So why should you read this book? Reviewing their finances regularly isn’t a top priority for a lot of individuals – although it should be – and it is human nature to become complacent about things that we’d really rather not have to think about. When we were writing Edition 3, though, I found that so much has changed since I published Edition 2 that it became necessary for me to discuss many of the old laws and the old solutions we used to use, and then explain why the old solutions are no longer effective under the new laws. The legislative changes also created new and possibly unforeseen problems for taxpayers that require proactive management on their parts. Without proactive management, those individuals can pay far more in taxes than they need to. Ultimately, it is their wealth that suffers from their lack of attention.

I’ve been accused of being a self-appointed ambassador of information, and I guess that’s true. I believe this information is so important that everyone should read my book from cover to cover, but I’m enough of a realist to know that not all of you share my enthusiasm for the subject matter. Since I’m a nice guy, though, I’ll respect your time and use this blog to point out the highlights of what’s changed in every chapter. Hopefully a sneak peek at what’s contained within will inspire you to read the whole book.

Happy Reading!

Jim

Jim’s strategies have been endorsed by The Wall Street Journal (33 times), Newsweek, Money Magazine, Smart Money, Reader’s Digest, Bottom Line, and Kiplinger’s. His articles have appeared in Bottom Line, Trusts and Estates Magazine, Financial Planning, The Tax Adviser, Journal of Retirement Planning, and The Pennsylvania Lawyer magazine.

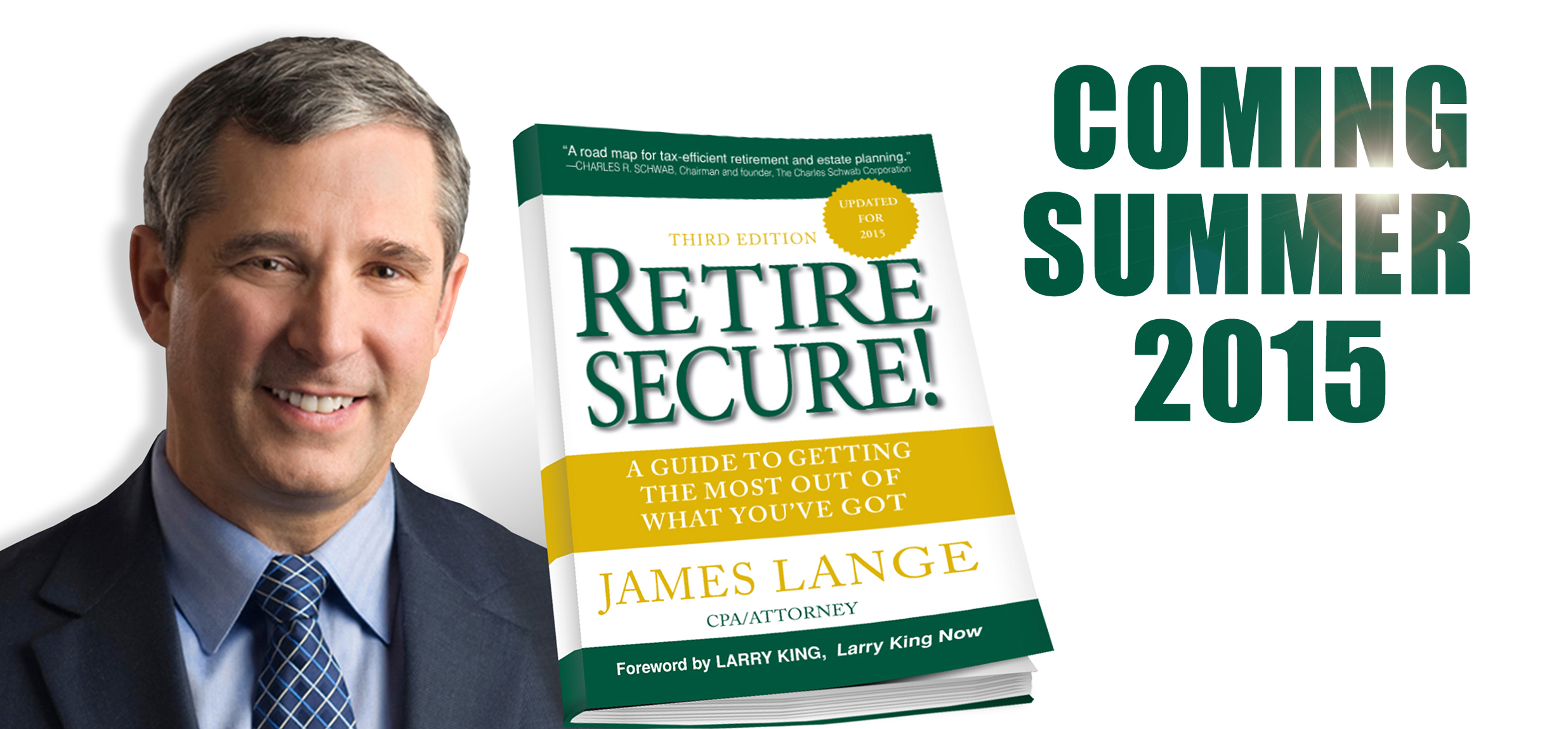

Jim is the best-selling author of Retire Secure! (Wiley, 2006 and 2009), endorsed by Charles Schwab, Larry King, Ed Slott, Jane Bryant Quinn, Roger Ibbotson and The Roth Revolution, Pay Taxes Once and Never Again endorsed by Ed Slott, Natalie Choate and Bob Keebler.

If you’d like to be reminded as to when the book is coming out please fill out the form below.