In my last post, I promised that I would answer some of the questions we have received in response to The Little Black Book of Social Security Secrets. So let’s have a look at some of the problems our readers are wrestling with.

Several readers have written and said that they are in a situation similar to this one:

My employer has just told us that the company has filed for bankruptcy and will be closing its doors later this year. I don’t know if I will be able to get another job at my age and, even if I do, I’m not sure I will be able to make as much money as I am making now. My spouse doesn’t work outside of the house. I was thinking about signing up for my Social Security benefits once the company closes, but then I read your book. I do have some savings in retirement plans (both traditional and Roth), and an investment account. When is the best time for me to apply for Social Security if I can’t find another job? Should I spend my savings now and apply for Social Security later, or should I save my money and apply now?

The loss of a job, especially at this point in your life, can be traumatic. Before we review the options that you have, let’s go through a quick refresher on two of the points covered in The Little Black Book of Social Security Secrets.

When Should You Take Social Security?

How does the age at which you actually collect Social Security affect the amount you receive? If you are now 62, your Full Retirement Age (FRA) is 66. If you wait until your FRA to collect your benefits, you will receive your Primary Insurance Amount (PIA). If you collect at 62, your monthly check will be permanently reduced, by 25 percent of your PIA. If you wait until you are 70 to collect, your check amount will be permanently increased by Delayed Retirement Credits (DRCs) of 8 percent per year (up to a maximum of 32 percent), plus Cost of Living Adjustments (COLAs).

When Should Your Spouse Take Social Security?

This next part is critical to understanding why you may have more options than you realize. If you file for your own benefit, even if you suspend them, your spouse will be permitted to file for spousal benefits based on your record as soon as she is eligible. When she files, though, is as important as when you file. If your spouse waits until her FRA (for most readers, this is 66), she’ll receive the highest spousal benefit possible – which is 50 percent of your own PIA. She is allowed to file as soon as she turns 62 but, if she does, she will only receive 35 percent of your PIA. In this case, we’re going to assume that your spouse is not entitled to a benefit based on her own earnings record. I have some examples for two-income households coming up in a later post.

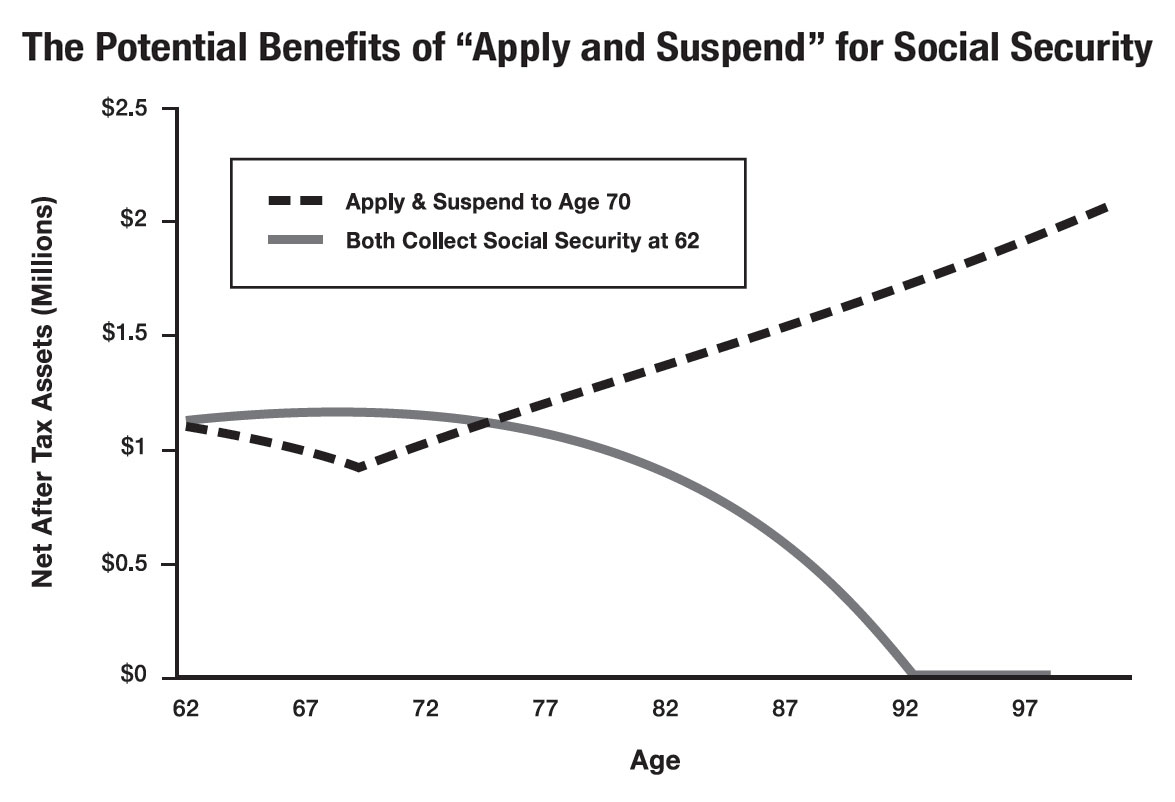

The answer to the above question posed by my readers, therefore, will depend on how old both of you are. If you were or will be 66 by April 29, 20165, you should consider applying for and then suspending your own benefits by April 29, 2016. If your spouse is at least 66, that will make it possible for her to file for a spousal benefit that will be 50 percent of your own PIA. (She can file at 62, but her benefit will be reduced.) The spousal benefit will give your family some income from Social Security every month, while at the same time allowing your own benefit to grow by those DRCs and COLAs. Maybe you can’t get another job that pays as well as the one you have right now, but you might be able to get one that you enjoy a lot more – like working on a golf course – because your spouse now has a source of income that can make up the difference.

So what happens when you do get that pink slip? As tempting as it might be to just throw in the towel, you should continue working in some capacity if you are able to do so. A job will provide you with some income and, if you are able to secure spousal benefits by using the apply and suspend technique by the deadline, you just might have enough income to meet your expenses while still allowing your own benefits to grow. Are you too young to apply for and suspend your benefits by April 29, 2016? For most people, it is still preferable to delay claiming Social Security benefits for as long as possible. Many of my readers have some money in retirement plans (both traditional and Roth), and also some money in non-retirement accounts. How does the spending affect their decisions about Social Security? Which account should they spend first?

Should I Spend My 401(k) Money First?

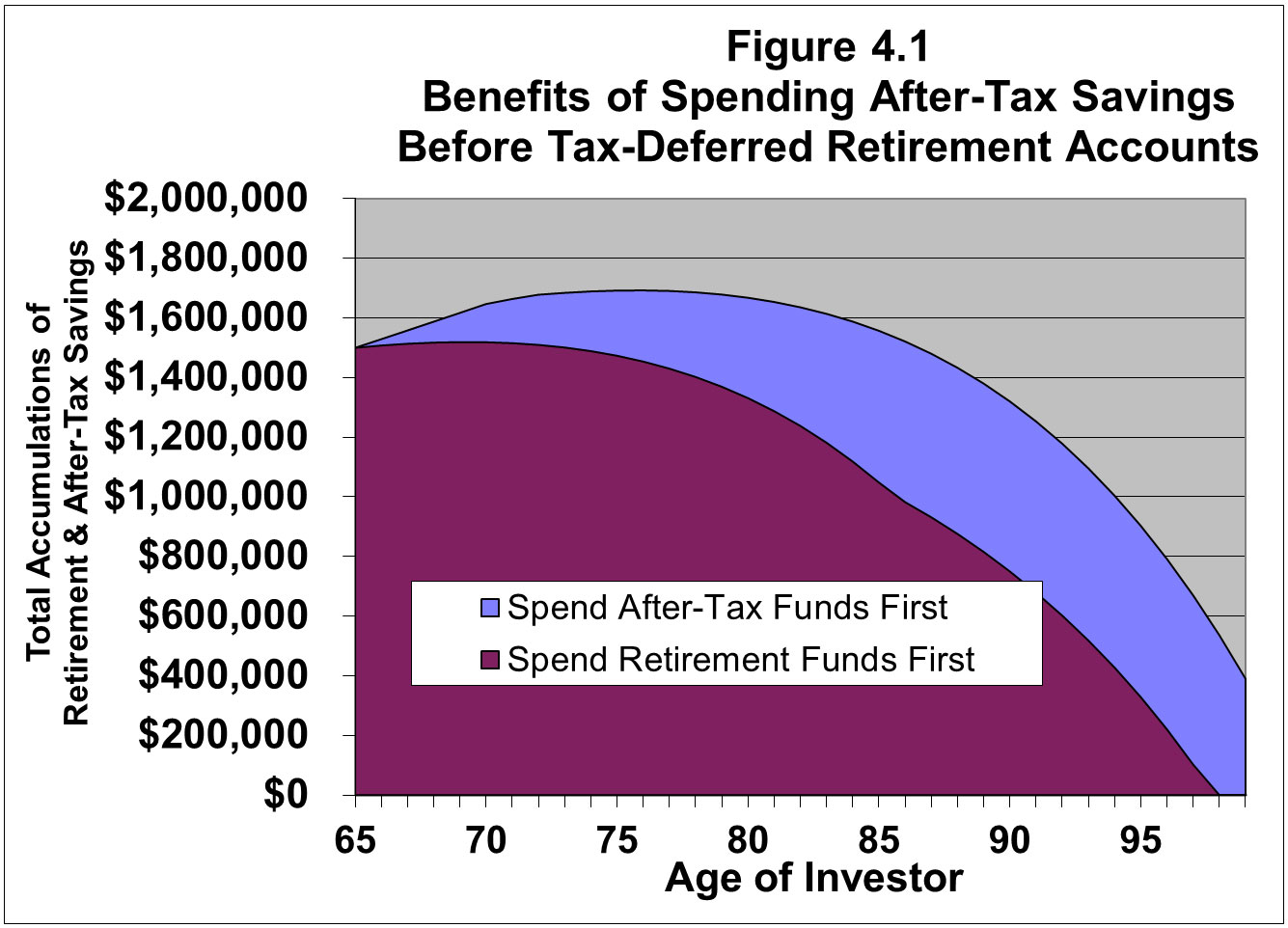

For most people, it is better to spend your non-retirement accounts before your retirement accounts. The graph that follows is from my book, Retire Secure! It shows that, the longer you can leave your money in a tax-deferred (or tax-free) account, the longer it will last.

When Should You Take Social Security benefits? Retirement questions answered from The Little Black Book of Social Security Secrets by James Lange CPA/ Attorney.

Once your investment account is liquidated, the question becomes complicated. You should spend your traditional and Roth IRAs strategically, depending on your own personal tax situation. What the heck does that mean? I wish there was a one-size-fits-all answer, but there isn’t. However, Chapter 4 of my book, Retire Secure!, does contain an extensive analysis of this topic, and includes specific examples that may provide you with some additional insight. If you’d like to learn more about why it’s so important to spend the right money first, you can get a copy of the book from this website.

If you don’t want to read the book, here are some general points to consider. You’ll be required to take withdrawals from your traditional IRA when you turn 70 ½, and those withdrawals will be taxable. Income generated from non-qualified investment accounts is taxable. If you have enough taxable income from other sources, a portion of your Social Security will also be taxable. Most retirees don’t plan for unavoidable changes in their tax situations, and their failure to do so can be very expensive. What we strive to do in our practice is find the spending and tax management strategies that makes your money last as long as possible. Ultimately, the solution is different for each client.

Readers, thank you for the question and please keep them coming! I love hearing from you! And check back soon to read about some more real-life challenges that people like you are dealing with!

—————————————————————————————————————————————–

Are you confused about how the Apply and Suspend strategies can benefit you? Please do not ask your local Social Security office for advice, because they can only present your options about government benefits! The decisions that you make about this affect far more than just your Social Security benefits, and could have unintended complications and/or repercussions if they are not made considering the big picture.

Getting your Social Security decision right is important, but it is even more important that you have the right strategies for all of your planning. To find out if your entire financial house is in order, fill out this pre-qualification form by clicking here to see if you qualify for a free consultation. Western PA residents only please.

Don’t delay. Go to www.paytaxeslater.com/ss to get your free digital copy of The Little Black Book of Social Security Secrets, and then talk to a professional about your options before it’s too late.

The Apply and Suspend strategy will be eliminated on April 29, 2016, so you must act now to take advantage of it. For those of you who cannot use the Apply and Suspend technique, there is another way that you may be able to maximize your benefits, though, which involves filing a Restricted Application (also known as Claim Now, Claim More Later). The great news is that you can take advantage of this strategy until December 31, 2019, assuming that you were at least 62 years old as of December 31, 2015.

The Apply and Suspend strategy will be eliminated on April 29, 2016, so you must act now to take advantage of it. For those of you who cannot use the Apply and Suspend technique, there is another way that you may be able to maximize your benefits, though, which involves filing a Restricted Application (also known as Claim Now, Claim More Later). The great news is that you can take advantage of this strategy until December 31, 2019, assuming that you were at least 62 years old as of December 31, 2015.  Apply and Suspend works this way. You file an application for benefits at age 66 (or later) and then suspend them – meaning that you will not receive monthly checks. There’s good reason to consider doing this. For each year that your benefit remains suspended, it grows by 8 percent (up to a maximum of 32 percent), plus cost of living adjustments. When you finally begin collecting checks at age 70, they’re significantly higher than they would have been if you had begun collecting them at age 66 – and they stay that way for the rest of your life. If you change your mind and want to start receiving your checks after you’ve suspended them, you can do so at any time.

Apply and Suspend works this way. You file an application for benefits at age 66 (or later) and then suspend them – meaning that you will not receive monthly checks. There’s good reason to consider doing this. For each year that your benefit remains suspended, it grows by 8 percent (up to a maximum of 32 percent), plus cost of living adjustments. When you finally begin collecting checks at age 70, they’re significantly higher than they would have been if you had begun collecting them at age 66 – and they stay that way for the rest of your life. If you change your mind and want to start receiving your checks after you’ve suspended them, you can do so at any time. Married women, statistically the widows of the future, will pay a high price due to the changes that the Bipartisan Budget Act of 2015 has made to Social Security. Pittsburgh attorney and CPA James Lange takes action by releasing audio and video presentations as well as transcripts and a report that will help couples ages 62-70 navigate this new rule and protect their benefits while they still can!

Married women, statistically the widows of the future, will pay a high price due to the changes that the Bipartisan Budget Act of 2015 has made to Social Security. Pittsburgh attorney and CPA James Lange takes action by releasing audio and video presentations as well as transcripts and a report that will help couples ages 62-70 navigate this new rule and protect their benefits while they still can!

In January of 2015, President Obama proposed eliminating the tax-free benefits of Section 529 college savings plans. Under his proposal, savings would grow tax-deferred, but withdrawals would be taxed as income to the beneficiary (usually the student). His belief was that taxpayers who save in 529 plans are families who can better afford the cost of college than everyone else. In reality, it is estimated that close to ten percent of 529 accounts are owned by households having income below $50,000, and over 70 percent are owned by households with income below $150,000. What isn’t surprising, though, is that the tax revenue realized by this action would have been significant, because as of the end of the 4th quarter of 2014, the assets held in 529 and other college savings plans reached almost a quarter of a trillion dollars. How many students would have been forced to apply for loans if they had been required to pay tax on withdrawals from their college savings plans? Fortunately, the House of Representatives thought differently than the President and, in February of 2015, they passed HR 529. This bill not only maintains the tax-free status of 529 plans, but also makes them more flexible and easier to use. Hopefully the Senate will follow the House’s lead and pass a companion bill with similar provisions.

In January of 2015, President Obama proposed eliminating the tax-free benefits of Section 529 college savings plans. Under his proposal, savings would grow tax-deferred, but withdrawals would be taxed as income to the beneficiary (usually the student). His belief was that taxpayers who save in 529 plans are families who can better afford the cost of college than everyone else. In reality, it is estimated that close to ten percent of 529 accounts are owned by households having income below $50,000, and over 70 percent are owned by households with income below $150,000. What isn’t surprising, though, is that the tax revenue realized by this action would have been significant, because as of the end of the 4th quarter of 2014, the assets held in 529 and other college savings plans reached almost a quarter of a trillion dollars. How many students would have been forced to apply for loans if they had been required to pay tax on withdrawals from their college savings plans? Fortunately, the House of Representatives thought differently than the President and, in February of 2015, they passed HR 529. This bill not only maintains the tax-free status of 529 plans, but also makes them more flexible and easier to use. Hopefully the Senate will follow the House’s lead and pass a companion bill with similar provisions.