, the Rushers and the Planners, with identical earnings records and investments. The Rushers didn’t read this book and during retirement, they ran out of money. Bad news. The Planners, however, took the time to read this short little book, implemented the recommended strategies, and when the Rushers were barely scraping by, they still had $2,013,881. Apply and Suspend works this way. You file an application for benefits at age 66 (or later) and then suspend them – meaning that you will not receive monthly checks. There’s good reason to consider doing this. For each year that your benefit remains suspended, it grows by 8 percent (up to a maximum of 32 percent), plus cost of living adjustments. When you finally begin collecting checks at age 70, they’re significantly higher than they would have been if you had begun collecting them at age 66 – and they stay that way for the rest of your life. If you change your mind and want to start receiving your checks after you’ve suspended them, you can do so at any time.

Apply and Suspend works this way. You file an application for benefits at age 66 (or later) and then suspend them – meaning that you will not receive monthly checks. There’s good reason to consider doing this. For each year that your benefit remains suspended, it grows by 8 percent (up to a maximum of 32 percent), plus cost of living adjustments. When you finally begin collecting checks at age 70, they’re significantly higher than they would have been if you had begun collecting them at age 66 – and they stay that way for the rest of your life. If you change your mind and want to start receiving your checks after you’ve suspended them, you can do so at any time.

A nationally recognized IRA, Roth IRA conversion, and 401(k) expert, he is a regular speaker to both consumers and professional organizations. Jim is the creator of the Lange Cascading Beneficiary Plan™, a benchmark in retirement planning with the flexibility and control it offers the surviving spouse, and the founder of The Roth IRA Institute, created to train and educate financial advisors.

A nationally recognized IRA, Roth IRA conversion, and 401(k) expert, he is a regular speaker to both consumers and professional organizations. Jim is the creator of the Lange Cascading Beneficiary Plan™, a benchmark in retirement planning with the flexibility and control it offers the surviving spouse, and the founder of The Roth IRA Institute, created to train and educate financial advisors. The third edition of Retire Secure! has been completed and will be going to the printer shortly. Some of you may be thinking, “So what? I already read that book.” Since the second edition of Retire Secure! was published in 2009, there have been two major revisions to the tax code and several landmark court decisions that have significantly changed the way we approach the cases we handle in our office. We try to keep you informed of these changes through our newsletters. If you’re a client, we also meet with you at least once a year to review your situation and, if needed, we help you make changes so that you can achieve the best results possible based on the current laws.

The third edition of Retire Secure! has been completed and will be going to the printer shortly. Some of you may be thinking, “So what? I already read that book.” Since the second edition of Retire Secure! was published in 2009, there have been two major revisions to the tax code and several landmark court decisions that have significantly changed the way we approach the cases we handle in our office. We try to keep you informed of these changes through our newsletters. If you’re a client, we also meet with you at least once a year to review your situation and, if needed, we help you make changes so that you can achieve the best results possible based on the current laws.