The Aftermath of Brexit

Pros and Cons: What Options Do Individual Investors Have?

What should you do about your own retirement plan in the aftermath of Brexit? Find out why now could be a great time to do a Roth conversion!

On June 23, 2016, a majority of British citizens voted to leave the 28-member European Union – an action referred to as the “Brexit”. The following day, Americans awoke to learn that global stock markets had not reacted well to the news. Our major domestic indices followed suit, with the Dow Jones Industrial Average declining more than 600 points in one day. Trillions of dollars in wealth were estimated to have been wiped out overnight, and more is likely to follow as the world adjusts to the news.

Prior to the historic Brexit vote, I watched with interest as the pollsters interviewed people on the streets and then confidently predicted that Britons would vote to stay in the union. The British pound made gains, and even the lethargic US stock markets seemed cheered at the news. Life, it seemed, would be good as long as the union remained intact. Investors throughout the world thought that the good citizens of Great Britain would never upset the apple cart, and placed their bets accordingly. And guess what? They bet wrong!

Time will tell, but I suspect that much of this market chaos is happening because the investors who relied on the pollsters got caught with their pants down. Plans were made and fund managers structured their portfolios assuming that the citizens of Great Britain would vote to stay – and they didn’t. Now these investors find themselves having to scramble to put their Plan B – assuming they even have one – in place. What does their mistake mean for you?

If you’re clients of ours, you know that we have always advocated using a balanced approach to money management. And we never advocate making changes to your portfolio based solely on what the market is doing. However, for many of you, now would be a great time for you to take that trip to London that you’ve always wanted to do. The US dollar strengthened on the news of the Brexit, and will stretch much further now than it would have a week ago. Or, consider establishing Roth IRAs or college tuition accounts for your grandchildren. If they have ten or more years to wait out a market recovery, you can fund those accounts with equities purchased at prices much lower than they were last week at this time.

What should you do about your own retirement plan in the aftermath of Brexit? If you hold any global funds in your IRA, now could be a great time to do a Roth conversion. By converting when the market value of the fund is low, you pay less in federal income tax than you would when the fund value is high. And if the market continues to drop even further, you can always recharacterize your conversion. I’ll be talking about some of these points on my next radio show on 1410 KQV. You can call in and ask questions during the live broadcast on Wednesday, July 6th, from 7:00 – 800 p.m., or catch the rebroadcast on Sunday, July 10th at 9:00 a.m. You can also read more about Roth conversions by clicking this link on my website: https://www.paytaxeslater.com/roth_ira/

Please call our office soon if you have been thinking about doing a Roth conversion, and we will run the numbers to see if it makes sense for you. And if you do go to London, send me a postcard!

Jim

The Apply and Suspend strategy will be eliminated on April 29, 2016, so you must act now to take advantage of it. For those of you who cannot use the Apply and Suspend technique, there is another way that you may be able to maximize your benefits, though, which involves filing a Restricted Application (also known as Claim Now, Claim More Later). The great news is that you can take advantage of this strategy until December 31, 2019, assuming that you were at least 62 years old as of December 31, 2015.

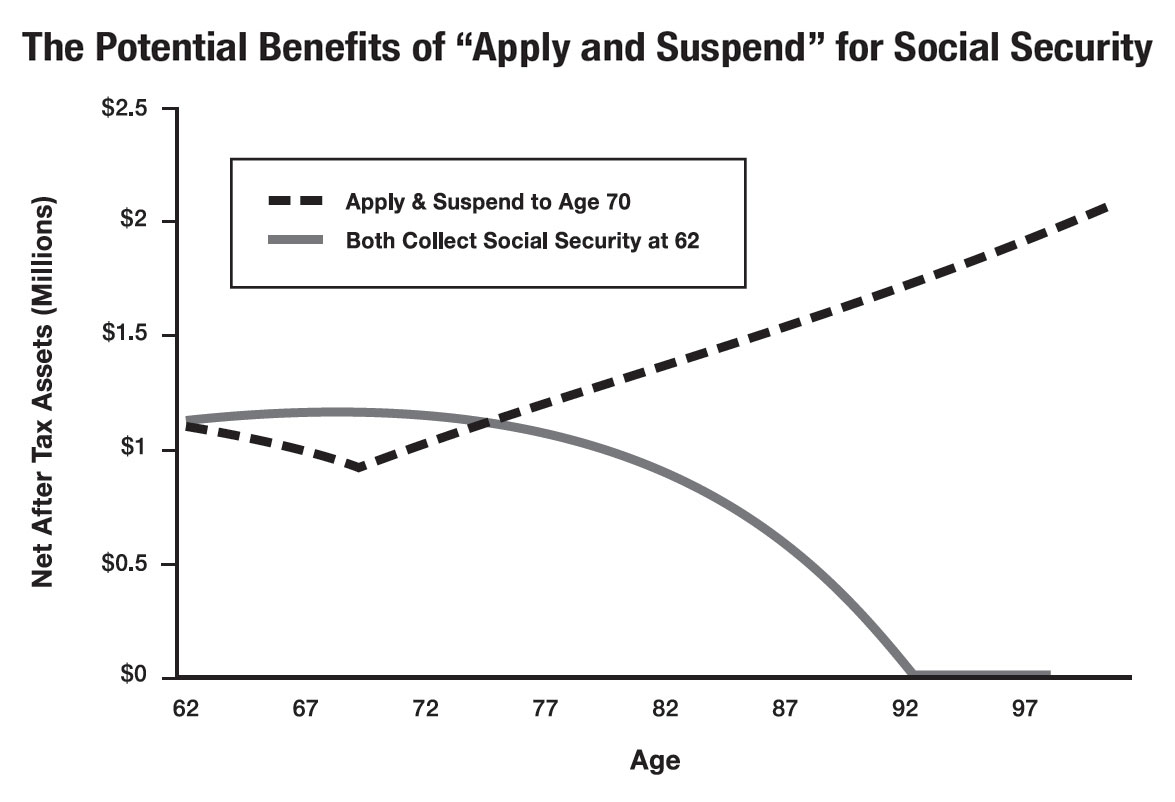

The Apply and Suspend strategy will be eliminated on April 29, 2016, so you must act now to take advantage of it. For those of you who cannot use the Apply and Suspend technique, there is another way that you may be able to maximize your benefits, though, which involves filing a Restricted Application (also known as Claim Now, Claim More Later). The great news is that you can take advantage of this strategy until December 31, 2019, assuming that you were at least 62 years old as of December 31, 2015.  Apply and Suspend works this way. You file an application for benefits at age 66 (or later) and then suspend them – meaning that you will not receive monthly checks. There’s good reason to consider doing this. For each year that your benefit remains suspended, it grows by 8 percent (up to a maximum of 32 percent), plus cost of living adjustments. When you finally begin collecting checks at age 70, they’re significantly higher than they would have been if you had begun collecting them at age 66 – and they stay that way for the rest of your life. If you change your mind and want to start receiving your checks after you’ve suspended them, you can do so at any time.

Apply and Suspend works this way. You file an application for benefits at age 66 (or later) and then suspend them – meaning that you will not receive monthly checks. There’s good reason to consider doing this. For each year that your benefit remains suspended, it grows by 8 percent (up to a maximum of 32 percent), plus cost of living adjustments. When you finally begin collecting checks at age 70, they’re significantly higher than they would have been if you had begun collecting them at age 66 – and they stay that way for the rest of your life. If you change your mind and want to start receiving your checks after you’ve suspended them, you can do so at any time. Married women, statistically the widows of the future, will pay a high price due to the changes that the Bipartisan Budget Act of 2015 has made to Social Security. Pittsburgh attorney and CPA James Lange takes action by releasing audio and video presentations as well as transcripts and a report that will help couples ages 62-70 navigate this new rule and protect their benefits while they still can!

Married women, statistically the widows of the future, will pay a high price due to the changes that the Bipartisan Budget Act of 2015 has made to Social Security. Pittsburgh attorney and CPA James Lange takes action by releasing audio and video presentations as well as transcripts and a report that will help couples ages 62-70 navigate this new rule and protect their benefits while they still can!