As many of you know, I am a strong proponent of waiting until age 70 to apply for Social Security, because I want both you and your surviving spouse to receive the highest benefit possible during your lifetimes. And one of the technical points about Social Security that I’ve never covered in detail in my books – because it’s only been in rare cases that I have recommended that my clients do it – involves applying for benefits retroactively. But in order to make you understand how your future Social Security benefits could be at risk from cyber criminals, I find myself in the strange position of having to give you a quick lesson on how retroactive benefits work.

Suppose that you could have applied for Social Security at your Full Retirement Age (FRA) of 66, but you took my advice and waited so that you can receive the highest benefit possible at age 70. When you turn 67, you go to your doctor for your annual physical. There, the doctor gives you some terrible news – you have six months to live! Now you’re cursing at me because you missed out on all of this Social Security money that you could have collected since you were 66 – or did you? Not necessarily. In certain instances, Social Security will allow you to apply for retirement benefits retroactively. If you qualify, Social Security will send you up to six months of retroactive benefits, paid as a lump sum.

A True Horror Story of a Social Security Fraud Victim

I won’t waste time telling you how you can qualify for retroactive benefits because it’s a complicated topic, and I will not recommend you do it because it will result in lower monthly benefits for the rest of your life. I am going to tell you something very important that you need to understand about retroactive benefits: if you are at least Full Retirement Age but are waiting until age 70 to file for Social Security so that you can earn Delayed Retirement Credits, your account may be compromised by cyber criminals who are trying to get their hands on any lump sum retroactive benefits to which you might be entitled, but have no intention of ever claiming. Here’s a real-life example of what I’m talking about:

I have a client who received an unexpected letter from the Social Security Administration. She and her husband had intended to hold off applying for benefits so that they could earn Delayed Retirement Credits. The letter they received, however, stated that Social Security had approved their request for a lump-sum retroactive benefit payment, which amounted to almost $12,000. Immediately my client and her husband went to their local Social Security office, and in the several hours spent there, discovered that the criminal(s) had called the office and pretended to be her husband. During the conversation, which was on a recorded line, the criminal simply said that he had changed his mind and wanted to apply for benefits retroactively! And the Social Security office complied with his request!

It Seems to Have Become Easier for Criminals

I found this situation to be so unbelievable that I called the Social Security office myself and asked how it could happen. What I learned might shock you. In order to access my client’s Social Security account, the criminals had to provide them with only the husband’s full name, date and place of birth, mother’s maiden name, and his current address and phone number. Personal information like this is widely available online through sites such as Facebook and Ancestry.com, not to mention what is available on the dark web thanks to the infamous Equifax hack in 2017.

My client spent hours at the Social Security office trying to put a hold on the “lump sum withdrawal,” and were assured that everything had been resolved. We thought that the criminals had been thwarted and everything was fine, but yesterday they received a 1099 from the Social Security Administration saying that they had received $12,000 in benefits that they needed to report on their tax return! So now we’re back to square one, and are still trying to get this mess sorted out. It’s bad enough that the IRS has been notified that they need to pay tax on money they never received, but now I’m wondering whether my client is still earning Delayed Retirement Credits after these criminals filed for benefits under his name!

How Can You Protect Yourself?

The bottom line is that you need to treat your Social Security account like a bank or investment account. Even though you might not think of it as being an asset, it is – because if a criminal manages to take control of it, the consequences could be costly and far-reaching. One way to protect yourself is to open an account with Social Security online, at this website: https://www.ssa.gov/myaccount/. Even if you do not plan to file for benefits in the near future, this action can prevent someone else from opening an account in your name without your knowledge. For your security you will be required to create a user name and password, and they’ll send a one-time security code to your email or phone.

Once you’ve established your account, you should check it periodically to make sure that information such as your name, address and phone number is correct. They also have a feature called “Block Electronic Access,” which prevents anyone (including you) from changing your personal information online or over the telephone. If you block access to your account and then change your mind, you have to ask Social Security to unblock it for you.

Years ago, the fear of Social Security theft was largely confined to the possibility of armed thugs waiting outside the bank for retirees who had just cashed their monthly checks. Unfortunately, criminals are constantly looking for ways to liberate you from your money, and their creativity can be surprising. Remember, protect yourself and your spouse by making sure that your benefits are safe – even if you don’t plan to apply in the near future!

Are you interested in learning more about Social Security maximization strategies? Visit our Social Security section of our website here for more information.

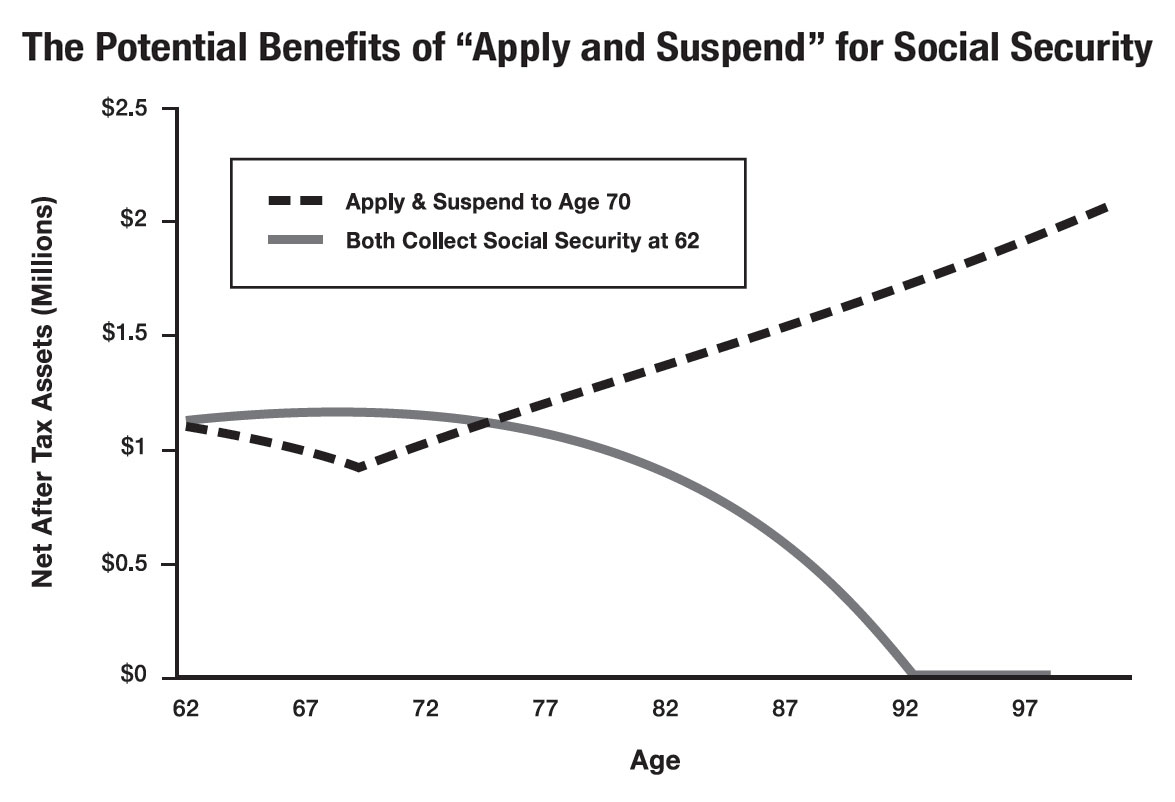

The Apply and Suspend strategy will be eliminated on April 29, 2016, so you must act now to take advantage of it. For those of you who cannot use the Apply and Suspend technique, there is another way that you may be able to maximize your benefits, though, which involves filing a Restricted Application (also known as Claim Now, Claim More Later). The great news is that you can take advantage of this strategy until December 31, 2019, assuming that you were at least 62 years old as of December 31, 2015.

The Apply and Suspend strategy will be eliminated on April 29, 2016, so you must act now to take advantage of it. For those of you who cannot use the Apply and Suspend technique, there is another way that you may be able to maximize your benefits, though, which involves filing a Restricted Application (also known as Claim Now, Claim More Later). The great news is that you can take advantage of this strategy until December 31, 2019, assuming that you were at least 62 years old as of December 31, 2015.  Apply and Suspend works this way. You file an application for benefits at age 66 (or later) and then suspend them – meaning that you will not receive monthly checks. There’s good reason to consider doing this. For each year that your benefit remains suspended, it grows by 8 percent (up to a maximum of 32 percent), plus cost of living adjustments. When you finally begin collecting checks at age 70, they’re significantly higher than they would have been if you had begun collecting them at age 66 – and they stay that way for the rest of your life. If you change your mind and want to start receiving your checks after you’ve suspended them, you can do so at any time.

Apply and Suspend works this way. You file an application for benefits at age 66 (or later) and then suspend them – meaning that you will not receive monthly checks. There’s good reason to consider doing this. For each year that your benefit remains suspended, it grows by 8 percent (up to a maximum of 32 percent), plus cost of living adjustments. When you finally begin collecting checks at age 70, they’re significantly higher than they would have been if you had begun collecting them at age 66 – and they stay that way for the rest of your life. If you change your mind and want to start receiving your checks after you’ve suspended them, you can do so at any time.