The American Taxpayer Relief Act of 2012 reinstated a phase-out of itemized deductions for high income taxpayers. For those individuals, it meant that they were unable to receive the full benefit of their charitable contributions on their tax returns, and they were very unhappy. A few taxpayers didn’t care. I have a client who donates an unusually significant amount of her annual income to charity every year, and who steadfastly refused to give me a list of the donations so that I could deduct them on her tax return. She felt that it was morally wrong for her to receive any benefit from them. It was an admirable position, to be sure, but then I pointed out that the government does not do a very good job of dealing with social problems in this country. I told her that I believe that the reason charities don’t have to pay taxes is because they do a much more efficient job of distributing money and services to the needy than our government does. Under those circumstances, it seemed wasteful to me to not deduct the donations. She listened to me, and the following year presented me with hundreds of donation receipts, which I deducted on her return. She received a significant tax refund, which she promptly used to donate even more to charity!

If donating to charity is important to you, you may find it worthwhile to review the ideas discussed in Chapter 18. Many readers will be surprised to learn that there are strategies available that can give them far more bang for their charitable buck than they may have thought possible. Charitable gifting does not necessarily have to come at the expense of family members either, and in some instances it may even benefit them! Your distant dreams of establishing a scholarship fund, building a bicycle trail, or providing ongoing medical care to people in need are more achievable than you may realize. The secret is to take advantage of all of the gifting strategies that are available to you.

See you soon!

Jim

Jim’s strategies have been endorsed by The Wall Street Journal (33 times), Newsweek, Money Magazine, Smart Money, Reader’s Digest, Bottom Line, and Kiplinger’s. His articles have appeared in Bottom Line, Trusts and Estates Magazine, Financial Planning, The Tax Adviser, Journal of Retirement Planning, and The Pennsylvania Lawyer magazine.

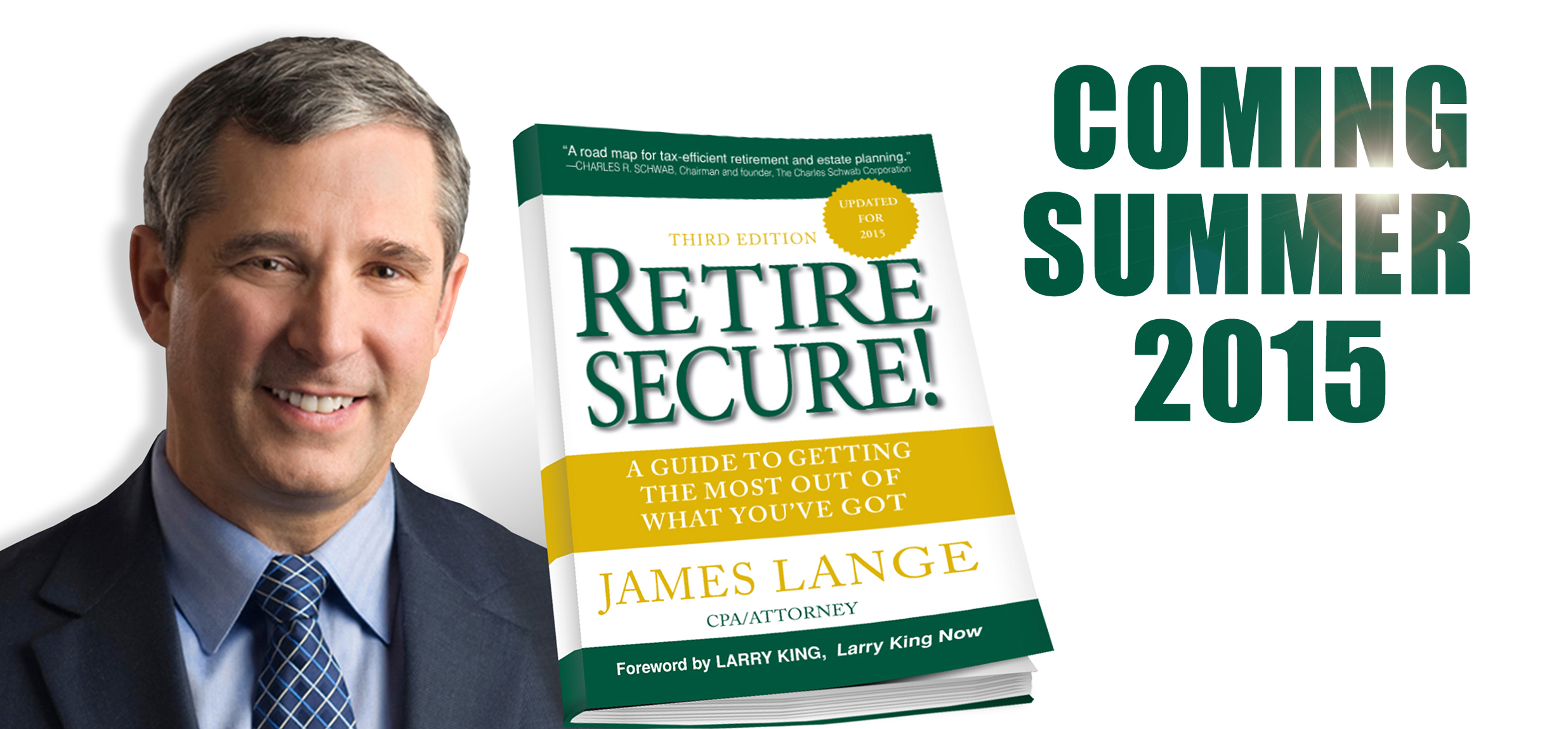

Jim is the best-selling author of Retire Secure! (Wiley, 2006 and 2009), endorsed by Charles Schwab, Larry King, Ed Slott, Jane Bryant Quinn, Roger Ibbotson and The Roth Revolution, Pay Taxes Once and Never Again endorsed by Ed Slott, Natalie Choate and Bob Keebler.

If you’d like to be reminded as to when the book is coming out please fill out the form below.

Thank you.

In January of 2015, President Obama proposed eliminating the tax-free benefits of Section 529 college savings plans. Under his proposal, savings would grow tax-deferred, but withdrawals would be taxed as income to the beneficiary (usually the student). His belief was that taxpayers who save in 529 plans are families who can better afford the cost of college than everyone else. In reality, it is estimated that close to ten percent of 529 accounts are owned by households having income below $50,000, and over 70 percent are owned by households with income below $150,000. What isn’t surprising, though, is that the tax revenue realized by this action would have been significant, because as of the end of the 4th quarter of 2014, the assets held in 529 and other college savings plans reached almost a quarter of a trillion dollars. How many students would have been forced to apply for loans if they had been required to pay tax on withdrawals from their college savings plans? Fortunately, the House of Representatives thought differently than the President and, in February of 2015, they passed HR 529. This bill not only maintains the tax-free status of 529 plans, but also makes them more flexible and easier to use. Hopefully the Senate will follow the House’s lead and pass a companion bill with similar provisions.

In January of 2015, President Obama proposed eliminating the tax-free benefits of Section 529 college savings plans. Under his proposal, savings would grow tax-deferred, but withdrawals would be taxed as income to the beneficiary (usually the student). His belief was that taxpayers who save in 529 plans are families who can better afford the cost of college than everyone else. In reality, it is estimated that close to ten percent of 529 accounts are owned by households having income below $50,000, and over 70 percent are owned by households with income below $150,000. What isn’t surprising, though, is that the tax revenue realized by this action would have been significant, because as of the end of the 4th quarter of 2014, the assets held in 529 and other college savings plans reached almost a quarter of a trillion dollars. How many students would have been forced to apply for loans if they had been required to pay tax on withdrawals from their college savings plans? Fortunately, the House of Representatives thought differently than the President and, in February of 2015, they passed HR 529. This bill not only maintains the tax-free status of 529 plans, but also makes them more flexible and easier to use. Hopefully the Senate will follow the House’s lead and pass a companion bill with similar provisions. The third edition of Retire Secure! has been completed and will be going to the printer shortly. Some of you may be thinking, “So what? I already read that book.” Since the second edition of Retire Secure! was published in 2009, there have been two major revisions to the tax code and several landmark court decisions that have significantly changed the way we approach the cases we handle in our office. We try to keep you informed of these changes through our newsletters. If you’re a client, we also meet with you at least once a year to review your situation and, if needed, we help you make changes so that you can achieve the best results possible based on the current laws.

The third edition of Retire Secure! has been completed and will be going to the printer shortly. Some of you may be thinking, “So what? I already read that book.” Since the second edition of Retire Secure! was published in 2009, there have been two major revisions to the tax code and several landmark court decisions that have significantly changed the way we approach the cases we handle in our office. We try to keep you informed of these changes through our newsletters. If you’re a client, we also meet with you at least once a year to review your situation and, if needed, we help you make changes so that you can achieve the best results possible based on the current laws.